Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Research Article - (2024)Volume 11, Issue 3

This study investigates the interactions among US stock market, crude oil, natural gas and bitcoin assets using daily data covering the period from January 20, 2015 to December 10, 2021, through Partial Least-Squares (PLS) regression method. Due to COVID-19 pandemic, the study period is characterized by lockdowns and mobility. This situation may affect the global economy and the financial market in the USA. Thus, a conscientious analysis of the incidence of a sanitary crisis such as COVID-19 on equity market seems to be primordial. Results are very interesting and approve the presence of a significant impact of COVID-19 pandemic on the U.S. financial market. More importantly, the follow up of the interconnections between the three assets under consideration and the US stock market proved that strengthening of these interdependences have been changed due to the sanitary crisis. Moreover, like after the financial crisis of 2008, during the sanitary crisis the crude oil asset seems to be the most decisive to boost the US stock market. Taken together, our empirical findings are effective for the relevant authorities and policymakers in the United States to establish an appropriate financial and fiscal policy such as promoting investment in crude oil in order to boost the US equity market.

Crude oil assets; Bitcoin; Natural gas assets; Stock market

After causing more than 800 thousand confirmed cases and over 40 thousand deaths worldwide by March 2020, the COVID-19 diseases have been declared as a pandemic by the World Health Organization (WHO). Indeed, the deadly virus hits rapidly almost all countries and the number of confirmed cases and deaths increased quickly, especially in the US that recorded the most confirmed cases. In fact, due to this global pandemic, the United States registered a large human toll reaching 55407793 total infection cases and 845806 total deaths until December 2021; a number that goes far beyond the number of American deaths in the Vietnam war. Since then, this pandemic has seriously deteriorated not only global healthcare systems but also it has had wide-ranging and enormous impacts on financial markets, energy and world economy due to the fact that many countries in the world adopt strict quarantine policies.

Indeed, following the novel COVID-19 pandemic outbreak, the international market crude oil has recorded an important downturn [1]. More specifically, the crude oil price has experienced a substantial fall. Many factors can explain this decrease such as the lockdowns, the travel restrictions and the economic turbulence. More explicitly, referring to Global Energy Review (GER) 2020, countries in partial lockdown are registered an average of 18% decline in energy consumption against an average of 25% decline for those adopting a full lockdown. Moreover, the unprecedented uncertainty resulting from this sanitary crisis has significantly affected the financial markets. More explicitly, the circuit breakers in the financial markets has been launched four times in ten days by March 2020 in the USA while, from its inception, in 1997, the circuit breaker has been launched only one time.

In addition, Europe, Asian, Japan and other stock markets have responded to the COVID-19 outbreak with dramatic movements. In fact, the UK Financial Times Stock Exchange (FTSE) fall over 10% in March 2020 and Japan Stock market dropped about 20% in December 2019. Indeed, this package of sanitary, economic shocks and financial shocks due to coronavirus pandemic has received important attention in the recent literature and some studies have investigated the impact of a sanitary crisis on financial markets [2-7]. Others papers concentrate on following the progress of the linkage among specific type of assets before and during the COVID-19 pandemic [8,9]. Indeed, the higher probabilities of tail risks in the oil assets that have been recorded due to dwindling oil prices in the midst of the COVID-19 pandemic pushes researchers to identify another alternative investment instrument to counteract the unprecedented uncertainty related to the risks of exposure to crude oil. To achieve this goal, researchers revisit the resistance of other assets such as gold, Bitcoin and other natural resources assets as safe haven assets during the COVID-19 pandemic. In greater detail, some studies have reported the influence of COVID-19 sanitary crisis on crude oil, gold and Bitcoin assets and they have reported that those three markets are strongly affected by COVID-19 [10,11].

