Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Research Article - (2024)Volume 11, Issue 3

The academic community is increasingly concerned about the relationship between market efficiency and the stock market bubble. Although they are interrelated, these two concepts are opposite. To gain a better understanding of this issue, a Residual Income Model (RIM) as used to estimate the intrinsic value and stock bubble rate of A-shares from 2001 to 2019. The analysis revealed that the historical bubble rate of A-shares is characterized by high volatility and often reaches a higher bubble range. The long-term bubble in China's stock market can be attributed to over-optimism among the public and improper regulatory intervention by the government, which acts as both a referee and a player. This type of self-interested regulation can negatively impact the effective functioning of the stock market clearing mechanism.

Efficient market hypothesis; Bubble measurement; Residual income valuation model

It is an important and interesting topic to study whether there is a bubble in the stock market and how to measure it. The relationship between the stock market bubble and the efficient market is not only related but also opposite, it is two sides of one problem. If there is a bubble in the stock market, especially a serious bubble, it means that the stock market is not efficient. And if markets are efficient, they should not accumulate large bubbles. The discussion of efficient markets originated from the Efficient Market Hypothesis (EMH) [1]. And its roots go back even further. Pascal and Fermat created probability theory to support the computational needs of some aristocrats on gambling. In 1900, Bachelier first extended the theory of probability to the calculation of the price of French government bonds. Von Neumann and Morgenstern (1947) developed the expected utility theory, which used rigorous mathematics to calculate utility problems and first developed an axiomatic system for measuring utility functions, which provided the theoretical basis for the efficient market hypothesis. Inspired by this, proposed the EMH is proposed the in 1965, which assumes that investors make rational decisions based on expected effects, quickly make unbiased estimates of available information and that asset prices reflect all publicly available information. Fama, in his classic dedication to ‘Efficient Capital Markets (ECM): A Review of Theory and Empirical Work’, reviewed the theoretical and empirical studies of the EMH and proposed three forms of markets such as weak, semi-strong and strong efficient markets [2].

With the successive development of the financial market and financial theory, especially the rise of financial psychology, behavioral finance, fractal theory and other financial sub-disciplines at the end of the 20th century, the classical financial theory based on the efficient market theory hypothesis has formed a great challenge. Malkiel, in ‘The Efficient Market Hypothesis and its Critics’, focuses on the criticism and controversy of the EHM and explores some of the influential factors that may contradict the hypothesis, such as psychological biases and behavioral finance [3]. Lo et al., listed the limitations of the EHM in their book ‘A Random Walk Down Wall Street’ by studying non-random behavior and price patterns in the stock market [4]. Fama et al., also developed a three-factor model, which extends 23th weak-form efficient market hypothesis, arguing that investors can make super profits by selecting stocks with undervalued values and high market returns [5]. In his book ‘Irrational Exuberance’, Shiller systematically studied investor sentiment and stock market bubbles in the stock market and proposed the possibility of irrational exuberance in the market [6]. According to Shiller, efficient market theory is a theory about asset pricing. Markets are highly competitive and rational and investors make informed investment decisions based on available information. In the short term, market prices may be affected by inefficiencies, but in the long term, the market automatically adjusts so that asset prices reflect their true value.

The above literature provides a comprehensive review and discussion of the theoretical and empirical research on the efficiency of the stock market, reveals the advantages, controversies and limitations of the EHM and provides an important reference for us to understand the operation of the stock market and investment decisions. Modern finance believes that there is an equilibrium price in the financial market after the full competition and the equilibrium price reflects all the information in the market, so it is also the embodiment of the intrinsic value of the stock. However, the equilibrium is short-lived and the market price always behaves too high and too low fluctuations and is far from the equilibrium. Imbalance is endless. From an unbalanced state to an equilibrium state, it is mean reversion. The evolution from the state of high valuation to equilibrium is the process of bubble bursting. The evolution from the state of low valuation to equilibrium is the gathering process of bubbles. In the development period of undervaluation → equilibrium → overvaluation, the stock market bubble experienced a process from negative to zero, then to positive and then to burst. Olivier et al., showed that in different periods of the growth of stock market bubbles, the growth rate of stock market bubbles also showed phased rules [7]. When the sustainable period of the bubble is longer, that is, the probability of the bubble bursting is less and the growth of the bubble will change with a decreasing exponential growth rate. On the contrary, as the sustainable period of the bubble decreases, the probability of the bubble bursting increases, then the bubble will change at an increasing exponential growth rate until it bursts. In the book ‘The (Mis) Behavior of Markets: A Fractal View of Risk, Ruin and Reward’ argues that contrary to the assumption of price independence, there is a memory of prices in many financial markets. Today's prices do affect tomorrow and if prices jump up and down dramatically now, there is a high probability that they will continue to do so tomorrow, with investors taking advantage of the inertial effects of stocks over a given period and the price memory they exhibit (as opposed to the random walk principle of prices in classical financial theory) [8]. The emergence of classical financial theory comes from stochastic mathematics and statistics. Its fundamental idea is that prices are unpredictable, but price fluctuations can be described by the mathematical principle of randomness, so the risk is measurable and controllable. However, many practical examples later prove that it is not easy to do so. For example, in the black swan event of the Russian national debt default, long-term capital management of the United States, which was participated by several Nobel prize winners in economics, went bankrupt because of the calculation of financial risk control model based on statistics.

