Journal of Hotel and Business Management

Open Access

ISSN: 2169-0286

ISSN: 2169-0286

Research Article - (2023)Volume 12, Issue 1

Since the advent of the OBORI, it was subjected to numerous studies. However, most previous studies investigated only the potential impact of the OBORI on the Chinese economy and geopolitics. Therefore, its real effect on Chinese international commerce in OBORI countries is not evaluated yet. Accordingly, this study intends to model the OBORI effect on Chinese product brand purchases across country members. The assessment is made on 18362 purchases of the International Online Consumers (IOCs) from a Chinese international online selling platform. The Data was obtained from a programming language and the octopus software. The OBORI policy's effect on Chinese brands' purchases was examined through a Different in Different Model (DIDM). Results show that the impact of OBORI is weak in the real market. However, it could be significant if OBORI includes more developed and economically strong countries. To Chinese brands and policymakers, we show how the inclusion in the OBORI project of developed countries could contribute more to Chinese product brands' purchases. Thus, the study enables decision makers to understand the current impact of OBORI on the real market and its potential effect if more developed and economically strong countries are included.

International online shopping; One belt one road initiative; Chinese bands; Brand preference; International online consumers

The advent of e-platforms has brought the world together by breaking down the traditional national borders [1,2]. As a result, a Chinese product brand, for example, can reach the New York market, be cognized and enjoyed by New York consumers before Beijing consumers. In this context, China's impressive achievement over the last decade, in international commerce and domestic e-commerce field, spawned new scope for Chinese International Online Shopping (CIOS) [3]. According to Wang, et al., the transaction rate via CIOS in terms of percentage increased by about 10 in 2010 to 40 in 2015. It is projected that this year (2020), the turnover would reach 12 trillion RMB, representing 37.6% of Chinese international commerce. As a result, electronic devices, mobile phones, clothes, shoes, household goods, etc., are exported every day around the world from China. We see an unprecedented growth of Chinese brand sales across the globe. For instance, it's almost impossible to find a store in Europe that does not sell Chinese product brands. Just a decade later, China transcends countries like Japan to become one of the essential exporters of product brands worldwide [4,5]. “Made in China” is nowadays a worldwide calling identification. In this perspective, many policies for supporting CIOS implemented to improve the competitiveness of Chinese companies operating in that field [6]. Such as the OBORI proposed by the Chinese government.

OBORI is a global expansion strategy of the Chinese economy. As a result, it offers opportunities to Chinese companies and brands at the international level [7]. Therefore, it constitutes sturdy support for Chinese international trade and Chinese brands. In this perspective, numerous studies have been carried out to study the OBORI policy from various angles and implications (e.g., economic, finance, and geopolitical implications) [8,9]. However, research on the OBORI remains related mainly to geopolitical and economic issues, while the real market ignored. For instance, the literature forgot to investigate the impact that the OBORI on the purchases of Chinese product brands across OBORI countries. Therefore, this study aims to examine the effect of OBORI on Chinese product brands' purchases across OBORI countries. We propose a DIDM to examine the effect of OBORI policy on purchases of Chinese product brands across OBORI countries. We use Chinese mobile phone brands to carry out our investigation. We apply the model to a dataset comprising 18362 purchases made by the IOCs. These IOCs come from 74 countries. Out of the 75 states, 27 countries are members of the OBORI. The result shows that the Impact of the OBORI remains weak across OBORI countries in terms of purchases of Chinese brands; however, it could be significant if the initiative could include more developed and economically strong countries.

Consequently, the contribution of this work lies in the fact that it allows us to appreciate the influence of the OBORI policy on the purchases of Chinese product brands across OBORI countries through CIOS since implementation. Therefore, our proposed study enables decision makers to understand the influence of the OBORI on the practical market since its advent but also its potential effect if developed countries were included.'

The following parts of the study organized in these ways. First, we examine the relevant literature related to OBORI and the CIOS and see how our study extends these studies. Next, we present the data description. Then, we develop a DIDM to capture the impact of the OBORI policy on the preferences and the purchases of Chinese product brands. Next, we analyze the results and discuss managerial implications. We end the paper with the conclusion and proposition of subsequent research.

