Mathematica Eterna

Open Access

ISSN: 1314-3344

ISSN: 1314-3344

Review Article - (2023)Volume 13, Issue 4

This study demonstrates the financial soundness of a model country’s central government and considers the present day as the starting point. Fiscal soundness is determined by the following criteria: (1) During and after the starting point, the central government can generate the necessary funds for executing budgeted items and there is never a situation in which the central government lacks the funds to maintain its finances and (2) even if the central government is in debt at the starting point, it presents no problem regardless of the amount of the debt. This demonstration is based on pure logic using mathematical induction in a model country that is very similar to a real country. In the discussion, we derive the required and initial conditions for the country to which this demonstration applies. Moreover, solutions to the problems caused by inflation are discussed. In conclusion, it is possible for a country with a financially sound central government to exist in the above two meanings.

Central government; Finance; Budget expenditures; Government bonds; Government debt; Money

A nation’s parliament passes a budget for expenditure that meets the goals and amount required by the state and its citizens. Then, the central government ensures that it is fully executed. This is the ideal fiscal state of a nation’s central government. Taxes and revenues from the issuance of government bonds are the sources of funding for the central government. As long as a central government can issue bonds, it can increase its revenue; however, it must take on additional debt equivalent to the value of the bonds issued. Conversely, the more reluctant a central government is to issue government bonds to suppress the increase in debt, the less able it will be to increase revenue and thus to spend funds in the interest of its citizens.

In the author’s view, (1) a central government can generate the funds needed to execute its budget, and there is no situation in which the central government would lack the funds needed to manage its expenditure. (2) Even if the central government is in debt at the beginning, i.e., the present day, it presents no problem regardless of the amount of debt, without materially deviating from the mechanism of the central government’s finances. Therefore, a fiscally healthy central government can be achieved under these two conditions. The significance of this study lies in demonstrating this fact and having desirable, sound central government finances adopted in many countries.

For example, Japan is a state with an almost fiscally healthy central government that features these two elements. However, very few would agree with the author’s opinion. In particular, the opinion of the Japanese government is completely different. The Japanese government acknowledges that its fiscal position continues to be one in which expenditures exceed tax revenues and that its debt outstanding and net debt to Gross Domestic Product (GDP) are among the highest in the world, thus making it imperative to achieve a surplus in the Primary Balance (PB). The Japanese government has therefore set a fiscal consolidation target of steadily reducing its debt outstanding to GDP and moving the PB to a surplus at both national and local government levels by the 2025 fiscal year (Ministry of Finance 2023) [1].

However, the author believes that it is completely unnecessary for the Japanese government to achieve a PB surplus or to reduce its debt to GDP. Therefore, although somewhat different from the current reality, this study considers Japan a realistic model country. The starting point for the model is the present day. I logically demonstrate that the central government is financially sound in this model country and demonstrate the two aforementioned points.

This study is conducted through logical thinking. It does not require data or theoretical analysis or any knowledge of economics to support it. Thus, someone without any knowledge of economics or mathematics can understand the analysis. Through the analysis, I derive the requirements for a country to maintain a fiscally healthy central government in terms of the two aforementioned elements.

In the discussion, we explain policies for countering inflation when it is expected to occur and has become normalized. Through this, we argue that even with inflation, the real value of individual and corporate bank deposits can be maintained and the borrowing and lending of money among individuals and corporations can proceed smoothly.

If the central government finances of two countries are stable, both countries’ currencies are floating in the currency markets and the real value of bank deposits is maintained, then the exchange rates of the currencies of both countries fluctuate in line with the relative purchasing power.

Finally, we consider central government finances in the context of trade between fiscally sound nations. This aims to clarify the meaning of imports and exports and demonstrate that ideal trade exists when the balance of imports and exports is zero.

We also aim to clarify the meaning of the use of foreign production locations by a given country’s corporations.

It is the author’s sincere hope that central governments with desirable finances might be established in many countries.

Japan-The model country

Japanese government and bank of Japan: We assume that the Japanese government and the Bank of Japan (BOJ) are modified as follows (while somewhat different from contemporary Japan, these modifications are plausible) [2].

