Review Article - (2023)Volume 12, Issue 3

Market Failure: The Odd Economics of Free News

Steven C. Tarr*Abstract

The free news market has failed. Why do consumers tolerate low quality news while they do not tolerate low quality cars? This research examines that question through an extension of economic principles, consumer and supplier behavior, information asymmetry, technology, and unique aspects of price and quality. Amidst a glut of dubious information driven by social media, websites, and news outlets, this paper provides an economic framework about modern news deficiencies. High speed production and consumption of facts and opinions overwhelm the individual’s cognitive processing limits. Similar to Gresham’s law, bad information drives out good. If consumers perceive news is free and quality is questionable, then consumer and social economic benefit is zero. All economic benefit goes to the supplier and the free market under performs. Seven factors drive this: One, technology enables fast cheap distribution such as television, websites, or social media; two, existing laws protect distributors from content liability, like section 230 in the United States; three, factual information is costly and its value fades quickly in the 24 hour news cycle; four, opinions have legal protection and facts do not; five, consumers perceive news is free due to supplier secondary payment mechanisms; six, consumers cannot process the immense volume of news which is subject to newly defined Masherg’s law. And seven, suppliers develop sophisticated quality definitions for themselves and consumers, far beyond the knowledge and resources of a consumer to know their own quality definition. These seven factors have converged, resulting in market failure for free news.

Classification codes: JEL B55: Social economics; D18: Consumer protection; E71: Role and effects of psychological, emotional, social, and cognitive factors on the macro economy; D82: Asymmetric and private information; D83: Search, learning, information and knowledge, communication, belief, unawareness; L15: Information and product quality.

Keywords

Information asymmetry; Misinformation; Social media; Public information products; Market failure; Economic surplus; Economics

Introduction

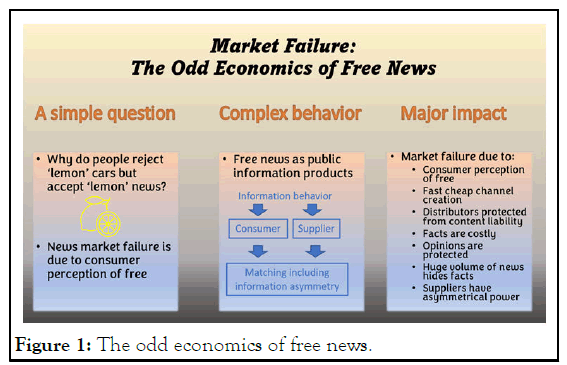

I started with simple questions about everyday news. If a low quality car is easy to spot after the buyer has owned it for some time, why isn’t low quality news easy to spot? Then, if consumers demand high-quality cars, why don’t they demand high quality news? This is important because people worldwide are continually exposed to a barrage of information from suppliers with diverse motivations, leading to personal confusion and social chaos. The information quality issue for tangible products was addressed many years ago. Lemon laws exist to protect the car buyer from unscrupulous sellers who have more information about a car’s quality. Yet consumers of news have little protection from low quality and, even worse; willingly consume low quality information when the same consumer would not tolerate a low quality car. The persistence of low quality information, and the appetite to consume it, is puzzling (Figure 1).

Figure 1: The odd economics of free news.

Ideas presented in this paper attempt to explain why the news marketplace has failed, generating much confusion and unpleasant behaviors at great social cost. News consumers and news suppliers interact to make a peculiar market. To understand these peculiarities, this series of short articles is a journey through the ecosystem piece by piece. The first stop on the journey is the information seeking behavior of consumers including the identification of consumable information, what price consumers will pay for news, and what quality will be consumed. The second stop is the information production behavior of suppliers. This includes the identification of producible information, how money is earned, and what quality will be produced.

The last stop looks at what happens when consumers largely perceive news to be free. This is a significant peculiarity that nearly eliminates price as a consumer choice factor. Instead, quality is the primary choice factor. Consumer and supplier quality matching is central to making the news market. There is information asymmetry about news quality and suppliers have massive resources available to drive the market.

Woven throughout these articles are the influences of technology which enable fast cheap channel creation; legal liability protections for content distributors; the high cost of facts which fade with the 24 hours news cycle; legal protection of opinions; the impact of consumer perception of free news and secondary payment systems; the sheer volume of news overwhelming people’s ability to process; and the ability of suppliers to know the consumer better than the consumer knows themselves. For individual and social benefits, I have written with four intentions. One, that academic economists deepen understanding of these ideas; two, that public information suppliers better understand their role and duty to their customers; three, that consumers of information are better able to process what they read and hear; and four, that stewards of public trust act intentionally and decisively to build the framework in which public information quality improves and becomes trustworthy [1].

News as public information products

For clarity, I define news as Public Information Products (PIP) which is perceived to be free by the consumer, delivered by traditional media or social media, and excluding private information governed by agreements or contracts which have an effective marketplace. Public information products are oversimplifications and omissions, with too much information for consumers to process. Therefore, the test of truth is also oversimplified to something like “I know it is true if it conforms to what I believe.” Truth is a mental composite of objective facts and subjective beliefs. Beliefs can be held so strongly that independently verifiable facts may not change beliefs. This distinction makes it possible for existing PIP to claim truth yet be factually false, such as “I believe the earth is flat.” The power of beliefs to override facts means any supplier claim of a single truth is folly. Historically, public information from our neighborhoods and towns affected our lives. Local news is still relevant but now competes with a near instantaneous deluge of global news. Most global news is not actionable by the consumer but feeds emotions. It appeals to subjective criteria, to be novel, sensational, outrageous, emotional, and addictive. PIP is everywhere. Most of us think we get it free and have little sense of its quality. Americans’ trust in their news sources is lowest with social media (4%), then friends and family (14%), national news (18%), and local news (22%). It is no wonder we get confused.

Consumers gain and lose by the PIP they believe. These gains and losses affect consumer status and social, personal, and financial well-being. These beliefs filter into the conscious and subconscious in ways formalized by Simon’s bounded rationality, Tversky’s decision processes, and Maslow’s human needs, each representing broad categories of human information processing. This processing is complex, varying by person, time, circumstances, and experience for any market in which they seek a specific product.

Market failure occurs in conditions where the free market does not self-correct. PIP dynamics show a mismatch between supply and demand, irrationally perceived “free” content, tension between individual good and society good, unusual principalagent interactions, and supplier-consumer information asymmetry. Each of these will be explored. Classically, the supply and demand is about quantity which applies to PIP oddly with too much inexpensive information saturating demand. Newly and significantly, supply and demand are about quality where questionable information is difficult to identify. In any market, personal confusion and societal costs are subject to Misinformation, Disinformation, and Malinformation (MDM). From a consumer point-of-view, pernicious information is wrong and misleading regardless of its origin or intent. MDM drives supplier and consumer behaviors for both price and quality. Consumers easily spot price differences and are driven to the equal-quality supplier with the lowest price. In contrast, consumers cannot easily spot differences in quality and consume from suppliers over the full spectrum, from honest to dishonest.

Where information is the product being produced and consumed, what happens when all PIP is perceived to be the same price, essentially free? Quality then drives our personal decisions about the PIP we consume. Worldwide searches for the “best” quality have long surpassed searches for “price” and the gap is increasing. Yet quality is often avoided in economics because it is hard to define with precision. Each consumer or supplier definition of quality includes many components of importance what news outlet, who said it, how recent with each component’s relationship to others, simple or complex [2].

