Journal of Agricultural Science and Food Research

Open Access

ISSN: 2593-9173

ISSN: 2593-9173

Research Article - (2017) Volume 8, Issue 4

Currently, Ghana’s agriculture is dominated by subsistence (smallholder production units) with weak linkages to industry and the service centre. The agricultural sector is characterized by low productivity, low income and uncompetitive production, processing and distribution. Given the structure of the Ghanaian economy, higher growth in the agricultural sector is needed to fuel growth in other sectors. The size of the sector indicates that, agriculture could be the engine for a more rapid growth and poverty reduction. This assertion could hold if the right policies are formulated and implemented with the right institutional frameworks. A large proportion of the population in Ghana are rural based and depends on agriculture for sustenance, in as much as the health of the citizens are concerned. Enhanced and stable growth of the agriculture sector is important as it plays a vital role not only in generating purchasing power among the rural population by creating on-farm and off-farm employment opportunities but also through its contribution to price stability. In Ghana, although the share of agriculture in real GDP is declining, it continues to be an important sector as it employs about 57% of the labour force in Ghana.

<Keywords: Savings and loans; Maize production; Credit facility; Techiman municipality; Ghana; Health

Low income countries like Ghana can rely on the sector to increase its GDP as it contributed about 38% of the National Gross Domestic Product (GDP) in the year 2007, dropped to 34% in the year 2008 and further dropped to 33.3% in the year 2009, it then increases to 35.6% in 2010 and reduced drastically to 24.6% in the year 2012 [1-4]. Three main factors that contribute to agricultural growth are increased use of agricultural inputs, technological change and technical efficiency. With savings being negligible among the small farmers, agricultural credit appears to be an essential input along with modern technology for higher productivity. An important aspect that has emerged in the last three decades is that credit is not only obtained by small and marginal farmers for survival but also by large farmers for enhancing their capital. Hence since independence, credit has been occupying an important place in the strategy for the development of agriculture. Maize is an annual grass and an input grain crop of the world. Maize ranks with wheat and rice as one of the world’s main grain crops. It ranks second to wheat in the world production of cereal crops [5].

According to the International Institute of Tropical Agriculture (IITA), maize or corn is a cereal crop that is grown widely throughout the world in a range of agro ecological environments. More maize is produced annually than any other grain. About 50 species exist and consist of different colours, textures and grain shapes and sizes. White, yellow and red are the most common types. The white and yellow varieties are preferred by most people depending on the region.

Maize was introduced into Africa in the 1500s and has since become one of the Africa’s dominant food crops. In West and Central Africa, a phenomenal increase in maize production has occurred in recent years. The land area devoted for maize production has increased significantly by an average of 2.7% per year for the regions. Much higher expansion rates were reported for several countries. Guinea 9.4%, Mali 6.6%, DR Congo 5.5%, Burkina-Faso 7.1%, and Ghana 8.3%. The average annual growth rate of maize production for West and Central Africa for the period of 1983 to 1992 was 4.1%. The comparable figure for Eastern and Southern Africa for the same period was 0.9%. Maize is being substituted for sorghum and millet in some local dishes and industries are using it for brewing and for oil extraction [6].

According to Seini, maize is grown in all agro-ecological zones of Ghana [7]. The transitional and the northern guinea savannah regions of Ghana, account for about 70% of maize output. Over 90% of maize production is in hands of small scale farmers who produce maize in scattered farm plots ranging from half a hectare to about three hectares. Small scale maize production is labour intensive with little or no purchased inputs. These are some of the problems facing maize production in Ghana; poor access to credit for purchasing inputs, poor marketing, poor transportation, low level of modern inputs, unfavourable climatic condition, problems of pests and diseases etc.

The agricultural credit systems of Ghana consist of formal and informal sources. The informal sources include friends, relatives, commission agents, private money lenders, among others. Three major channels for disbursement of formal credit include commercial banks, cooperatives and micro-finance institutions (MFI) covering the whole length and breadth of the country.