• The Japanese government can issue interest-free government bonds and sell them to the BOJ to cover budget expenditures.

• The BOJ issues and retrieves Japanese coins as well as BOJ notes.

• The outstanding balance of the Japanese currency issued, along with that of BOJ notes issued, is accounted for as BOJ debt.

• There will be no revenue for the BOJ. For example, the BOJ does not receive any interest on Japanese government bonds that it holds.

• The BOJ will not independently make any policy. For example, the BOJ will not sell Japanese government bonds to anyone other than the Japanese government. It will continue to hold these bonds until the Japanese government redeems them.

• The Japanese government pays for all BOJ expenses.

• The BOJ has no tax obligations.

• The Japanese government’s deposits and deposits in the BOJ’s current accounts do not accrue interest.

Current assets and liabilities of the Japanese government and BOJ: The assets and liabilities of the Japanese government and the BOJ at present are mentioned below, and they are largely similar to those of the current Japanese government and the BOJ.

• The outstanding balance of the Japanese government bonds is the total debt of the Japanese government account.

• The assets of the BOJ solely comprise Japanese government bonds, while its liabilities comprise yen currencies (BOJ notes and coins issued and outstanding), the BOJ’s current accounts and Japanese government deposits.

• The BOJ’s assets and liabilities are of equal amount.

Regarding the Japanese government’s actual liabilities (Ministry of Finance 2023), as of March 31, 2022, the ratio of the sum of government bonds (1,114 trillion yen) and financing bills (foreign exchange fund financing bills) (88 trillion yen), totaling 1,202 trillion yen, to the difference between total debt (1,411 trillion yen) and deposits received for public pensions (122 trillion yen), totaling 1,289 trillion yen, was 93.3%.

Regarding the BOJ’s actual assets and liabilities (Bank of Japan 2023), as of March 31, 2023, the ratio of the Japanese government securities (582 trillion yen) to total assets (735 trillion yen) was 79.1%. Further, the ratio of the sum of issued (Japanese) banknotes (122 trillion yen), current deposits in BOJ accounts (549 trillion yen), and deposits of the Japanese government (16 trillion), totaling 687 trillion yen, to the total BOJ debt (730 trillion yen) was 94.1%.

Definition of money

In our country, money includes cash in yen (issued BOJ notes and coins), BOJ current accounts and Japanese government deposits (in yen). All other assets are not considered money (in yen). Thus, total money (yen) is equal to issued currency (yen) plus the BOJ current accounts plus Japanese government deposits. Therefore, in our model country, money (yen) is accounted for as a liability of the BOJ, and the BOJ’s liabilities at present consist solely of money (yen).

Analysis

Issuing and retrieving yen cash: When Japanese financial institutions and the Japanese government withdraw deposits from their BOJ accounts, yen cash is issued by increasing the yen currency in circulation. The deposits in the BOJ’s current accounts or Japanese government deposits will then decrease by the same amount. Conversely, when yen cash is deposited by either Japanese financial institutions or the Japanese government at the BOJ, the issued and outstanding currency (yen) decreases and their deposits with the BOJ’s current accounts increase by the same amount. Therefore, the BOJ’s assets do not change. When yen cash is issued or retrieved, the type of money (yen) might change, but no other changes occur in terms of the BOJ’s accounting.

Bank deposits: The BOJ’s accounting remains the same even when an individual or a corporation (e.g., “Entity A”) other than the BOJ deposits yen cash in a bank. Similarly, the BOJ’s accounting remains the same when entity A has a deposit account with a bank and the bank pays interest on that deposit, which increases the deposit balance. There is no change in the BOJ’s accounting even when entity A withdraws yen from a bank and the holders of the yen cash change from the bank to entity A.

Fiscal expenditures of the Japanese government: When the Japanese government withdraws cash from government savings, the BOJ accounts do not change, although the type of money (yen) changes by the same amount as the withdrawal. The BOJ’s accounts do not change even when the Japanese government pays yen cash to entity A as part of its fiscal expenditure.

If entity A later deposits the yen cash received from the Japanese government at a bank, no change occurs in the BOJ’s accounts. Moreover, if the bank deposits the yen cash received from entity A at a later date with the BOJ, the type of money (yen) might change, but the BOJ’s accounts do not.