The OBORI policy

Since the OBORI advent, numerous academic investigations have been carried out to facilitate better understandings of the initiative and its goals. In this direction, the literature on OBORI divided into two core streams of research. The first stream of research concerns the geopolitical issues of the OBORI. The second streams of research are related to economic and financial issues. Therefore, for scholars, OBORI motivated towards economic and geopolitical issues.

According to Shahriar, et al., OBORI made up of two projects: The Silk Road Belt (SRB) and Maritime Silk Road (MSR), which together, unit almost 65 countries from different continents. In this direction, Chung, et al., discussed the economic and the political cost of involvement in the MSR Southeast Asian region. They highlighted that although the initiative is seen in terms of economic as an essential development factor in economic diplomatic relations between China and Southeast Asian countries for several decades; however, it will be crucial for China to clarify its real motivation behind the initiative. In terms of economic impact, they show through their analysis and estimations that the GDPs of countries members, and trade flows between China and those countries, will be positively influenced by the investment level through the implementation of the OBORI. Palit examined the issues and advantages of the MSR in the region of Bay of Bengal in India [10-12]. He highlights that the differences in the development, in terms of infrastructure and trade capability, constitute significant factors. Accordingly, these issues must be solved before implementing the OBORI to ensure a strong influence in those regions.

Sidaway and Woon evaluated OBORI from the perspective of geopolitics [13,14]. They stated that OBORI is associated with the policy of China to oppose its territory encircling, and thus, the OBORI reflects the discourse of protection against the domination of the west. According to Ferdinand, OBORI is President Xi’s major international policy breakthrough that endeavors to set a more active foreign policy. Thus, Nordin and Weissmann argue that OBORI is China's new world order vision and founded on interconnected capitalism [15,16]. For Ren, OBORI could be seen as an institutional strengthening effort of China. In this regard, Vangeli investigated China's connections along with 16 countries of Europe of the different regions [17]. He concluded that the relationship under the OBORI is for inducing a politico-economic vision change at the global level and that it will be crucial for the determination of the bilateral relationship. Similarly, Rolland analyzed the initiative and stated that the OBORI could be an option against America's leadership [18]. He concludes by drawing the attention of thinkers and policymakers on the strategic implications of OBORI. In this perspective, Huang thinks that OBORI as one of the leading global initiatives of the peoples' republic of China the main difficulties about the initiative lie at the level of the under-development politico economic of members [19].

Some authors analyzed the motivation behind the OBORI. For instance, one can mention the works of [20]. He analyzes the motivation of the OBORI and concluded that it motivated by the goal of China to be the new superpower. However, according to Shahriar and Qian, OBORI's main objectives are policy coordination, interpersonal contacts, financial integration, and commerce. In this direction, Yiwei analyzed the economic, political, as well as moral dimensions of the OBORI from a research book by explaining China's vision about the initiative. He points out that the OBORI is like a new alternative to how the West is directing the globalization in the political and economic terms. In this regard, Zhai shows that China is investing hugely in the OBORI countries since the advent of the OBORI. The study highlighting China's planned investment under the OBORI is about $6 trillion. Accordingly, studies have carried out to analyze China’s international economic policy through OBORI. For instance, on the Basis, optimal currency area theory Sun and Hou, investigated the optimal monetary zones between China and the OBORI countries. They identified the OBORI countries with the best potential for monetary and financial compatibility in terms of costs and benefits for cooperation with China. Fan, et al., investigated the effectiveness of the foreign direct investment of China in OBORI countries. They showed that there were substantial differences in performance between the OBORI countries. They highlight that there is a strong potential of China's investment in OBORI member countries. However, if China wants to leverage advantages on this investment, China needs necessarily to eliminate certain obstacles, such as obstacles commercial, poverty in the country members, etc. Concerning China's commercial, economic, and banking activities in OBORI countries. Shahriar, et al., revealed that they are increasing since the advent of the initiative. Chen, et al., examined and worked out misery alleviation and urbanization models in OBORI countries based on data characterizing 20 years of activities in those countries. The results show that over 20 years, the urbanization level is about 48 in terms of percentage. Cui, et al., examined the agribusiness issues under the OBORI. They concluded that under the OBORI, the agroindustry should be an essential bridge to reconcile consumers' concerns, factories, and products. Teo, et al., reviewed infrastructure development under OBORI by showing the relationship between the environment and social, economic, and political factors.

