Journal of Hotel and Business Management

Open Access

ISSN: 2169-0286

ISSN: 2169-0286

Research Article - (2024)Volume 13, Issue 6

This study examined the effects of Dutch disease on the economic growth of fourteen oil-exporting nations over 39 years. Employing a quantitative research design, the study utilized the Generalized Method of Moments (GMM) dynamic panel approach and a classification tree method to categorize the countries based on their oil production levels and reassess the relationship between oil and Per-capita Gross Domestic Product (Per-capita GDP). The dataset, sourced from the World Bank, comprises annual observations from 14 countries spanning the period from 1980 to 2014. The results revealed no significant evidence of an oil resource curse and no significant impact of oil renting on economic growth. The results further revealed that literacy rate and per-capita income in exporting countries were not affected by oil reserves. Traditional random and fixed effects estimators were employed in the panel data analysis to underscore the advantages of the difference GMM approach. The study recommends the oil market be made aware of the baseless theories related to oil renting, which hinder the growth of business startups and oil trading.

Dutch disease; Economic development; GMM dynamic panel; Oil exporting countries; Per-capita GDP

The resource curse phenomenon illustrates that natural resources do not inherently damage economic development, but rather cause distortions that impact growth through various transmission mechanisms [1-3]. The concept is embedded in the idea that resource wealth displaces growth-enhancing activities through crowding-out effects [4]. These mechanisms can include real exchange rate appreciation, neglect of the manufacturing sector, deterioration of institutional quality, governmental mismanagement and low human capital. These transmission mechanisms are categorized as social, political and economic factors that enable the resource curse [5,6]. The resource curse is problematic for different reasons. Firstly, these are non-renewable resources and their instant extraction can impend the political and economic structure. Secondly, resource exports are comparatively essential in these resource-rich countries since they might be the greatest economic growth and development source.

Rent-seeking behaviors indicate a situation where an individual or a company works to elevate their portion of the share regardless of elevating the entire level of wealth. Rent-seeking, as per Deacon is the process where competing political preferences disburse economically valuable resources for acquiring government preferences [7]. Similarly, Krueger developed the rent-seeking concept to describe activities that create institutions based on specific rents and it is a fundamental aspect of social activity [8]. This sort of behavior can lead to the economic situation of a country being worse off [5]. Previous studies have extensively focused on how rent-seeking can demonstrate how the economy acts [9-11]. The negative impact on economic development from rent-seeking activities is linked to excessive natural resources [12,13]. Economic development is expected to decline as more entrepreneurs engage in rent-seeking behavior [10]. Furthermore, an increase in natural resources would lead to reduction in economic welfare [14].

The examination of oil's role as either a curse or a blessing and its effects on the economic and financial development of oil-exporting countries is motivated by several main factors:

Firstly, the challenge of whether oil is a curse or a blessing continues to be an issue for oil-exporting nations. Previous research has focused on identifying a contagious effect in these countries. Previous research has focused on identifying a contagious effect in these countries. Over the past two to three decades, a significant body of literature has emerged to investigate the association between economic underperformance, resource abundance and other adverse effects concerning corruption and bad governance. On the contrary, Critics of the resource curse theory, however, highlight examples such as Indonesia and Norway, which have successfully avoided the resource curse. This ongoing debate is one of the primary reasons for focusing on the oil curse in this paper.

Secondly, recent fluctuations in oil prices serve as a reminder that oil can act as a resource curse, particularly for economies heavily dependent on petro-dollar revenue. In addition, Given the heightened uncertainty, it is particularly relevant to examine the effects of oil price fluctuations on economic development and performance in oil-exporting countries.

In this regard, this study aims to contribute to the current empirical literature by providing both empirical and theoretical insights into the presence or absence of the oil curse in these nations. Additionally, it will include an analysis of volatility spillover effects of crude oil prices on stock markets in oil-exporting countries. This analysis will help determine the extent to which oil influences financial markets in these countries. The findings of this study are expected to assist policymakers in assessing whether development driven by oil revenue is sustainable and highlight the need to reduce overall dependence on natural resources to avoid the resource curse.

