Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Review Article - (2018) Volume 6, Issue 1

Few studies explore the micro-cap market of stocks and mutual funds. As a result, little is known about these securities’ characteristics, risks and performance. This study analyzes the risk and risk-adjusted performance of microcap mutual funds with mid-cap and large-cap mutual funds. The study finds that micro-cap mutual funds are riskier and produce a lower Jensen’s alpha than those of mid-cap and large-cap mutual funds. In addition, the author provides a comprehensive literature review and suggests potential explanations for the growing evidence that micro-cap mutual funds are poor investments.

<Keywords: Micro-cap; Micro-cap mutual funds; Mutual fund performance

Micro-cap stocks and mutual funds receive very little attention from investors, financial media, and scholars. As a result, little is known about their characteristics, risks, and performance relative to larger, betterknown stocks and funds. Micro-caps are sometimes synonymous with penny stocks, Over-The-Counter (OTC) stocks and stocks listed on the Pink Sheets. The term micro-cap stock can be defined as a publicly traded stock with a very small market capitalization, meaning the total value of a company’s shares outstanding multiplied by the share price is small compared to other companies. However, the exact dollar amount that constitutes a micro-cap stock is open to interpretation. A microcap mutual fund is an investment fund which allocates investor capital to form a portfolio of micro-cap stocks.

In addition to being small, micro-cap stocks are significantly riskier than larger stocks, both in terms of total and idiosyncratic risk [1]. Micro-cap companies often lack reliable financial information and are commonly associated with fraud schemes [2] and gambling-like speculation [3]. Furthermore, the mechanics of trading micro-caps, often in OTC markets, is characterized by low volume, large bid-ask spreads, illiquidity, and high volatility; all of which contribute to higher levels of risk.

Several scholars argue that micro-cap markets are riskier due to market inefficiencies [1,2,4,5]. For the professional mutual fund manager, these inefficiencies can create opportunities for abnormal returns [6]. Therefore, it is appropriate to ask whether micro-cap mutual fund investors are compensated for the higher risk they take. Over the past decade in U.S. markets, outflows from actively managed funds to passively managed index funds topped $1 trillion [7], demonstrating the application of the Efficient Market Hypothesis [8-10], which assumes abnormal returns are not achievable on a consistent basis in competitive markets. Therefore, how do professionally managed microcap mutual funds perform in a market that is considered riskier and inefficient? To the best knowledge of the author, this question has only scarcely been addressed in the literature.

This study examines the risk and risk-adjusted performance of ten micro-cap mutual funds using a variety of measurements. The findings of this study provide evidence that micro-cap mutual funds are indeed riskier and fail to achieve abnormal returns. The remainder of this study presents a comprehensive review of the literature concerning microcaps, the methodology used in this study, the results of the analysis, and a discussion of the findings.

The micro-cap universe

Few studies in the literature focus on the micro-cap universe of stocks and mutual funds. Overlap exists between studies examining micro-cap stocks, OTC stocks, and Penny Stocks, which fragments a cohesive body of literature. Complicating the issue further, scholars and practitioners have competing definitions of micro-cap stocks. The Securities and Exchange Commission (SEC) defines a micro-cap stock as a stock with a market capitalization of less than $250-to-$300 million (SEC). Travers [2] widens the definition to include companies between $30-to-$500 million in market capitalization. Fama and French [11] refer to micro-caps as the “tiny” (p.458) bottom 10% of market capitalization in a stock market. To account for the differences in the average market capitalization between different markets globally, several scholars have described micro-caps as those stocks in the bottom decile, or bottom two deciles of a stock market [2,6,11,12].

Micro-cap stocks possess several unique characteristics in addition to their small market capitalization. The SEC states micro-caps are different from other stocks in that they lack public information, have no minimum listing standards, possibly have no assets, operations, or revenues, and trade in low volumes that create large price movements (SEC). Low trading volumes and large price movements creates risk regarding illiquidity and volatility. Harris et al. [13] found that companies delisted from the NASDAQ to OTC, OTC Bulletin Board (OTCBB) and Pink Sheets markets experienced a significant decline in wealth as a result of illiquidity.

