Journal of Tourism & Hospitality

Open Access

ISSN: 2167-0269

ISSN: 2167-0269

Review Article - (2022)Volume 11, Issue 4

Internet and digital media have significantly shaped consumer landscape affecting individuals and social groups due to increased connectivity and transparency; while travel perceptions and sentiments changed due to the unprecedented Coronavirus crisis. With these intervening factors in the tourism industry, the researcher crafted a destination marketing model for the Philippines in this study to better match market demands and leverages the power of Filipino-American travelers as a target market and brand ambassadors to increase visitation to the country. The study was similar to previous reviews, but it looked at new distribution channels for the Filipino-American travel market and discovered a way to increase market visibility while decreasing costs and increasing destination appeal. Using qualitative and quantitative method, the researcher surveyed 420 Filipino-American travelers mainly from California, New York, Illinois, and Texas the home states of about 2.1 million Filipino Americans. The researcher discovered that in making plans and decisions for travels, Filipino Americans rely on the four F-factors coined by American marketing guru Philip Kotler: friends, family, fans, and followers; plus two new “F” factors as added by the researcher: Facebook and Filipino community. She pointed out that Filipino Americans post their travels on Facebook and other social media and generate inspirations from Filipino community sites, celebrity posts, and events. Hence, the new FDA-Pallugna Model (2021) focuses on Filipino Americans not just destination brand consumers, but they are the best brand ambassadors for the Philippines as a global destination.

Asian-American travelers; Brand advocacy; Customer journey; Tourism F-factors; Tourism marketing

Filipino-American travelers constitute a significant market segment for the Philippines: Comprising 70 percent of the 1.65 million American arrivals in the country in 2019, pushing the U.S. as the third largest inbound market in Philippine tourism, after Korea and China. The researcher noted, however, that the Philippines’ market share from the international travel of Filipino-Americans was only 21.9 percent, and that this niche market remains an enigma. The present study then tried to understand Filipino-Americans as a travel market by documenting their demographic and geographic profiles while embracing their travel preferences as the world navigates in this digital age and the ongoing coronavirus pandemic focusing on how to increase their visitation to the Philippines. The study's findings could be relevant or valuable to the Philippine Department of Tourism (PDOT), Tourism Promotions Board (TPB), and other tourism organizations in developing marketing strategies to combat the Coronavirus pandemic. The PDOT and TPB are the Philippines’ Destination Marketing Organization (DMO) that is responsible to marketing and promoting the Philippines domestically and internationally as a major global tourism destination. It is also mandated to facilitate the development and enhancement of the country’s products and services including market development and identification and promotion of tourism investment opportunities [1-10].

The impact of the pandemic to the tourism industry: The novel Coronavirus crisis disrupted people's lives, economies, and travel and tourism industries. The crisis rages on, especially among developing countries, and fear became the industry's biggest competitor, while technology triumphed. It accelerated virtual tours, learning, working, travel, and shopping. It highlighted the use of digital platforms to make online purchases, allowing businesses to continue selling while consumers continuously buy online. Understanding the current travel landscape, especially consumer trends, could greatly benefit destination marketing organizations or DMOs. It means learning about travel customers' desires, reasons for traveling, favorite destinations, and preferred amenities, including travel preferences, attitudes, and trends. These data are critical to crafting a destination marketing model and developing efficient and effective marketing strategies.

The Philippine Department of Tourism is the leading DMO representing the Philippines in the U.S., targeting both Filipino- Americans and mainstream Americans. Before the Coronavirus pandemic, the U.S. was the Philippines' third-largest source of visitors (1.065 million), with roughly 70% being ethnic expatriate Filipinos. Many Filipino expatriates visit friends and family in the Philippines (earning them the dubbing of VFR; Visiting Friends and Relatives). During the pandemic, it became the Top 1 source market of the Philippines (outranking China) despite of the travel restrictions and closure of borders. Filipino Americans love to travel abroad for leisure while visiting their family and friends. They are the second largest Asian American group (19.7%), classified as Americans (77% or 2.6 million) and second-generation Filipino immigrants. Majority of them (2.1 million) are residents of California (47% or 1.6 million), New York, Illinois, and Texas [11-16].