Our analysis is motivated by different factors such as the important role that play the energy sector notably crude oil commodity that is considered, since a long time, country economies specifically during crisis periods, the extreme volatility recoded on oil prices over the previous two years caused by the sanitary crisis and the occurrence of Bitcoin assets that is considered both a hedge for the universal uncertainty indexes and a safe haven property over the stable and calm periods, notably for the Asian stock markets. All those factors stress the importance of having a conscientious analysis of the influence of a sanitary crisis on USA stock market [12].

The scope of our paper is, thus, to contribute further in the existing literature and carry out a first but focused analysis on tracking the evolution of the influence of some special assets such as crude oil, natural gas and bitcoin assets on the USA stock market before and in presence of a sanitary crisis. This is one of the first studies investigating the impact of specific assets on the USA stock market. To do this, we performed a PLS regression analysis based on a recent and extended-time period covering several episodes of major economic collapses such as the COVID-19 sanitary crisis. Thereby, this research tries to identify specific policies and mechanisms that can help to boost the USA stock market.

The existing literature has sufficiently documented the linkage between many assets and stock return. Consistent with the scope of our study, we, therefore, focus on studies that have examined the relationship between crude oil prices, Bitcoin, natural gas and stock market.

It can be said that commodity futures have been considered as a new asset class intervening in reducing portfolio risks, especially during periods of crisis in stock markets [13,14]. Indeed, commodity markets have gone through a process of financialization and received much attention from market participants and financial practitioners.

Among the first researchers that investigated commodity futures are Gorton et al., who studied the connection between commodity and stock market during the period 1959-2004 [15]. According to them, the considered stock markets and commodities registers a negative correlation between them. Researchers from their part, proved the existence of an asymmetrical dependence among equity and commodity assets [16,17]. Studies had highlighted that both commodity assets and stock markets are characterized by weak dependence [18]. In contrast, some studies tend to oppose those findings and proved that stock markets and commodity assets are described by time-varying correlations that climb in volatile conditions [19]. In greater detail, the effect of oil prices on international stock markets, is an established phenomenon and has been examined in many studies [20-26].

Another strand of recent literature has focused on investigating the safe haven property of Bitcoin. Indeed, there is no consensus among researchers regarding the role that play Bitcoin in stock markets.

Bitcoin serves as a hedge for the global uncertainty indexes. It is also proved that Bitcoin offers some diversification and hedging benefits for international investors, using Multivariate Generalized Auto Regressive Conditional Heteroskedasticity (GARCH) model. Moreover, it was confirmed that Bitcoin can be considered as a hedge for equity movements applying Generalized Auto Regressive Conditional Heteroskedasticity-Baba, Engle, Kraft and Kroner (GARCH-BEKK) technique [27-29]. It has been confirmed that Bitcoin can be used as a hedge in most of the developing countries and only as a diversifier in developed countries. A hedge asset is an asset with a negative correlation with the rest of the portfolio, a diversifier as an asset with a positive connection and finally, a safe haven is an asset that is uncorrelated or negatively correlated with the portfolio in times of increasing market volatility or systemic risk [30-31].

However, it is proved that, although Bitcoin possesses some safe haven and hedging properties, it is not considered as a superior asset for hedging over the US dollar [32]. Furthermore, applying quantile regression, it was confirmed that Bitcoin display a weak safe haven property. It was also seen that Bitcoin acts as a weak hedge for developed markets using quantile regression. Moreover, studies had proved Bitcoin can be considered as a weak safe haven against the stock market indices using the Dynamic Conditional Correlation-Multivariate Stochastic Volatility (DCC-MSV) approach for four developed indices [33-35].

Although quite a several empirical research has dealt with the interconnection between commodity markets, Bitcoin and stock markets, a relatively-little attention has been paid to the linkage amongst the aforementioned vectors in presence of a sanitary crisis such as the COVID-19 pandemic.