The SEC cautions that although micro-cap companies are required by law to truthfully file with the SEC, the SEC cannot guarantee the accuracy of these reports, which creates opportunities for micro-cap companies to “cook their books” (SEC). The SEC acknowledges that every year dishonest companies break the law and file false reports. Common fraud schemes among micro-caps stocks include spreading false information online with the intent to manipulate stock prices, hiring paid promoters to “tout” a stock, the use of cold calling and aggressive sales tactics among brokers to encourage potential investors to buy a stock and issuing questionable press releases that contain false or exaggerated claims about a company’s sales, revenue or other financial projections (SEC). For example, Hanke and Hauser [14] demonstrate the abnormality of the micro-cap market by examining the effect of stock spam emails on prices of OTC stocks, finding no lasting positive effect. Nofsinger and Varma [3] state that the little we do hear of OTC stocks typically involve stories of “pump and dump” schemes. Certainly movies like: The Wolf of Wall Street and Boiler Room have not helped micro-cap, OTC, OTCBB, Pink Sheet and Penny Stock reputations.

Despite the less than positive standing of micro-cap stocks, investors show interest in these securities. Nofsinger and Varma [3] state the literature provides three explanations for the attraction to OTC stocks, including interests in speculation or direct gambling, aspirational portfolios that contain different investor goals and possessing private information. When examining the portfolio characteristics of individuals who invest in OTC stocks, Nofsinger and Varma [3] found OTC investors tended to be older, had more investing experience, are wealthier and have more diversified portfolios. These findings are contrary to the direct gambling hypothesis, nor demonstrate investors possessing superior private information. Rather, Nofsinger and Varma [15] suggest investors in OTC stocks possess an aspirational preference in behavioral portfolios. These findings are consistent with Shefrin and Statman’s [16] Behavioral Portfolio Theory, which states investors, divided their portfolios into layers that have a corresponding and unique aspiration or goal.

Finally, several scholars suggest the idiosyncrasies of the micro-cap universe make the micro-cap market inefficient. While Efficient Market Theory [8-10,13,17,18] states stock prices quickly and accurately reflect available information, thus making it difficult to outperforming the market consistently, Travers [2] argues micro-caps may be the exception as analyst coverage is lacking and asset managers seem uninterested. Likewise, many institutional investors may not be allowed to invest in micro-caps for various reasons, including the lack of liquidity. Chen acknowledges that the thin trading of micro-caps permits a few marketmakers or traders, the ability to manipulate the market. Further, Cudd et al. [5] find a high likelihood among micro-cap companies to mimic the decisions of competitors, leading to unfavorable risk, suboptimal outcomes and micro-cap inefficiency. If the micro-cap market is indeed inefficient, it should create opportunities for skilled active management [2].

The micro-cap universe is unique with its fragmentation, various working-definitions, distinctive risks, fraudulent reputation, and perception of market inefficiency. The next section describes an important finding in finance and its relation to micro-cap stocks.

The size effect

In the 1980s scholars began to empirically explore the relationship between market capitalization and stock returns. Two separate studies in the Journal of Financial Economics, Banz [19] and Reinganum [20] discovered that a portfolio of small stocks, those with less valuable market capitalizations, outperform a portfolio of large stocks in U.S. markets. Similar findings were discovered in other countries and the anomaly became known as “the size effect” [6]. In addition, during the 1990s, scholars continued to address the deficiencies of the Capital Asset Pricing Model (CAPM). The seminal work of Fama and French [21] improved the CAPM by incorporating the size effect in a threefactor model to explain stock returns. The three-factor model gained prominence among scholars [6] despite criticisms [22]. Fama and French [21,23] were able to empirically demonstrate that the patterns of U.S. average stock returns were associated with size, value, and market risk. Fama and French [21] argued that the CAPM was “dead” as beta, or market risk, alone could not explain average stock returns, and that the relationship between beta and average returns is weak when empirically testing for variation in beta unrelated to size. Carhart [24] expanded on Fama and French [21] by adding an additional anomaly, momentum, to create a four-factor model explaining average U.S. stock returns. Today, factor-based investing strategies are widely accepted among investment practitioners.