To express this succinctly, let a consumer or supplier definition of quality, Q, be a composite set of a number of n quality components c where:

Q={c1+c2+c3+… cn} and components care anything important whether static or transitory, objective or subjective, articulated or not; + represents a component’s simple or complex relationship to other components; and n is usually large.

Supplier s of PIP has its own set of quality component members

Qs={cs1+cs2+cs3+…csn}

And consumer c different set of quality component members

Qc={cc1+cc2+cc3+… ccn}

The sets Qs and Qc must have sufficiently common members for a transaction to occur. Yet perfect alignment is improbable. The large number of quality components is nearly a guarantee of information asymmetry between suppliers and consumers.

In 1961 George Stigler wrote economists “assume that the consumer has a large laboratory, ready to deliver current information quickly and gratuitously” to the consumer to learn about products. Today the assumption is gone. Consumers now have countless suppliers providing near real time information. Yet the search problem remains. With so much being produced, finding high quality information is difficult.

Literature Review

A well-functioning market corrects itself when consumers detect low quality before or soon after purchase, creating feedback to suppliers driving higher quality or lower prices. This does not happen with PIP. The market fails due to an odd combination of a perceived endless supply at a perceived price of zero. This drives a market flooded with non-perceived low quality products. Without a consumer feedback loop on price and quality, the market does not correct and becomes deluged with more inexpensively produced PIP, with low quality undetectable by the consumer.

Information seeking behavior of consumers

The information age has changed consumer economic behaviors. As a study of humans in the ordinary business of life, economics is “on the one side a study of wealth; and on the other, and more important side, a study of people. For character has been molded by every-day work, and the material resources which is thereby procured, more than by any other influence.” Today, information resources rival material resources for wellbeing. PIP molds character, shaping what we believe and how we act on those beliefs. Consumers must sort through facts and overwhelming amounts of MDM [3].

Our attention span is the finite resource, with the flood of information exceeding our ability to process it. Herbert Simon wrote “a wealth of information creates a poverty of attention” which may lead to information snacking, essentially junk food for the mind. People read junk information for the same reasons as eating junk food: It is inexpensive, easy to get, and provides instant gratification. It is also unhealthy and raises the question: how do people identify what to consume?

Identification of consumable information

Consumption matches supplier price and quality with consumer price and quality. This is simultaneously a simple process but driven by many complex dynamics. This section examines how consumers identify what to consume. This is challenging as technology disrupts our world view away from the direct personal impacts of local PIP to the tenuous impacts of global PIP, much of which consumers lack a framework with which to comprehend. We may resort to trusting groups as a modern form of tribalism. Local PIP about nearby towns and cities has expanded to PIP about nations and the world. We consume and believe indirect experiences that are more digital than real. Global databases, operating systems, and networks form the core of this new world, delivered to the mobile device in our hand.

This is because information has unique properties. Consumption does not deplete PIP, storage is cheap and persistent, and dissemination is inexpensive, easy, and fast, thus lowering barriers to consumption. The ease of creating and disseminating PIP makes it plentiful and accessible. But it creates problems of too much information, too many search results, and a mismatch of quality-expected versus qualitydelivered [4].

Components of QC

Economic research and psychology describe QC, sometimes more accurately than we can for ourselves. Many of us do not have a formal QC and have little awareness of its components. Our QC is likely to be incomplete so we function with partial personal mental framework. The best a consumer can hope for is to satisfice. In most cases, that is good enough yet leaves consumers partially unsatisfied.

This is in marked contrast to a supplier which has resources and economic motivation to create both robust Qs and a supplier’s version of QC. Thus, the supplier knows more about overall Q than does the consumer, creating tremendous consumer disadvantage in the marketplace.

A car example illustrates the consumer conundrum. “How do you size up vehicles across categories, built for different buyers, who may use them for entirely different purposes? The apples-tooranges comparison is always excruciating, but what has become apparent is that the choice, now, may not be useful: In reality, sometimes you want an apple; other times you reach for the orange.”

Some may think subjective components are inferior. They are not. The customer wants what they want even when the subjective components of QC overwhelm the objective. Logic rarely changes the mind when emotions run strong.

A consumer can crisply rate quantitative components for a car such as acceleration and fuel mileage. They may convert some qualitative components to a number such as smooth ride, seat comfort, and styling. More elusive components might not be articulated thus not included, such as regency, brand beliefs, and cognitive bias. Yet they are still likely at play, lurking in the mind.

What about post-consumption quality assessment? With a car, we learn about quality by using it, the product cycle measured in months and years. Such learning is less clear with PIP which, unlike a car, changes rapidly with the whims of news cycles, leaving consumers to trust the source as a proxy for the quality of the products they deliver [5].

We intuitively know that information is not useful forever. Historical facts, like last Friday’s high temperature, no longer have value. With dynamic facts like a disease treatment, the new replaces the old. To make it even more difficult, facts change because definitions change, like whether Pluto is a planet or not.

There is a price to pay for keeping up. Arbesman acknowledges social sciences change faster than physical sciences because “if you are making measurements that have to do with people, things are a lot messier, because people respond to a lot of different things.” Sorting through changing information is taxing for our brain so we create shortcuts to make it easier.

Psychological value of information consumption

Humans have developed strategies to minimize taxing our brains and still satisfice. While these strategies are beyond the scope of this paper, an illustrative selection provides some insight into how people take shortcuts while creating objective and subjective quality components in our personal QC.

Filtering PIP becomes essential with the 24 hours news cycle and its news-of-the moment. For example, voters have difficulty constructing an enduring Qc. This is especially true of those who wait until the last minute to cast their ballot, weighing recency higher than the relevancy of months-old PIP, now forgotten. Consumers process high volumes of PIP, driven by the speed of technology and a supplier’s need to fill time with something, anything.

Tribalism can be very strong, with personal decisions more heavily weighted toward ego, group belonging, and self-interest as a proxy for historically local views. Whether group norms make sense or not, straying from them has consequences: Getting kicked out of the group or being denied membership. Social media influencers are a type of tribe leader and research supports the sensationalism and lower quality of their content. Yet many people follow them to maximize social rewards and minimize social costs. Tribes can be very effective at reducing personal search costs by pooling information, while putting quality at risk. This is because group identification leads to overconfident beliefs about group members regardless of member ability. Low ability members overestimate their ability and high ability members underestimate their ability, shifting influence from high ability to low ability members, a sort of lowest common denominator. Beyond tribalism, PIP can enable collective narcissism where the group holds unrealistic beliefs of greatness and perceives threats from other groups [6].

Subjective value of PIP is influenced by the QC components. Views of money, time, or data given can all influence value perception. If you nudge people sufficiently, their subjectivity engages and they will behave as the supplier wishes. Michael O’Leary, CEO of Ryanair, is certain of this with low fares overcoming safety concerns, he says, “€ 9.99 fares will cure an awful lot of customer apprehension.”

Six biases have been found by google researchers as core to decisions shortcuts:

• Category heuristics: Shortcuts or rules of thumb that aid us in making a quick and satisfactory decision. This includes reducing choices, simplifying, and ease of access.