Furthermore, if entity A is a domestic Japanese financial institution that deposits yen cash received from the Japanese government with the BOJ, the type of money (yen) changes, but the BOJ’s accounts do not.

Similarly, when the Japanese government makes a fiscal expenditure other than that to the BOJ, the type of money (yen) might change according to the amount of the expenditure, but there is no other change in the BOJ’s accounts.

Expenditures, tax payments, loans and their repayments in yen

Regarding changes in the BOJ’s accounts, the following hold: There is no change in the BOJ’s accounts, even when entity A purchases company B’s products and the holder of the yen cash shifts from entity A to company B.

• Moreover, there is no change in the BOJ’s accounts even if a firm pays employee salaries in yen from its cash holdings.

• Even if entity A pays yen cash to entity C to purchase shares held by an individual or an entity other than the BOJ, the BOJ accounts do not change.

• There is no change in the BOJ’s accounts even when entity A holds shares of company B and company B pays a dividend in yen cash to entity A.

• There is no change in the BOJ’s accounts even when local government L in Japan pays the yen cash it possesses as part of its fiscal expenditure to entity A.

• There is no change in the BOJ’s accounts even when entity A pays the central and local governments in Japan their taxes in yen cash.

• There is no change in the BOJ’s accounts even when entity A loans money (yen) to entity C and ownership of the yen cash changes hands from entity A to entity C.

• There is no change in the BOJ’s accounts even when entity C repays entity A (either principal or interest) in yen cash borrowed (in yen) from entity A.

Before or after these events, even if an individual or an entity other than the BOJ withdraws yen cash from a bank or deposits yen cash in a bank, the BOJ’s accounts do not change. In addition, even if a domestic financial institution in Japan withdraws yen cash from the BOJ’s current account or deposits yen cash into the BOJ, while the type of money (yen) might change, no other changes occur in the BOJ’s accounts. The same is also true if the Japanese government deposits yen cash into the BOJ.

Similarly, even if individuals or entities other than the BOJ make payments to entities other than the BOJ, make tax payments to the central government or local governments in Japan, or make or repay loans among themselves in yen, the type of money (yen) might change, but there are no other changes in the BOJ’s accounts.

Point in time

We assume a point in time when the BOJ’s assets consist only of X yen of interest-free Japanese government bonds and that debt is also X yen. Thus, the BOJ’s assets and debt are equal. I call this “point-in-time O.” We also assume that the world is at point-in-time O now and that the Japanese government makes no payments to the BOJ but makes fiscal expenditures to entities other than the BOJ. Individuals and these other entities act freely, make expenditures, pay taxes, borrow, lend and repay loans in yen. In addition, they deposit and withdraw yen cash into and out of banks. Banks accept yen deposits from individuals and entities and pay interest on interest payment dates, which adds to the value of these accounts.

Domestic Japanese financial institutions and the Japanese government deposit yen cash into and withdraw yen cash from the BOJ. The BOJ makes no profit, has no expenses, incurs no tax obligations, and cannot unilaterally execute policies.

While the type of money (yen) may change, there are no other changes to the BOJ’s accounts. Thus, as long as the world remains at point-in-time O, even if the Japanese government makes fiscal expenditures other than those to the BOJ, individuals and entities other than the BOJ can act freely, and if the BOJ issues and retrieves cash in yen, the world remains at point-in-time O, although time continues to move.

Japanese government and BOJ at point-in-time O

We assume that the world now is at point-in-time O. The Japanese government makes fiscal expenditures to entities other than the BOJ; individuals and entities other than the BOJ freely act; and the BOJ issues and retrieves yen cash. Therefore, although time moves, the position of the world remains the same, and the BOJ’s debt is only equal to X yen.

If yen is the issued currency, then that amount of yen cash is circulating in the world. Further, the BOJ is not obligated to make payments, although it holds debt on its books.

If money (yen) is in the BOJ’s current account deposits or the Japanese government’s deposits, it means that the BOJ has received money (yen) deposits in these amounts from domestic Japanese financial institutions or the Japanese government. If either domestic Japanese financial institutions or the Japanese government attempts to withdraw yen cash from the BOJ, it issues yen cash—the BOJ’s assets are not used for payments.