Fama and French [11,25] continue to explore the size effect by investigating the potential of small stocks internationally. When analyzing stock returns from North America, Europe, Japan and Asia Pacific, Fama and French [18] provide evidence that common patterns exist in average returns across developed markets. Interestingly, they found evidence that international value and momentum returns are higher for smaller stocks, as well as decrease as market capitalization gets larger. However, and perhaps unusual, they did not find a size premium. Additionally, Fama and French [11] state “the lower average returns of small stocks for North America, Europe, and Asia Pacific combine with a typical size effect to produce larger value premiums for small stocks, especially micro-caps” (p. 461). In this international study covering many different markets, Fama and French [11] acknowledged that micro-caps create “serious problems” that disrupt several of the tested global empirical asset pricing models, and suggest that either global pricing does not extend to micro-caps, or that micro-caps expose the shortcoming of these asset pricing models. This seminal study [11] demonstrates that little is known and understood of the micro-cap universe.

The significance of the size effect in the literature is evident. However, Fama and French [21] caution that while the three-factor model explains the size and value patterns in post-1962 U.S. average stock returns better than the CAPM, it is far from perfect. Similarly, others express concern that models based on anomalies fail to comprehensively explain average returns when beta is manipulated [26-28]. Taken together, the size effect demonstrates that a portfolio consisting of small capitalization stocks, such as micro-caps, tend to outperform their larger market capitalization peers. Next, an exploration of the few studies in the literature that focus on micro-cap mutual funds is presented.

Micro-cap mutual funds

The discussion of micro-cap mutual funds is highly scarce in the literature. One of the few studies that mention micro-cap mutual funds is Amihud and Goyenko [29], which include micro-cap mutual funds in sample data, as well as nine other categories, to demonstrate that R2 predicts fund performance. Amihud and Goyenko [29] observe that actively managed funds with lower R2 exhibit greater selectivity of securities by their fund managers and that funds containing micro-cap stocks demonstrated lower R2.

While micro-cap mutual funds are rarely focused on, several studies have examined micro-cap stocks. Foerster et al. [6] analyzed micro-cap stock data from Canada, spanning from 1950 to 2009, and found a substantial size effect in Canadian markets [29]. Foerster et al. [6] makes the case that micro-cap stocks possess relatively high returns and low correlations to large-cap stocks in Canada, the U.S., and other developed markets, thus providing diversification benefits in addition to outperformance. Similarly, Travers [2] argues micro-cap stocks represent a valid asset class, noting that a $1 investment in micro-caps from 1926 to 2001 grew to $7,500. However, the same $1 investment grew to only $4,569 for small-caps, $3,756 for mid-caps and $1,740 for the market as a whole [2]. Finally, a well-known investing book by O’Shaughnessy [30], titled: What Works on Wall Street, provides an impressive historical quantitative analysis using CRSP and Compustat data from 1929 to 2009 and 1964 to 2009, respectively. O’Shaughnessy [30] demonstrates that the stocks in the smallest decile of U.S markets outperform their larger peers, and that while micro-caps outperform small-caps significantly, much of the outperformance can be attributed to the stocks below $50 million in market capitalization. When these stocks are excluded, micro-caps only slightly outperform small-cap stocks. In a parallel point of emphasis, Travers [2] argues that the small-cap premium and January Effect are really a micro-cap effect as the performance is generated by the ninth and tenth deciles, which are considered micro-cap stocks according to Traves. Interestingly, what appears to be the case is that large returns in the nano-caps, those below $50 million in market capitalization, push the average returns higher for micro-caps and small-cap stocks due to definitions for these categories not being strictly defined.