• Authority bias: Altering opinions to match those we consider authoritative experts.

• Social proof copies other people’s behaviors in situations of uncertainty. This can be tribal through word of mouth or star ratings on products of popular choice and can be subconscious.

• Power of now: Humans want things now rather than the future. Planning takes energy and immediate gratification is powerful, driving demand for same day package delivery and continual instant news feeds.

• Scarcity bias: Rare things are more desirable than common things. Techniques are deadlines (order now), quantity limits (may not last), limited access (I get something you don’t).

• Power of free: The demand for something priced at zero is much higher than just slightly above zero.

These six are built upon basic human behaviors, with roots in Maslow’s work on human needs. All of these shortcuts influence PIP consumption. Social proof and authority bias are especially interesting because of their contributions to tribalism. The combination of personal shortcuts and group dynamics is a powerful driver of the psychology of consumption.

Price to pay for PIP

The consumer pays others to gather PIP, similar to a company outsourcing work. But unlike the firm, the consumer takes greater risk, having no formal quality agreement with the supplier. In Stigler’s 1961 scenario, the local information about car price and quality was limited, making the purchase process fairly easy.

In contrast, today the purchase process can be difficult. We are overwhelmed with millions of web search results and the tyranny of choice sets in. We cannot make sense of millions of results, so we take the easy way out: click on one of the first few we see. Various studies you can search for them show about 90 percent of clicks are on the first page.

We may adapt our search strategy by avoiding search engines altogether. We revisit the same cable news, website, or social media site followed by more shortcuts, looking for familiar names and familiar topics. All trying to minimize the cost of search and maximizing the value of results through subjective control of our QC, with economic impacts on both personal and society well-being [7].

Quality dispersion as a measure of ignorance

“Price dispersion is a manifestation and, indeed, it is the measure of ignorance in the market.” Now, with PIP price perceived as zero, I suggest quality dispersion is the primary measure of ignorance in the PIP market. Critically, while more searches improve knowledge of prices, more searches may not improve knowledge of quality. Creating definitions of Qs and Qc is hard. Consumers get information for which they have no background to comprehend. Satisficing can help lower cost by ending the search when a good enough result is found. Maximizing utility in a classical sense is seldom relevant.

Stigler’s paper also cites “the widely held view that inexperienced buyers pay higher prices in a market than do experienced buyers as the former have no accumulated knowledge of asking prices. They will pay higher prices on average.” Similarly, inexperienced consumers of PIP are at a marked disadvantage. They lack the experience to distinguish high quality from low.

Forms of payment for PIP

Consumers are often clear about money and time yet less clear about the value of their data, mental health, and the cost of regretted decisions. The precision from paying with money is lost. Nothing captures a single tally of cost for a consumer in their search for PIP. Herbert Simon said it well: “We aspire only to approximate truths; we are under no illusion that we can find a single simple formula, or even a moderately complex one, that captures the whole truth and nothing else.” The absence of a simple formula for PIP makes it difficult for the consumer to understand their consumption costs.

In particular, consumers have little sense of the value of data given or taken by suppliers. It can be about the person (name, gender, background), their behaviors (purchases, navigation), engagement (texts, social media, emails), and others. “Much of the news currently published online is simply not worth paying for. Some of it is hardly worth our fleeting attention, let alone hard-earned cash” yet we willingly pay with personal data. Facebook has built their multi-billion dollar annual business on the data generosity of its 2.8 billion users.

People will pay with their time but are less willing when they quantify how much time they spend on PIP, discovering the “negative consequence of monetizing leisure.” With a simple calculation of an average 142 minutes a day on social media at an average wage of about $30 an hour, the cost is $71 a day.

Media outlets have tried subscription models and pay walls with varying degrees of success. A pew research center report also showed that willingness to pay for news PIP is low. When paying with money, only 16% of consumers pay for news PIP yet 44% will pay for entertainment PIP. Keeping current with PIP is difficult and consumers may pay more when it is supplied as entertainment, lowering the barrier to access much like a catalyst. Consumers willingly, perhaps eagerly, distribute PIP that takes advantage of the desire to be entertained. For suppliers, that distribution channel is free. This leads to important questions about economic winners and losers, as well as impacts on society benefit.

Economic surplus and societal benefit

Economists developed a way to look at the winners and losers. Economic surplus is a measure of the total benefit to society, by both consumers and suppliers, from buying and selling things. It accounts for the net of all the good and bad impacts. This gets messy with PIP transaction payment forms of money, time, or data, combined with the tricky sense of economic well-being from subjective quality components.

Therefore, overall economic surplus, S, is the sum of consumer surplus Sc and supplier surplus Ss defined below. Both Sc and Ss can be positive. If one is negative, the other must be positive and large enough to balance the negative. If both are negative, S is negative:

S=Sc+Ss is positive when both Sc and Ss are positive

If Sc is negative, then S is positive when Ss>|Sc|,

If Ss is negative, then S is positive when Sc>|Ss|,

S is negative when both Sc and Ss are negative.

Economic surplus also has subjective components, from the consumer and the supplier. The consumer has a maximum price they will pay. The supplier has a minimum price to accept. Looking at each:

Consumer surplus is when the price paid is lower than the highest price they are willing to pay. Paying less is a bargain, bringing a subjective sense of economic well-being to the consumer.

Pcp

Supplier surplus is when the price accepted is higher than lowest price they are willing to accept. Accepting more is profit, bringing a sense of economic well-being to the supplier.

Psa>Psw where P is price, s is supplier, a is accepted, w is willing to accept.

If both are true then consumer and supplier win, an overall economic surplus exists, and a wide sense of economic wellbeing is created with associated societal benefits. When this occurs:

When Pcp=Psa a transaction is made.

If Pcw>(Pcp=Psa)>Psw both Sc and Ss are positive and S is positive.

A general sense of benefit is important for the current transaction and for the possible additional consumption or production resulting from feelings of economic well-being.

However, when PIP is delivered to the consumer at a perceived price of zero and the maximum they are willing to pay is zero, there is no subjective bargain perceived by the consumer. They expect free and their expectations are simply met. Thus, there is zero consumer benefit, and no consumer surplus.

When Pcw=Pcp=0 then Sc=0

Importantly, the consumer does not realize subjective benefits and the overall economic benefit is then only subject to supplier benefit. This means that society-wide economic surplus rests solely with suppliers. Further,

If Pcp=0 then Psa=0 directly from consumer to supplier

With PIP, the consumer is not directly paying money to the supplier. To make money, the supplier must sell through secondary payment systems such as advertising and consumer data such as media outlets operating without consumer subscriptions or paywalls.

But what if the consumer is willing to spend non-currency resources? The entire concept of surplus is moved from the objective (money) to the subjective components of Qc assuming the consumer perceives no value for time or data. And markets are hard to understand when the consumer components are subjective [8].

The consumer also pays a non-monetary but real cost for rejecting information that is factual and instead relying on MDM. Information rejection is a serious problem when scientific PIP meets general public comprehension. In the example of COVID-19, most people do not understand pandemic disease transmission and control. They can rely on factual expertise or rely on MDM and perhaps pay the cost of illness or death.