Some studies have also been carried out from the perspective of OBORI countries’ interests. For instance, Timofeev, et al., investigated how Russia sees the OBORI. They conclude that for Russia, the OBORI as a prime concern in its connections with China since it could be a worthwhile project for both parts. Herrero and Xu analyzed the initiative from the perspective of Europe's interest. For them, the initiative would be advantageous for Europe in terms of trade with China. Other studies have also been carried out in the context of international online shopping. In this regard, Yang, et al., examined the development of International Online Shopping in the context of OBORI. They state that the initiative could play a crucial role in the economic development of China through international online shopping. However, they did not provide any evidence to shore up their point of view.

In summarize, one observes a lack of studies focusing on the impact of OBORI on purchases of Chinese product brands, whether through traditional international commerce or international Online Shopping. Accordingly, this study intends to examine the impact of OBORI policy on purchases of Chinese product brands across OBORI countries and within the CIOS framework.

The CIOS framework

Since these late years, CIOS entered into a growing process. CIOS constitutes a new way of expanding Chinese companies and Chinese brands outside China. This model of international commerce playing, thus, an incommensurable part of the growth of China’s international commerce. Accordingly, studies carried out to understand this new opportunity for Chinese firms and brands. Fang presented the state of CIOS, by comparing existing marketplaces and various commercial models related to it as well as examining the essential barriers dressing CIOS development (e.g., the problems of customs clearance). They concluded that although, CIOS has progressively become a crucial part of the e-commerce domain in China, with its unrepeatable influence in promoting China's international commerce. However, there are still issues existing in the regulations system which undermine its fast development. From on the development status of CIOS, He and Xu analyzed the situation as well as the elements upon which the CIOS may be innovated. They concluded that the innovation must be based on enhancing the competitiveness and marketing model through the development of logistics and supply chain. However, the competitiveness and marketing models have to be also built upon strong skills of workers operating in that field. Zhong explained that there is a lack of qualified personnel concerning the international online shopping domain in higher vocational schools in China for the development of CIOS. Thus, Yang and Shen examined the issues related to CIOS development through an analysis of the context. They highlight that there are many issues related to the CIOS field which are reinforced by a legal vacuum (e.g., goods clearance, exchange settlements, logistics, and taxes). However, these issues can not hinder the growth and fast development trend of CIOS.

Likewise, some authors focused on the issues of logistics and taxation issues. However, the logistics of CIOS can still be greatly improved in terms of fast customs clearances, cost, and taxes, as well as the quality of services. In this direction, based on the advantages and disadvantages of overseas warehouses, Xu and Liang made suggestions on the healthy and sustainable development of CIOS and the reasonable use of overseas warehouses for sellers' commercial activities. They proposed that given the cost of warehouses abroad, the construction of overseas warehouses by platforms to facilitate the shipment of goods. In this regard, they highlight that China should use the context of promotion of the belt and road initiative to build CIOS local service networks in countries members of the initiative and making Chinese product brands go global. Li examined taxation customs measurements by making suggestions about the customs administration to contribute to CIOS development. Some studies also focused on case studies. Utilizing a cosmetic industry company as a case study, Chen, Wang and Xu investigated the effect of factors constituting the exterior environment on CIOS through the PEST theory. They highlight that political, economic, technical, and social factors favor the development of CIOS, although there are still operational issues concerning the standardization between Chinese sales platforms.

Finally, some works analyzed the CIOS from a regional or provincial perspective. For instance, from bilateral market theory and geographic location, Lu and Wang build two competitive theory models to suggest strategies of prices for two main areas of CIOS. Namely Dalian and Tianjin. Accordingly, they show that the features of the markets affect the strategies of those markets. Niu and Li analyzed the issues and advantages of the CIOS field in Ningbo province. They point out that factors like infrastructures, and the geographical situation of the province of Ningbo as the coastal province, give to that province considerable advantage on the logistics development plan compared with other provinces in China. However, at the transaction level, there are few kinds of products exported from that province. Likewise, concerning the fast distribution of shipping products by logistics companies, payment safety and the number of talents specialized in the International Online Shopping field Ningbo is lagging. Wang, et al. has established a spatial model for CIOS pilot areas from a salop model. They show that the space, structure, and the impact of concurrence influence the endogenous values.