To the best knowledge of the author, only one study, Rodriguez [1], focuses on the risk and performance of micro-cap mutual funds. Rodriguez [1] analyzes the risk characteristics of open-end microcap mutual funds in comparison with small-cap and mid-cap funds. Using the CRSP mutual fund database to form a sample of 94 unique micro-cap funds, Rodriguez [1] finds micro-caps have significantly higher total and idiosyncratic risk than small-cap and mid-cap mutual funds. In addition, Rodriguez’s [1] findings suggest the risk-adjusted performance of micro-cap mutual funds seems to change during different economic cycles. During the complete sample period from January 2005 to June 2011, micro-cap funds fail to generate positive excess returns. Furthermore, Rodriguez [1] finds that the average alpha for micro-cap mutual funds during the sample period is significantly lower than those of small-cap and mid-cap funds, demonstrating that micro-cap mutual fund managers are not able to take advantage of the less efficient market.

This study adds to the work of Rodriguez [1] by continuing to analyze the risk and risk-adjusted performance of micro-cap mutual funds. This study provides additional evidence to the literature that micro-cap mutual funds are characterized by higher levels of risk and lower risk-adjusted performance. These results are of importance to micro-cap investors, fund managers, and scholars as this area is unexplored.

This study compares the risk and risk-adjusted performance of a sample of ten micro-cap mutual funds with a sample of ten mid-cap and ten large-cap mutual funds. When examining risk, the researcher closely follows the methodology of Koski and Pontiff [31] by measuring total risk, idiosyncratic risk, systematic risk (beta), skewness, and kurtosis. In addition, each fund’s daily returns are sorted by their 25th percentile, mean, median, 75th percentile, and total returns, and then summarized by category. When examining risk-adjusted performance, the researcher uses the Sharpe Ratio [32] the Treynor Ratio [33] and Jensen’s Alpha [34], Many scholars have used these methods to assess the performance of portfolios and mutual funds [6,23,29,35-38]. The time period for this study is September 28th, 2016 to September 28th, 2017. This time period was chosen in order to analyze the performance of micro-cap mutual funds in a period following the Rodriguez [1] time period ending in June of 2011 and to include the most recent data provided by the Ken French data library. While Rodriguez [1] analyzes micro-cap, small-cap and mid-cap mutual funds, this study analyzes micro-cap, mid-cap, and large-cap mutual funds in order to avoid potential portfolio-commonality between micro-cap and small-cap mutual funds.

The researcher used the Financial Industry Regulation Authority (FINRA) Fund Analyzer tool to search for mutual funds with the terms “micro cap” “mid cap” and “large cap” in the fund name. FINRA (n.d.) states the Fund Analyzer provides information and analysis on over 18,000 mutual funds, exchange traded funds and exchange traded notes. The researcher selected a nonrandom sample of thirty mutual funds from well-known investment firms that included a specified market-cap category in the fund name. In addition, the researcher attempted to balance the number of value funds with growth funds, and avoided funds that seek inverse exposure or used leverage. Ten mutual funds were selected for each category and historical pricing data was downloaded from Yahoo! Finance for analysis. Additionally, three benchmarks were selected to compute the CAPM regression of each fund. The researcher selected these benchmarks due to their appropriateness to the market-cap category. Because pricing data was not available for the Russell Micro-Cap Index, an iShares ETF which tracks this index was used as the micro-cap benchmark for the CAPM regressions. Finally, during the analysis, the researcher noticed an unusual one-day pricing discrepancy in the RMCAX mutual fund data which impacted the fund’s returns. The researcher assumed this discrepancy to be an error in the historical pricing data and removed this one-day return from the analysis. Table 1 lists each mutual fund and benchmark used in this study.