Financial institutions are defined as registered companies that are licensed to offer financial services by Central Monetary Authority [8]. Adegeye and Dittoh defined agricultural finance as the economic study of the acquisition and use of capital in agriculture [9].

The financial institutions in developing countries are composed of formal, semi-formal and informal financial institutions [10]. Formal financial institutions are further categorized into; Universal bank with an example being Ghana Commercial Bank (GCB), Rural banks with examples being Kintampo rural bank, Fiagya rural bank etc. and Non-banking financial institutions, examples are Co-operative credit society, Presbyterian credit union etc. It was reported by ISSER that the importance of formal financial institutions e.g., Rural banks are to accelerate the development of the priority areas including agriculture through increased in productivity in the agriculture sector [2]. The overall thrust of the current policy regime assumes that credit is a critical input that affects agricultural/ rural productivity and it is important enough to establish causality with productivity. Therefore, complexities in agricultural operations are softened through the interventions of credits [11].

According to Bayeh, microfinance institutions have evolved since the late 1990s as an economic development tool intended to benefit low-income people [12]. Ledgerwood points out that the goals of microfinance institutions as developmental organizations are to service the financial needs of underserved markets as a means of meeting developmental objectives such as to create employment, reduce poverty, help existing business grow or diversify their activities, empower women or other disadvantaged population groups, and encourage the development of new business [13]. In short, microfinance institutions have been expected to reduce poverty, which is considered as the most important developmental objective [14].

Due to the peculiarities of agriculture, especially its uncertainties, low returns, high rate of rent and limited scope of employment, a large number of farmers cannot manage the needed finance without resorting to borrowing. One of the most important lessons of the universal agrarian history is that the agriculturalist must borrow, due to the fact that, his capital is locked up in his lands and stock. For stimulating the tempo of agricultural production, it is necessary that the farmer must be provided with adequate and timely credit [15].

Moreover, significant increase in productivity in the agriculture sector will directly reduce hunger and also bring down the cost of food import. High agricultural productivity has a lot of benefits economically ranging from stimulating rural income to providing raw materials for industries. The question however is whether the Ghanaian economy is on the path of agricultural transformation which will lead to the desired economic turnaround [2]. Credit is often regarded as a major factor in agricultural production. Inadequate finance is always offered as an explanation to many of the problems facing agricultural development in developing countries like Ghana. It is therefore argued that, if agricultural credit were made available to farmers, the retarded agricultural sector would start moving. Studies have shown that, agriculture credit improves poor people’s lives by contributing to improved healthcare, children education, nutrition and women empowerment [16].

According to Lele and Adu-Nyarko, one sure way of enhancing employment opportunities includes the administration of microcredit which is an intended strategy approach to poverty alleviation with Africa being its paramount priority [17].

All these facts mentioned above suggest that, agricultural credit in the hands of the destitute and financially handicapped farmer could help turn their unfortunate situation around for the better and make them financially independent. This would go a long way to improve food security, health and educational needs.

In 1998, it was established that access to a banking facility by small clients such as poor maize farmers was around 8%. Credit is normally available for people who can afford to present collateral to access loans from the bank. The requirements to access such loans are so high that the poor finds it difficult to access them [18]. According to Oyedele and Akintola inadequate availability of formal credit to support production activities of majority of the resource poor farm households which constitute the bulk of agricultural producers has constrained agricultural growth and development [19].

Again formal financial institutions by virtue of their location, design, procedures and preference do not favour illiterate and the poor smallholder rural farmers. Informal lenders have traditionally provided credit to the rural people, but because their excessive interest rates are considered inefficient for improving productivity and agricultural growth. Therefore, improve financial intermediation is considered necessary for agricultural growth [20].

Direct agricultural credit is supposed to have a positive impact on agricultural output and its effect is supposed to be immediate. Most maize farmers in the Techiman municipality have been receiving credit from governments, non-governmental organizations (NGOs), financial institutions, friends, and families. It is not known whether these rural farmers have really been investing these credits into their farming business. It is also not known the effects of this direct agricultural credit on the output of these maize farmers.