The BOJ’s assets that correspond to a debt of X yen can be any type of asset. The BOJ’s assets and debt are of equal amount. Therefore, as long as the world remains at point-in-time O, there are no issues with the BOJ’s accounts. In substance, the Japanese government has no obligation to redeem interest-free Japanese government bonds held by the BOJ. Therefore, the Japanese government will not redeem X yen of interest-free Japanese government bonds held by the BOJ, even when the bonds are due. The BOJ holds X yen of interest-free Japanese government bonds, corresponding to X yen of money, and continues to account for them on its books as X yen worth of assets. Having no expenses and no obligation to pay taxes, the BOJ does not require any revenue.

Thus, as long as the world is at point-in-time O, it is not that the Japanese government cannot make payments to the BOJ, but there are no expenditure items in the government’s budget for which payments must be made to the BOJ.

Capital creation by the Japanese government at point-in-time O

We assume that, at point-in-time O, the Japanese government issues interest-free government bonds consisting of Y yen, which the BOJ purchases for Y yen. Afterward, the Japanese government deposits, which are debt for the BOJ, increase by Y yen. Moreover, the BOJ acquires assets of Y yen of interest-free Japanese government bonds. The BOJ’s assets are now (X+Y) yen of interest-free government bonds and its debt also equals (X+Y) yen. We call this point-in-time P. As with point-in-time O, the BOJ’s assets at point-in-time P are interest-free Japanese government bonds; its debt includes only money (in yen); and the two amounts are equal.

The Japanese government makes fiscal expenditures to entities other than the BOJ and, similarly, individuals and entities other than the BOJ are free to act. In addition, the BOJ issues and retrieves yen cash. Thus, although time passes, the world remains at point-in-time P. Just as when the world was at pointin- time O, there are no problems with the BOJ’s accounts. The Japanese government essentially has no obligation to redeem the interest-free government bonds held by the BOJ. Thus, there are no expense items in the Japanese government’s budget for which expense payments must be made to the BOJ.

If the Japanese government issues interest-free government bonds worth Y yen at point-in-time O, which the BOJ purchases for Y yen, and the world moves to point-in-time P, the Japanese government deposits increase by Y yen. As long as the Japanese government makes fiscal expenditure to entities other than the BOJ or follows its expenditure budget, it can use that money (yen) freely. As a result, debt, an obligation to redeem the interest-free government bonds worth Y yen held by the BOJ, increases for the Japanese government. However, the Japanese government, in essence, has no obligation to redeem the interest-free government bonds held by it. In addition, there are no changes whatsoever, either before or after this, for individuals and entities other than the BOJ.

Thus, at point-in-time O, the Japanese government can create money (yen) that can be freely used as long as it is applied to budget expenditure. In doing so, the world moves from point-intime O to P, which is the current period.

Japanese government can create money (Yen) and execute its budget

The BOJ’s assets are simply interest-free Japanese government loans and debt that includes only money (yen). At point-in-time O, their assets and debt are equal. The world stays at point-intime O even if the Japanese government makes fiscal expenditures to parties other than the BOJ. Individuals and entities other than the BOJ act freely, or the BOJ issues and retrieves cash in yen as time passes. Further, if the world is at point-in-time O, it does not mean that the Japanese government cannot make expenditures to the BOJ, but it simply means that the Japanese government does not have an expenditure budget to make payments to the BOJ.

At point-in-time O, the Japanese government can essentially create money (yen) that can be freely used as long as it executes the budget for expenditure. By doing so, the world moves from point-in-time O to P, which is maintained. Just as with point-intime O, at point-in-time P, the BOJ maintains assets of interestfree Japanese government bonds and debt comprising only money (yen), where the assets and debt are equal.

Assets of the BOJ at the current point in time comprise only Japanese government bonds, all of which are basically interestfree. In addition, its debt comprises only money (yen), and its assets and debt are equal. As long as we are at the current point in time or later, the Japanese government can essentially create money (yen) and follow an expenditure budget.

