Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Research Article - (2024)Volume 11, Issue 3

This article aims to examine the impacts of digitizing financial products and services in microfinance on entrepreneurial innovations. Using a recursive bivariate probit regression on panel data from 180 microfinance institutions in sub-Saharan Africa from 2019 to 2022, the main results include a positive and significant influence of the digitization of microfinance products and services on the creation and financing of start-ups, digitization stimulates the financing of the growth of already established businesses, these favorable effects of digitization on entrepreneurial activities are more pronounced in urban areas than in rural areas, these digitization effects are more marked among men compared to women. Furthermore, the digitization of microfinance products and services increases start-up financing more, by 27.35%, than the financing of the growth of existing businesses, by 25.36%. It is imperative to enhance financial innovations bespoke to the clientele's requirements to foster heightened entrepreneurial ingenuity.

Digitalization; Microfinance; Financing startups; Growth of existing businesses; Entrepreneurial

Over the past three years, the conjunction of the COVID-19 crisis and the conflict in Ukraine has highlighted the lag of the African continent, despite its engagement in ambitious economic and social transformations. The marked slowdown in growth observed in the presence of these events reveals the persistence of significant structural vulnerabilities within most economies on the continent. The limited development of startups, restricted job creation in so-called modern sectors, difficulties in the growth or recovery of struggling existing businesses and limited access of the informal sector to financial services, despite its ubiquity, underscore the increased importance of digitalization. Entrepreneurial innovations, involving the creation of new goods or services or the use of new production processes often implemented by startups are stimulated by digitally enabled financing and marketing practices through technologically innovative processes, thereby enhancing productivity and economic progress [1]. Financing for existing successful businesses relies on better risk assessment, as highlighted by Copestake et al., [2]. Concurrently, to foster financing for entrepreneurial innovations, tailored financial practices are necessary, as demonstrated by Bermini et al., [3]. Furthermore, digital transformations, as described by Alsufyani et al., play an important role in enhancing the efficiency of financial services and facilitating access to innovative financing solutions [4,5]. Thus, these studies shed light on the importance of a combination of transparent financial practices and effective digitization in supporting the financing of entrepreneurial innovations.

Digitization involves applying digital technologies to improve the production practices of goods or services by providing products or implementing new processes. Digitizing business processes significantly enhances productivity and the capabilities of enterprises [6]. Enterprises that digitize their financing or marketing processes can transform their traditional structure into a modern organization by managing their resources judiciously and facilitating their production processes. Among digitized production or service processes are digital planning and control, online ordering, booking, delivery or tracking services, as well as digital financial services such as transfers, credit card usage, banking and mobile microfinance [7]. Recent studies suggest that digitizing production or service delivery processes promotes greater financing and has a positive and significant impact on innovative solutions such as entrepreneurial innovations [8-10]. However, financing startups or even their creation may be limited by a lack of understanding of the innovations they incorporate, unlike existing businesses that already have a reputation. Innovative financing, which mostly exploits digital technologies, responds to innovative entrepreneurial activities, at least through the digital technology channel they often share. Financial digitization involves the application of digital financial techniques by institutions or companies involved in financial activities, such as banks and Microfinance Institutions (MFIs), including digital financial services offered by these institutions. Studies on digital financial inclusion assume that digital financial services provided by banks or microfinance institutions are inclusive and more accessible in terms of volume (larger amount of credits granted) and/or in terms of quantity (a greater number of people considered) to all strata of society [11-13]. Digital financial services, which are more inclusive and accelerate the financing of new entrepreneurial activities, also contribute to the progress of existing economic activities. However, in the African context where the lack of digital infrastructure limits the diffusion of digital services, it is uncertain whether financial services are actually more inclusive or whether the digitization of financial operations triggers greater financing of economies, especially increased financing of innovative entrepreneurial activities. Digitized financial services do not always guarantee greater financing, especially for women and disadvantaged communities [14-16].

Although previous studies exist, they do not take a position on the most appropriate funding habits or techniques for the creation of entrepreneurial innovations [17,18]. They also do not jointly specify the conditions of the environment favorable to digital infrastructures that fuel these entrepreneurial innovations. This study has questioned the assumption that the diffusion of digital financial services would be more widespread and has put forward the idea that the digitization of microfinance processes could lead to greater financing of innovative entrepreneurial activities. This hypothesis stems from inconclusive results regarding the impact of digitizing traditional financial processes on the financing of poor or disadvantaged communities or those with reduced opportunities.