Traditional rationalists assume that humans possess omnipotent cognitive abilities and can make investment decisions based on rational principles, adjust trading quantities and maximize expected utility like super humans. However, many economists have challenged this assumption by arguing that human rationality is bounded and cognitive abilities are finite. Simon proposed the concept of bounded rationality, suggesting that human decision-making is subject to certain limitations [9]. Simon highlighted that due to time constraints and limited computational capabilities, decision-makers often rely on quick or frugal methods and draw from past experiences rather than constantly optimizing for utility maximization as assumed by traditional rationalists [9].

The assumption of limited rationality is more in line with reality for the reasons such as psychological experiments show that human learning, memory and problem-solving abilities are limited by psychological abilities and people cannot consider all aspects of a problem at the same time, but simplify the problem and only considers the aspects related to the current problem. Kahneman et al., demonstrated the existence of this phenomenon, called the frame-dependent effect, as a cognitive illusion or simply an intuitive judgment [10]. In repeated decision-making situations, people often mentally and emotionally agree with a certain decision-making method or conclusion and are unwilling to give up the existing and accustomed method or state, which leads to the preference for maintaining the status quo. By studying the behavior of China's public fund managers, it can also be found that professional fund managers still have an irrational herding effect. They pursue the position and investment structure consistent with most of their peers and imitate the operation of head fund managers to pursue the negative goal of not underperforming the market because it can avoid their regret psychology [11].

The stock market is not fully efficient, meaning that the market price can be overvalued or undervalued for a long time, rather than always at the level of the equilibrium price (intrinsic value). From the viewpoint of system theory, the stock market may be a complex system formed by invisible forces pulled by various funds participating in the game, which is full of noise. People blindly trade according to illusory trends, thinking that they have understood the puzzle of value, but they may only be the blind people in the fable and cannot see the whole. In the words of the ancient Greek philosopher Plato, investors see only the shadow in the cave and do not know where the light is coming from. Although people can observe price changes, they cannot predict and explain them correctly. A closely related question is how to measure the intrinsic value of the stock market.

One method to measure the stock market bubble is the indirect method, which measures the size of the stock market bubble in different periods through the calculation and statistical analysis of the price/earnings ratio and other related indicators. Olivier studied price bubbles from the perspective of probability distribution and believed that the generation and distribution of price bubbles were in line with the characteristics of fat tail and thin peak [7]. Stock market bubbles can be tested indirectly through run tests and tail tests. Zhou et al., used the dynamic autoregressive method and compared it with the supernormal variability test method proposed by Shiller [12]. Other methods include the factor model, Kalman filter, etc. [13,14].

Another way to measure stock price bubbles is the direct method, which measures the intrinsic value of a stock through a financial model and then calculates the degree of deviation from the stock price. Another way to measure stock price bubbles is the direct method, which measures the intrinsic value of a stock through a financial model and then calculates the degree of deviation from the stock price. The methods to calculate the intrinsic value of stock directly include the dividend discount model, free cash flow discount model and RIM. Because the proportion of dividends paid by listed companies in China is too low, it is not suitable for the dividend discount model. However, the discounted free cash flow model is also not suitable for valuation, because the free cash flow generated by operating activities is the value obtained by the enterprise through selling products, but it will be reduced due to cash investment. If the cash investment is greater than the cash flow obtained from operations, the free cash flow will be negative and the valuation of the enterprise will also be negative. Then its valuation method is not applicable. In contrast, the RIM is widely accepted and used in the field of with Equity Valuation (EV) because of its high financial accuracy and less restrictive indicators. Some scholars also use this model to estimate the intrinsic value and bubble degree of China's stock market history [15,16].