Bitcoin cannot be considered as a safe haven during the COVID-19 pandemic for the USA using value at risk model [36]. In the same line, Bitcoin can be served as a safe haven during extreme Islamic stock market downturns using daily data covering the period from January 2010 to May 2020 [37]. When an asset pricing framework was applied Bitcoin showed the properties of a safe haven asset for investments in the case of the Shanghai Stock Index. Bitcoin exhibits short-term safe haven features before and during the COVID-19 pandemic for the USA market. In contrast, using daily frequency data covering the period between July 2010 and June 2015, it was evident that Bitcoin can offer great diversification benefits [38-40]. More recently, studies confirmed that Bitcoin act only as a diversifier using daily data from January 2020 to March 2020.

Moreover, a new stream of recent literature on the dynamics and interconnections among oil assets and financial markets has emerged in light of the global COVID-19 pandemic.

Scientists investigated the co-movements between commodities and equities during the COVID-19 pandemic in the USA. Applying the coherence wavelet and wavelet-based Granger causality methods, authors proved the existence of a significant impact of COVID-19 and oil price shocks on financial market volatility at the low-frequency bands. In the same vein, using a Dynamic Conditional Correlation Generalized Autoregressive Heteroskedastic Model (DCC-GARCH) [41]. Another significant effect of the oil shock on Gulf Cooperation Council (GCC) stock market returns during COVID-19 was reported [42]. Consistent with previous findings and studies which provided evidence of important oil-stock risk spillovers during the COVID-19 pandemic compared to normal times. Moreover, recently, the existence of strong co-movement between the oil assets and five stock markets (USA, Canada, China, Russia and Venezuela) during COVID-19 pandemic was proved.

More importantly, Ghorbel et al., found evidence that for energy markets (oil and gas) Bitcoin cannot be considered as a diversifier [43]. Indeed, they proved that, during the COVID-19 pandemic, the linkages between oil and Bitcoin were stronger than in the pre-pandemic period.

Despite the interesting idea, the literature is less conclusive and unambiguous on the impact of a sanitary crisis on, simultaneously, Bitcoin, Commodity assets and the USA stock market. No previous studies have tracked the evolution of the impact of bitcoin, crude oil and natural gas on the USA stock market.

We fill in this gap in the existing literature and we contribute by exploring the impact of COVID-19 disease on the trio commodity markets, Bitcoin and the USA stock market in the USA based on an extended and recent weekly data starting from January 20, 2015 to December 10, 2021 and using PLS regression model.

This section is reserved to describe the data as well as the empirical method implemented in this study.

Data description

The main goal of our research was to investigate the impact of commodity assets (crude oil and natural gas) and Bitcoin on the United Nations Stock markets. To achieve our purpose, we used a daily frequency dataset for the four vectors mentioned above covering the period January 20, 2015 to December 10, 2021. The investigated time period is both recent and extended enough to cover several episodes of major financial market collapses such as the COVID-19 pandemic at the end of 2019. Due to this structural break, our full sample period is split into two subsamples such as before and during COVID-19 crisis.

All the data for West Texas Intermediate (WTI) oil price data, natural gas price, Bitcoin and S&P 500 were obtained from the U.S. Energy Information Administration.

Our investigation starts with a graphic analysis of all our variables. As illustrated in Figure 1, above the WTI crude oil prices registered an unprecedented decrease at the end of 2015; a slight increase, thereafter, to record its highest level at the middle of 2018, a sharp decline another time in the beginning of 2019 and a short phase of stabilization at the end of 2019. Indeed, Bitcoin continue to rise to record its highest level at the end of 2017, it increases, thereafter and register a second peak, less interesting than the first, in July 2018. Natural gas, from its part, registered its first peak in January 2018, it declines, thereafter, to reach after that two other peaks in November 2018 and at the beginning of 2019. The stock market indices continue to improve before the sanitary crisis and it has recorded a single fall at the end of 2018 (Figure 1).

Figure 1: Evolution of West Texas Intermediate (WTI) before COVID-19 crisis Note: a) Oil prices; b) Bitcoin; c) Natural gas and d) S&P 500.