As we have seen from the above studies, CIOS constitute an essential part of china's international commerce. Nevertheless, does taking OBORI into account in the context of CIOS stimulate purchases of brands of Chinese products in OBORI countries? Until now, there is no study to confirm or unconfirmed that assumption. Accordingly, in this study, we model the impact of the OBORI policy on the purchases of Chinese product brands across OBORI countries in the CIOS framework.

Data description

18362 transaction data have been collected from more than 50 online retail stores using a programming language and octopus software within a CIOS platform. These 50 online retail stores are made up of brand stores as well as individual stores. Brand stores are selling the B2C mode while the individual stores are selling through C2C selling mode. The data consists of 4 Chinese mobile phone brands, purchased by consumers from 75 countries. Namely Huawei (Br0=0), Xiaomi (Br1=1), Meizu (Br2=2), and Coopad (Br3=3). Out of the 75 states, we have 27 OBORI countries. To identify the OBORI countries, we used the list of OBORI Countries from the study of Sun and Hou plus Italy which integrated the initiative just 2019. Since the Chinese government has not yet officially presented the definitive list of OBORI countries. The dataset contains 2016 consumers' purchase as well as the consumers' purchase after 2016. Given to the heterogeneity among the OBORI countries, we grouped countries in term of the region, continents as well as the economic development level. Thus the dataset contains 14 regions, 5 continents, and 3 economic development levels, which we named status (Developed country=1, Developing country=2, Emerging country=3). Table 1 exposes the variables and presents the descriptive statistic of the dataset.

| Variables | Definitions | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| After 2016 | Whether a purchase made in years after 2016 (1) or not (0) | 0.11 | 0.99 | 0 | 1 |

| OBORI | Whether the order made from a country of OBORI(1) or not (0) | 0.35 | 0.86 | 0 | 1 |

| Country | From which country the order made | 15.31 | 56.82 | 1 | 75 |

| Continent | The continent of consumer | 0.42 | 3.92 | 1 | 5 |

| Region | The belonging Region of the consumers country | 1.22 | 5.29 | 1 | 14 |

| Status | The market status of the country (emerging, developed or developing market) | 0.65 | 2.71 | 1 | 3 |

| Purchase quantity | Product quantity purchases by consumer | 0.68 | 1.05 | 1 | 50 |

| Brand preferences | Chosen brands | 0.78 | 2.24 | 1 | 4 |

| Cool pad | Huawei | Meizu | Xiaomi | Grand Total | |

| Price | 174.62 | 276.36 | 132.32 | 174.21 | 180 |

| Total Purchase quantity | 2317 | 1711 | 1607 | 13769 | 19404 |

| Total Purchase quantity (OBORI) | 2057 | 1213 | 1544 | 11665 | 16479 |

| Total purchase quantity (NOBORI) | 260 | 498 | 63 | 2104 | 2925 |

| Total market share ($) | 404598.3 | 472844.6 | 212642.8 | 2398655 | 3492634 |

| Market share ($) (OBORI) | 359196.6 | 335219.5 | 204306.5 | 2032124 | 2966147 |

| Market share ($) (NOBORI) | 45401.62 | 137625.2 | 8336.34 | 366531.3 | 526487 |

| Total market share (%) | 11.57 | 13.64 | 6.11 | 68.68 | 100 |

| Market share (%) (OBORI) | 12.13 | 11.45 | 6.91 | 69.51 | 100 |

| Market share (%) (NOBORI) | 8.5 | 23 | 1.49 | 67 | 100 |

| Countries | 54 | 63 | 20 | 70 | 75 |

| OBORI countries (1) | 22 | 23 | 6 | 25 | 27 |

| NOBORI countries (0) | 32 | 40 | 14 | 45 | 48 |

Table 1: Descriptive statistics.

In Table 2, we present the trends of purchases and preferences across the world’s regions and the status of the states. Out of 14 regions, 4 are the most important in terms of purchase. Namely, the regions of Eastern Europe (16252), the European Union (1968), North America (235), and South America (286) The Middle East, as well as regions of Africa, are the areas where the Chinese brands less purchased through the CIOS framework from the dataset.