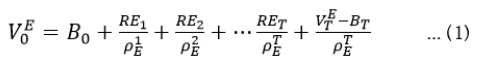

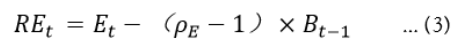

The method adopted in this paper is the RIM which is generally used in the world. The concept was first proposed by Alfred Marshall in 1890. The so-called Residual Income (RI) is the income left by the owner after deducting the interest on his capital at the prevailing interest rate. In 1995, American scholar Ohlson systematically elaborated the RIM in his article ‘Earnings, Book Value and Dividends’ in Equity EV, established the relationship between corporate equity value and accounting variables and brought the method to the attention of the theoretical circle again. The basic view of RI is that only when a company earns a net profit that exceeds the return required by shareholders can it be regarded as obtaining real RI. According to the RIM, the company value (V) is equal to the sum of the present value of the book value (B) and the expected RI, namely:

Where, V_T^E-B_T represents the residual value of the enterprise at the end of the forecast period. Equation 1, shows that the intrinsic value of the stock market is based on the book value plus the discounted present value of the future residual earnings and the latter part is also called the premium of the book value. The book value of equity is calculated as follows.

Where, B_T is the dividend per share of period T. RI is the difference between the company's net profit and the compensation required by shareholders and the formula is as follows.

Et is the company's net profit or Earnings Per Share (EPS),  is the necessary rate of return on equity or the cost of capital ratio of equity and Bt-1 is the book value of equity or net asset value per share for the previous period. According to the RIM, RI belongs to common shareholders and represents the amount of excess income corresponding to each 1$ invested by shareholders. RI is equal to the difference between the return on common equity and the required return on stockholders' equity, multiplied by the beginning book value of stockholders' equity.

is the necessary rate of return on equity or the cost of capital ratio of equity and Bt-1 is the book value of equity or net asset value per share for the previous period. According to the RIM, RI belongs to common shareholders and represents the amount of excess income corresponding to each 1$ invested by shareholders. RI is equal to the difference between the return on common equity and the required return on stockholders' equity, multiplied by the beginning book value of stockholders' equity.

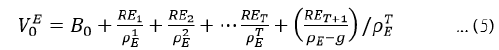

ROEt represents the return on equity of the company. Assuming that constant growth (g) is adopted in the end of the RI of the enterprise, the valuation model of equation 1 becomes:

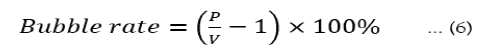

Finally, after using the RIM to calculate the intrinsic value V result of A shares, the stock market bubble rate can be calculated.

It is difficult to predict the future income which affects the accuracy of the financial valuation model, especially in the long-term forecast of the company under the premise of continuous operation. One of the criteria to judge whether the valuation technology is suitable is that the forecast period should be limited. The intrinsic value of a company consists of three parts such as the book value of current equity, the estimated value of RI in recent years and the estimated value of RI in the future. Among them, the book value of equity can be extrapolated according to the known book value, EPS, dividend per share ratio, etc., which is relatively accurate. In order to enhance the applicability of the model, this paper uses real financial data as much as possible to estimate the RI in recent years and adopts all the years with financial data in the last 5 years in the calculation. Because it is a fact that has happened, this part of the calculation value is very accurate. For the operation of partial discounting of the forward value or continuing value, in addition to the discount rate ρ, it is necessary to assume a constant g of the rate of perpetual growth (Equation 5). Because continuous value accounts for a relatively large proportion of stock valuation, the choice of g has a correspondingly large impact on the valuation results. In this paper, based on existing studies, a long-term growth rate of 3% is adopted uniformly to make the impact on different years in the valuation converge.

Using the RIM to estimate 2001-2020 A-share bubble

We use the RIM to estimate the intrinsic value of China's A-shares and analyze the bubble rate of equity markets from 2001 to 2019.

Sample, matching process and data: The indicators required by the model are shown, where the data of net asset value per share, return on net asset, EPS (and dividend per share of the A-share market are taken from the Wind database and counted according to the overall method (Table 1).

| Variables | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Book value | 2.18 | 2.27 | 2.53 | 2.78 | 2.96 | 1.99 | 3.1 | 3.19 | 3.53 | 3.69 | 4.06 | 4.41 | 4.67 | 5.04 | 5.29 | 5.55 | 5.83 | 6.1 | 6.5683 |

| Earnings per share | 0.16 | 0.19 | 0.26 | 0.4 | 0.35 | 0.24 | 0.44 | 0.34 | 0.41 | 0.49 | 0.53 | 0.51 | 0.55 | 0.55 | 0.49 | 0.49 | 0.55 | 0.51 | 0.53136 |

| Dividends per share | - | - | - | - | - | - | - | - | - | - | - | - | - | - | 0.13 | 0.13 | 0.14 | 0.14 | 0.1124 |

| Return on equity (%) | 7.90 | 8.50 | 10.90 | 15.40 | 13.00 | 14.40 | 18.40 | 11.70 | 12.50 | 15.10 | 14.40 | 12.30 | 12.60 | 11.70 | 9.80 | 9.20 | 10.30 | 8.60 | 8.50 |