Furthermore, as shown in Figure 2, after the COVID-19 sanitary crisis, WTI crude oil prices revealed a sharp decline from January 2020 to record its lowest level in the middle of April 2020 and subsequently, begin to improve until reaching a level similar to its level before the COVID-19 disease. This evidence may be explained by the fact that the U.S government imposed general lockdowns and mobility restrictions beginning from March 2020 that affect directly the use of means of transport and thus, the oil consumption and prices. On the other side, following the corona virus shock, Bitcoin shows a stable level at the beginning of 2020 and roughly equal to its level before the sanitary crisis. After that, its level has been improved to reach a first peak in April 2021 followed by a fall in June 2021 and a second peak at the end of 2021.

Figure 2: Evolution of West Texas Intermediate (WTI) during COVID-19 crisis. Note: a) Oil prices; b) Bitcoin; c) Natural gas and d) S&P 500.

Evidently, natural gas recorded a phase of stabilization due to COVID-19 pandemic followed by a significant increase to reach its highest level ever in February 2021 to stabilize, after that, with a level slightly higher than that recorded before the pandemic. Furthermore, the stock market indices record a sharp decline at the beginning of the financial crisis and it continue to improve from April 2021. All the descriptive statistics of the assessed return and the U.S. stock market indices data are presented in Table 1. Contrary to the literature surveyed results Table 1, showed that all assets are characterized by a daily mean far from zero in both subsamples, before and after the Global Sanitary Crisis (GSC) [44]. Moreover, the volatility for each series is almost variable within the two subsamples of our analysis. However, the highest volatility is registered for Bitcoin, proving that it is the riskiest asset for the two subsamples, followed by the stock market indices. On the other hand, it seems that the natural gas asset is the less risky since it registered the lowest volatility in both subsamples. Furthermore, the negative skewness values for the crude oil asset and the S&P 500 during the crisis period confirm that they are on average impacted by negative shocks. More interestingly, the average return of the crude oil and natural gas markets and U.S stock market are more important during the crisis subsample, which means that after the sanitary crisis onslaught, there is a regime-shift phenomenon (Table 1 and Figure 2).

| Statistic | Crude oil | Bitcoin | Natural gas | S&P500 |

|---|---|---|---|---|

| Pre-crisis | ||||

| Mean | 52.97161 | 3975.233 | 2.771302 | 2455.557 |

| Maximum | 77.41000 | 19039.01 | 6.240000 | 3240.020 |

| Minimum | 26.19000 | 211.1600 | 1.490000 | 1829.080 |

| Standard deviation | 9.480182 | 3961.700 | 0.509732 | 356.1744 |

| Skewness | 0.013645 | 0.888502 | 1.066952 | 0.164759 |

| Kurtosis | 2.880228 | 3.039413 | 8.343143 | 1.714145 |

| Jarque-Bera | 0.811084 | 169.8122 | 1779.271 | 94.70775 |

| During crisis | ||||

| Mean | 53.13497 | 28667.00 | 2.937151 | 3715.594 |

| Maximum | 85.64000 | 67510.06 | 23.86000 | 4712.020 |

| Minimum | -36.98 | 4980.000 | 1.330000 | 2237.400 |

| Std. Dev. | 17.47101 | 19674.87 | 1.568996 | 593.2625 |

| Skewness | -0.427989 | 0.352001 | 5.445414 | -0.108816 |

| Kurtosis | 3.438447 | 1.553167 | 65.26907 | 2.014068 |

| Jarque-Bera | 19.61635 | 54.90720 | 84749.51 | 21.62033 |

Table 1: Descriptive statistics of assessed return and the U.S. stock market indices data.