The specific objective of this study is to evaluate the significant influence of digitization of products and services of Microfinance Institutions (MFIs) on the creation and financing of entrepreneurial activities in Sub-Saharan Africa (SSA). SSA countries are characterized by a widespread informal sector, primarily financed by microfinance within formal financial circuits. According to the International Labour Organization (ILO), 85.8% of jobs in Africa are informal, compared to 68.2% in Asia and the Pacific, 68.6% in Arab States, 40.0% in the Americas and 25.1% in Europe and Central Asia [19]. Digitization operations have enabled MFIs, according to the Autonomous Development Support Program, to achieve an average revenue increase of $86,620 in the first year of adoption, with a return on investment after 12 months [20]. Although microfinance plays an important role in disseminating Information and Communication Technologies (ICT) in predominantly informal economic activity in SSA, it is worth exploring whether digitization of microfinance products and services effectively increases financing for entrepreneurial innovations in SSA [21,22].

The contribution of this study is manifested in several ways.

• It highlights positive and statistically significant effects of digitization of microfinance products and services on the creation and financing of startups, suggesting that the adoption of financial technologies has a tangible impact on supporting new ventures.

• It proposes an extension of existing microfinance theories by integrating the dimension of digitization, thus enriching the existing theoretical framework on how financial technology influences the creation and financing of enterprises. Indeed, financial innovations, through the channel of innovation diffusion, act as a catalyst for financing entrepreneurial innovations.

• It conducts a differentiated analysis of the effects of digitization based on the existence (startups/existing enterprises), location (urban/rural) and gender (male/female), highlighting the importance of addressing gender inequalities in access to entrepreneurial opportunities.

• The application of the effects of digitization of microfinance products and services on the financing of innovative entrepreneurial activities in the African context, where the presence of disadvantaged communities or groups requires particular attention, also constitutes a reality to be elucidated. The application of the theory of innovation diffusion effects has underscored the importance of digitization of microfinance products and services for entrepreneurial incentives.

The following sections of this study review recent literature on digitization and financing of economic activities, discuss the application of the theory of innovation effects diffusion, explain the methodology employed and illustrate the results. This study concludes with a synthesis of the obtained results.

It delves into the impact of digitization on financial services, shedding light on its benefits such as enhancing fund circulation and promoting financial stability, as well as its challenges, particularly concerning financial inclusion and economic disparities. In parallel, also examines how digitization has spurred the growth of startups through increased accessibility to funding and streamlining lending processes in the microfinance domain. These subsections provide a comprehensive overview of the digitization's effect on the financial and entrepreneurial landscape, highlighting both opportunities and challenges associated with this significant evolution.

The role of digitization in transforming financial services

Digitization of financial products and services enhances the performance of credit institutions by improving fund circulation and fostering financial stability [23]. This emerging trend transforms conventional financial processes to enhance loan efficiency while strengthening the reputation and value of credit institutions in financial intermediation [24]. Digital financial services eliminate geographical barriers between borrowers and financial intermediaries, promoting digital financial inclusion and supporting economic activity with positive spillover effects on other sectors [25,26]. However, digitization can exacerbate economic and social disparities by creating a digital divide in poor communities while limiting access to financial services for disadvantaged households, potentially worsening their financial distress [27,28]. The sustainable transformation of a city into a digitized city is closely linked to innovation and the digitization of the living environment, although the development of a digitally focused urban area can also create a digital divide in poor communities. Digitalization of financial services improves access to financial services but also increases household financial distress and while it may benefit retail credit institutions, it can exert competitive pressure on smaller credit institutions, leading to economic instability. The explosion of mobile telephony and the recent uptake of the Internet via mobile represent new opportunities for modernization in a segmented and unproductive informal sector. In the light of the above discussion, we formulate the following hypothesis.

Hypothesis 1: Digitization significantly transforms financial services in favor of enhanced financial access for economic activities.