The main objective for the research is to assess the effects of Opportunity International Savings and Loans credit facility on maize production in Techiman Municipality whereas the specific objectives are narrowed down to find out the requirements for accessing loan from Opportunity International Savings and Loans credit facility in Techiman municipality, examine the outputs of maize before and after accessing the loan, identification of constraints to loan acquisition from Opportunity International Savings and Loans credit facility in Techiman municipality and also to identify the problems facing maize production in Techiman municipality.

In justification, according to Okurut et al. credit is an important instrument for improving the welfare of the poor [21]. This research will help in assessing the effects of credit of agriculture on output of maize farmers. The study will reveal the credit needs of the maize farmers and can help provide policy document for government and non-governmental agencies working with the maize farmers. The study will also unveil to policy makers and government the roles agricultural credit can play in increasing maize production.

Study area

Techiman Municipality is in the Brong Ahafo Region of Ghana. The major occupation of the people in the municipality is predominantly agriculture and engages about 57% of the active population economically [22]. The Techiman Municipality shares boundaries with Kintampo South District to the north, Wenchi Municipality to the west, Nkoranza North and South Districts to the east, and Offinso North District and Sunyani West District to the south. The municipality is within the transitional zone of Ghana with a bimodal rainfall pattern [23]. The municipality lies between longitudes 10° 49ʹ east and 20° 30ʹ west and latitudes 80° 00ʹ north and 70° 35ʹ south [24]. It has an area cover of 1053.5 km2 with a population of 206,856 (Figures 1 and 2) [25].

Source and types of data

Data collected were from primary sources. The data on the credit needs of maize farmers, their output per hectare etc were obtained from the farmers whilst the number of farmers (groups) who patronized the credit scheme was also obtained from the officials of the opportunity international savings and loans bank.

Methods and instruments for data collection

The following methods were employed in the collection of the data in the research. They are observation, interview and survey. A survey was conducted to identify maize farmers or groups and further to identify the farmers who patronized the credit schemes. Open and closed ended questionnaires were used together as instruments in collecting data on the age, years of farming farm size etc of maize farmers in the municipality (Figures 3 and 4).

Sample size and technique

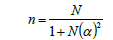

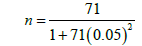

Five communities were purposively selected within the study area. Purposive sampling was used because, not all the farmers groups in Techiman municipality were operating with the bank. Numbers were assigned to farmers according to their names. The numbers were folded and placed in box. Twelve (12) interviewees were randomly selected from each farmers group giving a sample size of 60 respondents in the whole study. This was done in order to avoid bias. The equation below was used to determine the sample size:

(1)

(1)

Where, n=Sample size; N=Sample frame; α=Confidence level (5%) respectively.

(2)

(2)

n=60.3=60 people.

The target communities and their respective farmers groups are listed below:

Farmer group location

Susu bribi Maize Farmers’ Association Oforikrom,

Aworowa Maize Growers’ Association Aworowa,

Nyame Bekyere Kuo Koforidua,

Esereso Kroye Kuo Esereso

Boankron Maize Farmers Association Boankron

Method of data analysis

The data was analysed using both descriptive and quantitative methods. The quantitative data was analysed with the help of the following software; Microsoft excels, etc. The results obtained were presented in frequency tables, statistical means, pie chart, line graph, tables etc. The requirement for accessing credit which was obtained from the bank was analysed verbally and descriptive method was used to identify the credit needs of the farmers. Pair wise ranking was used for the identification of constraints in acquiring loan and the other problems facing maize production in each selected community.