| OBORI | Region | Coolpad | Huawei | Meizu | Xiaomi | Grand Total |

|---|---|---|---|---|---|---|

| NOBORI countries | Central America | 13 | 32 | 1 | 89 | 135 |

| Central Asia | 2 | 16 | 0 | 17 | 35 | |

| Eastern Africa | 1 | 1 | 0 | 3 | 5 | |

| Eastern Asia | 3 | 6 | 0 | 16 | 25 | |

| Eastern Europe | 66 | 41 | 21 | 327 | 455 | |

| European union | 130 | 251 | 33 | 1071 | 1485 | |

| Middle East | 0 | 1 | 0 | 0 | 1 | |

| Northern Africa | 3 | 0 | 0 | 14 | 17 | |

| Northern America | 11 | 69 | 5 | 150 | 235 | |

| Oceania | 6 | 15 | 3 | 211 | 235 | |

| South America | 25 | 65 | 0 | 196 | 286 | |

| Southern Africa | 0 | 1 | 0 | 9 | 10 | |

| Western Africa | 0 | 0 | 0 | 1 | 1 | |

| Total NOBORI | 13 | 260 | 498 | 63 | 2104 | 2925 |

| OBORI countries | Central Asia | 10 | 3 | 0 | 25 | 38 |

| Eastern Asia | 0 | 5 | 1 | 3 | 9 | |

| Eastern Europe | 1970 | 1132 | 1539 | 11156 | 15797 | |

| European union | 42 | 40 | 4 | 397 | 483 | |

| Middle East | 0 | 2 | 0 | 3 | 5 | |

| Northern Africa | 1 | 1 | 0 | 1 | 3 | |

| Southern Asia | 27 | 27 | 0 | 52 | 106 | |

| Western Africa | 7 | 3 | 0 | 28 | 38 | |

| Total OBORI | 8 | 2057 | 1213 | 1544 | 11665 | 16479 |

| Grand Total | 2317 | 1711 | 1607 | 13769 | 19404 | |

| NOBORI | Developed country | 181 | 357 | 39 | 1443 | 2020 |

| Developing country | 53 | 45 | 23 | 385 | 506 | |

| Emerging country | 26 | 96 | 1 | 276 | 399 | |

| OBORI | Developed country | 14 | 18 | 1 | 276 | 309 |

| Developing country | 71 | 53 | 61 | 407 | 592 | |

| Emerging country | 1972 | 1142 | 1482 | 10982 | 15578 |

Table 2: Trends of brands purchased across the regions of the world.

This model deals with the effect of the OBORI policy on preferences and purchases of Chinese brands through OBORI countries. Accordingly, we assume that since the OBORI officially proposed in 2015 by the Chinese government, it took almost a year for decision makers and governments to promote the initiative and allowing the consumers to adapt to that.

Consequently, the data of this model are those of 2016 and years after 2016. Thus, within the dataset, we have three dummy variables. Which indicating respectively, whether a purchase made in the years after 2016 (1) or not (0). Whether the order made from a country of OBORI member (1) or not (0) and the interaction term between the two dummy variables, which give us the actual estimated treatment effect (OBORI). Likewise, within the dataset, we have variables indicating the number of purchases or the orders made in the stores as well as the preferred brands chosen among the four brands.

Theoretical model

In this section, we model the effect of the OBORI policy on purchases of consumers through OBORI countries toward Chinese brands since the implementation of the OBORI. We use the most straightforward shape of the DIDM to investigate the effect of OBORI policy on Chinese brands spread across OBORI countries. We use OLS DID estimator because of the nature of our dataset, which is cross-section data. Therefore, we are in a binary treatment case before and after implementation of the OBORI policy. In the simple shape of the DIDM, we have two groups or clusters (c=1 and c=2) for observations in two different times (t=1,2). In the first time, cluster (c=1) and cluster (c=2) are subject to the verification situation. In the second time, one of the groups subjected to processing.

In the case of this study, our control cluster or group (cluster=1) is the group "NOBORI” and constituted by the set of countries no members of the initiative until the end of 2016. Our treatment cluster ("Obori"=cluster=2) thus is made up of countries members of the OBORI. Let Oc=1 (t=2) be the binary variable measuring observation of OBORI'S cluster. That is to say, consumers' purchases from countries members the OBORI policy after the end of 2016. Et=1 for (t=2) denotes the consumers' purchases after the end of 2016. As we see Et written without cluster subscript and Oc also written without time subscript since the time does not change through the clusters, and cluster membership is invariant in time. Accordingly, the interaction variable can write as an interaction between the two dummy variables B.