Digitalization in microfinance and the rise of startups

Financial digitalization fosters the emergence of startups by enabling broader access to financing, reducing geographical barriers and facilitating financial transactions. For instance, Geng et al., emphasize that digital financial services eliminate geographical boundaries between borrowers and financial intermediaries, thus promoting digital financial inclusion [25]. This increased accessibility to financing allows a larger number of entrepreneurs to launch startups, particularly in regions where traditional financial services are limited. Additionally, the digitalization of microfinance processes can lower transaction costs and make loans more accessible to entrepreneurs, even in remote or underserved areas by traditional infrastructures. For example, by utilizing online lending platforms, entrepreneurs can submit funding applications and receive funds quickly and efficiently, without the need to physically visit a bank branch. This ease of access to financing may encourage more individuals to start their own businesses. Furthermore, microfinance digitalization enables a more in-depth credit risk analysis, potentially reducing barriers to obtaining loans for entrepreneurs with no established credit history. As a result, startups have a higher likelihood of securing funding and thriving. These examples demonstrate how digitalization in microfinance creates an environment conducive to the emergence and growth of startups by facilitating access to financing, overcoming geographical barriers and improving the efficiency of lending processes. The foregoing discussion leads us to propose the following hypothesis.

Hypothesis 2: Digitalization of microfinance products and services fosters the creation of startups.

This literature provides a comprehensive overview of the impact of digitalization on the financial and entrepreneurial landscape, highlighting both the opportunities and challenges associated with this significant evolution.

The presentation of data, accompanied by the rationale for the chosen variables, is followed by the model specification leading to the analyses.

Data

The data utilized in this paper are qualitative and sourced from mix-market social performance data in microfinance, as gathered by the World Bank group [29]. These data, provided by Financial Service Providers (FSPs) with a focus on the unbanked population in developing markets globally, are predominantly derived from surveys. Our sample consists of a panel of 180 Microfinance Institutions (MFIs) over a period of 4 years, precisely from 2019 to 2022 in Sub-Saharan Africa (SSA). The selected sample is the one for which observations extend up to the year 2022.

In the context of socio-economic financing goals in microfinance, the chosen dependent variable is startup financing (FINSTAR), defined by mix-market as social goals for which the institution has explicitly designed products, services and procedures aimed at the development of young businesses. Startup financing is an important measure of entrepreneurial innovation funding, as it catalyzes the development and growth of new business ideas. For instance, Bernimi et al., have demonstrated that the digitization of institutional credit processes contributes to enhancing the reputation and value of credit institutions in financial intermediation [3]. This results in increased availability of funds for startups, as credit institutions are better positioned to take calculated risks on innovative projects. For comparison purposes, a second dependent variable, financing for the growth of existing businesses (FINCROI), was retained. This variable, also defined by mix-market, targets social goals for which the institution has designed products, services and procedures for the growth of existing businesses. Although several studies have employed these variables, they have not always evaluated their impact from the perspective of digitization, especially in microfinance [30-32].

The variable of interest is increased access to financial services (SERFI), measuring the improvement in the level of financing in MFIs. It summarizes social goals for which the institution has designed products, services and procedures aimed at greater access to financial services. The expansion of financial services in digitized microfinance products and services results in a significant improvement in access to financing for underbanked populations. For instance, Geng et al., highlighted that the digitization of financial services abolishes geographical barriers between borrowers and financial intermediaries, thereby promoting increased digital financial inclusion [25]. This variable of interest is instrumented by proxies for digitization, such as fund transfer services, including those of migrants (TRANS), debit or credit cards (CART) and mobile microfinance (MOB). These ICT indicators are considered complementary products and services, with accelerating effects on innovation financing, depending on the level of digital infrastructure development and mastery of financial innovations. In addition to these digitization explanatory variables, control variables have been considered to integrate the overall financial environment of MFIs. These include governance quality (GOUV), measured by the quality of interactions with clients, portfolio quality (PORTF), incorporating risks and activity costs of MFIs and opportunities for youth (OPJEUN), defined as social goals aimed at facilitating youth access to entrepreneurial opportunities. These control variables are included to better understand the overall financial context of Microfinance Institutions (MFIs). The foundational work of Bateman et al., emphasizes the importance of governance in microfinance performance [33]. Quality interactions with clients, measured by the GOUV variable, can influence entrepreneurs' trust in financial services, thus impacting their propensity to seek financing [34]. The foundational works of Morduch et al., highlight the importance of portfolio management in the sustainability of microfinance [35]. The PORTF variable, which integrates risks and costs of MFIs' activities, aims to assess the financial robustness of institutions, thus influencing their ability to finance entrepreneurial innovations. The writings of Copestake et al., highlight the impact of specific opportunities for youth in the context of microfinance [2]. The OPJEUN variable captures social goals aimed at facilitating youth access to entrepreneurial opportunities, providing a social dimension to the analysis. The statistical description of the variables is depicted (Table 1).