| Large-Caps | Ticker |

|---|---|

| Dreyfus Large Cap Equity A | DLQAX |

| Goldman Sachs Large Cap Growth Insights Fund Class C | GLCCX |

| JPMorgan U.S. Large Cap Core Plus Fund Class I Shares | JLPSX |

| QS U.S. Large Cap Equity Fund Class FI | LMUSX |

| BlackRock Large Cap Focus Growth Inv A | MDLHX |

| Russell Investments U.S. Large Cap Equity Fund Class A | RLCZX |

| AIG Focused Alpha Large-Cap Fund Class A | SFLAX |

| Deutsche Large Cap Focus Growth C | SGGCX |

| JPMorgan US Large Cap Core Plus C | JLPCX |

| ProShares Large Cap Core Plus | CSM |

| S&P 500 (Market Benchmark) | GSPC |

| Mid-Caps | Ticker |

| Boston Trust Midcap Fund | BTMFX |

| Fidelity Mid-Cap Stock Fund | FMCSX |

| Goldman Sachs Mid Cap Value Fund Class R | GCMRX |

| Invesco Mid Cap Core Equity Fund Class C | GTACX |

| Aberdeen U.S. Mid Cap Equity Fund Class R | GUERX |

| Deutsche Mid Cap Value Fund Class C | MIDZX |

| BNY Mellon Mid Cap Multi-Strategy Fund Class Investor | MIMSX |

| Russell Investments U.S. Mid Cap Equity Fund Class A | RMCAX |

| Allianz GI Mid-Cap Fund Class C | RMDCX |

| Guggenheim StylePlus - Mid Growth Fund Class C | SUFCX |

| Russell 1000 (Market Benchmark) | ^RUI |

| Micro-Caps | Ticker |

| RBC Microcap Value A | TMVAX |

| Ancora MicroCap I | ANCIX |

| DGHM MicroCap Value Investor | DGMMX |

| Franklin MicroCap Value R6 | FMCVX |

| Hancock Horizon Microcap Inv | HMIAX |

| Perritt MicroCap Opportunities Investor | PRCGX |

| Perritt Ultra MicroCap | PREOX |

| Wasatch Micro Cap Fund | WMICX |

| Thomson Horstmann & Bryant Microcap Investor | THBVX |

| Royce Micro-Cap Opportunity Fund Service Class | ROSSX |

| iShares Micro-Cap ETF (Market Benchmark) | IWC |

Table 1: List of mutual funds.

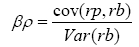

The researcher analyzed total risk by calculating the mean standard deviation of daily returns for each mutual fund category. Idiosyncratic risk was analyzed by calculating the mean standard deviation of the residual terms in the CAPM regression for each mutual fund category. Systematic risk or beta (β), is the beta coefficient in the CAPM regression. Each mutual fund category used a different and appropriate market benchmark to calculate the beta of the mutual fund. Beta, β, was calculated according to formula:

Where βρ is the beta of the mutual fund, Cov (rp,rb) is the covariance of the daily returns of the mutual fund (rp) with the daily returns of the market benchmark (rb) and Var (rb) is the variance of the market benchmark. Each mutual fund’s beta was then averaged by category. In addition, quartile, mean, median, total return, skewness, and kurtosis statistics were also used to demonstrate the return distributions and symmetry among the mutual fund categories.

Mutual fund data was given in daily terms, and the daily returns were calculated based on each fund’s daily adjusted closing price. The daily excess returns were calculated using the daily risk-free rate provided by the Ken French data library. The Sharpe Ratio was calculated for each fund as follows:

Sharpe Ratio=Rp – Rrf/σ

where Rp is average daily return of the mutual fund, Rrf is the average daily risk-free rate and σ is the standard deviation of daily returns of the mutual fund. The Treynor Ratio was calculated as follows:

Treynor Ratio=Rp – Rrf/β

where Rp is average daily return of the mutual fund, Rrf is the average daily risk-free rate and β is the beta of the mutual fund.