Fiscal health of the Japanese government

The Japanese government is fiscally healthy in the following two ways. First, after the current point in time, the Japanese government can essentially create money (yen), allowing it to make expenditures according to its budget. Thus, the Japanese government would always have sufficient funds. Second, even if the Japanese government now has debt, it causes no problems regardless of the amount.

The Japanese government’s total debt is equal to its obligations to redeem Japanese government bonds and make interest payments. The BOJ holds Japanese government bonds, and the bonds held by the BOJ at the current point in time are essentially interest-free. Now, in the future, and eternally, the assets of the BOJ are all interest-free Japanese government bonds, while its debt is money (yen). The amount of its assets equals the amount of its debt. No problems exist regarding the BOJ’s accounts and the Japanese government has no actual obligation to redeem interest-free Japanese government bonds held by the BOJ.

At present, the Japanese government must redeem Japanese government bonds and make interest payments on bonds held by entities other than the BOJ. The Japanese diet accounts for this in the budget as the Japanese government’s expenditure. Individuals and entities other than the BOJ holding Japanese government bonds may receive payment from the Japanese government in yen in exchange for the right to ask the Japanese government to redeem government bonds and make interest payments on them. Therefore, the Japanese government’s expenditure does not increase the assets of individuals or entities that receive these payments. Moreover, the amount of debt does not change at all.

The Japanese government can essentially create money and redeem and make payments for Japanese government bonds now held by entities other than the BOJ. In doing so, no increase or decrease in net assets takes place for individuals or entities.

Therefore, based on these two points, the fiscal status of the Japanese government is healthy.

We assume that cash, central bank current account deposits and central government deposits comprise only money. In Japan, assuming the present time to be the starting point, the financial soundness of the central government can be logically demonstrated according to the two points discussed in the previous section.

Unless the Japanese government and the BOJ are modified, as outlined in this study, the analyses provided herein will not materialize. In addition, unless the assets and debt of the Japanese government and the BOJ at the current starting time are not as outlined in this study, the analysis presented in this study would not stand. Therefore, given the aforementioned two points as the conditions for a healthy central government’s fiscal condition, the following required and initial conditions are set.

Required conditions

To execute its expenditure budget, the central government can issue interest-free government bonds and have them purchased by the central bank.

• The central bank can issue and retrieve currency.

• The central bank makes no profit.

• The central bank does not independently execute policy.

• The central government pays for the central bank’s expenses.

• The central bank has no tax obligations.

• The central government’s deposits and the central bank’s current account deposits do not accrue interest.

Initial conditions

• The outstanding balance of government bonds is equal to the total debt in the central government’s accounts.

• Government bonds are the central bank’s only assets, and money is its only debt.

• The assets and debt of a central bank are equal.

Based on the idea that a government can impose a long-term deficit ceiling to avoid fiscal crisis, there is a study that investigated the impact of income fluctuations on the deficit ceiling by using a political economy model [3]. However, a country that satisfies the above two conditions will not fall into a fiscal crisis.

There is a discussion about what fiscal sustainability is [4]. However, in a country that meets the above two conditions, this is not a question.

The office of Econometric Analysis for Fiscal and Economic Policy, Policy Research Institute, Ministry of Finance Japan examined Japan’s long-term fiscal conditions and fiscal sustainability using macro-econometric models [5]. However, in the model country of this paper, fiscal analysis of the central government is not necessary.

There is an argument that Japanese fiscal consolidation should include many revenue increase measures, including a consumption tax increase [6]. In addition, there is a study that quantitatively examined the welfare effects of fiscal consolidation on the Japanese economy [7]. However, in the model country in this paper, fiscal consolidation is not an option.

There is a study that analyzed prices of the Japanese Government Bond futures options in order to obtain information on private-sector perceptions on the future course of the Japanese Government Bond market [8]. However, the model country in this paper has no government bond market.

There is a study that reviewed and analyzed the effects of monetary policy adopted to fight deflation since the late 1990s in Japan [9]. However, this study is not useful for the model country in this paper, which do not have monetary policy options.