| A-share weighted average price 1 | 8.91 | 7.01 | 7.13 | 5.6 | 4.6 | 6.99 | 18.02 | 6.1 | 11.1 | 9.17 | 6.91 | 6.96 | 6.7 | 9.77 | 11.67 | 9.97 | 10.35 | 7.49 | 9.45 |

| Book value 2 | 2.18 | 2.27 | 2.53 | 2.78 | 2.96 | 1.99 | 3.1 | 3.19 | 3.53 | 3.69 | 4.06 | 4.41 | 4.67 | 5.04 | 5.29 | 5.55 | 5.83 | 6.1 | 6.57 |

| Earnings per share 3 | 0.16 | 0.19 | 0.26 | 0.4 | 0.35 | 0.24 | 0.44 | 0.34 | 0.41 | 0.49 | 0.53 | 0.51 | 0.55 | 0.55 | 0.49 | 0.49 | 0.55 | 0.51 | 0.53 |

| Price-earnings ratio 4 | 55.24 | 37.37 | 26.97 | 14.16 | 13.07 | 29.06 | 41.34 | 17.78 | 27.11 | 18.54 | 13.08 | 13.69 | 12.18 | 17.81 | 23.72 | 20.39 | 18.84 | 14.59 | 17.78 |

| Present value of short-term residual income 5 | 0.33 | 0.54 | 0.56 | 0.52 | 0.57 | 0.78 | 0.69 | 0.78 | 0.81 | 0.72 | 0.59 | 0.52 | 0.4 | 0.29 | 0.22 | 0.17 | 0.18 | 0.15 | 0.12 |

| Present value of continuing value 6 | 3.03 | 4.06 | 1.4 | 2.26 | 3.11 | 3.42 | 2.69 | 2.89 | 2.57 | 1.3 | 0.97 | 1.55 | 0.69 | 0.63 | 0.69 | 0.74 | 0.74 | 1.51 | 1.65 |

| Intrinsic value 7 | 5.55 | 6.87 | 4.49 | 5.56 | 6.65 | 6.19 | 6.47 | 6.87 | 6.91 | 5.71 | 5.61 | 6.49 | 5.76 | 5.96 | 6.2 | 6.46 | 6.74 | 7.76 | 8.33 |

| A-share bubble rate (%) 8 | 60.53 | 2.05 | 58.73 | 0.77 | -30.71 | 13.01 | 178.32 | -11.15 | 60.63 | 60.48 | 23.12 | 7.24 | 16.34 | 63.76 | 88.27 | 54.25 | 53.49 | -3.51 | 13.42 |

| Future earnings (CAGR) (%) |

10.20 | 31.10 | 4.00 | 20.90 | 19.30 | -3.80 | -15.50 | 3.10 | -0.30 | 4.70 | 7.10 | 7.80 | 3.30 | -1.20 | -1.10 | 2.20 | 0.60 | 19.10 | 14.60 |

Note: CAGR: Compounded Annual Growth Rate.

Table 1: A-share financial data and valuation based on the Residual Income Model (RIM).

Firstly, we substitute the data in Table 1, into equations 2 and 5 to calculate the intrinsic value of A-share market in each year since 2001. Next, according to the total share capital and total market value of China's A-stock market provided by the wind database, the total market value divided by the total share capital is the average price level (at the end of each year). Finally, we calculate the bubble rate of A-shares in each year according to equation 6.