Suppliers invest to create the supplier version of QC to know which subjective components they can exploit to drive nonmonetary forms of payment. Suppliers will edge closer and closer to quality limits of QC that would repel a consumer, much like they edge close to Pcw until consumers object and reduce consumption. And if a supplier of MDM causes illness or death, the costs are borne by the consumer, creating a moral hazard.

Determining consumer quality

Consumer detection of quality remains elusive, leaving the consumer vulnerable to MDM. A consumer’s consumption choices are puzzling, given that Qc uses many thought processes and PIP takes many forms. A consumer’s objective and subjective needs converge to a decision to consume or not. And there is no certainty that consumption leads to comprehension or satisfaction.

The inability to detect quality results in Masherg’s law where bad information drives out good information. Unlike ‘bad’ copper coins driving higher value ‘good’ silver coins from the market, good PIP is not driven out. Rather it is drowned out by the flood of bad PIP overwhelming the relative scarcity of good PIP. Critically, with Masherg’s law the consumer cannot tell the difference in quality. A consistent rigorous Qc is too hard for consumers to apply. And with price perceived to be zero, there is no economic incentive to tell good PIP from bad. Market failure is the result.

Information production behavior of suppliers

India 1932. Sir Malcolm darling describes a small village moneylender charging interest far above prime rate. The moneylender uses intimate knowledge of customers to provide loans to those who would otherwise get none. Here is darling’s passage updated to reflect not money but information suppliers: “It is only fair to remember that in the villages, the information supplier is the one knowledgeable person amongst a generally unknowing people; and that those methods of business suit the happy-go-lucky ways of the people. The supplier is always accessible, even at night; dispenses with troublesome formalities, asks no inconvenient questions, gives promptly and, if personal data is shared, does not press for other payment. The supplier keeps in close personal touch with consumers, and in many villages shares their occasions of weal or woe. With intimate knowledge of these people, the supplier is able, without serious risk, to supply those who would otherwise get no information at all.”

Similar to the moneylender, modern PIP suppliers invest in knowing their consumers very well. There are few troublesome formalities including payment. And when the perceived price is zero the only driver is quality, the match of Qs and Qc. Modern media companies have substantial resources to make the match, leaving the consumer highly disadvantaged.

Identification of producible information

A supplier shapes PIP into something attractive to the consumer, matching Qs with QC, thus creating a market. Both supplier and consumer are influenced by the ease of producing volumes of PIP cheaply, then delivering it to mass or micro targets using harvested personal data. This personal data is processed at very low cost by algorithms acting as information brokers to deliver PIP. Big technology companies have enabled automated refinement of PIP production and reduced the role of human editors.

Suppliers learn consumers’ habits, feeding them what they want, sustaining a cycle of consumption. One Qs component is to create consumer allegiance to the PIP supplier, regardless of costs to the consumer or society. Each supplier protecting its self-interest is akin to the invisible hand, ever growing in the new global commons of PIP. When supplier self-interest ignores externalities, consumers and society pay the cost. With PIP, it is the modern equivalent of Garrett Hardin’s grazing commons where it is not the cows overgrazing a finite pasture but suppliers overloading a finite attention span, destroying our individual and collective abilities to process information. Masherg’s law assures the volume of PIP will continue to surpass our ability to pay attention. When that happens, consumers exit the market, choosing not to consume any PIP and weakening the PIP market.

Supplier usefulness differs from consumer usefulness. Suppliers define extensive information quality dimensions using sophisticated methods unavailable to the consumer. Suppliers invest in big data analytics dynamically linked to automated marketing, targeting consumers in a way far beyond the ability and comprehension of the consumer. For example, suppliers monitor the lineage and provenance of their data but seldom share that with consumers. Data quality is, once again, the domain of suppliers [9].

Components of Qs

As with consumer quality, physical product suppliers have an advantage over PIP suppliers. Analytical methods for a car organize both the objective (miles per gallon) and subjective (looks fast) qualities. These are all discoverable through product development techniques. Customers largely say what they want which the supplier then augments by unarticulated qualities obtained through market research. The objective and subjective attributes of both Qs and supplier created QC are clear and verifiable. Individuals do not have the time, resources, or mindset to be so rigorous for all products.

PIP suppliers, however, have a substantial challenge. “In-depth qualitative studies of news preferences can complement surveys and online tracking to help news organisations address the complex balance of personal and civic concerns that their readers care about.” They define only partial Qs because “the same news story can be read by different people as an ‘international’ story, a ‘technology’ story, or a ‘financial’ story.” Attributes are not clear and difficult to verify. Both Qs and QC are incomplete and dynamic.

Business value of PIP production

Similar to consumers determining the psychological value of PIP consumption, suppliers have developed strategies to minimize the costs of information production while maintaining business viability. Again, a comprehensive view is beyond the scope of this paper but an illustrative selection follows.

Hedonic pricing can help a supplier understand how to provide PIP to consumers if products can be reduced to constituent parts, such as PIP timeliness and subject matter. The market value of those parts can be understood using hedonic regression. Based on preferences revealed through data about what people actually consume, hedonic regression can be used to understand consumer choice preferences and the final form of the PIP. Such methods require significant data to gather and analyze, for which many suppliers have sufficient resources.

While Hedonic modeling may be largely price oriented, this suggests a quality orientation that simplifies complex information using personal Qc.

Deadweight loss is the cost of market inefficiency such as imbalanced supply and demand with three main causes: Taxes (increasing price paid), price floors (minimum wage), or price ceiling (rent control). In each case they influence the price paid by consumers and revenue received by suppliers. Deadweight loss calculators require price and quantity but with PIP, the consumer perceives a price of zero and quantity nearly infinite. Perhaps, then, the loss occurs with quality variations, not price. Masherg’s law asserts itself again, with the flood of bad PIP driving out good PIP. The personal and societal costs of this market are open questions.

Discussion

Externalities can be used by suppliers to shift costs to external parties with PIP. Technology enables much of the substantial PIP distribution costs to be carried by the consumer, personally paying for PIP transport, display, and storage via internet access and device costs.

The costs to create the supplier’s version of Qc are also shifted to the PIP consumer by capturing their interaction behavior and by consumers freely giving their personal data. This data automates Qc which modifies algorithms and data, more precisely targeting what the consumer is later presented. PIP consumption generates data to guide and modify the entire PIP supply chain using algorithms unknown to consumers and regulators, shifting control to the algorithm owners where they can drive external cost apportionment and revenue generation. This might be a mechanism indicating Qc is satisficed and Sc>0.

Externalities may also lead to the destruction of common pool resources when incentive structures leave no one in control. However, Ostrom has shown that people can manage common pool resources for the benefit of all when they agree on their goals and the group is not large. Without joining a group, individual PIP consumers can “vote with their clicks” and change suppliers if they become dissatisfied, still uncertain that they have improved their lot.

This point out two problems. One, large media companies are responsible monitors of performance and costs for their customers, which is like the proverbial fox guarding the chicken coop. And two, consumer common pool management requires clear goals and criteria, which is nearly impossible for consumers given the elusive nature of Qc for PIP and that finite attention is a limited resource.

Induced demand is a factor driven by the flood of information. Similar to expanding roadways leading to more traffic clogging the expanded roadways, more PIP consumes more computing power, network bandwidth, and our attention span. Like indirect funding of freeways through taxes, suppliers use indirect compensation to increase consumption of PIP. Supplier PIP pathways are paved with social media influencers supported by supplier-paid advertising. These unconstrained media influencers increase consumption more than editorially guided news anchor. Good PIP is supplanted bad PIP according to Masherg’s law.