Tourism as an economic growth driver: The Philippines' tourism industry remains one of the hardest hits by the pandemic, from prominent hotels, restaurants, and entertainment venues, to local businesses. Based on the statistical date of the Philippine Department of Tourism (PDOT, 2021), the Philippines received 8.26 million foreign visitors, exceeding its target of 8.2 million and having $9.8 million tourism receipt, while domestic tourism soared with 109.8 million tourists with a revenue of $25.6 million in 2019. The Philippine tourism industry generated 5.7 million jobs contributing 12.7% of the GDP [17-22]. From January to December 2020, the Philippines received 1,482,535 visitors, down to 82.05% from the previous year's 8,260,913 arrivals. While foreign arrivals fell in 2020, overseas Filipinos increased 84,080 overseas Filipinos entered the country, up 16.07% from 72,436 in 2019. Concentrating on the U.S. market, Table 1 shows U.S. visitor arrivals to the Philippines from 2016 to 2020, indicating the steady increased of American tourists to the country, except in 2020 with a tremendous decline of 80%. Factors causing the decline include travel restrictions for non- Philippine passport holders, temporary suspension of Philippine visa issuance for non-Filipino tourists or business travelers, and 10-day or 14-day quarantine requirements (at the time of writing). While Filipino-Americans make up the majority of US visitors to the Philippines, this source market can increase its arrivals if adequately marketed.

| Year | No. of visitors | Growth rate (%) | No. of Filipino-americans |

|---|---|---|---|

| 2016 | 8,69,463 | 11.58 | 6,08,625 |

| 2017 | 9,57,813 | 10.16 | 6,70,470 |

| 2018 | 10,34,471 | 8 | 7,24,130 |

| 2019 | 10,64,440 | 2.9 | 7,45,108 |

| 2020 | 2,11,816 | -80.1 | 1,48,272 |

Table 1: Visitor arrivals from the U.S. to the Philippines 2016-2020 (PDOT, 2021).

Unlike previous studies, this study utilized digital media to reach respondents (e.g., Facebook, Philippine destination website, and retargeting). She combined an online survey and email marketing using MailerLite's online tracking device to understand the market better and recommend a destination marketing model for the Philippine Department of Tourism, Tourism Promotions Board and other organizations to adopt. The researched mapped the customer journey using Kotler’s five A’s-Awareness, Appeal, Ask, Act, and Advocacy and Brand Advocacy Ratio (BAR) to identify Filipino-American decisionmaking touch points. However, the study could not track the advocacy phase due to the Philippine government imposed travel restrictions owing to the pandemic. She used a combination of several models and frameworks in the study such as Destination Think Model (2020), Kotler's Buying Behavior Framework, and Kotler’s O Zone Model and 5 A’s Model to map the Filipino-American consumer journey.

She also applied qualitative method by conducting in depth interviews with 16 Filipino community leaders, travel trade professionals, and Philippine government representatives in the U.S. The researcher then summarized, analyzed, and interpreted the study's findings using secondary data, frequency counts and percentages, weighted mean, and the Pearson product correlation coefficient. Using retargeting and market segmentation, the researcher ran the online survey through the Philippine Department of Tourism USA Facebook Page for 14 days (from August to September 2021) in California, Illinois, New York, and Texas [23-31]. She generated 793 respondents,but only 420 of the respondents with Filipino-American ethnic background became the main focus of the study (Table 2).

| Ethnic Background | Frequency | Percentage |

|---|---|---|

| Filipino | 420 | 53 |

| African American | 176 | 22.2 |

| Asian Pacific Islander | 80 | 10 |

| Non-Hispanic Caucasian | 58 | 7.3 |

| Native American | 53 | 6.7 |

| Hispanic | 6 | 0.8 |

| TOTAL | 793 | 100 |

Table 2: Respondents’ ethnic background.