Pair wise ranking

It is a structured method for ranking a small list of items in order of priority. Pair-wise ranking is a tool that helps in the identification of the most important needs and concerns of group of people, helps to prioritize small list and make decisions in a consensus- oriented manner. According to Russel pair wise ranking is often used as a means of prioritizing or ranking list of problems prepared by a group of people (Table 1) [26].

| Problems | A | B | C | D | E | Scores | Rank |

|---|---|---|---|---|---|---|---|

| A | X | A | A | D | A | 3 | 1st |

| B | X | C | B | E | 2 | 2nd | |

| C | X | C | E | 1 | 3rd | ||

| D | X | D | 2 | 2nd | |||

| E | X | 1 | 3rd |

Table 1: A model of pair wise ranking.

Production function

According to Mansfield the production function of any commodity is the relationship between the equalities of various inputs used per period of time and the maximum quantity of the commodity that can be produced per period of time. The production function summarizes the characteristics of existing technology at a given point in time; it shows the technological constraints that the firm must reckon with.

Frank also defined production function as a relationship by which the inputs is combined to produce outputs [27]. The production function is an input starting point for the analysis of the firm’s technology. It gives us the maximum total output that can be realized by using each combination of quantities of inputs. The production function transforms inputs like land, labour, capital, management etc. into output. Schiller pointed out that [28]; production function is a technological relationship expressing the maximum quantity of good attainable from different combinations of fact inputs.

Koutsyiannis also explained production method and process under production function as a combination of factor inputs required for the production of one unit of output [29]. Production function is a technical relationship between inputs and outputs. This implies that the relationship between physical inputs and physical outputs used by a farm firm.

Mathematically, a production function is expressed as Y=f (X1, X2 … Xn), Where y is the quantity of farm outputs, X1=quantity of variable input. X2 …… Xn represent quantities of fixed inputs [15].

Types of production function

There are various types of production function: we have both linear and non-linear production functions. To produce, there should be a relationship between quantity of input used to make the good and the quantity of output of that good. Linear production function is the type of function that shows direct relationship between input and output whilst non-linear production function is the type which does not show direct relationship between input and output.

Production relationships can exist in many forms. They are factorproduct relationship, factor-factor relationship and product- product relationship. Adegeye and Ditto explained factor- product relationship as the production of one output with one variable input [9].

Factor-factor relationship is where a single output is produced but two of the factors used in producing the output are variable factors while all others are constant [9].

Adegeye and Ditto further explained product-product relationship is where one variable factor such as labour (with fixed inputs) is being used to produce two commodities.

For the purpose of our research, concentration will be on factor – product relationship. This was chosen based on the assumptions that Factor – product relationship works under:

• We are interested in only one product, which is maize.

• We are interested in the effects of variation of credit while other inputs are considered to be fixed at a given level.

• The inputs both fixed and variable and the products are finely divisible.

• The objective of the farmer is to maximize profits.

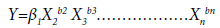

The factor – product relationship can be expressed as Q=F(X), where Q is the quantity of output and X is the quantity of variable inputs used. At optimality, farmer’s profit under factor-product relationship should be maximized. Therefore, our interest is assessing the effects of credit on maize output [9]. Baye then summarized production function as an engineer relation that defines the maximum amount of output that can be produced with a given set of inputs [30]. According to Gujurati [31] the Cobb-Douglas production function is given as:

(2)

(2)

The multiples regression below was used to estimate the production (output) of maize after accessing the loan.

ΙηY=β0+β1ΙηX1+β2IηX2+β3IηX3+β4IηX4+β5IηX5+β6IηX6+β7D1+β8D2 +β9D3+U (3)

Where, ΙηY=log of output; β0=Constant; ΙηX1=Log of farm size in Acres, expected to have a positive effect on output; IηX2=Log of years in maize production, expected to have a positive effect on output; IηX3=Log of herbicide in Litres, expected to have a positive effect on output; IηX4=Log of age in years, expected to have a positive effect on output; IηX5=Log of seed in kilograms, expected to have a positive effect on output; IηX6=Log of Fertilizer in kilograms, expected to have a positive effect on output; D1=Sex of respondents, 1 if male and 2 if female, expected to have a positive effect on output. D2=credit; credit=1, no credit=2, expected to have a positive effect on output; D3=Education; no education=1, Education=2, expected to have positive effect on output; U=Error term or disturbance term.