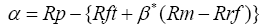

Jensen’s Alpha is an important risk-adjusted performance metric as it represents excess, or abnormal returns generated by the skill of the fund manager. The expectation is that a professional portfolio manager operating in the micro-cap universe should generate positive alpha based on market inefficiencies. Jensen’s Alpha is calculated as follows:

where α is Jensen’s alpha and the intercept of the CAPM regression, representing risk-adjusted performance, Rp is the average daily return of the mutual fund, Rrf is the average daily risk-free rate, β is the beta of the mutual fund, and Rm is the average daily return of the market benchmark. These performance metrics used to evaluate micro-cap mutual funds are interpreted by whether they produce positive numeric measurements, with higher numerical values representing superior performance, as well as in comparison with the results of the mid-cap and large-cap categories. The next section presents the results.

Table 2 presents the risk measures of this analysis, including mean total risk, mean annualized total risk, mean idiosyncratic risk, mean beta, and the mean R2 for the CAPM regressions. The mean annualized total risk was calculated by averaging each mutual fund’s annualized total risk. Each mutual fund’s annualized total risk was calculated by using the daily standard deviation and 252 trading days per year, according to the following formula: (1+Standard Deviation)252-1.

| Total Risk | Annualized Total Risk | Idiosyncratic Risk | Beta | CAPM R2 | |

|---|---|---|---|---|---|

| Large-Caps | 0.005 | 8.56% | 0.0018 | 1.06 | 0.874 |

| Mid-Caps | 0.006 | 9.11% | 0.0025 | 1.07 | 0.800 |

| Micro-Caps | 0.008 | 13.15% | 0.0035 | 0.83 | 0.806 |

Table 2: Mean risk measures.

Table 3 presents a summary of each category’s 25th percentile, mean, median and 75th percentile daily returns, as well as each category’s mean total return, skewness, and kurtosis.

| 25th Percentile | Mean | Median | 75th Percentile | Total Return | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|---|

| Large-Caps | -0.20% | 0.08% | 0.05% | 0.37% | 20.24% | -0.13 | 2.24 |

| Mid-Caps | -0.27% | 0.05% | 0.06% | 0.38% | 14.15% | -0.10 | 1.00 |

| Micro-Caps | -0.45% | 0.09% | 0.08% | 0.61% | 22.51% | 0.08 | 0.73 |

Table 3: Summary of return distributions.

Finally, Table 4 presents the mean risk-adjusted performance for each mutual fund category. The performance measurements used in this study are the Sharpe Ratio, Treynor Ratio, and Jensen’s Alpha. Jensen’s Alpha is shown in both daily and annualized terms. The annualized alpha is calculated by averaging each mutual fund’s individual annualized alpha within its category. Each mutual fund’s annualized alpha was calculated using 252 trading days a year according to the formula (1+daily alpha)252-1.

| Sharpe Ratio | Treynor Ratio | Jensen’s Alpha | Annualized Jensen’s Alpha | |

|---|---|---|---|---|

| Large-Caps | -0.304 | -0.002 | 0.0003% | 7.33% |

| Mid-Caps | -0.323 | -0.002 | 0.0001% | 2.16% |

| Micro-Caps | -0.188 | -0.002 | -0.0002% | -5.69% |

Table 4: Summary of mean risk-adjusted performance.

Discussion

The findings of this study suggest that micro-cap mutual funds are riskier and produce negative excess returns, making them a poor investment in comparison. The sample of micro-cap mutual funds demonstrates considerably higher levels of both total and idiosyncratic risk. While each mutual fund category demonstrates return distributions that resemble normality and symmetry, micro-cap returns are more extreme on both sides of the median. However, it does not appear that fund managers of micro-cap mutual funds are able to take advantage of the additional risk through active management. Although the Sharpe Ratio is less for micro-caps, this metric is still negative, which the researcher interprets as unattractive. More troubling is the appreciably lower annualized Jensen’s Alpha of -5.69% in comparison with 2.16% for mid-caps and 7.33% for large-caps. This indicates that micro-cap mutual fund managers are not only underperforming other mutual fund categories, but are doing more harm than good for their investors. When risk is ignored, the total return of micro-cap mutual funds is higher than both mid-cap and large-cap mutual funds, demonstrating the size effect. However, a rational investor may not be pleased with outperforming large-caps by only 2.27% given the additional risks associate with micro-cap mutual funds.