Sample data and methodological approach

Data was obtained from the World Bank, consisting of a panel of annual observations from 14 oil-exporting countries between 1980 and 2019. The countries studied include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates (UAE), Libya, Algeria, Nigeria, Ecuador, Angola, Iran, Iraq and Venezuela. All these nations are members of Organization of the Petroleum Exporting Countries (OPEC), with the first six also being members of the GCC. The analysis utilized random and fixed effects panel data estimators. To address country-specific effects, a GMM dynamic panel approach was adopted to tackle the issues caused by country-specific effects, dynamic features and endogeneity such as lagged dependent variables. Finally, a classification tree approach was used to provide evidence either supporting or contradicting the resource curse theory. This method helps to categorize countries based on their level of exposure to the resource curse GDP per-capita growth has been utilized as the dependent variable, serving as a measure of economic growth and is one of the most commonly adopted indicators measures in the literature. The resource proxy has been the second most important variable. The reason behind selecting this measure is because of oil rent and oil resource per-capita where the former refers to the variation between the total costs of production and the value of crude oil production. The latter refers to the per-capita amount of petroleum discovered in any predefined oil field or country.

Other explanatory factors in the model were human capital, tertiary enrolment and the literacy rate. Health capital is another measure of human capital, which is the reciprocal of life expectancy at age one. Human capital was also related to the fertility rate. Government consumption, foreign direct investment and international openness are other variables used in this paper.

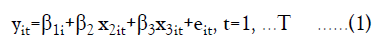

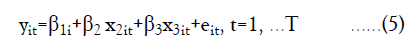

Methodology-panel data analysis: The panel data comprised cross-sectional units, such as countries, observed over a predetermined period. The number of cross-sectional units is represented by N and the number of observation periods by T. Panel data accounts for individual differences or heterogeneity. The seemingly uncorrelated regression model was utilized for the panel data set, which is narrow and long. Consider the following flexible linear regression model.

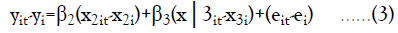

By averaging the data over the periods, we obtain

The “bar” notation suggests that the values of the variable are averaged over time and; therefore, the time (t) was dropped

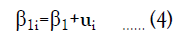

Thus, the least square estimates of the parameters are equivalent to those derived from the more complex least squares dummy variable model. The random effects model is based on the idea that the individuals in a panel data set are randomly selected from a large population. Conversely, all individual differences are assumed to be captured by variations in the intercept parameter in the fixed effects model. The same assumption applies in the random effects model, where all cross-sectional variations are reflected by the intercept parameters, but the individual differences are treated randomly not fixed.

Where ui represents the random effect. It is assumed that ui has a zero mean, is uncorrelated across different individuals and has a constant variance.

Key descriptive statistics of all the variables studied are presented in Table 1. The inclusion of Qatar in the sample leads to significant variation in GDP per-capita. In contrast, most other economies in the sample have a moderate GDP per-capita of around 12,000 United States Dollar (USD). Notably, there is a considerable number of missing values for the adult literacy variable. Moreover, educational attainment was presented through two different measures such as adult literacy and tertiary enrolment and therefore, can focus on the effects of the latter one if missing values occur in the latter cause any issues.

| Mean | Standard deviation | Minimum | Maximum | Observations | |

|---|---|---|---|---|---|

| Per-capita GDP | 12854.73 | 15855.73 | 494.239 | 81788.96 | 389 |

| Per-capita oil reserve | 8.279 | 13.569 | 0.093 | 60.947 | 473 |

| Oil rent | 30.548 | 14.654 | 4.222 | 78.932 | 446 |

| Tertiary enrolment | 17.563 | 13.105 | 0.013 | 77.457 | 286 |

| Adult literacy | 82.487 | 12.492 | 49.631 | 97.478 | 69 |

| Consumption | 18.087 | 9.083 | 2.332 | 76.222 | 415 |

| Openness | 79.219 | 40.007 | 0.21 | 251.139 | 424 |

| Investment | 1.838 | 3.878 | -13.605 | 40.467 | 441 |

| Fertility | 4.278 | 1.714 | 1.726 | 8.352 | 476 |

| Mortality | 39.867 | 36.267 | 5.9 | 138.3 | 476 |

| Life expectancy | 67.305 | 9.7 | 40.159 | 78.418 | 476 |

| Democracy | 2.718 | 2.524 | 0 | 9.33 | 440 |

| Inflation | 28.222 | 218.735 | -16.117 | 4145.108 | 371 |

Note: Per-capita oil reserve is scaled down by 1000 (barrels). This table reports the overall statistics for the 14 countries in our sample.

Table 1: Summary statistics.

The correlation matrix for all the variables has reported a statistically significant correlation between oil reserves and GDP per-capita, which provides preliminary evidence that the resource curse cannot be supported.