Concerning the analysis of the linear correlation between the different assets, we adopt three measures of dependence (Pearson, Kendall and Spearman) between the S& P 500 stock market indices and the three assets under consideration. The correlation results for the both subsample periods are summarized (Table 2).

| Variables | Pre-crisis | During crisis | ||||

|---|---|---|---|---|---|---|

| Pearson | Kendall | Spearman | Pearson | Kendall | Spearman | |

| Crude oil | 0.7205 | 0.5391 | 0.7473 | 0.9117 | 0.7575 | 0.916 |

| Bitcoin | 0.8364 | 0.7106 | 0.8958 | 0.8785 | 0.7407 | 0.9041 |

| Natural gas | 0.1925 | 0.1059 | 0.1744 | 0.6465 | 0.7416 | 0.9148 |

Table 2: Analysis of the linear correlation between the different assets.

The results of the different measures of correlation are very close in terms of value as well as sign for all the assets in the two subsamples under consideration. A positive linear dependence is registered between the pairs (crude oil and the US S&P 500), (Bitcoin and the US S&P 500) and (natural gas and the US S&P 500) in the two samples, with a light upturn during the sanitary crisis period, especially for the natural gas asset. A major finding can be highlighted by this descriptive investigation. Indeed, if the Bitcoin seems to be the most correlated asset with the US stock market before the sanitary crisis, it leaves its place to the favor of crude oil asset during the COVID-19 pandemic. Otherwise, the US equity markets give more importance to the oil market during than before the sanitary crisis.

Finally, to track the effect of a sanitary crisis on the U.S. stock market, crude oil, natural gas and bitcoin assets, our model is expressed as follows.

If the literature has investigated the impact of the COVID-19 pandemic on the U.S. stock market, no work, to our knowledge, has analyzed the impact of this crisis on the U.S. stock market and simultaneously crude oil, natural gas and bitcoin assets using PLS regression; hence the interest of our study.

Econometric methodology

The Partial Least Squares (PLS) is a linear multivariate regression model. This method combined regression modeling based on multiple dependent variables Y and multiple independent variables X with principal component analysis. Otherwise, this technique is used to build both predicted and observable variables in a new space and it can be very effective to solve the problem occurred when the number of variables is larger than the number of samples.

The strategy of PLS regression is based on the decomposition of the matrix of explanatory variables X into a bilinear product except the residual part.

Where,  and

and  are, respectively, the first PLS component the most correlated to Y and its correspondent steering vector.

are, respectively, the first PLS component the most correlated to Y and its correspondent steering vector.

First principal component extraction

and

and  represents, respectively, independent variables and dependent variables vectors. All variables must be standardized to facilitate the description. T and U represent the partial least squares factors retrieved, respectively, from exogenous and endogenous variables.

represents, respectively, independent variables and dependent variables vectors. All variables must be standardized to facilitate the description. T and U represent the partial least squares factors retrieved, respectively, from exogenous and endogenous variables.

Extracting the linear combination of the first pair T1 and U1 from the original vectors are written as follow:

Where,  and

and  represents, respectively, the model effect and the dependent variable weight. Moreover, to ensure that T and U are very much correlated and can retrieve as much information as possible, those three relations must be verified.

represents, respectively, the model effect and the dependent variable weight. Moreover, to ensure that T and U are very much correlated and can retrieve as much information as possible, those three relations must be verified.

Giving that, X0 and Y0 represent the initial variable and they are calculated as follow:

With,  and

and  are the parameter vectors when the exogenous variable is t. and represent, respectively, the residual matrix of order (n ✕ m) and (n ✕ p).

are the parameter vectors when the exogenous variable is t. and represent, respectively, the residual matrix of order (n ✕ m) and (n ✕ p).

Parameter’s validation

Four indicators can be used to evaluate the effectiveness of parameters of the model namely: the prediction coefficient rp, the correlation coefficient rc, the Root Mean Square Error of Cross Validation (RMSECV) and Root Mean Square Error of Prediction (RMSEP). Indeed, the prediction accuracy of the regression model is qualified as excellent if the correlation coefficient is high and the RMSECV and RMSEP are weak.