By the way, a fiscal theory called Modern Monetary Theory (MMT) has been proposed in recent years. In the MMT approach, the state (or any other authority able to impose an obligation) imposes a liability in the form of a generalized, social, legal unit of account-a money-used for measuring the obligation. And MMT concludes that the main problem with excessive spending by the state is inflation, not risk of default and insolvency [10]. This conclusion alone is similar to the argument in this paper, but this paper has nothing to do with MMT.

Central government finances and inflation

The central government’s expenditure can increase the disposable income of its citizens. The central government implements the budget passed by the national legislature. Therefore, if the central government implements the spending budget, the national legislature will increase people’s disposable incomes through legislation. When people’s disposable income increases, their demand also increases. When people’s demand increases, companies increase supply or raise the prices of their products. Therefore, when people’s disposable incomes increase, corporate profits also increase. When corporate profits increase, companies increase their wage levels. Through legislation, the national legislature can increase civil servants’ salaries and pension payments to the elderly. This further increases people’s disposable income. Thus, if the central government truly implements its spending budget, the national legislature can increase people’s disposable income. When people’s disposable income goes up, corporate profits will also go up. When corporate profits go up, people’s disposable income increases further, and this cycle repeats.

Therefore, in a country with a fiscally sound central government, if the national legislature increases people’s disposable income at a certain point in time, an inflationary spiral will develop and become normalized as people’s disposable income will continue to increase. Thus, by accepting inflation, we will prolong increases in our disposable income forever. This means that we need to continue responding appropriately to inflation. By no means does it imply that inflation is bad or that increasing disposable income is unrealistic.

We now discuss how inflation should be handled. In doing so, we will see that in a country in which the central government is fiscally sound, people’s disposable incomes should continue to increase indefinitely.

Issuance of inflation-indexed zero-interest government obligation

Here, taking Japan as an example, we assume the following:

• Besides its goal of implementing the budget passed by the national legislature, the central government can issue shortterm inflation-indexed zero-interest government bonds to domestic financial institutions.

• Financial institutions that hold inflation-indexed zero-interest government bonds can sell them to the central government prior to the maturity date or to the central bank on the maturity date.

Domestic banks gather funds by borrowing money (yen) from individuals and corporations. During inflation, letting this money (yen) simply sit there causes the real value of deposits to decline. Thus, domestic banks purchase inflation-indexed Japanese government bonds.

As an example, we assume that the Japanese government issues 100-million-yen worth of inflation-indexed government bonds with a maturity of one year and Bank D purchases at 100 million yen. In the BOJ’s books, it reduces Bank D’s current deposits by 100 million yen and increases the Japanese government’s deposits by 100 million yen. The Japanese government’s deposits at the BOJ go up by 100 million yen as it incurs 100 million yen in debt. As for the BOJ, there is no change in its debt, as money (yen) is the same as money (yen), and there is no change in the BOJ’s assets. Therefore, there is no real change.

We assume that Bank D holds its purchase of inflation-indexed Japanese government bonds for one year. It is further assumed that prices are 2% higher a year later. Then, Bank D sells the inflation-indexed Japanese government bonds that it had held for one year to the BOJ. The BOJ buys these government bonds at their principal amount. At this time, inflation-indexed Japanese government bonds with a principal value of 100 million yen would have become zero-interest Japanese government bonds with a principal value of 102 million yen. The Japanese government’s corresponding liabilities will increase from 100 million yen to 102 million yen.

The BOJ will increase Bank D’s current deposit in its books by 102 million yen in return for 102 million yen worth of zerointerest Japanese government bonds from Bank D. For Bank D, the 100 million yen it used from its current deposits at the BOJ to purchase inflation-indexed Japanese government bonds came back one year later as 102 million yen. Thus, if Bank D had been holding money (yen) that money (yen) would have increased in line with price increases, thereby preserving its real value.

The BOJ’s assets increased by 102 million yen of zero-interest Japanese government bonds and its liabilities increased by 102 million yen of money. At the previous point in time, the BOJ’s assets were only zero-interest Japanese government bonds, and its liabilities were only money (yen). If these amounts were the same, they would remain unchanged.

The ownership of a principal amount of 102 million yen in zerointerest Japanese government bonds changed from Bank D to the BOJ. The BOJ’s assets were only zero-interest Japanese government bonds and its liabilities were only money (yen), and if these were both the same amounts, the Japanese government would have no actual obligation to redeem the zero-interest Japanese government bonds held by the BOJ.