The estimated coefficients from the GMM models, presented in Table 2, used per-capita oil reserve or oil rent as proxies and GDP per-capita growth as the dependent variable. Human capital, in the form of tertiary enrollment, was included in the model. The variables related to the oil resource curse were statistically insignificant, indicating no evidence of a resource curse in these countries. As a result, the findings do not support the resource curse hypothesis. Furthermore, the education variable did not reach traditional statistical significance levels. Additionally, there was no serial correlation in the differenced residuals, as indicated by Auto-Regressive (AR), AR (1) and AR (2) test in different models.

| Variable | Coefficient | Standard error |

|---|---|---|

| Lagged dependent variable | 0.698*** | 0.768*** |

| 0.197 | 0.097 | |

| Per-capita oil reserve | -0.076 | - |

| 0.153 | - | |

| Oil rent | - | 0 |

| - | 0.003 | |

| Tertiary enrolment | -0.005 | -0.005 |

| 0.028 | 0.028 | |

| Constant | 2.688 | 2.050** |

| 1.786 | 0.895 | |

| Observations | 313 | 305 |

| Groups | 13 | 13 |

| Instruments | 19 | 19 |

| AR(1) | -1.650* | -2.540** |

| AR(2) | -0.99 | -1.85 |

| Hansen J | 7.03 | 9.27 |

| Wald chi-square | 17.680*** | 79.800*** |

Notes: AR (1) and AR (2) tests are for the first and second-order tests of serial correlation in the differenced residuals. Hansen J-test is for the null hypothesis that the over identifying restrictions are valid. ***, **, * denote statistical significance at the 1, 5 and 10% statistical level respectively. All variables are in natural logs except Oil rent and Inflation. The null of the panel data unit root test has been rejected for each variable under analysis. The instrument lag limit is set to 5. Robust standard errors are reported in italics.

Table 2: Dynamic panel GMM dependent variable: Per-capita GDP growth.

The estimated coefficients from the GMM models were presented in Table 3, where the per-capita GDP growth was the dependent variable. The proxies for resources were either the per-capita oil reserve or oil rent. Human capital, represented by tertiary enrollment for both genders. In addition, macroeconomic variables were included such as investment, consumption and trade openness. The findings have shown a lack of statistical significance in such variables; thus, the analysis did not empirically support the resource curse claim. Economic trade deteriorated due to consumption, while growth in per-capita GDP was increased through trade openness. A very small and vague effect was found on investment economically. However, there was no statistically significant individual effect of macroeconomic variables, although they are mutually significant as per the specifications.

| Variable | Coefficient | Standard error |

|---|---|---|

| Lagged dependent variable | 0.528 | 0.962* |

| 0.486 | 0.503 | |

| Per-capita oil reserve | 0.065 | - |

| 0.149 | - | |

| Oil rent | - | -0.001 |

| - | 0.005 | |

| Tertiary enrolment | 0.027 | -0.009 |

| 0.051 | 0.037 | |

| Consumption | -0.149 | -0.002 |

| 0.155 | 0.195 | |

| Openness | 0.242 | 0.03 |

| 0.244 | 0.363 | |

| Investment | -0.003 | 0 |

| 0.002 | 0.001 | |

| Constant | 3.413 | 0.223 |

| 3.636 | 3.448 | |

| Observations | 300 | 300 |

| Groups | 13 | 13 |

| Instruments | 37 | 37 |

| AR (1) | -1.630* | -1.340* |

| AR (2) | -1 | -1.56 |

| Hansen J | 4.27 | 8.66 |

| Wald chi-square | 67.180*** | 30.820*** |

Table 3: Dynamic panel GMM dependent variable: Per-capita GDP growth.

The analysis was replicated in Table 4, with the addition of social variables such as democracy, fertility and mortality, yielding qualitatively similar results. The oil resource curse was confirmed using both natural resource measures, showing a positive but insignificant effect, which might suggest slight evidence of an oil blessing. The negative impact of consumption on economic growth persisted but was not significant at conventional levels in both specifications. There was no clear relationship between trade openness and per-capita GDP growth. Investment showed a positive impact on per-capita GDP growth through increased investment levels. Higher fertility rates were linked to lower economic growth when the per-capita oil reserve was used as the natural resource proxy. Mortality displayed positive and negative signs when the resource proxy was the per-capita oil reserve and oil rent, respectively, although these did not reach statistical significance. No significant effect was observed, indicating that the impact on per-capita GDP growth was negligible.