Profile of Filipino American travelers: Many Filipino-American travelers profiled in the study are women (50.6 percent), ages 25-34 (45 percent), college graduates (41.7 percent), and working full time (60 percent). They have an annual household income ranging from US$50,000 to US$74,000, which is within the ambit of the median U.S. household income of $67,521. Onethird of those profiled in the study (34.7%) are residents of California, while the rest are from New York, Illinois, and Texas (Table 3).

| State | Frequency | Percentage |

|---|---|---|

| California | 146 | 34.7 |

| New York | 104 | 24.8 |

| Illinois | 61 | 14.5 |

| Texas | 43 | 10.3 |

| Others – from 32 States | 66 | 15.7 |

| TOTAL | 420 | 100 |

Table 3: Location/residence (city or state) of the respondents.

Since traveling is part of their lifestyle, they travel for international trips, once a year (50.1 percent) or 1-2 times a year (40.2 percent). The last time they visited the Philippines was 6-12 months ago, during the pandemic [32-43].

Distribution channel: Filipino American travelers “somewhat agree” that the top three primary sources of information for their future travels include: 1) Facebook and Instagram, 2) Filipino community newspapers, and 3) email communication. They prefer to book their international trips through a travel agent or tour operator (Mean Score=3.61) and online travel agents or booking sites (Mean Score=3.39).

Promotion: The data reveal that Filipino-American travelers “somewhat agree” that they were inspired to travel when they see their friends or family postings on social media, such as Facebook and Instagram (Mean Score=4.46). Meanwhile, they “somewhat disagree” that they travel because their friends travel (Mean Score=1.93) and when their travel agent offers them good tour package deals (Mean Score=1.69).

Travelers’ customer journey: Based on the customer path, classified the data into five A's: aware, appeal, ask, act, and advocate (brand loyalty retention, and purchase); Using Kotler’s 5 A’s to understanding the Filipino-American travelers' customer path to purchase and leverage on the power of their connectivity and advocacy, data reveal that Filipino-American travelers somewhat agree that: 1) they look back at their old holiday photos on social media or are stuck at home thinking about their planned or canceled holiday with a Mean Score=4.42, 2); they share the stories, photos, and travel experiences with their family and friends through social media with a Mean Score=36.7; and 3) they search online for flights, hotels, and car rentals and either book their trip online or through a preferred travel agent with a Mean Score=3:53. It means reflecting the connectivity among the customers (as travelers) and driving them from awareness to advocacy (awareness=advocacy) by leveraging on three sources of influence, called: The ‘O’ Zone own, others, and outer influence. The ‘O’ Zone is a valuable marketing tool for destination marketers to optimize their marketing efforts. It visualizes conversion rates of attractions, curiosity, commitment, and affinity levels across the five A’s (Aware, Appeal, Ask, Act, Advocate) helping the destination marketer uncover essential insights into the industry. The study revealed that Filipino-American travelers learn and become attracted to the destination through their family and friends on social media (e.g., Facebook and Instagram), travel advertisements, travel blogs, and destination videos, while recalling their past experiences. All-inclusive travel deals, cheap air tickets, and good tour package deals offered by their travel agents are not appealing to them [44-51]. However, their travel decisions are neither influenced by their travel agent nor friends. It came from their outer and others’ influences, such as social media posts of family and friends, travel advertisements, travel blogs, and destination videos. Their own influence comes from their past experiences in and travels to the Philippines or other destinations, personal judgment, and evaluation of the destination they are planning to visit. It also validates claim that today’s customers rely heavily on the recommendation of others or others’ influence (from their social circle of friends and family and online reviews) due to information overload through multiple channels exposure.

Since Filipino-American travelers have a strong awareness of the country, they are willing to recommend the Philippine brand because of its high reputation as an outdoor, nature-based, beach, and tropical destination with very satisfactory quality of services, activities, and amenities. Their affinity to the Philippine brand is also vital because of their generational roots, having friends and relatives in the Philippines, including repeat visits. Their curiosity lies in the country's new infrastructure development, attractions, and activities. It means that the Philippine brand accomplishes a perfect Brand Advocacy Ratio (BAR) score of 1 (aware=advocacy). Essentially, the BAR represents the Filipino-American traveler’s willingness to recommend the Philippines brand as a destination to their friends and relatives. The Philippines' brand appeal is so strong that everyone attracted to the Philippine brand ends up buying it (appeal=act). There is no need for Filipino-Americans to research further, reflecting a precise positioning of the Philippine brand as a destination and identifying the right level of curiosity and affinity. They are well aware and knowledgeable of the Philippine destination's product features, branding, pricing, promotions, and advertising; they turn to their social circle of friends and families for inspiration and advice on where to go and what to visit while in the Philippines [52-60].