To check the performance of the PLS regression for the two subsamples that is before COVID-19 sanitary crisis and during this pandemic, the examination of the Principal Component Analysis (PCA) of the spectral data seems to be most important. Indeed, Figure 3, shows the PCA of the spectral data revealed that data laying outside the 95% confidence ellipse that were omitted from the dataset used in our investigation are negligible for the both subsamples before and during crisis confirming, hence, the performance of the PLS. Moreover, this finding is, also, proved by examining the result of R squared statistic. In fact, R2 values are equal to 0.754 for the pre-crisis period and 0.89 during COVID-19 pandemic period. Values that are very close to 1 corroborating the efficiency of the two first PLS components (Figure 3).

Figure 3: Detection of outliers after principal component analysis for the two subsamples. Note: (a): Before sanitary crisis; (b): During-crisis.

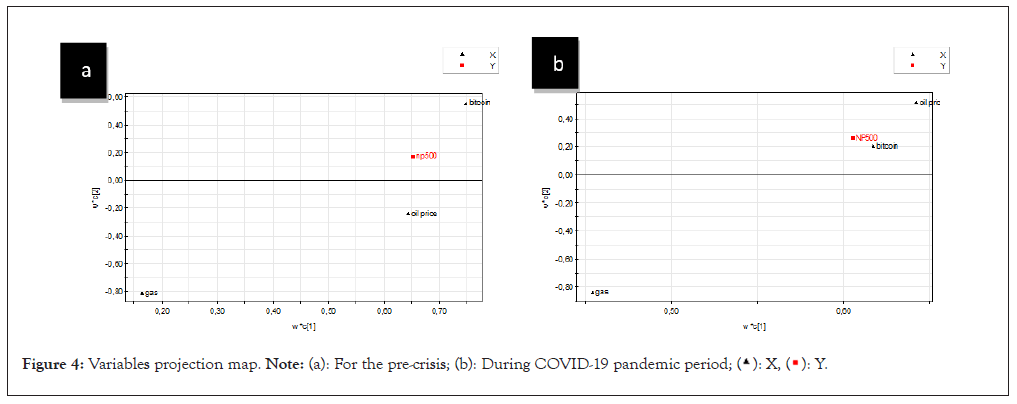

A deeper analysis confirms that bitcoin and crude oil assets are more correlated with US stock market than natural gas assets for the two subsamples: pre-crisis and during COVID-19 pandemic periods. Otherwise, the S&P 500 is influenced by bitcoin and crude oil assets more than natural gas assets. Thereby, to boost the U.S. equity market, policy makers can intervene by encouraging investment in crude oil and bitcoin assets. Further, it is obvious that the strengthen of the interconnection between the couple’s crude oil assets S&P 500 and Bitcoin assets S&P 500 has changed in the two subsamples confirming, thus, that COVID-19 turbulence has affected the U.S. stock market. In other words, the sanitary crisis can be considered as a change point in the U.S. equity markets and certain awareness in the investment in oil and bitcoin assets should be given during the crisis period (Figure 4).

Figure 4: Variables projection map. Note: (a): For the pre-crisis; (b): During COVID-19 pandemic period;  .

.

In our analysis, the model estimation reported in the Table 3, corroborates the results aforementioned in the unconditional dependence and variables projection investigation. During the pre-crisis period, with 95% confidence interval, the US stock market is influenced positively by bitcoin and crude oil assets. The influence of natural gas asset is not significant and even negative. Going into greater detail, all things being equal, and a 1% increase in bitcoin investment increases S&P 500 level by 0.58%. Moreover, following a 1% increase in the crude oil price, the US equity market raise by 0.38%. More importantly, during the sanitary-crisis period, with a 95% confidence interval, a positive and significant link is detected between S&P 500, crude oil price and bitcoin asset. Even if crude oil and bitcoin assets remain the most significant among the three assets under consideration in our analysis, undoubtedly, the impact of natural gas assets on the US stock market has been improved and become positive. Moreover, during COVID-19 pandemic, the impact of Bitcoin asset on S&P 500 recedes in favor of crude oil asset, as demonstrated by the unconditional dependence analysis. More clearly, a 1% upturns in the crude oil price and bitcoin asset boost the U.S. equity market, respectively, by 0.523% and 0.427% (Table 3).