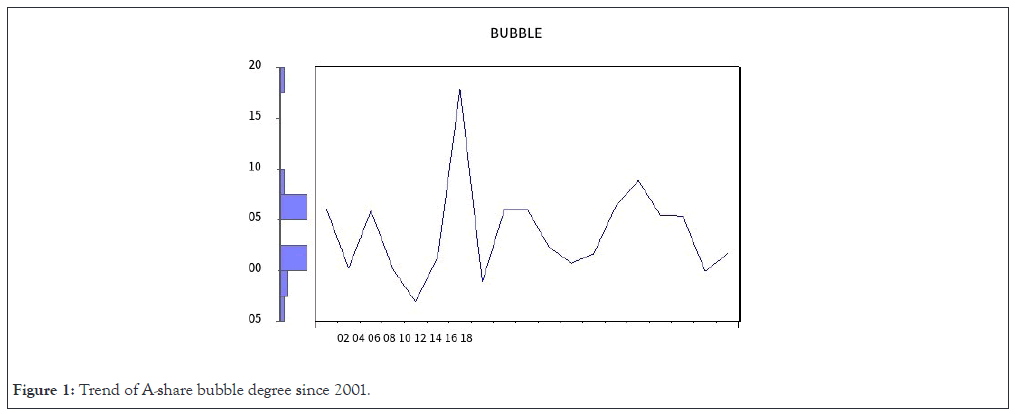

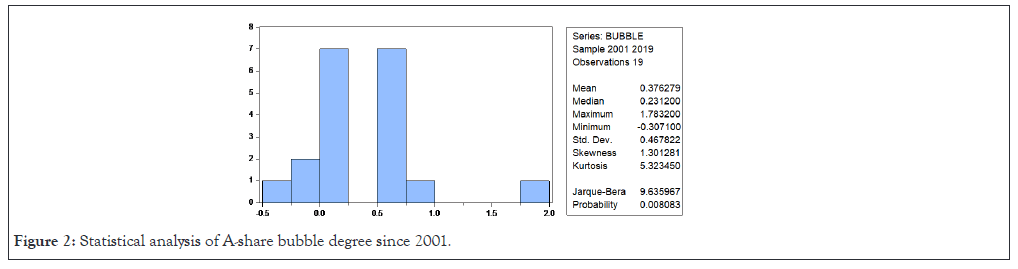

Measurement result analysis: According to the above calculation as shown in Table 1, the average bubble rate of A-shares from 2001 to 2019 is 37.6%, which is generally at a premium level. The median was 23.1% and the maximum occurred in 2007, 178.32%. The minimum was -30.71% in 2005. The only years with negative premia were 2005, 2008 and 2018 (all with year-end data), at -30.71%, -11.2% and -3.5%, respectively. Compared with the normal distribution, the distribution of A-share bubble rate is statistically right-sided and peak-sided. The high standard deviation and unstable state indicate that the A-share market has fluctuated wildly in history (Figures 1 and 2).

Figure 1: Trend of A-share bubble degree since 2001.

Figure 2: Statistical analysis of A-share bubble degree since 2001.

The average annual A-share price is overvalued by 37.6% when compared to the intrinsic value of the A-share market, indicating a prolonged period of overvaluation in A-shares. This has been a significant constraint on the long-term performance of the A-share market over the past 30 years. The high bubble rate means that most investors have too high expectations for the future development of companies and even if the market has a certain degree of correction, the price is quickly supported by optimistic investors trading. In addition, China's stock market has always had the attribute of policy market. Xu Xiaonian argues that China's stock market is still trapped within the confines of a policy-driven framework, with the government prioritizing the stock index as a regulatory target rather than focusing on market order and enhancing information disclosure. Hu, based on the operation data of stock price indexes from the beginning of trading in Shanghai and Shenzhen stock markets to the end of 2001, applied the abnormal volatility point method and concluded that China's stock markets had obvious policy effects [17]. In the period of economic cycle downturn and bear market, China government stabilization funds boost the stock market by buying index weights and other methods, which also distorts the normal de-frothing behavior of the A-share market.

The stock market in China lacks an efficient mechanism and system for accurately determining prices. The scarcity of institutional supply results in inadequate financing support for Chinese private enterprises, leading to relatively high prices in the secondary market. This, in turn, fosters the formation and eventual bursting of bubbles, ultimately resulting in a loss of overall social welfare.