Socio-demographic characteristics of maize farmers

Sex and educational level of respondents: The study showed that 41 of the respondents were men representing 68.3%. Men were involved in maize production than women who were 19 (31.7%) of the respondents. From all indications, men are the major growers of maize in the study area as against women. Education is the key to success and the easiest way to move away from poverty. According to Rahm and Huffman, the introduction of new production methods and practices are generally easier to adopt as the farmers educational level increases. That is, the higher the level of education, the easier the adoption of technology. This means that, a community with high illiteracy rate is perceived to have high rate of poverty. Table 2 revealed that 46 people representing 76.7% of the respondents had no formal education and 14 people representing 23.3% of the respondents had formal education.

| Sex of respondents | Educational level of respondents | Total | |

|---|---|---|---|

| No Education | Education | ||

| Male | 33 | 8 | 41 |

| Female | 13 | 6 | 19 |

| Total | 46 | 14 | 60 |

Table 2: Sex and educational level of respondents. Source:

The educational level of maize farmers is very vital since, it helps them to put their credit into better use. Nelson et al. confirmed this assertion when they said credit is dangerous in the hands of those who do not know how to use and understand it [32].

The study revealed that the educational level of maize farmers in the municipality was low. This confirmed why educational training was a major requirement for accessing credit from the Opportunity International Savings and Loans Bank.

Age and years of farming (experience) of maize farmers: From Table 3, 26.7% of the respondents were between the ages of 20-30 years, 35% of them were between the ages of 31-40 years, 15% of the respondents were also between the ages of 41-50 years, 13.3% of them were between the ages of 51-60 years and 10% of them were above 60 years. It is clear from the results above that majority that (61.7%) of the respondents were within the active productive age (20-40 years). This indicates that the prospect of maize production in the municipality is bright, since the active age is interested in maize farming.

| Age of respondents | Years of farming of respondents (Experience) | Total | |||

|---|---|---|---|---|---|

| 1-10 | 11-20 | 21-30 | 31-40 | ||

| 20-30 | 10 | 6 | 0 | 0 | 16 |

| 31-40 | 11 | 7 | 3 | 0 | 21 |

| 41-50 | 0 | 5 | 4 | 9 | |

| 51-60 | 1 | 1 | 4 | 2 | 8 |

| 61+ | 2 | 1 | 2 | 1 | 6 |

| Total | 24 | 20 | 13 | 3 | 60 |

Table 3: Age and years of farming (Experience) of respondents.

The study revealed that 44 (73.3%) of the respondents had been in maize production from 1-20 years whereas 16 (26.7%) of the respondents had been in maize production from 21 years and above. It is clear from the table that the active population have had interest in agriculture for long and that one’s age does not necessarily determines his or her experience.

Requirements for accessing credit from opportunity international savings and loans credit facility

The study identified the following as the requirements for accessing loan:

• Organization of maize farmers into groups. (Micro Loans)

• The group must operate a compulsory individual and group accounts with the bank.

• The members of the maize farmer groups must undergo an educational training which is conducted and supervised by credit officials of the bank

• The members of the group must agree to serve as guarantors for themselves in the group; in that, the groups collectively pays a member’s debt should he or she default or the unexpected happens during and after production.

The inability of a farmer or group to meet any of these requirements will lead to the denial of the credit facility. This was confirmed by both the farmers and credit officials of the bank.

Cultivated land area before and after credit (Acres)

From Table 4, it is evident that, most of the farmers (91.3%) cultivated land area between 1-10 acres before accessing the credit whilst 8.7% of the respondents cultivated land areas above 11 acres. The average land area of the respondents before accessing the credit was 4 acres. This gives an indication that farmers in the area are mainly small holder farmers when grouped using MoFA categorization which categorized farmers cultivating 1-10 acres as small holder farmers [23].

| Acre(s) | Before credit | After credit |

|---|---|---|

| 01-Oct | 55 | 38 |

| Nov-20 | 5 | 22 |

| Total | 60 | 60 |

Table 4: Cultivated land area (acres) before and after accessing credit.