Induced demand may not apply to PIP because individual consumption has practical time limits each day and the number of hours per day spent on PIP has plateaued. While new media is replacing traditional media, overall hours per day have been nearly constant, except for an increase in 2020 due to COVID. Supply, however, can grow not having the constraint of an individual consumption limit, driving the supply of PIP far past the demand thus contributing to market failure [10].

Earning money from PIP

Suppliers have many ways to earn money from PIP production, much different than traditional consumer direct pay schemes. Whereas consumers have a perceived price of zero, suppliers must know their costs and how to get money to make a profit. Fixed and variable costs may tempt suppliers to produce products with little fact quality when opinions are lower cost and they know their consumers are driven more by qualitative components of Qc. Asymmetric commitment is also true for the PIP market. Consumers are free to switch at any time while most suppliers have longer-term production investments requiring a commitment to the market.

With consumers using simple search terms, suppliers must use their own knowledge of Qc to be found. To address the problem of too many results from too easy searches, the supplier must stand out through simple appeal to consumers. Once matched to a consumer, cognitive shortcut signaling via packaging and presentation of PIP become retention methods, particularly useful for pooling efficiencies.

PIP suppliers can get money directly by charging consumers for subscriptions and streaming online events. Selling advertising is also familiar to suppliers and consumers. Less familiar is buying and selling consumer data. Each supplier has their own method for the final translation of non-monetary to monetary payment.

Consumer data pays suppliers by selling more products to existing consumers and efficiently targeting new consumer acquisition. Monetizing benefits are calculated by a Return on Data (ROD) metric, value of gain minus cost of data, similar to ROI. Companies can also sell data they collect on their customers. The marketplace for consumer data is large and obscure to most people with much of the market operated through data brokers with thousands of data points per person.

When consumers get PIP without paying money, advertisers and data brokers become outsized influencers. The PIP consumer’s role is diminished, dominated by supplier Qs and supplier created QC.

Determining supplier quality

The quality burden lies on the supplier using their Qs and their supplier created Qc. Consumers want easily understood PIP to minimize the time and effort to understand deep information. From this perspective, suppliers and consumers share the complex PIP market dynamics of the 24 hours news cycle. Speed promotes short-term thinking, quick conclusions, and impatience. These are unarticulated components of Qc, all easily exploitable by suppliers. There is no time for depth. And no one can keep up with the knowledge needed to comprehend topic after topic.

Some new PIP suppliers decrease quality by using sensational opinion content to gain consumer attention. They may not attract a large mainstream base but they do not need to. Technology enables them to exploit niche markets without concern for objective quality, leading high quality mainstream suppliers to compete on sensationalism.

When PIP suppliers make money by tilting towards sensational Qc, the quality of the PIP can be questionable, much like a new paint job covering a car that may be rusting or not. George Akerlof’s work on the market for lemons gave a structure “for determining the economic costs of dishonesty.” The rise of the internet and social media has revealed dishonesty for information itself. Many technology enabled niche PIP suppliers have a skewed PIP to make money from a small segment of uninformed consumers driving their content. With unverifiable factual quality, the least honest have incentive to dishonesty, building a following by making up opinions and using technology to finding people to consume junk PIP.

In the market for Lemons, Akerlof shows “dishonest dealings tend to drive honest dealings out of the market.” He goes on to write, “The cost of dishonesty, therefore, lies not only in the amount by which the purchaser is cheated; the cost must also include the loss incurred from driving legitimate business out of existence.” Another cost externalized by suppliers and paid by consumers and society.

Dishonesty is limited when product or service quality can be verified. The seller knowing more than the buyer is a classic lemon market. It typically motivates sellers to know the quality so they can charge a higher price. But what if the seller cannot verify the quality of the product? What price can they charge? In both cases, the buyer may lose but may have no way of knowing. What is the impact of unknown loss due to dishonesty? Caveat emptor? Venditor (seller beware)? Lector (reader)? Auditor (listener)?

PIP quality asymmetry exists because suppliers have both Qs and deep knowledge of Qc, deeper than a consumer’s knowledge of their own Qc. Perhaps the consumer would benefit from seeing the supplier’s Qc. With Masherg’s law, high quality information is like the needle in a haystack of MDM.

Public and private information product quality

A consumer is vulnerable because public information products lack consumer-supplier agreements. Private information, produced for a specific target market, is usually governed by a contract specifying information quality and consumer recourse for product failure.

Private information has both clear price and quality facts. The supply and demand dynamics are familiar. Companies will collect information, prepare a usable format, and charge for it. Their consumers expect reassurance from the company for the expected value. Public information product consumers have little recourse for recompense when PIP consumption causes damages, due to the perceived price of zero and no quality claims made. To dramatize, what are the expectations and rights of a consumer who has paid $50,000 for something versus a consumer who has paid nothing? Yet there is the consumer cost of thinking and acting on faulty information. A free car driven into an injury causing wreck still causes damages even though nothing was paid.

In the absence of enforceable supplier consumer contracts, there is little financial incentive for high quality PIP with its short shelf life and fast-in fast-out news cycle. More important is for the supplier to get the consumer engaged for continuous consumption and additional revenue generation. PIP suppliers know consumers, by and large, will accept low cost junk news in large volumes, making it hard to remember what they consumed in the past. Short memories give newsmakers great latitude as facts are not relevant nor remembered nor recalled. Suppliers keep producing high volumes of PIP like transactional piecework with factual quality eluding the consumer.

A supplier threat may come from others who attempt to match their consumers’ Qc as happened in late 2020 when a popular news outlet started reporting U.S. election facts instead of opinion. Viewers quickly switched to PIP outlets that better matched their QC subjective components rather than accept facts.

Copyright law does not protect facts, only original expressions about the facts. This motivates PIP suppliers to use opinions to get consumers emotionally engaged. If they release a fact which they spent significant effort to get, public domain rules apply and other PIP providers can spin their own low cost expressions. Facts are expensive.

Suppliers of high quality products generally have high costs of research, verification, creation, and production which justify a higher price and associated legal protections, much different from the daily news. It is much cheaper for free-riders to take public domain information and spin opinion around it. Free riding suppliers, including social media spreaders, generate low cost, high volume, questionable quality PIP. Pervasiveness can lead to believability and, as a high school teacher told my class, “If a million people say a stupid thing, it is still a stupid thing.”

Trust is essential. Low-quality PIP shifts risk to the consumer to verify facts, contrary to why they outsourced PIP production. Suppliers create a severe moral hazard by shifting the extrinsic costs of their actions to the consumer [11].

How information suppliers reassure consumers

PIP consumers’ quality beliefs often depend on signals. In general, consumers assume quality is low I don’t know what to believe unless they are extremely knowledgeable or a signal like branding, licensing, certification, or guarantees raises the expectation of quality. Without knowledge, consumers seek signals that may be trivial or misleading: A polished website, a smiling face, or an outraged rant. Consumers may accidentally undervalue informative signals and high-quality information.

