Research Article - (2023)Volume 12, Issue 4

Financial Inclusion and Economic Security of East African Community States

Peter Misiani Kerage* and Zedakia SidhaAbstract

Financial inclusion is a key pillar for financial deepening which a necessary condition for promoting national security and inclusive economic growth. Using a ten-year panel data for the years 2012 to 2021, this study investigated the interplay amongst financial inclusion and economic security in the East African Community (EAC) States. Three financial inclusion dimensions were considered, namely, usage, penetration, and availability. Data was collected from the World Development Indicators (WDI) of the World Bank and the Financial Access Survey (FAS) of the International Monetary Fund (IMF). Three countries (Rwanda, Uganda, and Kenya) were selected based on availability of consistent representative data. For analysis of the data, the study employed the Generalized Method of Moments (GMM). The study established that availability and composite dimensions have a significant positive impact on economic growth, while the usage dimension indicates a significant negative impact. The penetration dimension has a negligible adverse effect on economic expansion. Financial services utilization, ATMs, bank locations, mobile money agent locations, deposit accounts, mobile money transactions, outstanding deposits, and mild inflation. It is recommended that EAC governments must promote for financial inclusion in their search to combat terrorism and other criminal activities that potentially arise from financial exclusion, increase the number of CRBs in sub region to deal with information asymmetry and establishment of a National Commission on Financial Inclusion under the National Treasury (NT) to synchronize financial inclusion-related laws, rules, programs, and initiatives.

Keywords

Financial inclusion; Economic security; Financial access survey

Introduction

Financial inclusion and economic security are vital components of the development and national security agenda for East African Community states. A well-functioning financial system serves a significant catalyst for economic growth and development [1]. A financial system that is inclusive allows for widespread access to adequate financial services that are likely to help the disadvantaged and other marginalized groups. According to the World Bank, The World Bank (2021) defines financial inclusion as a process which leads to ease of access, availability, and usage of the formal financial services for all members of the economy [2].

Next, we examine the conceptual linkage between financial inclusion, national security, and economic security. National security is a continuum demarcated by a dichotomy of ‘state security’ and ‘human security’. The UNDP report of 1994 on Human Development Report (HDR) provided a bleak prediction that led to the conceptualization of this dichotomy [3]. The framing of this dichotomy follows a sobering prognosis by the “1994 Human Development Report (HDR) of the United Nations Development Program (UNDP).” The report asserts that “for far too long, the idea of security has been viewed narrowly as the defense of a state or country against threats originating outside of its borders, with military strength as the primary focus [4].”

Today's security studies, however, have experienced a significant change and expansion from state centric security to include other securities that were not previously considered to be of security strategy relevance. In the expanded definition of security that today encompasses all spheres of society, including the economic, political, social, environmental, and military, the individual is increasingly considered as the reference point for security. Barry defines security as “freedom from military, economic, political, environmental and societal threats.” The conventional state-centric definition of national security has given way to one that is more inclusive and emphasizes human security. This makes the term national security “interdisciplinary, encompassing aspects of politics, economics, socio-culture, technology, the environment, and the military.”

One of the most important aspects of national security is economic security, whether it is seen through the lens of state centrism or human security. It encompasses a wide range of topics, from the provision of essentials for human survival to the country's national economic development agenda. Buzan avers that economic security is necessary for military security since it establishes a nation's resource capacity [5]. According to Roy Economic security is used as a barometer to measure the general security of the state. Karl Marx came to the conclusion that the economy served as the cornerstone upon which the rest of society is built.

Economic security implies to a nation's capacity to maintain the levels of welfare and government authority that are considered to be acceptable. In order to promote inclusive and sustained economic growth, financial inclusion is consequently essential. Financial inclusion programs are any initiatives that provide all demographic groups with formal financial services that are available, inexpensive, and accessible [6]. Numerous groups of people have traditionally been excluded from the official financial system.