It is clear from Table 4 that maize farmers who joined the credit scheme were able to increase their land size. The percentage of maize farmers who cultivated land areas of 11-20 acres increased from 5 (8.3%) to 22 (37%). The average land area cultivated is 6 acres as compared to 4 acres previously. This shows that the land area (acres) of the maize farmers has increased.

Quantity of inputs used by maize farmers before and after accessing credit

From Table 5, the average quantity of inputs used by maize farmers were 5 kilograms (kg) of seeds per acre, 50 kilograms (kg) of fertilizer per acre and 2 litres (Lt) of herbicides used for the three consecutive times of weeding (0.67 Lt per acre) before accessing the credit compared with 7 kilograms (kg) of seeds per acre, 165 kilograms (kg) of fertilizer per acre and 3 litres (Lt) of herbicide used for the three consecutive times of weeding, (1 Lt per acre) after accessing the credit.

| Inputs | Qty used before credit | Average quantity | Qty used after credit | Average |

|---|---|---|---|---|

| quantity | ||||

| Seeds (kg) | 1443 | 5.15 | 2006 | 7.01 |

| Fertilizer (kg) | 13975 | 49.91 | 47300 | 165.38 |

| Herbicide (Lt) | 649 | 2.32 | 858 | 3 |

Table 5: Quantity of Inputs used by respondents before and after accessing credit.

It is evident therefore that, the acquisition of the credit increased the quantity of inputs used by maize farmers in the municipality.

Output before and after accessing credit

Agricultural credit is vital in both peasant and commercial farming activities. The study revealed that maize farmers were not satisfied with their output before accessing the credit.

Before the credit from Opportunity International Savings and Loans Limited, maize farmers in the municipality had an average output of 8 bags (400 kg) per acre as compared with 10 bags (500 kg) per acre after accessing the credit. There was a difference of 2 bags (100 kg) in output of farmers before and after accessing the credit. It is evident in Table 6 that maize farmers who were able to access the credit increased their total output.

| Bags (50 Kg) | Before credit | After credit |

|---|---|---|

| 05-Oct | 10 | - |

| Nov-20 | 29 | 28 |

| 21-30 | 12 | 19 |

| 31+ | 9 | 13 |

| Total | 60 | 60 |

Table 6: Maize farmer’s output (50 kg) before and after accessing the credit.

Production function of maize

From Table 7, herbicide had positive effect on the total output and 100% increase in herbicide application will increase total output by 27%. Educational level, age, and credit had positive effects on total output of maize production. The low contribution of credit to maize output may be as a result of several factors. Some of the factors that were pointed out by the maize farmers were inadequate credit, late disbursement of credit, misapplication of the credit etc. Even though the contribution of credit to maize production wasn’t all that much, it confirms the theory and the earlier expectation that, credit is supposed to increase outputs. This is because maize farmers will be able to purchase inputs that would help facilitate their farming business. The positive impact of credit on maize total output is in line with Carter and Olinto, Petrick, Foltz, Guirkinger and Boucher and Fletschner et al. findings that agricultural credit has positive effects on farm output [33-37]. It also confirms RRRP statement that, microfinance institutions in various parts of the world, particularly Asia and Latin America, have proved that providing financial service to poor rural people like maize farmers is possible and can be profitable [38]. The positive effect is in disagreement with Kocher, Gyader and Seayoh findings that credit has no effect on farm output [39].

| Variable | Coefficient | T-Statistics | Prob.>[T] |

|---|---|---|---|

| Sex | -1.55 | -0.62 | 0.541 |

| Age | 0.127 | 1.44 | 0.155 |

| Educ. Level | 0.2 | 0.18 | 0.855 |

| Experience | -0.192 | -1.62 | 0.112 |

| Seed | 0.079 | 1.4 | 0.167 |

| Land area | -0.138 | -0.49 | 0.626 |

| Credit | 0.08 | 12.56 | 0 |

| Fertilizer | 14.345 | 2.34 | 0.023 |

| Herbicide | 2.686 | 0.52 | 0.607 |

| Constant | -15.031 | -1.46 | 0.152 |

Number of observation=60; F (9, 50)=23.52; Prob. >F=0.0000; R- Square=0.8276; Adj. R- Square=0.7924; Dependent Variable=Total output (Bags of maize)

Table 7: Production function of maize after credit.