| Variable | Coefficient | Standard error |

|---|---|---|

| Lagged dependent | 0.469** | 1.028*** |

| 0.237 | 0.387 | |

| Per-capita oil reserve | 0.029 | - |

| 0.107 | - | |

| Oil rent | - | 0.004 |

| - | 0.004 | |

| Tertiary enrolment | -0.009 | 0.071 |

| 0.011 | 0.128 | |

| Consumption | -0.188 | 0.021 |

| 0.19 | 0.221 | |

| Openness | 0.074 | -0.393 |

| 0.26 | 0.862 | |

| Investment | 0.002 | 0.003 |

| 0.002 | 0.008 | |

| Fertility | -0.534 | 0.026 |

| 0.574 | 0.93 | |

| Mortality | 0.197 | -0.087 |

| 0.324 | 0.683 | |

| Democracy | -0.007 | -0.115 |

| 0.131 | 0.116 | |

| Constant | 4.889*** | 1.401 |

| 1.134 | 7.062 | |

| Observations | 260 | 260 |

| Groups | 13 | 13 |

| Instruments | 55 | 55 |

| AR (1) | -0.980* | -0.610* |

| AR (2) | -0.86 | 0.03 |

| Hansen J | 0.94 | 1.84 |

| Wald chi-square | 206.750*** | 59.810*** |

Table 4: Dynamic panel GMM dependent variable: Per-capita GDP growth.

The Table 3 was further supported by the addition of inflation in Table 5. The conclusions indicated no oil resource curse for the economies in the sample. Conversely, the per-capita oil reserve suggests that oil is a blessing for these countries when considering the complete set of social and macroeconomic factors. However, the oil blessing could not be confirmed when using oil rent as the measure.

| Variable | Coefficient | Standard error |

|---|---|---|

| Lagged dependent | 0.476 | 0.639** |

| 0.361 | 0.269 | |

| Per-capita oil reserve | -0.185* | - |

| 0.107 | - | |

| Oil rent | - | 0 |

| - | 0.002 | |

| Tertiary enrolment | 0.115 | 0.121 |

| 0.083 | 0.131 | |

| Consumption | 0.012 | 0.004 |

| 0.079 | 0.081 | |

| Openness | -0.253 | 0.222 |

| 0.256 | 0.311 | |

| Investment | 0.011** | -0.006 |

| 0.006 | 0.006 | |

| Fertility | -1.784** | 0.174 |

| 0.689 | 0.818 | |

| Mortality | 1.010** | -0.103 |

| 0.416 | 0.632 | |

| Democracy | 0.044 | -0.089 |

| 0.16 | 0.065 | |

| Constant | -0.001* | -0.001 |

| 0.001 | 0.001 | |

| Observations | 4.195 | 2.348 |

| Groups | 3.823 | 4.157 |

| Instruments | 205 | 205 |

| AR (1) | 12 | 12 |

| AR (2) | 61 | 61 |

| Hansen J | -0.040* | -1.08 |

| Wald chi-square | 4.56 | -0.15 |

Table 5: Dynamic panel GMM dependent variable: Per-capita GDP growth.

The reciprocal of life expectancy replaced mortality in Table 6. The findings were generally consistent with those in Table 6, regardless of the statistical evidence for a resource curse at traditional significance levels.

| Variable | Coefficient | Standard error |

|---|---|---|

| Lagged dependent | 2.196*** | 0.481 |

| 0.218 | 0.622 | |

| Per-capita oil reserve | 0.004 | - |

| 0.113 | - | |

| Oil rent | - | -0.001 |

| - | 0.003 | |

| Tertiary enrolment | 0.411* | 0.152 |

| 0.23 | 0.134 | |

| Consumption | -0.087 | 0.028 |

| 0.108 | 0.099 | |

| Openness | -0.084 | 0.178 |

| 0.146 | 0.483 | |

| Investment | 0.004 | -0.011 |

| 0.011 | 0.016 | |

| Fertility | -2.32 | 0.45 |

| 2.944 | 0.948 | |

| Mortality | 16.178 | -2.99 |

| 16.896 | 5.587 | |

| Democracy | -0.207 | -0.107 |

| 0.194 | 0.083 | |

| Constant | -0.002 | 0 |

| 0.002 | 0.001 | |

| Observations | 60.347 | -9.547 |

| Groups | 75.083 | 20.438 |

| Instruments | 205 | 205 |

| AR (1) | 12 | 12 |

| AR (2) | 60 | 60 |

| Hansen J | -0.15 | -0.89 |

| Wald chi-square | 1.42 | -0.32 |

Table 6: Dynamic panel GMM dependent variable: Per-capita GDP growth.