The East African Community (EAC) countries have had tremendous economic growth during the past decade with the Gross Domestic Product (GDP) growing at an average rate of 6% annually. (World Bank Global Economic Prospects Report, 2022) However, a number of security issues, including numerous terrorist attacks, showed that the sub-strong region's economic growth had not yet produced shared prosperity and better living conditions for the majority of people [7]. A key component of inclusive development is financial inclusion, but East African countries have lagged behind in this area.

Studies on how financial inclusion and economic security interact are widely available in literature. While some of these studies have established a substantial positive association between financial inclusion and economic growth, other studies have found a negative impact of financial inclusion on economic growth. In Europe, by comparing the original and new European Union (EU) member states, Ruixian et al. demonstrated that there is a favorable linkage between financial inclusion and economic advancement a similar scenario with Asia [8]. Daniel and Walle studied how financial inclusion affected 42 African states' economic expansion applying the system GMM dynamic panel data estimator and demonstrated a beneficial relationship between financial inclusion and economic growth. Ifediora et al. discovered that Sub-Saharan Africa's (SSA) economic growth was significantly impacted by financial inclusion.

Despite these arrays of studies that demonstrate the beneficial impact of financial inclusion on economic growth, some researchers have established the opposite hypothesis. The opponents draw the conclusion that a number of problems, including a weak financial system, subpar financial instruments, and inadequate policymaking, hinder the positive impact of finance on growth. Sulong and Bakar in view of conflicting findings from earlier empirical research, this study was undertaken to ascertain whether financial inclusion significantly contributes to a country's economic growth. When creating a composite financial inclusion index, mobile money-related indicators were taken into consideration. According to the author's knowledge, this is the first empirical study to use mobile money as a measure of financial inclusion in the subregion [9].

As we delve into the complicated region of financial inclusion and economic security within the EAC states, it becomes evident that this region is undergoing a revolutionary change. The interconnectedness of financial services, access to banking, and the overall economic stability of these countries are important factors that impact the lives of millions. This journal entry seeks to provide insights into the current state, challenges, and prospects of financial inclusion and economic security in the EAC states [10].

The remainder of the paper is structured as follows: The research methodology is described in Section 2, findings of the study are profred in Section 3, and the conclusions are discussed in Section 4. Sections 5 provide a conclusion.

Theoretical framework

The Financial Intermediation Theory will serve as the foundation for this research. Financial intermediation is the deposit of funds by surplus units with financial institutions, which then lend to deficit units. This research benefited immensely from the works of Joseph, Goldsmith and Shaw that emphasized financial mobilization in intermediation process which subsequently formed the basis for economic development. McKinnon affirmed the theory by providing evidence that shows that demand for money has a direct relationship with physical accumulation of capital. That is, physical accumulation of capital and investment within the economy can only thrive when money is available within the economy, which is the rationale behind the existence of financial intermediaries [11].

Shaw further avers that this is because intermediation results to mobilization of savings which can be channeled into investment for physical capital accumulation or other productive endeavors. According to Joseph, Substantially, the industrial revolution in the Great Britain which is a major example of economic development was only made possible because banks were available to extend credit to the economy. Apart from the major role in economic development Jeremy and Jovanovic submitted that the presence of intermediaries has reduced information asymmetries, strengthened resource allocation and improved liquidity within the economy. One major assumption of this theory is the importance attached to the financial system in driving economic development through its channels such as its financial intermediaries. Thus, financial intermediaries are vital channels for reaching the largely unbanked population of the economy in a bid to drive an all-inclusive growth [12].

Materials and Methods

Data and research variables

The research was conducted to establish the linkage between financial inclusion and economic security of three-member states of the East African Community: Kenya, Rwanda, and Uganda. The three nations were based on purposive samplingbased on the availability of reliable, comprehensive, and representative data. Data was obtained from “World Development Indicators (WDI) from the World Bank database and the Financial Access Survey (FAS) of the International Monetary Fund (IMF).”

Financial inclusion is a multifaceted notion that calls for multifaceted measurement. This statistic comprised the three financial inclusion variables of penetration, availability, and usage. The multidimensionality is encapsulated in a single number by the Indexes of Financial Inclusion (IFI), Mandira [13].