Again the low contribution of credit to the total output of maize was due to the inadequate nature of the credit. This confirms Aryeetey and Gockel argument that, among the farm inputs, the availability of credit is inadequate and this has constrained, to a large extent, the adoption and extensive use of modern agricultural inputs particularly, among small scale farmers [40].

Fertilizer (use) also has a positive influence on maize output and is significant at 1% level. The model is a double – log function, the coefficients are the elasticity’s that is used to measure the responsiveness of output to changes in the independent variable. This means that 1% increase in fertilizer will result in 14% increase in maize output. Sex, experience, and land area had insignificant influence on maize production.

Prob. >F=0.0000 is an indication that, the whole model is significant. R-Square=0.8261 implies that, 83% of the independent variables explain dependent variable (output).

According to Gail Clarence, farm credit is needed to finance farm expansion and higher production cost [41].

Constraints of accessing credit

It was revealed from the field survey that some problems were encountered when accessing credit by maize farmers. Some of the requirements were unfavourable to the maize farmers, hence their inability to access credit. The problems that were faced are late disbursement, high interest rate, early recovery period and cumbersome procedure. Focus group discussion was conducted and the problems were ranked with the most pressing one been ranked first (Table 8).

| Problems | A | B | C | D | Scores | Rank |

|---|---|---|---|---|---|---|

| A. Late disbursement | X | A | A | A | 11 | 1st |

| B. High interest rate | X | C | B | 6 | 3rd | |

| C. Early recovery period | X | C | 4 | 4th | ||

| D. Cumbersome procedure | X | 9 | 2nd |

Table 8: Ranked constraints when accessing credit.

Problems of maize production apart from credit

The following are the problems that maize farmer in Techiman faced apart from credit; bush fires, lack of farm inputs, pests and diseases, weeds control, theft and high cost and shortage of labour. These problems pertained to the maize farmers and their environment. Focus group discussion was conducted and the problems were ranked according to priority (Table 9).

| Problem | A | B | C | D | E | F | Score | Rank |

|---|---|---|---|---|---|---|---|---|

| A. Bush fire | X | B | A | D | E | F | 2 | 6th |

| B. Lack of farm inputs | X | C | B | B | F | 7 | 2nd | |

| C. Pests and diseases | X | C | C | C | 9 | 1st | ||

| D. Problem of weeds control | X | D | F | 3 | 5th | |||

| E. Theft | X | E | 4 | 4th | ||||

| F. High cost and shortage of labour | X | 5 | 3rd |

Table 9: Problems faced by maize farmers aside credit in the municipality ranked.

Conclusion

Access to credit is likely to improve the well- being (output) of beneficiaries. Based on the study, the following findings were generated: Credit had significant influence on agricultural total output, the low contribution of credit to the total output of maize was due to the inadequate nature of the credit late delivery of credit affected the total output of maize including age, educational level, land size, fertilizer and herbicides had significant influence on maize production. Credit should be delivered on time, the government as well as NGO’s should intervene in eradicating the pests and diseases that are disturbing the production of maize in the municipality, the procedure for accessing credit should be made flexible and simple, inputs should be provided to the maize farmer at subsidised prices by the government and NGO’s to boost maize production, the interest rate should be massaged in order to improve maize farmers’ income and lastly, education should be given to beneficiaries in order to help them use the credit appropriately. Therefore, it will be healthy and fertile if the above suggestive measures are adhered to in as much as the conduction of this research is concerned.