To conclude with this model, the plot depicted retraces the superposition of the two curves of real and estimated observations. The graphic inspection proved the existence of certain harmonization between the two curves of observed and adjusted series for the two subsamples and especially during the sanitary crisis period. This concordance indicates the how well it fits , which validate the adequacy of the model for policy direction and guidance (Figure 5).

Figure 5: S&P 500 and its adjustment by the model for the two subsamples. Note: (a): Pre-crisis period; (b): During crisis-period.

Using daily time-series data from January 20, 2015 to December 10, 2021, the present research aims to highlight the influence of COVID-19 sanitary crisis on US equity market within the PLS regression model. More clearly, we track the impact of three assets on S&P 500 before and during COVID-19 pandemic. Moreover, this study looked at the unconditional dependence amid crude oil, natural gas and bitcoin assets and U.S. stock market.

Despite that, the link between oil price, S&P 500 or Bitcoin and S&P 500 is well documented in the literature; rare are the researches that examine the interaction of, simultaneously, crude oil, natural gas, bitcoin and S&P 500 in presence of a sanitary crisis. Importantly, considering the previous studies, our paper contributes to the existing literature and seeks to fill this gap by using both recent and extended enough dataset to cover several episodes of major financial and economic markets collapses such as the COVID-19 pandemic at the end of 2019.

Broadly, several outcomes in our research merit highlighting. Indeed, the unconditional dependence results suggest that the correlation between the three assets and the U.S stock market records a slight improvement during the COVID-19 sanitary crisis. More importantly, PLS regression output proves that the COVID-19 pandemic plays an important role in determining the main factors that may influence the US equity market. Moreover, PLS outcomes show that both crude oil and bitcoin assets affect the US stock market before and during the sanitary crisis. In addition, the crude oil asset seems to be the most important in determining the level of the US equity market during the COVID-19 sanitary crisis, a common point with the Lehman filed for bankruptcy. In fact, we noticed some awareness in the global stock markets regarding the importance of investment in crude oil commodity after the financial crisis of 2008. Undoubtedly, the sanitary crisis is considered as a change point in the US stock market.

Our empirical findings are both original and encouraging from a policy viewpoint. Indeed, According to these results, several implications in financial terms for the USA must be underlined. The United States authorities and policymakers must develop an effective financial and fiscal strategy focused narrowly on subsidizing, interest rates reduction and promoting crude oil investment, to boost and to recover the US equity market.

Although the findings are showing positive outcomes, our study also faces certain limitations. For instance, our framework only uses two commodities and Bitcoin assets as input. Future studies can incorporate others data such as gold asset. Moreover, we can enhance our work by consider others equity markets.

We wish to confirm that there are no known conflicts of interest associated with this publication and there has been no significant financial support for this work that could have influenced its outcome.

We confirm that we have given due consideration to the protection of intellectual property associated with this work and that there are no impediments to publication, including the timing of publication, with respect to intellectual property. In so doing we confirm that we have followed the regulations of our institutions concerning intellectual property.

Citation: Gam I, Mbarek MHBH (2024). Bitcoin versus Commodity Assets: Impact on the US Equity Market Before and After COVID-19 Crisis- Evidence from PLS Regression. J Stock Forex. 11.264.

Received: 05-Aug-2024, Manuscript No. JSFT-24-33360; Editor assigned: 07-Aug-2024, Pre QC No. JSFT-24-33360 (PQ); Reviewed: 21-Aug-2024, QC No. JSFT-24-33360; Revised: 28-Aug-2024, Manuscript No. JSFT-24-33360 (R); Published: 06-Sep-2024 , DOI: 10.35248/2168-9458.24.11.264

Copyright: © 2024 Gam I, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.