Now, what if Bank D does not hold the 100 million yen principal amount of inflation-indexed Japanese government bonds until maturity but instead wants its 100 million yen returned? In this case, Bank D will sell the bonds to the Japanese government. Then, the BOJ will reduce the Japanese government’s deposit balance by 100 million yen and increase Bank D’s current deposit balance by 100 million yen.

From the perspective of the Japanese government, its 100 million yen deposit and an equivalent amount of liabilities increase from the issuance of a 100 million yen principal amount of inflation-indexed government bonds disappears. For the BOJ, there is no change in its liabilities as money (yen) equals money (yen), and there is no change in its assets. Thus, there is no real change. By getting back 100 million yen for the 100 million yen principal amount of inflation-indexed Japanese government bonds, Bank D can give loans to individuals and corporations, thereby generating real profit.

At this point in time, the BOJ’s only assets are Japanese government bonds and all of these are in effect zero-interest government bonds. Further, the BOJ’s only liabilities are money (yen) and both amounts are the same. If the Japanese government issues inflation-indexed government bonds and these are approaching maturity or returned prior to maturity, there will be no change in the BOJ’s accounts. If the Japanese government issues inflation-indexed government bonds, its liabilities will increase by that amount, but this does not create a problem for anyone.

Real value of protected bank deposits

If the Japanese government issues inflation-indexed government bonds to domestic financial institutions, the domestic banks should link deposit balances of depositors to inflation. For the banks, this is simply increasing deposit balances of depositors as interest payments.

Thus, the Japanese government can issue inflation-indexed government bonds to domestic financial institutions, and domestic banks can link deposit balances of depositors to inflation. Even with inflation, the banks can maintain the real value of their profits and the money deposited with them by individuals and institutions, and individuals and institutions can preserve the real value of their savings.

Borrowing and lending money

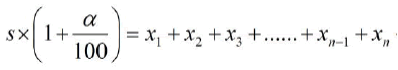

Next, we consider a case of borrowing and lending money during inflation. By purchasing inflation-indexed government bonds or depositing in a bank, the lender of the money can preserve the real value of the repayment amount that it received. Thus, for the borrower, taking the real price paid at the ith payment time and assuming price levels at the time the money was borrowed is xi, the number of payments is n, the nominal price of money borrowed at the point in time that the money was borrowed is S, and the return interest rate is α%, the amount to be paid back will be as follows:

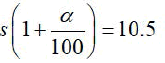

For example, if Bank D lends 10 million yen to A, repayment will be divided into 10 installments, and the return interest rate will be 5%, in this example, S=10.0 million yen, n=10,

million yen, and xi=1.05 million yen (i=1, 2, 3, … 10).

Redemption of government bonds held by the central bank

If the central government issues inflation-indexed government bonds and financial institutions buy the bonds at their principal amount, the central government’s deposit balance will increase. Here, what should it do with that money? If financial institutions holding inflation-indexed bonds want to get back the principal amount of the bonds before maturity, the central government will handle the conversion. Then, what happens with the rest of the central government’s deposits? The central government would best use the money to redeem the government bonds held by the central bank.

If the central government redeems the government bonds held by the central bank, the central bank will tender the government bonds that it owns to the central government, leading to a decline in the central government’s deposits by that amount. As for the central bank, its assets of zero-interest government bonds and its liabilities of money will both decline by the same amount. Therefore, if the central bank’s assets consist only of zero-interest government bonds, its liabilities are only money, and both amounts are the same, there will be no change even if the central government redeems the government bonds owned by the central bank. Further, except for the central government and the central bank, no party will experience any change from this.

Foreign exchange rates

The higher the interest rates in the government bond market, the more investment funds will flow into the government bond market. The more the banks use their funds to buy government bonds, the less funding there will be for them to offer loans. Less funding for banks to make loans leads to higher rates on loans and deposits. Further, the currencies of countries with high-interest rates will be bought. Therefore, the higher the interest rates in the government bond market, the more the country’s currency will be bought.