The availability dimension is evaluated using the “natural logarithms of the number of bank branches, ATMs, and mobile money agents,” while the penetration dimension is evaluated using the number of deposit accounts and mobile money accounts. To evaluate the usage dimension, the “natural logarithms of the total number of mobile money transactions with commercial banks as a percentage of GDP,” the total amount of outstanding loans with commercial banks as a percentage of GDP, and the total amount of outstanding deposits with commercial banks as a percentage of GDP are used. The Gross Domestic Product Per Capita (GDPPC) measures the level of economic security [14]. The GDPPC's value will be given in US dollars and natural logarithms. The three financial inclusion dimensions were used to create the general financial inclusion index.

Using a multidimensional framework was appropriate because financial inclusion has many facets. The component index was created using distinct indicators for each of Sarma's suggested financial inclusion factors. As a result, the IFI is determined using three key variables: the capacity to use financial services, the accessibility of financial services, and the availability of financial services. The study also took into account trade openness, population growth, and inflation rate as control variables. The ratio of GDP to the sum of exports and imports was used to determine trade openness. To assess inflation, the consumer price index was utilized [15].

Empirical model

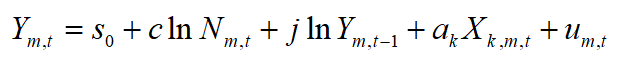

The study adopted an empirical model from Ifediora et al., Takeshi and Hamori and Makina and Walle who utilized GMM. The model was thus redefined to take the analytical form:

Where, X captured financial inclusion, s, j and a were model parameters while u captured idiosyncratic disturbances. Economies were indicated by subscript m, and in this respect, the economies considered were Rwanda, Uganda, and Kenya, and; t was the year. Since Ym,t and um,t are correlated, it followed that um,t and Ym,t-1 were also correlated. This constitutes endogeneity. As such, the employment of Ordinary Least Squares (OLS) technique to retrieve the model’s parameters would lead into biased and inconsistent estimates. Similarly, pooling the data cannot address the endogeneity problem [16].

Blundell and Bond argued that addressing endogeneity problem in dynamic panels is best done using Generalized Method of Moments (GMM). These include the system and the differenced GMM techniques which yield consistent estimates. Blundell and Bond further indicated that system GMM outperforms the differenced GMM in retrieving efficient estimators. Accordingly, this research opted for system GMM, and followed the prescription advanced in Blundell and Bond.

Results and Discussion

Summary of the System GMM data output on the impact and significance of variables of the study are as presented in the Table 1 as shown below.

| S.No | Dimension/ Variable | Significant/ Insignificant | Impact on GDP (+ve or -ve) |

|---|---|---|---|

| 1 | Composite FI | significant | Positive |

| 2 | Availability | significant | Positive |

| 3 | Usage | significant | Positive |

| 4 | Penetration | Insignificant | Positive |

| 5 | Number of bank branches | significant | Positive |

| 6 | Number of ATMs | significant | Positive |

| 7 | Mobile money agent outlets | significant | Positive |

| 8 | Mobile money transactions | significant | Positive |

| 9 | Outstanding deposits | significant | Positive |

| 10 | moderate inflation | significant | Positive |

| 11 | Money accounts | significant | Negative |

| 12 | Bank deposit accounts | significant | Negative |

Table 1: GMM data output on the impact and significance of variables.

According to the results, East African countries indicate that financial inclusion has a positive and significant effect (0.0167) on Economic growth under the availability dimension index. At 10% confidence level, the model suggests East Africa's GDP increases by 0.0167% for every 1% increase in the availability dimension. The more transaction points the banking sector offers, the more economic agents react by boosting their economic activity [17].

Second, the usage dimension index significantly influences economic growth (0.220) at 10% level. This means that for every 1% increase in the sub-area, the utilization component of financial inclusion accelerates economic growth by 0.220%. The EAC experiences an increase in economic activity as more individuals use formal banking services. Finally, penetration insignificantly affected economic growth. This shows that there was little to no impact of the penetration dimension on economic growth.