| Variables | Number of observations | Frequency of Yes | Frequency of No |

|---|---|---|---|

| Startups Financing (FINSTAR) | 720 | 66 | 34 |

| Growth Financing of Existing Businesses (FINCROI) | 720 | 54 | 46 |

| Increased Access to Financial Services (SERFI) | 720 | 72 | 28 |

| Funds Transfers, Including those from Migrants (TRANS) | 720 | 57 | 43 |

| Use of Debit or Credit Cards (CART) | 720 | 63 | 37 |

| Use of Microfinancial Mobile Payment Methods | 720 | 44 | 56 |

| Quality of Governance (GOUV) | 720 | 52 | 48 |

| Portfolio Quality (PORTF) | 720 | 56 | 44 |

| Opportunities for Youth (OPJEUN) | 720 | 69 | 31 |

Table 1: Descriptive statistics for variables.

This Table 1, provides a detailed overview of trends in financing, access to financial services, the use of financial technologies, governance, portfolio quality and opportunities for youth. It suggests some diversity in financial practices and highlights areas where improvements can be considered to enhance financial inclusion and support for entrepreneurs, especially the youth. The greatest improvements are needed in the use of mobile microfinance payment methods (MOB), reflecting a widespread adoption of 44%, indicating the widespread use of mobile financial solutions (Table 2).

| Independent variables | Chi2 (FINSTAR) | Prob (FINSTAR) | Chi2 (FINCROI) | Prob (FINCROI) |

|---|---|---|---|---|

| Increased Access to Financial Services (SERFI) | 153.2 | 0 | 22.52 | 0 |

| Funds Transfers, Including those from Migrants (TRANS) | 177.2 | 0 | 62.35 | 0 |

| Use of Debit or Credit Cards (CART) | 171.2 | 0 | 118.94 | 0 |

| Use of Microfinancial Mobile Payment Methods (MOB) | 60.88 | 0 | 28.62 | 0 |

| Quality of Governance (GOUV) | 160.1 | 0 | 4.14 | 0.042 |

| Portfolio Quality (PORTF) | 107.1 | 0 | 6.944 | 0.008 |

| Opportunities for Youth (OPJEUN) | 10.94 | 0.001 | 22.59 | 0 |

Table 2: The chi-squared dependence test to reveal significant associations between the variables.

The results of the chi-squared dependence test reveal significant associations between the dependent variables, startups financing (FINSTAR) and growth financing of existing businesses (FINCROI) and the examined independent variables. Increased access to financial services, funds transfers, use of debit or credit cards, as well as micro-financial mobile payment methods are strongly linked to both types of financing. Furthermore, governance quality and portfolio quality also show significant associations with both types of financing, although governance quality may have a larger impact on startup financing. Conversely, opportunities for youth appear to have a more pronounced impact on financing growth of existing businesses. These findings suggest that improving access to financial services and better governance may foster business financing, but specific policies targeting young entrepreneurs might be necessary to further stimulate growth of established businesses.

Model specification and empirical strategy

The model employed in this study draws inspiration from Yue et al., who examine whether increased diffusion of digitalization serves as a vector for financial inclusion or rather a liquidity bottleneck. In the same spirit, we investigate the impact of Information and Communication Technologies (ICT) usage in microfinance on the financing of entrepreneurial innovations [27]. The functional form of the relationship to be estimated is as follows.

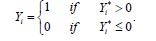

Thus, the specified model captures the observed probability that a microfinance i participates in development goals (Yi). To this end, we will not observe Y* i, if a microfinance has not chosen to support innovation by financing. That is to say.