Thus, Bct for clusters "NOBORI" and “OBORI” in the time 1 is equal to 0 since Et=0; and Oct=1 for OBORI’S cluster in second time (t=2). Accordingly, one can write the equation of the standard DID estimator:

Y is the dependent variable. β is the constant term. γ, δ, and θ are, respectively the coefficients of variables year 2016, OBORI, and interaction. ε represents the error terms; Oc is the group dummy and takes care of the differences between treatment (estimate) and control group (NOBORI). Et is the year dummy variable, which tells us if we are in 2016 or not. The inclusion of this variable in the equation is taking care of the time trend issue; if the purchases of Chinese product brands have increased or decreased over time. Bct is the interaction term between OC and Et. It gives us our actual estimation treatment (DID) affect. The effect of the OBORI policy on the IOCs preference for Chinese brands across OBORI countries.

Here, we discuss the practical impact of the OBORI policy from the DIDM. One sees that sales and market share of brands obtain from OBORI countries (16479) are higher than those of NOBORI countries (2925). However, the dataset contained just 27 OBORI countries out of 75 countries. This fact shows the OBORI countries seem to appreciate more Chinese brands than NOBORI. Going further, one sees that the Xiaomi brand appears to be the most appreciated in the OBORI countries, follows respectively by Coolpad, Huawei, and Meizu brands. However, within the NOBORI countries, Xiaomi, the market leader, was followed by the Huawei brand (the second-highest market share). The best market shares of all of the four brands within the NOBORI countries have been getting in the European Union countries (1485 items sold; Huawei (251) and Xiaomi (1071)). We observe that despite the relatively high average price of Huawei products ($276.36), however, its products have been well sold in that region (European Union countries). However, it is in that region one finds most of the developed and not members of the initiative (NOBORI countries). That means consumers of the most developed countries and not members of the OBORI of European Union countries appreciate Huawei and Xiaomi the most globalized Chinese brands compared with two other brands (Coolpad and Meizu). One can see that despite the weak number of OBORI countries (27 countries) vs. 48 countries (NOBORI), more purchases have been made in the OBORI countries (16479) than those NOBORI countries (2925). This result seems to indicate that OBORI countries appreciate more Chinese product brands than NOBORI countries. After 2016 variable for the preference and purchases have a positive coefficient. That signifies that the preferences and the purchases were trending up over time. The Obori variable is positive, as well. That shows that the purchase and preferences of OBORI countries, regardless of the country, had higher preferences and purchases. The coefficient of interaction variables θ is negative. That denotes the initiative (OBORI) by itself does not increase the preferences and the purchases of Chinese brands. The reason for this negative outcome is that the purchases made by NOBORI countries from 2016 (1.34) to the years after 2016 (2.04) have increased than those OBORI countries during the same period.

Stating in another way, for instance, NOBORI purchases from EU countries or North American countries have increased than those OBORI countries during the same period (from 2016 to the years after 2016). That indicates that the OBORI, to contribute significantly to influencing international consumers to purchase of Chinese product brands, must necessarily include these developed countries. This finding is crucial since it confirms the view of some researchers, who think that the OBORI to get more political, economic, and commercial influence, has to make efficient economic decisions in favor of most of the members. Since the majority of OBORI members are countries that have no strong economy and political stability. However, that fact affects the purchasing power of consumers from those countries. Accordingly, decision makers of the initiative should do their best to include these countries in the initiative (Table 3).

| Source | SS | P-values | df | MS |

|---|---|---|---|---|

| Model | 173.61 | 3 | 57.87 | |

| Residual | 11009.78 | 18,36 | 0.6 | |

| Total | 11183.39 | 18,36 | 0.61 | |

| DD Variables | Coef. | - | - | |

| After 2016 | 0.70***-0.12 | 0 | - | - |

| OBORI | 0.58***-0.13 | 0 | - | - |

| interaction | -0.34** | 0 | - | - |

| -0.14 | ||||

| cons | 1.34***(0.12) | 0 | - | - |

| Year | OBORI | Purchase | ||

| 2016-NOBORI | 0 | 0 | 1.34 | |

| 2016-OBORI | 0 | 1 | 1.91 | |

| Years after 2016-NOBORI | 1 | 0 | 2.04 | |

| Years after 2016-NOBORI | 1 | 1 | 2.28 | |

| NOBORI=control | - | OBORI=Treatment | DD | |

| 0.701 | - | 0.36 | -0.34 |

Table 3: Impact of One Belt One Road Initiative (OBORI) on consumer brand purchases.