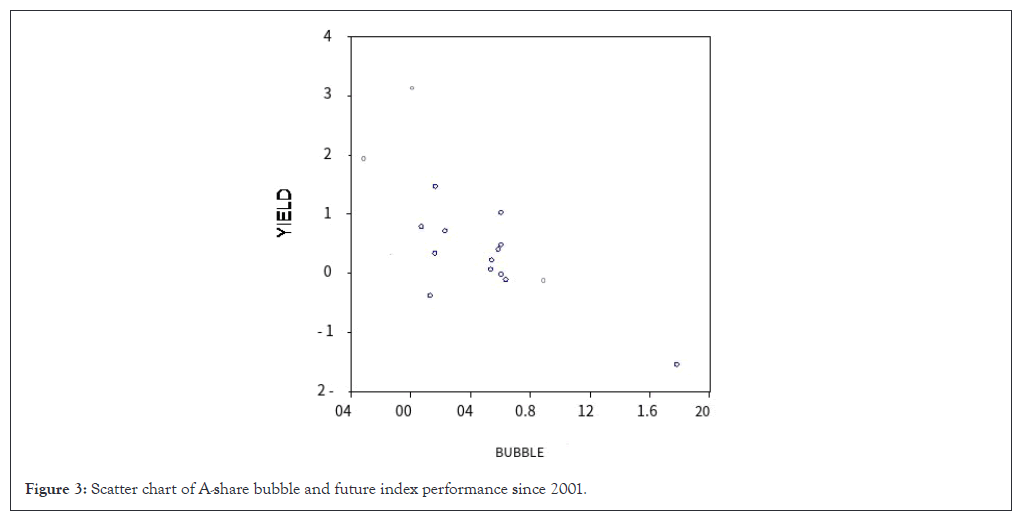

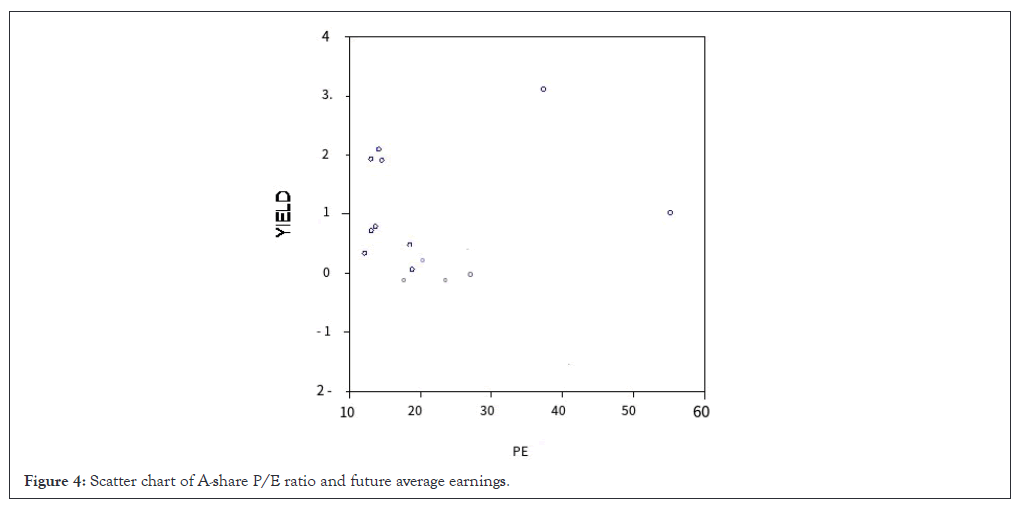

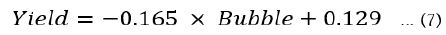

Correlation analysis of bubble rate, P/E ratio and investment return: From an investment perspective, the historical bubble rate of A-shares reflects the valuation level of the stock market. In periods of high bubble rates, it indicates an overvalued stock market and prompts investors to swiftly exit at elevated levels. Conversely, during low bubble rates, it suggests an undervalued stock market where investors should strategically accumulate positions at lower levels. To enhance the clarity of this correspondence, we utilize data from 2001 onwards to compare the bubble rate and Compounded Annual Growth Rate (CAGR) of the stock market (measured by the Shanghai Composite Index (SCI)) over the subsequent five years, based on specific time points within each year. It is found that the two have a strong inverse correlation, with the correlation coefficient reaching -0.72. Statistics prove that buying and holding a stock market index at a time when the bubble rate is lower will result in higher investment returns over the next five years (Table 2 and Figure 3).Some scholars use the Price-Earnings (P/E) ratio to measure stock market valuation and estimate its relationship with future investment returns. When the P/E ratio is higher, it indicates that the future growth space has been overdrawn in advance, then the future return on investment at this time will be poor and vice versa. This is similar to the logical relationship between the stock market bubble rate and future investment returns. We use the same method to analyze the relationship between the P/E ratio and future investment returns. The P/E data are shown in Table 1. The correlation coefficient between the P/E ratio and future return CAGR is -0.15, which is negative as we imagine, but the degree of negative correlation is significantly less than that between the stock market bubble rate and future market returns CAGR (-0.72). Analyzing the reasons, except for the market price P, the P/E ratio only contains the information of EPS. However, the stock market bubble rate calculated based on the RIM contains the Return on stockholder’s Equity (ROE), the Book value Per Share (BPS) and the information of RI, which reflects the profitability of an enterprise that exceeds the necessary rate of return in the market. We believe that although the RIM has some subjective judgments, such as the setting of the long-term growth rate of the company in the future, it reflects more comprehensive and accurate corporate financial information than the P/E ratio method (Figure 4).

| Historical bubble rate of A-shares | Investment return over the next 5 years |

|---|---|

| Covariance | -0.03426 |

| Correlation | -0.72324 |

| t-statistic | -4.31804 |

| Probability | 0.0005 |

Table 2: Correlation analysis between the historical bubble rate of A-shares and the investment return over the next 5 years.

Figure 3: Scatter chart of A-share bubble and future index performance since 2001.

Figure 4: Scatter chart of A-share P/E ratio and future average earnings.