Guarantees

Guarantees tell a consumer that the supplier carries the cost of quality. This is unusual for PIP suppliers and caveat venditor is rare. More commonly, the consumer bears the risk. With PIP, the consumer rarely has the resources to assess that risk yet bears the cost. A consumer will not exercise a guarantee if it costs more than the cost of replacement. With a perceived price of zero, holding a supplier accountable always costs more and little is done about low quality PIP.

A guarantee for PIP would be difficult in practice. Suppliers may offer a correction or retraction but how does a consumer return faulty PIP? How does one clear their head of falsehoods? Changing suppliers for the future may be the consumer’s only recourse.

For PIP, “the primary qualitative concerns are whether the information is correct, whether it is relevant to the use for which it was intended, and whether it is delivered in a form that is understandable and, therefore, usable by the recipient.” Nimmer and Krauthaus continue. “Although in sales of goods a promise to deliver goods of acceptable quality is implied unless expressly negated, no such promise is recognized as to the accuracy of information sold unless expressly made.” Yet few PIP suppliers expressly claim accuracy of their information. Caveat emptor.

Branding

In practice many consumers will pay a premium when the brand infers quality: Ben and Jerry’s ice cream, an MIT college grad, or a Lexus automobile. With PIP, historically trustworthy brands included the BBC, CBS, The economist, and the wall street journal. A current list may be small. All are suspected by someone to be untrustworthy.

The micro markets of PIP have impacted branding with many suppliers and many fragmented consumers. For example, the academy award brand has become less relevant as streaming content has exploded. Measured by United States viewing audience size, the emmys, oscars, and grammys all show shrinking numbers and lower brand impact. Paradoxically, streaming services lobby to receive these awards, attempting to confer legitimacy on their movies by aligning with fading brands. Branding can also work to define the QC of a novice consumer. Brand perception of one product, say sports PIP coverage, extends to other products (news PIP coverage) within the brand resulting in more polarized judgments of product experience with an entire brand. If I think sports coverage is good, I think news coverage is too, and vice versa.

Licensing, certification, and distribution

While licensing is often government issued and used by professionals to provide consumer confidence, it is unlikely for PIP consumers to check for it. Similar to licensing, certifications can be granted by any group to show subject specific qualifications. Certifications vary in quality and usefulness to the consumer and may be a supplier marketing tool. And distribution can protect the integrity of PIP transfer through protocol and agreements, much like emergent food supply traceability systems. Consumers care where their food comes from and how it is delivered. Similar care may apply to PIP for both the supplier and consumer. The perception and reality of higher supplier quality increases value to the consumer and may justify high prices or increased market share.

Legal influence incenting low quality PIP

In a manner of deception, branding may intentionally obscure unseen attributes of PIP. Does the Facebook brand extend to content it promotes? Explicitly no, yet implicitly yes. Before social media, publishers were excluded from liability in winter vs G.P. Putnam’s Sons, where the courts found “the publisher of the encyclopedia had no duty to investigate the accuracy of its publications.” The book publisher was not liable for a child’s injury doing a science experiment printed in their book.

With the internet, Section 230 of the telecommunications Act of 1996 provides similar protection for platform operations like facebook and twitter from liability of third party content, including users. This legal protection allowed the content of the internet to flourish albeit with no quality control and little brand protection. Much dishonesty and junk PIP is the result. “We accept the risk that words and ideas have wings we cannot clip and which carry them we know not where. The threat of liability without fault (financial responsibility for our words and ideas in the absence of fault) could seriously inhibit those who wish to share thoughts and theories.”

With the supreme court decision in New York Times vs Sullivan, the court favored opinion commentators to discuss their view on public and issues with slight risk of liability. Inaccuracy or reckless disregard must be proven by a plaintiff who effectively gives PIP suppliers wide latitude in the breadth of opinion topics, shifting Qs away from facts.

PIP has no objective quality assurance requirements whereas private information does. Specifics of what, who, when, and how are spelled out in a contract. “The law recognizes relatively limited property rights in generally disseminated information products but it also implies only narrow assurances about their quality, thus contributing to ready access and broad use.” It is precisely this trade-off between quality assurances and easy to access/use that affects PIP [12].

Consumer and supplier quality matching

Consumers and suppliers have different components that must align for a transaction to occur. Consumers perceive as free PIP, leaving quality component matching as the transaction enabler. If there is insufficient match, no transaction will occur.

Information asymmetry for public information products

Quality asymmetry: Information asymmetry is the essence of lemon laws, where the seller may know more about the car’s condition than the buyer. The same holds true for PIP. Information about the quality of the PIP can determine if a transaction occurs or not. Parties can be disadvantaged or advantaged by knowing the factual basis for the PIP. If the supplier and the consumer both know facts A and C but not B they are equally disadvantaged. B could be good or bad for either the seller or buyer. It is imperfect information, yet symmetric.

But if either the supplier or consumer knows B or the other does not, the information is asymmetric and the knowledgeable party has an advantage. Quality asymmetry is a central issue with PIP and can take many forms. Some enable transactions and some do not. This forms the basis for an analytical framework. Simple possibilities could be:

Qs=Qc information symmetry without control over MDM, transactions occur (1).

Qs ⊃ Qc supplier has more information without control over MDM, transactions may occur (2).

Qs ⊂ QC consumer has more information, supplier does not satisfice, transaction may occur (3).

Let Qse ⊂ Qs the essential supplier quality subset for a transaction to occur and

Let Qce ⊂ Qc the essential consumer quality subset for a transaction to occur.

Qse ⊄ Qc essential supplier quality components are not wanted by consumer, no transaction (4).

Qs ⊅ Qce essential consumer quality components are not met by supplier, no transaction (5).

Qse ∩ Qce=Ø essential quality criteria are missing for both parties, no transactions (6).

In all cases, suppliers attempt to cause a transaction to occur by offering reassurance. If that works, the supplier has successfully tapped into a Qce, perhaps unarticulated by the consumer.

The presence or absence of Qse or Qce is screening criteria that act as gatekeepers to transactions. In a non-PIP market, a supplier or consumer may have secret criteria to provide a financial advantage which, if made public, drives costs and/or prices higher or lower. With PIP and a consumer perceived price of zero, there is no direct financial advantage possible. Thus, we are back to quality component matching as the driver. In many markets, like cars or labor, clear quality components can be defined and observed. This is difficult with PIP. There are benefits for suppliers to be secret about their quality and how they get paid. The supplier of PIP can use private information in cases (1) (2) (3) to drive transaction volume higher with payment via secondary mechanisms of advertising and consumer data. This private information may actually be collected consumer information that the consumer may be unknowing about themselves. Strict adherence to Qs to drive transactions is risky because “if it works, do it” is fraught with unknown side effects. In the words of Hal Varian, “people in business usually know a set of rules that work well for running their own business, but they often have no idea of where these rules come from or why they work.”

Are there substitute quality characteristics for which a consumer might be willing to trade? To make a transaction precede a precise match of Qs and Qc is not required, only a partial match with essential components by either the supplier or consumer. We cannot appeal to either party’s behavior for good choices but can only influence the matching process to meet both personal and societal desires.

The simple illustrations (1-6) show two parties. There may be more with PIP, such as an agent A in the supplier compensation chain, whether money (cash for clicks) or data (sending the supplier information about consumer); More subtly, an agent B may be a member of the tribe compensated by emotional rewards of belonging or the emotional penalties of not belonging.