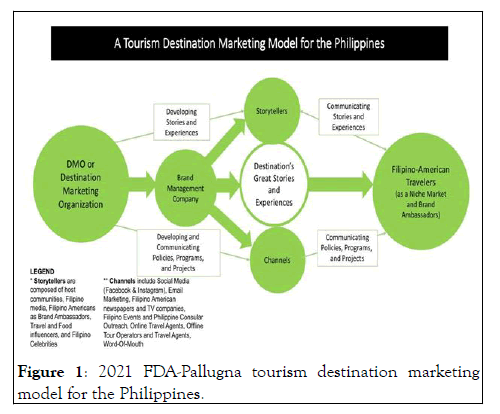

FDA-Pallugna tourism destination marketing model: Based on the findings of the study, the researcher crafted a destination marketing model (Figure 1) for the Philippines focusing on Filipino-Americans to increase visitation to the country.

Figure 1: 2021 FDA-Pallugna tourism destination marketing model for the Philippines.

In a digital era, the Philippines have to leverage the power of Filipino-American travelers as a target market and brand ambassadors to increase visitation to the country. Capitalizing on great storytelling, partnering with the right storytellers and a destination brand management company, creating, developing, and communicating great stories, and applying the proper distribution channels. The model focuses on Filipino-American travelers, a niche target market segment, and brand ambassadors for the Philippines. Using offline and online distribution channels, it capitalizes on Kotler’s F-factors-friends, family, fans, followers, plus the two F-factors that the researcher added, Facebook and Filipino community, while underscoring on the online and offline travel agencies, local host communities, and destination suppliers. Offline marketing strategies will drive awareness and interest (ask and appeal) about the destination, while online marketing strategies will drive action and advocacy about the destination.

Storytelling: Great stories move Filipino-Americans to travel to the Philippines. They have the power to ignite their emotions and inspire their sense of wanderlust about the country. According to the Destination Think (2020) model, the best method to promote a destination to tourists is using stories and experiences about the destination (i.e., culture, people, attractions). This holds true to Filipino-American travelers since that they are inspired to see holiday postings of friends and families on social media (particularly Facebook and Instagram) and watch destination videos and online travel advertisements. They are also inspired to travel when they see Philippine travel stories on Filipino community newspapers and Filipino televisions. Filipino events and Philippine Consular Outreach are good sources of stories or information about the country. Online and print media are the most effective means to share stories and experiences of the new developments, attractions, and activities in the Philippines [61-69].

Storytellers: The storytellers for Filipino-American travelers include the destination host communities, Filipino-American media personalities, food video bloggers and bloggers, travel influencers, Filipino influencer celebrities, and Filipino- American travelers as Philippine brand ambassadors. With a perfect Brand Advocacy Ratio (BAR) score of one (aware=advocacy), Filipino-American travelers could also be the DMO’s Philippine brand ambassadors. They could be storytellers as they have a strong awareness of the Philippines. They are willing to recommend the Philippine brand to their families and friends because of the country's high reputation as an outdoor (e.g., surfing, scuba diving, and snorkeling), naturebased (e.g., beach), cultural, food and cuisine, a recreational center, and a tropical destination with very satisfactory quality of services, activities, and amenities. Their affinity to the Philippine brand is also vital because of their generational roots, having friends and relatives in the Philippines, including repeat visits. Their curiosity lies in the country's new infrastructure development, attractions, and activities. The Philippines' brand appeal is so strong that everyone attracted to the Philippine brand ends up buying it (appeal=act). There is no need for Filipino-Americans to research further, reflecting a precise positioning of the Philippine brand as a destination and identifying the right level of curiosity and affinity. They are well aware and knowledgeable of the Philippine destination's product features, branding, pricing, promotions, and advertising; they turn to their social circle of friends and families for inspiration and advice on where to go and what to visit while in the Philippines [70].