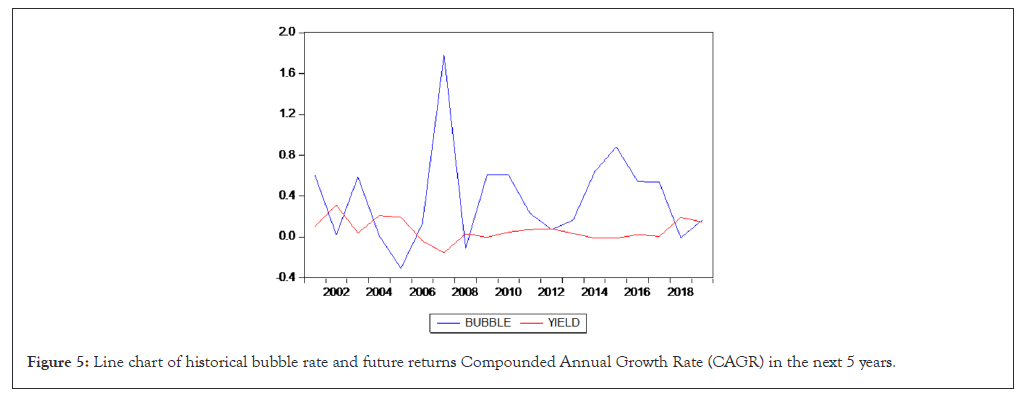

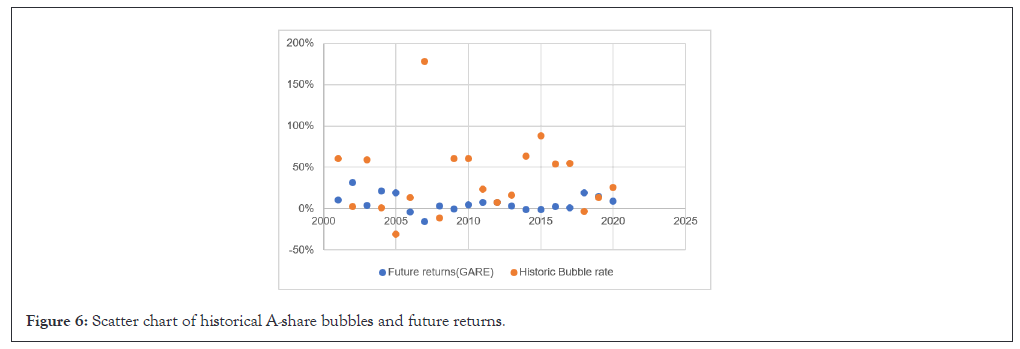

Establishing regression model: In view of the regularity between A-share bubbles and future investment returns, we use Eviews 10 to establish a regression model reflecting the relationship between historical A-share bubbles and future investment returns. The regression analysis results are shown below. The probability of T-test and F statistic value are both 0.05%, indicating that the equation can pass the significance test.

The Yield is a forward-looking indicator that estimates the future average earnings of A-shares. Bubble rate represents the A-share bubble rate as computed in this study (Table 3, Figures 5 and 6).

| Variable | Coefficient | Standard error | t-statistic | Probability |

|---|---|---|---|---|

| C | 0.128625 | 0.022605 | 5.690144 | 0 |

| Bubble | 0.16524 | 0.038268 | 4.31804 | 0.0005 |

| R-squared | 0.523081 | Mean dependent variable | - | 0.066447 |

| Adjusted R-squared | 0.495027 | Standard dependent variable | - | 0.106885 |

| Standard error of regression | 0.075954 | Akaike info criterion | - | 2.21807 |

| Sum squared residual | 0.098074 | Schwarz criterion | - | 2.11865 |

| Log likelihood | 23.07165 | Hannan-Quinn criterion | - | 2.20124 |

| F-statistic | 18.64549 | Durbin-Watson statistic | - | 1.487611 |

| Probability (F-statistic) | 0.000467 | - | - | - |

Table 3: The statistical results of A-share bubble and future return regression model.

Figure 5: Line chart of historical bubble rate and future returns Compounded Annual Growth Rate (CAGR) in the next 5 years.

Figure 6: Scatter chart of historical A-share bubbles and future returns.

Does the bubble rate of A shares have a moderate bubble area: Finally, the above research on the A-share bubble rate also raises an important question regarding how to judge whether the stock market bubble is in a reasonable range? The general theory is that, like inflation, a moderate bubble is conducive to market activity and market efficiency, but a severe bubble is a manifestation of the inefficiency of the market mechanism. Some scholars have made some preliminary answers to this question. For example, Ainong studied and judged the rationality of the Chinese stock market bubble by referring to the P/E ratio method of Shiller and the situation of bubbles in mature stock markets.