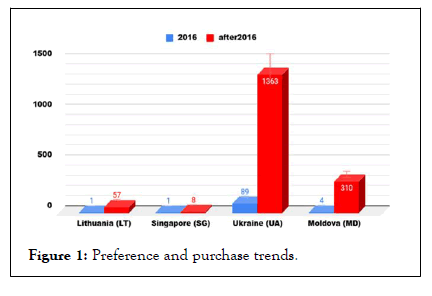

To better understand this empirical result, one must understand the computation method of the DIDM. Fundamentally, the model takes the average of the preferences and purchases in the control cluster (NOBORI) of 2016 and the Years after 2016. Then it takes the average of preferences and purchases in the treatment cluster (OBOIRI countries) from 2016 and years after 2016 to get the difference in those differences. All of the four brands’ purchases increased Years after 2016. However, it's weak compared to those of NOBORI on the whole. That means the initiative to be able to increase its influence strength on the spread of Chinese product brands must include the developed countries, as stated. Especially those of the European Union countries. That is to say that the more the initiative spreads in developed countries, the more Chinese brands will be sold (Figure 1).

Figure 1: Preference and purchase trends.

Utilizing DIDM to quantify the OBORI impact on Chinese product brand purchases, the analysis showed that the OBORI policy's effect is not significant enough to contribute to the purchases of Chinese products brands around the world. Chinese product brands’ purchases are increased since the implementation of the policy in OBORI members; however, this growth of the purchase across OBORI countries is less than that of countries non-members of the initiative (NOBORI). Likewise, OBORI countries represent only 18% of the world's GDP. Accordingly, if the goal of OBORI is to contribute to strengthening the sale of its products and services worldwide; it will be necessary to promote the OBORI toward the developed countries but also to support Chinese brands, and companies across OBORI members since it is projected that the OBORI will influence the international commerce by about 5% in around 2030. Our model offers a more unobstructed view of the effect of the OBORI on IOCs purchases of Chinese brands through country members and NOBORI countries. Accordingly, our study enables decision-makers about the OBORI to understand the impact of the OBORI on the real market since its advent. However, to a certain extent, this study has certain limitations despite the contribution it makes to the OBORI literature within the international online shopping framework. The first limitation of this work concerns the source of the data. Indeed, the data utilized in this work collected from a single Chinese international online sales platform. The second limitation of this work concerns the official number of OBORI country members, which has been utilized in this current study (27 countries) since, with geopolitical and economic dynamics, countries continue to integrate the OBORI. However, we could not consider those countries in this study since we considered only the list of OBORI countries of the study of sun and Hou plus Italy, which integrated the initiative just in 2019. As a result, additional research could be conducted by collecting data from other or several Chinese international sales platforms by integrating the omit countries in this current research to verify our results.

Our study could extend in these ways. Future research can examine the influence of the Chinese brands' performance and features on the IOCs preferences and choice according to consumers of OBORI's countries.

Karamoko K.E.H. N’da collects data, performs the formal analysis and writes the original draft. Jiaoju Ge supervises, providing the funding; review, editing and finalizing the article. Steven Ji-Fan Ren co-supervises and reviews the draft. Jia Wang co-supervises and reviews the draft.

This research was funded by national natural science foundation of China (No. 71831005 and No. 71402039).

The authors would like to thank the editors and the anonymous reviewers for their valuable insights.

The authors declare no conflict of interest.

[Crossref][Googlescholar][Indexed] [PubMed]

Citation: Karamoko K, Ge J, Ren SJF, Wang J (2023) Effect of One Belt One Road Initiative (OBORI) Policy on the International Spread of Chinese Brands. J Hotel Bus Manage. 12:028.

Received: 16-Aug-2022, Manuscript No. JHBM-22-18813; Editor assigned: 18-Aug-2022, Pre QC No. JHBM-22-18813 (PQ); Reviewed: 01-Sep-2022, QC No. JHBM-22-18813; Revised: 13-Jan-2023, Manuscript No. JHBM-22-18813 (R); Published: 20-Jan-2023 , DOI: 10.35248/2169-0286.23.12.028

Copyright: © 2023 Karamoko K, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.