This study examined the oil resources of oil-exporting countries and assessed their impact on economic growth to understand fluctuations in per-capita GDP across 14 nations. The findings do not support the assumption that oil rent, typically associated with a negative impact on economic growth, leads to Dutch disease. The results demonstrated that the countries containing huge oil reserves are witnessed to have an ascending GPD per-capita therefore, the presence of a resource curse was not supported (Table 1). The study further identified that there is no impact of oil resources on the educational level of these countries with no significance about the resource curse as well, in the period of 10 years from 1980-1990 (Table 3). Throughout the analysis, the study showed no signs of a resource curse on GPD per-capita in the next 20 years from 1991-2000 and 2001-2010 (Tables 3 and 4). The economy of each country has either not been affected by the oil resources or showed a moderate effect from 2010 to 2015 (Table 5). Insignificant impact in the next four years was witnessed, from 2016-2019 (Table 6). However, the blessing of oil resources does not comply with the oil renting procedure according to the results.

Hassan et al., investigated the relationship between oil wealth and economic growth in 35 oil-exporting developed countries from 1984 to 2016, finding a clear reliance of economic growth on oil resources [15]. Similarly, Inuwa et al., studied the impact of natural resources on economic growth among OPEC members from 2008 to 2018. However, in contrast to the current study, the findings showed a positive significant impact of oil rent on economic development [16]. Additionally, Asiamah et al., examined the validity of the Dutch disease among the states of Sub-Saharan Africa (SSA) from 2005 to 2019 [17]. It found that natural resources negatively impacted the overall economy, affecting non-natural resource sectors. Middelanis analyzed the Dutch disease's effects on both commodity and non-commodity sectors from 2000 to 2018. The findings demonstrated that commodity prices substantially decrease the growth rate in manufacturing sectors in the countries exporting commodities confirming the theory of Dutch disease [18]. Moreover, the study suggested that diversification in the trading sectors including manufacturing helps avoid Dutch Disease effects and provides a stable and developed economy [18]. Kheirandish et al., believed that prosperity and slump in economies rich in natural resources are caused by the fluctuations in the financial market of natural resources and commodities which is the cause of irregular economic development [19]. Their study evaluated the impact of wealth funds on economic growth in the 15 largest oil-exporting countries, which account for 80% of the world's oil exports. These results contrast with the present study, which demonstrated a positive and significant relationship between the finance generated from oil resources and economic growth. In addition, Sharma employed panel data from 140 countries from 1995 to 2018 to examine the effect of resource allocation and corruption on foreign tourism in a country [20]. The findings demonstrated that resource endowment and corruption had a negative impact on tourism which validated the theory of Dutch disease [20].

This study provided a detailed examination of the impact of oil rents on economic growth and found no evidence to support the hypothesis that Dutch disease affects a country's development. Contrary to the prevalent belief that an influx of oil revenues harms non-oil sectors and leads to economic decline, the results of this study suggested otherwise. The findings indicated that the effects of oil rents on economic growth are specific to each context and cannot be generalized across countries.

The present study has revealed on the impact of oil reserves on various aspects of development, particularly the literacy rate, through the utilization of a GMM dynamic panel approach that effectively addresses the endogeneity, country-specific effects and dynamic features of the economy. The findings indicate that the theory of Dutch disease and oil renting is invalid in the selected regions, as no statistically significant results were found to support it. Moreover, the study demonstrated that education in oil-exporting countries has not been affected by the presence of oil reserves or any other natural resources.

Based on these results, it can be concluded that countries that are rich in natural resources are expected to prosper without facing any hurdles posed by oil blessings. However, it is recommended that future researchers investigate the existence and origins of Dutch disease in other contexts. Furthermore, the oil market must be made aware of the invalidity of theories related to oil renting, as they can limit the growth of business startups and present oil trading. Overall, this study contributes to our understanding of the impact of oil reserves on development and suggests new avenues for research in this area.

The author is very thankful to all the associated personnel in any reference that contributed to/for this research.

The authors declare no conflicts of interest.

[Crossref] [Google Scholar] [PubMed]

Citation: Khan CM (2024). Dutch Disease: Rent Seeking Behavior in Oil Exporting Countries-How Contagious is it? J Hotel Bus Manag. 13:124.

Received: 04-Nov-2024, Manuscript No. JHBM-24-34957; Editor assigned: 06-Nov-2024, Pre QC No. JHBM-24-34957 (PQ); Reviewed: 20-Nov-2024, QC No. JHBM-24-34957; Revised: 27-Nov-2024, Manuscript No. JHBM-24-34957 (R); Published: 04-Dec-2024 , DOI: 10.35248/2169-0286.24.13.124

Copyright: © 2024 Khan CM. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.