Channels: Word-of-mouth marketing, social media marketing and the "pull" marketing approach are the most effective channels in communicating the destination's stories and experiences, including the F-factors: friends, families, fans, followers, Facebook, and Filipino communities.

Brand management company: A brand management company would be an integral part of the destination marketing model. The company will help the destination management organization manage and communicate their stories and experiences to Filipino-American travelers. They can create highvalue content suited for Filipino-American travelers and keep them informed on the country's new developments, including new tourist attractions, amenities, and activities or any community-based activities offering authentic experiences for them. The company can also do media destination takeover, email marketing, and search engine optimization to ensure accruing traffic, long-term business growth, maintain dominance in this Filipino-American market segment, and improve destination brand loyalty. It will also promote destination brand recognition with Filipino-American traveler engagement and visibility, increase social media traffic and social media sharing grow traffic to the Philippine tourism site across organic, referral, and social segments. It will, eventually, improve sales and revenue among the online and offline tour operators and travel agent partners of the Philippine Department of Tourism USA.

Destination Marketing Organization (DMO): The DMO will focus on social media marketing, Filipino print and broadcast media, and Filipino consumer events. For Filipino-Americans, the heart of the destination is storytelling. The ultimate goal of this model is to turn the Philippines into a preferred tourist destination among Filipino-American travelers and make them Philippine ambassadors. They can choose to share the most appropriate experiences for the Philippines and use the proper channels and storytellers. Local stories are a better content strategy than highlighting beautiful imagery and locations within a destination to create emotionally resonant stories. It plays a vital role in formulating policies for the destination and developing, managing, and promoting the destination's products and services. It includes communicating stories and experiences to Filipino-American travelers and managing the brand management company, an integral part of the destination marketing ecosystem.

Target audience/consumers: Aside from being the Philippine brand ambassadors, Filipino-American travelers are the consumers themselves. As traveling is part of their lifestyle, they travel for international trips 1-2 times a year. The last time they visited the Philippines was 6-12 months ago, during the pandemic. Hence, they can communicate their own stories and experiences to their friends and families. They can also recommend the tourism products, services, and experiences to the DMO or the brand management company to address their evolving needs and wants, especially during and post-pandemic.

The primary objective of this study was to craft a destination marketing model (Figure 1) for the Philippines focusing on Filipino-Americans to increase visitation to the country. The study found that DMOs must leverage on Filipino-American travelers as a target market segment and a Philippine brand ambassador. The most effective channels in communicating the destination's stories and experiences and enticing them to visit the country are through the six F-factors: friends, families, fans, followers, Facebook, and Filipino communities. Filipino- American travelers’ decision-making could either come from their past experiences and personal judgment (own influence) and others’ influence, validating claim that today’s customers rely heavily on the recommendation of others or others’ influence (from their social circle of friends and family and online reviews) due to information overload through multiple channels exposure. This market segment is pandemic-proof or recession-proof, contributing to the growth of tourist arrivals and tourism receipts of the country. They are the best market segment to tap for the Philippines as the Philippine brand has a strong appeal to them, hence, they end up buying it (appeal=act) with less marketing cost to the marketers.

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref][Googlescholar][Indexed]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

Citation: Pallugna A (2022) A Tourism Destination Marketing Model for the Philippines. J Tourism Hospit. 11:501

Received: 14-Mar-2022, Manuscript No. JTH-22-16257; Editor assigned: 17-Mar-2022, Pre QC No. JTH-22-16257(QC); Reviewed: 31-Mar-2022, QC No. JTH-22-16257; Revised: 07-Apr-2022, Manuscript No. JTH-22-16257(R); Published: 14-Apr-2022 , DOI: 10.35248/2167-0269.22.11.501

Copyright: © 2022 Pallugna A. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.