PIP market issues

Classically, product price goes up or down to ensure market clearing. With PIP, however, perceived price is zero and it does not change. Driven by technology, supply continues to grow beyond the simplest demand definition: What one person can consume in 24 hours. There is no market clearing at all.

This creates a powerful incentive for PIP suppliers to create products that match emotion, the simplest component of QC. Because objective high quality PIP has higher costs research, creation, production than subjective lower quality PIP, Masherg’s law applies and low quality drives out high quality. It is convenient that low quality PIP is equally capable of engaging consumers, who actively consume low quality PIP for which they are willing to pay nothing.

Suppliers have little motivation to understand the demand for high quality PIP if consumers cannot articulate high quality. Perhaps the high quality market is not worth serving with such little demand. They can make more money with low quality PIP [12].

Consumer vulnerability

Stigler claimed inexperienced consumers pay higher prices. But at PIP price zero, inexperienced consumers get lower quality. With an underdeveloped Qc, they consume lower quality information than more experienced information consumers. Determining quality requires knowledge and skills to counteract MDM.

Inexperienced consumers also have higher search costs. They have little basis for assessing quality, little sense of their personal Qc, and therefore little sense of how much searching they should do. The PIP consumed in early stage learning affects their mental construction of Qc. The inexperienced consumer builds persistent thought framework that may mislead, anchored permanently in an unstable foundation [13].

Goals and payoff

In the PIP world, suppliers know their payoff functions with some precision, consumers less so. Suppliers have existential motivation to understand their Qs. Consumers might benefit from a well understood Qc but instead operate very informally, unaware of their own quality components. They seldom ask, “What is fox news trying to do?” or “What is CNN trying to do?” Without questioning the supplier’s Qs, the consumer consumes without a critical eye. Perhaps it is too obscure, too elusive, and too difficult to understand. This is one problem with economic game theory applied to PIP is that few buyers the consumers of information try to understand the payoff function of the sellers.

From an economic perspective, the PIP market is a game where the supplier has a clearly articulated strategy and the consumer does not. The consumer does, however, have an unarticulated subjective strategy governed by their personal QC. The consumer does not know about nor question the structure of the game being played by suppliers. Adding to their disadvantage, the consumer has less information about the PIP content of the game. The supplier has much more information about the PIP and uses it to disadvantage consumer.

This is partially and selectively revealed by the supplier only when it serves their goals, for example, Qs1=conservative/liberal but keeping others hidden such as Qs2=financial goals, Qs3=editorial process, Qs4=fact omission, and Qs5=story selection. The consumer is also disadvantaged by the dynamic nature of PIP and lacks a mechanism to track PIP topics to make sense of the flow. The supplier controls PIP and likely does track its own PIP products, giving it an advantage over the consumer. Could a broadcaster’s opinion about selective facts grab consumer’s attention? Only when it triggers a subjective element in QC. This leads to an important question: does a constant influx of inexperienced new consumers drive quality down, owing to their lack of knowledge and simple QC? [14].

Recruiting the inexperienced consumer

New consumers enter the PIP market continually and old consumers exit. The supplier must attract the inexperienced consumer by providing knowledge that fits Qc in its early form and a growth path to a more sophisticated Qc. They must make their products sticky to the consumer’s evolution. This is done by both transparent and nefarious methods, the latter through algorithms unknown to the consumer. This brings into question why suppliers survive by offering low quality information. The readiest answer is the lack of discrimination by inexperienced consumers, who may be either new to or disinterested in the dynamics of the information marketplace.

History views this more simply with price: “I had decided to get a new TV so I followed the ads in the newspaper to get an idea of how much it would cost. I noticed that the prices fluctuated quite a bit from week to week. It occurred to me that the challenge to economics was not why the prices were sometimes low (i.e., during sales) but why they were ever high. Who would be so foolish as to buy when the price was high since everyone knew that the item would be on sale in a few weeks? But there must be such people, otherwise the stores would never find it profitable to charge a high price. Armed with this insight, I was able to generate a model of sales. In my model there were two kinds of consumers: informed consumers who read the ads and uninformed consumers who didn’t read the ads. The stores had sales in order to price discriminate between the informed and uninformed consumers.”

In that powerful illustration, price is easy to find and easy to track. Yet with more complex PIP quality and consumer price near zero, quality substitutes for price. When consumers cannot discriminate PIP quality there are more uninformed consumers and with the flood of bad PIP, Masherg’s law drives market failure [15].

Principal and agent

The principal agent model can be used, viewing the consumerprincipal hiring the supplier-agent to produce PIP more efficiently than the consumer could on their own. Except for brand image, Qs is largely hidden from the consumer-principal. The consumer-principal only sees what the supplier-agent produces, not why or how, creating a moral hazard where the supplier-agent can behave irresponsibly and without consequence.

Like a hired employee or contractor, the supplier-agent produces just enough to maximize gains and minimize effort and expense. The supplier-agent of PIP has no risk for the consumerprincipal’s time costs, emotional costs, or societal costs. What can be shifted to externalities is shifted, giving the information equivalent of environmental pollution. A money based incentive solution is impossible because the price of PIP appears to be zero to the consumer-principal.

The consumer principal will decide and act based upon a belief that the supplier-agent respects their interests. They do, but only as far as needed to keep the consumption high. The supplier’s entire existence depends on a sufficiently large audience and thus will approach quality limits to do so, substituting attention grabbing opinions for facts as needed. Unlike standard principal-agent agreements, there is no pay-for-performance and no agreed-upon metrics. With advertising and data payment methods, consumers are but a product to be offered and suppliers are protected from the consequences of their actions [16].

Implications

Experienced corporate suppliers of PIP are skilled with their business practices and their defense. Suppliers include traditional print, radio, and televised media, cable broadcasting, internet information providers, and social media companies. They are well-known and heavily used. While frequently criticized, they persist in an opaque social bargain.

Technology makes it easy to polish up a website or social media account to look substantial and authoritative. Many websites knowingly publish PIP focusing on the subjective components QC and are advised by their lawyers to include disclaimers such as “for information and entertainment purposes only,” begging the definition of information. Some sites include disclaimers on every web page. Others only have a disclaimer on one page of fine print. It is up to the consumer to detect. This also applies to businesses you trust. Suppliers have uneven approaches to manage MDM. Amazon’s ecommerce platform has been used to publish fake positive reviews. Third party vendors are reported to reward customers via a complex scheme of purchasing a product then refunding the purchase price but allowing the customer to keep the product in exchange for the positive review. An intermediary is used for payment processing, making the deception difficult to detect. In this way, MDM is used to defraud consumers on tangible products as well as PIP.

Consumers are not protected from MDM with other supplier products, such as generic drugs versus brand name drugs. A search for ‘buy ibuprofen 200 mg’ showed Advil at rite-Aid,$9.49 for 100 tablets and Costco generic, $10.99 for 1000 tablets. Branding works so well that people will pay nearly 10 xs for a branded version of the exact same drug. Those consumers’ QC weighs brand image guided opinion over scientific fact, to great consumer cost.

These tangible products have market limits due to physical production and distribution constraints. PIP has no such limits. Technology enabled production PIP floods the market, driving Masherg’s law, leaving consumers vulnerable to pervasive MDM [17].