Some could argue that the micro-cap benchmark used in this study, the IWC, to calculate beta is inappropriate. While micro-cap portfolio managers may use other benchmarks indices to assess their performance, the IWC represents a valid alternative for micro-cap investors who prefer a passive, indexed approach, and therefore its use is justified. However, it should be noted that using the IWC produced relatively lower betas in comparison with the other market benchmarks. Assuming the IWC is an appropriate micro-cap benchmark, micro-cap portfolio managers may prefer comparatively lower correlations with the Russell Micro-Cap Index or are risk-adverse, which could explain the results of the performance analysis. Yet ultimately, Jensen’s Alpha exhibits the inability of micro-cap mutual funds to benefit from the inefficiencies of the micro-cap market.

There are several potential explanations for these poor results. First, this sample of micro-cap mutual funds may have below-average fund managers, and therefore not able to generate positive risk-adjusted performance. Second, the market of micro-cap stocks may be more efficient than investors recognize despite the characteristics discussed earlier. Elton et al. [38] emphasizes the generalized rule, which states when markets for securities are almost efficient, the market for fund managers is not efficient. Further, investors may have increased their attraction to smaller capitalization stocks, such as micro-caps, as a result of the size effect. This would lead to greater competition in the micro-cap market making it harder for fund managers to outperform. Yet, any outperformance of micro-cap mutual funds may not be sustainable. Berk and Green [33] argue that mutual fund performance cannot be superior or predictable over time as managers capture all excess performance in fees. In addition, as a fund gets more successful, it grows in size, making it harder to outperform due to diseconomies of scale such as higher transaction costs, accepting inferior investments and problems associated with span of control [38].

Third, there is evidence, both anecdotal and from the literature, that economic cycles influence micro-cap performance, however it seems to vary by cycle. Investing folklore describes John Templeton’s courageous purchase of every stock trading below $1 per share in 1939, during the Great Depression. Templeton was able to quadruple his investment by buying risky, small capitalization stocks. Rodriguez [1] states the average alpha of micro-cap mutual funds was positive before and during the 2008 financial crisis, however suffered mightily afterwards (p. 11). Similarly, Bello [39] states small capitalization stocks produced good results the 12 months following the recession of 1990, however the trend faltered after the recession of 2001 (p. 6). Therefore, it is possible that the results of this study can be attributed to an economic cycle where risk-adjusted performance is negative and may reverse to a more favorably outcome in the future.

Finally, micro-cap investors should consider the growing trend of private market “unicorns” and the dramatically smaller amount of publicly traded securities compared with past decades. In recent years, many private companies have decided to seek capital in the private markets by way of private equity investments, and forgo the option of going public. This has caused the “unicorn” phenomenon where private firms possess high valuations relative to history. As a result, many of the outsized returns are being realized in the private markets rather than potentially the micro-cap market where many of these firms would have been categorized. As it seems likely that the success of micro-cap portfolios relies heavily on the occasional big-winner to raise the mean return, private market unicorns present a serious challenge to microcap investors.

This study has examined the risk and risk-adjusted performance of micro-cap mutual funds, finding them to be riskier and less attractive relative to larger-sized mutual funds. Given that the micro-cap market is perceived as less efficient than the small, mid, and large cap markets, and that a size effect exists among smaller stocks [6,11,19-21] it is perhaps surprising that professional micro-cap mutual fund managers cannot produce positive risk-adjusted performance or excess returns. This study adds to the limited literature that micro-cap mutual fund investors are not properly compensated for the risk they take. These results should be important to micro-cap investors, portfolio managers, and scholars as micro-cap mutual funds are essentially unexplored. Future studies should continue to explore the micro-cap universe of stocks and funds as much is still unknown. The exploration of micro-cap mutual fund risk and performance in foreign markets should also be a priority. In addition, future studies should attempt to explain the reasons surrounding the poor performance among micro-cap mutual funds seen in this study and in Rodriquez [1] as it is not clear what the cause is.