However, new issues of government bonds by central governments that are fiscally sound never circulate in the financial markets. The higher the inflation will get, the lower a currency’s value will fall. Therefore, the higher the expected rate of inflation, the more a country’s currency will be sold. However, the real value of bank deposits will be maintained as long as the central government issues inflation-indexed government bonds. Therefore, if the central governments of two countries with floating currencies are both fiscally sound and issue inflation-indexed government bonds, the currencies of the two countries are considered to be traded based on their relative purchasing power parity rates in the foreign exchange market.

Trade and foreign production by domestic companies

It is meaningless for Japanese domestic companies to increase their profits through exports. This is because even if Japanese companies deliberately do not export, the Japanese diet will pass budgets that will be implemented by the Japanese government; therefore, the Japanese government will, in effect, create money, which will enable domestic companies to increase their profits. Japanese domestic companies’ exports are tantamount to aid for the countries to which they are exported. Conversely, the more a Japanese domestic company imports, the more aid Japan will be receiving from other countries.

A surplus of exports over imports between two countries means that one country is aiding the other without receiving any value in return. Conversely, a surplus of imports over exports between two countries means that one country is receiving aid from the other without giving any value in return. If imports and exports between two trading countries are equal, it means that both countries are receiving the same amount of aid from each other. Is this not the ideal state of trade between nations? Therefore, the ideal state of trade between nations that have fiscally sound central governments is for the balance of imports and exports between the two countries to be zero.

When Japanese domestic companies export, it is meaningless for Japan as a country if Japanese companies set up production overseas to increase their profits. Thus, for Japan as a country, local production overseas by Japanese companies merely represents domestic productivity for the host foreign country. Local production in foreign countries by domestic companies is a business endeavor that only increases the foreign country’s productivity.

We assume that a new nation or state is born. The citizens of the new state create a central assembly, a central government and a central bank. In the new state, cash, central bank current account deposits, and central government deposits are designated to be money. The central assembly passes laws so that they might fulfill the required conditions for a nation whose central government’s financial status is healthy in the following two ways: (1) After the starting point, the central government can essentially create money for budgeted expenditures and (2) no one has any problem, even if the central government has debt at the starting point of time, regardless of the amount.

If we assume that the moment the new state is born and the central government and central bank are installed is the starting point in time, neither the central government nor the central bank has any assets or debt at that point. This satisfies the initial conditions of a nation with a central government having a healthy fiscal status according to the two meanings stated above. Given that the central government can, in essence, create money to use for budgeted expenditures, a new state with a fiscally healthy central government is born.

The central assembly establishes a tax system for purposes other than tax revenue. The tax revenue of the central government can be applied to the fiscal expenditure of the central government. The nation’s parliament passes a budget for expenditure that meets the goals and amount required by the state and its citizens. The central government faithfully executes the budget in accordance with the laws set forth by the central assembly. Such is the ideal fiscal state of a nation’s central government.

When the central government issues interest-free government bonds that allow it to execute its budget and the central bank purchases them, money is created. There is no change in the total amount of money, even if individuals and entities other than the central bank act freely and the central bank issues and retrieves cash. Thus, money is created by the central government. From a fiscal perspective, this is the ideal state.

However, even if the central government’s finances are sound in the above two meanings, it does not necessarily mean that the finances will be implemented with the amount, purposes and distribution that are desirable for the state and its citizens. If people want a nation with a sound budget, that nation must have a healthy central legislature. The limitation of the study is that the discussion in this paper does not guarantee this third requirement at all.

None

I would like to thank Crimson Interactive Pvt. Ltd. (Ulatus)- www.ulatus.jp for their assistance with manuscript translation and editing.

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Citation: Obata H (2023) Requirements for a Country with a Fiscally Sound Central Government. Mathe Eter. 13:195

Received: 03-Nov-2023, Manuscript No. ME-23-27830; Editor assigned: 07-Nov-2023, Pre QC No. ME-23-27830 (PQ); Reviewed: 22-Nov-2023, QC No. ME-23-27830; Revised: 30-Nov-2023, Manuscript No. ME-23-27830 (R); Published: 08-Dec-2023 , DOI: 10.35248/1314-3344.23.13.195

Copyright: © 2023 Obata H. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.