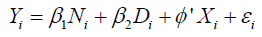

In the form of a model, we have:

Where, Yi measures either financing of innovations or financing of existing businesses, Ni the increase in financial services, Di the digitalization variables, including debit or credit cards, mobile microfinance, fund transfers, including those from migrants and Xi the control variables. When assessing the probability of obtaining funding for startups, we anticipate positive coefficients for increased access to financial services (SERFI), "funds transfers, including those from migrants (TRANS)", "use of debit or credit cards (CART)", and "use of microfinancial mobile payment methods (MOB)", as these factors are likely to facilitate access to funding. We also expect a negative coefficient for "Quality of Governance (GOUV)" and "Portfolio Quality (PORTF)" if poor governance or low portfolio quality hinder startup financing. For "Opportunities for Youth (OPJEUN)", we anticipate a positive coefficient if opportunities for young entrepreneurs are favorable.

When it comes to assessing the probability of obtaining funding for the growth of existing businesses, we expect positive coefficients for "Increased Access to Financial Services (SERFI)", "Funds Transfers, Including Those from Migrants (TRANS)", "Use of Debit or Credit Cards (CART)", and "Use of Microfinancial Mobile Payment Methods (MOB)", as these factors are likely to facilitate access to funding. Conversely, we anticipate negative coefficients for "Quality of Governance (GOUV)" and "Portfolio Quality (PORTF)" if poor governance or low portfolio quality hinder businesses' ability to obtain funding for their growth. As for "Opportunities for Youth (OPJEUN)", we expect a positive coefficient if opportunities for young entrepreneurs are favorable. These expectations are based on theoretical considerations; however, empirical analyses are needed to confirm these effects in the specific context under study.

As the data is survey data and essentially binary, the chosen estimation method is that of the seemingly unrelated bivariate probit regression. The utilization of a biprobit regression, as mentioned by Greene, enables the simultaneous modeling of two equations containing binary dependent variables, thus providing a robust approach to studying interactions between two distinct phenomena [36]. For instance, in this study, biprobit regression is employed to examine the correlation between access to digitized banking services and individuals' propensity to obtain financing.

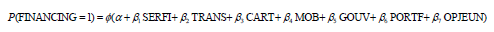

Where, P(FINANCING=1) is the probability of the startup obtaining funding, ∅ is the cumulative distribution function of the standard normal distribution, α is intercept and β1, β2….β7 are the coefficients associated with the independent variables.

This method significantly demonstrates the positive impact of utilizing digitized banking services on business financing habits, thereby offering a concrete illustration of the utility of biprobit regression in analyzing financial behaviors. Indeed, a seemingly unrelated bivariate probit regression, proposed by Zellner, extends the bivariate probit regression by incorporating the bivariate probit results into a function that does not model any relationship between the covariates [37]. Then, any potential unobserved heterogeneity in the model is examined through an analysis of the correlation between the residual terms.

Therefore, the seemingly unrelated bivariate probit regression method is appropriate in this case, as it allows us to simultaneously model the explanatory variables on the decision to deploy digitalization and promote entrepreneurial activities. This will account for the condition of the level of digital infrastructure necessary for the realization of the effects of digitalization on entrepreneurial activities.

Furthermore, this model will help address any potential endogeneity between the decision to deploy digitalization and promote entrepreneurial activities because this regression takes into account the correlations and relationships between the terms and unobserved residuals. Probit estimation with instrumental variables is used to ensure the robustness of the results. Indeed, the provision of funds through withdrawals or loans, including those online or transfers, can be highly correlated with the possession of debit or credit cards and mobile microfinance. Debit or credit cards and mobile microfinance, which are correlated with the provision of funds, can serve as instruments for fund transfers to access financing more easily. The foundational work of Suri et al., emphasizes the role of debit cards in expanding access to financial services [38]. Holding debit cards can facilitate fund withdrawals, especially online, offering increased flexibility in fund transfers for broader access to financing. The writings of Mas et al., provide insights into the use of mobile microfinance as a means of fund transfer [39]. Access to financial services via mobile can facilitate rapid and efficient transfers, reinforcing the correlation between holding these instruments and the availability of funds.

After presenting the baseline results, we will proceed to the robustness results.