Financial inclusion index demonstrates a favorable and influence of economic expansion that is statistically significant at a 10% level (0.0561). This means that a 1% increase in financial inclusion overall boosts economic development in EAC nations by 0.0561 In the GMM estimates, for the control variables, growth in the population and trade openness were two factors that reduced per capita GDP growth. In contrast, per capita GDP increased greatly when the inflation rate was between 5% and 7%, but it shrank when it exceeded 7% [18].

The study's findings are consistent with the financial intermediation theory, which holds that offering financial services promotes economic growth. The theory was espoused by Joseph, Goldsmith and Shaw who emphasized that financial mobilization in intermediation process forms the basis for economic development. The theory shows that demand for money has a direct relationship with physical accumulation of capital. That is, physical accumulation of capital and investment within the economy can only thrive when money is available within the economy, which is the rationale behind the existence of financial intermediaries.

Empirically, these findings validate the findings of Ifediora et al. and Siddik et al for the availability dimension index and the overall financial inclusion index. More inclusive financial systems are likely to benefit underprivileged individuals and other marginalized groups. For example, being able to use official channels for financing and savings may make it simpler to engage in important activities like making company investments.

To evaluate each indicator's relative importance in the relationship between financial inclusion and growth and to provide us the benefit of additional policy implications, we use individual financial inclusion indicators. Two important metrics, namely mobile money accounts and deposit accounts, were used to gauge the penetration dimension. According to a correlation analysis, deposit accounts and mobile money have meaningful linear relationships with per capita GDP.

ATMs, bank branches, and locations of mobile money agents served as proxies for the availability dimension. An examination of correlations revealed substantial linear relationships between per capita GDP and locations of bank branches, ATMs, and mobile money agents [19]. The study used outstanding deposits and mobile money transactions as its primary utilization dimension indicators. The results showed that while outstanding deposits and GDP per capita considerably moved in opposite directions, outstanding deposits above 2% significantly moved in the same direction as GDP per capita. Mobile money transactions and GDP per capita co-movements were statistically negligible.

Recommendations

The study's findings are significant from the perspective of EAC partner states, as they have enabled a number of policy recommendations. First, governments must champion for financial inclusion in their quest to combat terrorism and other criminal activities that potentially arise from financial exclusion. The direct interplay and causal connection between poverty and terrorism has generally been highlighted by policymakers.

Second, increase the number of CRBs in EAC sub region. For instance, Kenya’s Credit reference sector is underserved, and the CBK should make it easier for new entrants by removing the various regulatory barriers, which would spur competition and innovation of better credit rating models.

Third, initiatives to close the digital divide that arises from unequal access to technology between and within EAC states should be developed. Making investments in the fundamental components of developing digital financial services, like mobile broadband infrastructure, will be required to reduce high transaction costs, especially in rural places.

Fourth, establishment of a National Commission on Financial Inclusion under the National Treasury (NT) of EAC member states. The role of the proposed commission shall, among other things, be to develop a national strategy for financial inclusion, coordination of various financial inclusion-related laws, rules, supervisory frameworks, programs, and initiatives; provision of overall policy and strategic guidance; supervision of strategy implementation; and effective financial inclusion activity progress monitoring to support evidence-based policy making.

Conclusion

Financial inclusion and economic security are inextricably linked in EAC. The progress made in expanding access to financial services, coupled with ongoing efforts to address challenges, holds promise for a brighter economic future in the region.

This article offers proof that financial inclusion is a powerful economic growth accelerator in East Africa. The study discovered a positive and significant link between the GDP per capita and the general financial inclusion index. The inference is that because the characteristics of financial inclusion are complementary, when viewed as a single financial inclusion index, they will encourage economic growth. Further, the study established that availability and utilization characteristics have a positive and significant influence on economic growth, even though financial services penetration only somewhat yet significantly fosters it.