Based on the analysis of this paper, we propose the classification criteria of A-share bubble rate based on future investment value.

When the A-share bubble rate is less than 5%, the A-share has a high investment value. When the bubble rate is in the range of (5%, 30%), A-shares have normal investment value or the bubble is moderate and acceptable. When the A-share bubble rate is higher than 30%, investors are overly optimistic about the future of the enterprise and there is an obvious overreaction between the market price and the intrinsic value.

Reasons for the long-term bubble in China's stock market and suggestions

We believe that the main reasons for the long-term formation of bubbles in China's A-shares are as follows:

First, investors are too optimistic about the future of the macroeconomy. China's economy has come a long way since the reform and opening up in 1979 and the biggest risk for investors is that they have not experienced recessions, depressions and crises and have not experienced the experience of a true bear market. When investors invest in the stock market with excessive optimism, the stock prices in the market may be pushed up to form a bubble, which will lead to market instability and increased risks. The A-share market bubble is driven by the public's systematic cognitive bias. Therefore, now for A-share investors, it may be necessary to study and evaluate the fundamentals of the stock more carefully and consider the overall situation of the market and risk factors.

Second, policy intervention affects the automatic clearing of the market. It is found that the response of A-share investors to policy factors presents ‘A policy dependence bias’. Li et al., studied the abnormal changes in trading volume and trading frequency before and after the release of policies and found that there were insufficient policy response and excessive policy response in the market, both of which resulted from the alternations of excessive greed and excessive fear of investors [18]. From the perspective of regulators, the China Securities Regulatory Commission always expects to achieve the goal of regulating the stock market by issuing negative or favorable policies. When the stock market soared, the China Securities Regulatory Commission often adopted bearish policies to suppress the stock market and prevent the stock market from rising excessively. When the stock market is in a downturn for a long time, the regulator plays the role of market rescuer, hoping to introduce some positive measures to stimulate the stock market, such as the rescue measures issued by the Chinese government in August 2023, including reducing the stamp duty on stock transactions, interest rate cuts and so on. However, it backfired. The premise of the effectiveness of these interventional policies is that the government has a superior ability to predict the market so that it can find the right policy tools at the right time to release in a timely manner and guide market expectations, which is actually an impossible task.

Moreover, from the perspective of policy practice, favorable policies can sometimes stimulate the growth of investor trading volume and produce a short-term pulse effect on the market index. But in the medium to long term, policy functions only as an exogenous variable and does not change market trends.

We believe that in order to fulfill the government's regulatory role, the first step is to address the regulatory challenges concerning judges and players. The supervisory department serves as both architect and enforcer of a securities system that upholds market justice, fairness and transparent transactions, exercising top-down management authority over market participants (including listed companies and investors). However, regulators also act as representatives of the state. Many large listed companies in China are state-owned enterprises and the government is naturally the major shareholder of these state-owned enterprises, so regulators are both judges and players, which makes it easy to fall into self-interested supervision during supervision, resulting in moral hazard. If the relationship between two parties is not managed appropriately, it can have negative effects. For instance, in the market, if the government imposes different penalties on different players for the same violation like data falsification, it can be detrimental to the efficiency of China's stock market. This is because state-owned listed companies may receive light measures for violations, while private listed companies may face increased penalties. Such market signaling can harm the construction of the stock market's efficiency.

To assess the true value of A-shares and the extent of stock market bubbles between 2001 and 2019, we utilized the RIM. Our analysis indicates that A shares have a history of volatile bubble rates, often reaching high levels. The long-term bubble trend in China's stock market is primarily due to excessive optimism among the public and inadequate regulatory intervention. The government's dual role as both referee and player can result in self-interested regulation, hindering the stock market's clearing mechanism. To prevent this, we recommend the establishment of an effective regulatory mechanism for the A-share market. Proper supervision will facilitate price discovery, allowing A-shares to return to their intrinsic value equilibrium level in the long run.

Citation: Yu Z (2024). Bubble Measurement of China A-share Based on the Residual Income Model (RIM) and Discussion of Bubble Space under Efficient Market. J Stock Forex. 11:266.

Received: 26-Aug-2024, Manuscript No. JSFT-24-33922; Editor assigned: 28-Aug-2024, Pre QC No. JSFT-24-33922 (PQ); Reviewed: 12-Sep-2024, QC No. JSFT-24-33922; Revised: 20-Sep-2024, Manuscript No. JSFT-24-33922 (R); Published: 27-Sep-2024 , DOI: 10.35248/2168-9458.24.11.266

Copyright: © 2024 Yu Z. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution and reproduction in any medium, provided the original author and source are credited.