Conclusion

The public information product market has failed. Technology has enabled an explosion of PIP, making it hard to tell high quality from low, and facts from opinion. Our character is molded by what we personally see and read, by what our groups accept and reject, and by how our society unites or divides. Information is the raw material of our cognitive well-being.

We have a convergence of factors resulting in PIP market failure. First, technology enables fast cheap channel creation with cable, a website, or social media. Second, existing laws protect distributors from content liability, like section 230 in the United States. Third, factual information is costly and fades quickly in the 24 hour news cycle. Fourth, opinions have legal protection and facts do not. Fifth, consumers perceive news is free due to supplier secondary payment mechanisms. Sixth, consumers cannot process the immense volume of PIP which is subject to Masherg’s law. Seventh, suppliers develop both their own Qs and a very sophisticated supplier QC, far beyond the ability of a consumer to know their own QC. A convergence of these seven factors has resulted in market failure for free news. Prices can be collected and tracked while observing how people act. With the perceived price of zero, a price-like quantitative metric is absent with PIP. When a consumer perceives the PIP price to be zero, quality is the sole determinant of their consumption. Suppliers control PIP quality, at a cost to consumers and society. Fifty years after “The market for lemons,” dishonesty with PIP has shown both economic and societal costs as well as ongoing ineffective attempts at control. We see a cost to the individual consumer who perceives a price of zero and cannot determine quality. We also see a cost to communities through a skewing of PIP to MDM, with the economic and societal costs of confusion.

For society, the major societal cost of low quality is that it drives out high quality. This is seen when consumers devalue PIP, not knowing what to believe. People cannot distinguish low quality from high because there are no signals to tell the difference. These signals must be sent in a broad framework for the consumer to receive, process, and understand them. In many cases this is the brand that delivers the PIP, be it Johns Hopkins University, Edward R. Murrow, or the national weather service. PIP categories get diluted by low quality imitators a loud voice on cable or anger on social Media causing individual costs (MDM) and general citizenry costs (market failure). High quality news agencies and reporters get lost in the sheer volume of low quality suppliers.

Robert Shiller’s observations about people and stock investing also apply to PIP and misinformation. “Headlines reflect the news media’s constant attention to trivial factoids and ‘celebrity opinion’ about the market’s price level. Driven as their authors are by competition for readers, listeners, and viewers, media accounts tend to be superficial and thus to encourage basic misconceptions about the market.” One would need to write books to provide correct information. Therein lies the tension. Sharing accurate information with books versus sharing superficial information through mass media. Books inform a small audience and mass media misleads large groups. Neither suffices with PIP.

PIP suppliers, acting in their self-interests, have aligned with low cost technology to create a failed market of information asymmetries, principal and agent dysfunction, moral hazards, and the extreme shift of externalities to unsuspecting consumers. Technology, in particular, has enabled market failure only hinted at in the past and now presented to consumers in full force.

This is unusual. Instead of few suppliers creating a noncompetitive market, an excess of supply from an excess of suppliers has created a hyper-competitive market. The consumer perceives zero cost and cannot perceive product quality. Suppliers are incented to reduce costs by selling opinion with the coincident societal and economic cost.

Free market mechanisms, with transparent price and transparent quality driving market dynamics, have failed to govern the supply and demand of PIP. The result is PIP market failure.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

References

- Paul F, Velamuri M. Is the Internet bad news? The online news era and the market for high quality news. Rev Net Eco. 2010;12:125.

- Luis Z. Still an alternative way to protect traditional news: Why barclays did not kill the hot news tort. Berkeley Tech. 2012:12:957.

- Bertin M, Aguiar L, Gomez-Herrera E, Mueller-Langer F. The digital transformation of news media and the rise of disinformation and fake news."2018; 12:45.

- Thomas PE. Doing well and doing good. Ava SSRN. 2000; 7:45.

- Bill D. Dissolving innovation in Meltwater: Copyright and online search. J Inform Policy. 2015;12: 204-244.

- Atara O. Online News and Editorial Standards. Ava SSRN. 2022;12:15.

- Bogunovic I, Trevisani S, Seput M, Juzbasic D, Durdevic B. Short range and regional spatial variability of soil chemical properties in an agro-ecosystem in Eastern Croatia. Catena. 2017;154:50-62.

- Cambardella CA, Moorman TB, Novak JM, Parkin TB, Karlen DL, Turco RF, et al. Field scale variability of soil properties in central Iowa soils. Soil Sci Soc Am J. 1994;58(5):1501-1511.

- Cemek B, GULer M, Kili K, Demir Y, Arslan H. Assessment of spatial variability in some soil properties as related to soil salinity and alkalinity in Bafra plain in Northern Turkey. Environ Monit Assess. 2007;124:223-234.

[Crossref] [Google Scholar] [PubMed]

- Reddy CB, Guldekar VD, Balakrishnan N. Influence of soil calcium carbonate on yield and quality of Nagpur mandarin. Afr J Microbiol Res. 2013;8(42):5193-196.

- Chai Y, Guo J, Chai S, Cai J, Xue L, Zhang Q. Source identification of eight heavy metals in grassland soils by multivariate analysis from the baicheng songyuan area, jilin province, Northeast China. Chemosphere. 2015;134:67-75.

[Crossref] [Google Scholar] [PubMed]

- Chen Y, Cui J, Tian X, Zhao A, Li M. Effect of straw amendment on soil Zn availability and ageing of exogenous water-soluble Zn applied to calcareous soil. PLoS One. 2017;12(1):e0169776.

[Crossref] [Google Scholar] [PubMed]

- Costa C, Papatheodorou EM, Monokrousos N, Stamou GP. Spatial variability of soil organic C, inorganic N and extractable P in a Mediterranean grazed area. Land Degrad Dev. 2015;26(2):103-109.

- Dhaliwal SS, Naresh RK, Mandal A, Singh R, Dhaliwal MK. Dynamics and transformations of micronutrients in agricultural soils as influenced by organic matter build up: A review. J Environ Sustain. 2019;1:100007.

- Dongare VT, Reddy GP, Kharche VK, Ramteke IK. Spatial variability of soil nutrients under sugarcane cropping system in semi-arid tropics of western India using geostatistics and GIS. J Soil Water Conserv. 2022;21(1):67-75.

- Fageria NK, Baligar VC, Clark RB. Micronutrients in crop production. Adv Agron. 2002;77:185-268.

- Fu W, Fu Z, Zhao K, Tunney H, Zhang C. Variation of soil P and other nutrients in a long-term grazed grassland P experiment field. Arch Agron Soil Sci. 2014;60(10):1459-1466.

Author Info

Steven C. Tarr*Citation: Tarr SC (2023) Market Failure: The Odd Economics of Free News. Global J Comm Manage Perspect. 12:026.

Received: 21-Nov-2022, Manuscript No. GJCMP-23-20318; Editor assigned: 23-Nov-2022, Pre QC No. GJCMP-23-20318 (PQ); Reviewed: 07-Dec-2022, QC No. GJCMP-23-20318; Revised: 28-Jan-2023, Manuscript No. GJCMP-23-20318 (R); Published: 04-Feb-2023 , DOI: 10.35248/2319-7285.23.12.026

Copyright: © 2023 Tarr SC. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.