The proposition is that establishing an efficient financial infrastructure benefits the economy of EAC states, its penetration has not significantly impacted economic growth. Findings of the study for the various financial inclusion indicators showed that whereas deposit accounts, outstanding loans, and outstanding deposits only little or negatively affect economic growth, bank branches and ATMs had a positive and significant impact on it.

As we move forward, it is imperative that governments, organizations, and stakeholders continue to collaborate to ensure that financial inclusion becomes a cornerstone of economic security for all EAC states' citizens. The journey is ongoing, but the path is clear-a financially inclusive East Africa is a more economically secure East Africa.

References

- Bekele WD. Determinants of financial inclusion: A comparative study of Kenya and Ethiopia. J Afr Bus. 2023;24(2):301-319.

- Blundell R, Bond S. Initial conditions and moment restrictions in dynamic panel data models. J Econom. 1998;87(1):115-143.

- Buzan B. People, states and fear: an agenda for international security studies in the post-cold war era. ECPR press; 2008.

- Chakravarty SR, Pal R. Financial inclusion in India: An axiomatic approach. J Policy Model. 2013;35(5):813-837.

- Dahiya S, Kumar M. Linkage between financial inclusion and economic growth: An empirical study of the emerging Indian economy. Vision. 2020;24(2):184-193.

- Hernandez RR. The Relationship of Monetary Policy to National Security. Bangko Sentral NG Pilipinas Economic Newsletter. Nº1. 2014.

- Huang R, Kale S, Paramati SR, Taghizadeh-Hesary F. The impact of financial inclusion and trade openness on economic development in the European Union. Economic Integration in Asia and Europe: Lessons and Policies. 2021;641-664.

- Ifediora C, Offor KO, Eze EF, Takon SM, Ageme AE, Ibe GI, et al. Financial inclusion and its impact on economic growth: Empirical evidence from sub-Saharan Africa. Cogent Econ. 2022;10(1):2060551.

- Inoue T, Hamori S. Financial access and economic growth: evidence from sub-saharan africa. Emerg. Mark. Finance Trade. 2016;52(3):743-753.

- Makina D, Walle YM. Financial inclusion and economic growth: evidence from a panel of selected African countries. In extending financial inclusion in Africa. 2019;193-210.

- Özkaya MH. Financial Inclusion and Economic Growth in Turkey: A Causality Analysis. International Conference on Eurasian Economies. 2013.

- Revell JR. RW Goldsmith. Financial Structure and Development. Econ J. 1970.

- Seman JA. Financial inclusion: The role of financial system and other determinants. University of Salford. 2016.

- Shaw ES. Financial deepening in economic development. 1973.

- Siddik MN, Ahsan T, Kabiraj S. Does financial permeation promote economic growth? Some econometric evidence from Asian countries. Sage Open. 2019;(3):2158244019865811.

- Sulong Z, Bakar HO. The role of financial inclusion on economic growth: theoretical and empirical literature review analysis. Journal of Business & Financial Affairs. 2018;7(4):2167-0234.

- Triki T, Faye I. Financial inclusion in Africa. African Development Bank. 2013;556.

- Determinants of financial inclusion: A comparative study of Kenya and Ethiopia

- World Bank. Financial inclusion. 2021.

Author Info

Peter Misiani Kerage* and Zedakia SidhaCitation: Kerage PM, Sidha Z (2023) Financial Inclusion and Economic Security of East African Community States. Global J Comm Manage Perspect. 12:048.

Received: 23-Oct-2023, Manuscript No. GJCMP-23-27766; Editor assigned: 26-Oct-2023, Pre QC No. GJCMP-23-27766 (PQ); Reviewed: 16-Nov-2023, QC No. GJCMP-23-27766; Revised: 23-Nov-2023, Manuscript No. GJCMP-23-27766 (R); Published: 30-Nov-2023 , DOI: 10.35248/2319-7285.23.12.048

Copyright: © 2023 Kerage PM, et al. This is an open access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.