Basic results

The results of our basic estimations by a bivariate probit are summarized in the Table 3. First, we look at the overall fit of the model, which is tested using the Wald statistic. The Wald test gives a significant Chi2 (all probabilities are less than 1%) for all our estimates, demonstrating that the model is globally significant. Next, we examine the correlations between our variables capturing entrepreneurial innovations (absolute value ranging from -0.1438 to 0.2060) and the digitalization of microfinance products and services. Overall, we observe low correlations. However, when we look at all the Wald statistics attached to our correlation coefficients Rho, they all have probabilities greater than at least the 10% threshold. This signifies the absence of endogeneity in all our estimates (the null hypothesis being heterogeneity). Therefore, this low correlation simply indicates mainly indirect effects of the digitalization of microfinance products and services on entrepreneurial innovations in SSA, especially regarding credit or debit cards.

| Characteristics | Startups financing | Growth financing of existing businesses | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Mobile microfinance | -0.1815 | - | - | 0.2902** | - | - |

| (-0.96) | (-2.09) | |||||

| Debit or credit cards | - | 0.1673 | - | - | 0.7345*** | - |

| (1.1) | (3.48) | |||||

| Transferts | - | - | 0.3813*** | - | - | 0.3821*** |

| (5.14) | (5.14) | |||||

| GOUV | 0.08097 | 0.1301 | 0.3778* | 0.3105 | 0.1125*** | 0.3241 |

| (0.6111) | (0.7663) | (1.8721) | (1.0573) | (2.7839) | (1.2028) | |

| PORTF | 0.07214 | 0.3235*** | 0.5132 | -0.0732 | 0.0312 | 0.6376*** |

| (0.5529) | (4.9858) | (1.4259) | (-0.388) | (0.2522) | (3.1428) | |

| OPJEUN | 0.2196*** | 0.0859 | 0.2728*** | 0.2738*** | 0.2648*** | 0.3706*** |

| (5.7715) | (0.6014) | (4.0158) | (4.0158) | (2.5996) | (3.0458) | |

| Constant 1 | -0.3007*** | 0.8071*** | -0.2906*** | -0.2250*** | 0.2160*** | -0.9008*** |

| (-4.11) | (9.79) | (-3.46) | (-3.10) | (2.97) | (-10.78) | |

| Funding through mobile microfinance | -0.2851 | - | - | 0.2922** | - | - |

| (-1.06) | (2.1) | |||||

| Funding through cards | - | 0.3184*** | - | - | 0.7280*** | - |

| (3.4) | (3.45) | |||||

| Funding through transfers | - | - | 0.3291*** | - | - | 0.3251*** |

| (3.47) | (3.44) | |||||

| Constant 2 | 0.3818*** | 0.3832*** | 0.3813*** | 0.3823*** | 0.3830*** | 0.3821*** |

| (5.13) | (5.15) | (5.14) | (5.14) | (5.15) | (5.14) | |

| Wald Chi2 | 20.95*** | 15.72*** | 19.32*** | 16.05*** | 16.42*** | 19.35*** |

| Prob : 0.0003 | 0.0034 | 0.0007 | 0.0029 | 0.0025 | 0.0007 | |

| Athrho | -0.1438** | 0.2063** | -0.1402* | -0.1713** | -0.1608** | -0.0699 |

| (-1.84) | (2.34) | (-1.79) | (-2.12) | (-2.05) | (-0.80) | |

| Rho | -0.1428 | 0.2035 | -0.1393 | -0.1697 | -0.1594 | -0.0699 |

| Wald test of Rho | 3.3758 | 5.4884 | 3.2024 | 4.7736 | 4.1269 | 0.6422 |

| Prob : 0.0662 | 0.0191 | 0.0735 | 0.029 | 0.04 | 0.4229 | |

Note: *10%, **5%, ***1% threshold significance of coefficients. ( ) statistics are calculated.

Table 3: Effects of the digitalization of microfinancial products and services on entrepreneurial innovation financing in Sub-Saharan Africa (SSA).

The results of the bivariate probit provide us with indications of the incentives for digitalization in microfinance to finance entrepreneurial innovations, which are compared with the incentive for digitalization in microfinance for financing already existing businesses. To begin with, let's examine the results of the direct incentives of digitalization indicators to increase start-up creation.

The results demonstrate that fund transfer activities increase the chances of developing startups. Indeed, fund transfers involve increased mobilization of financial resources, attesting to the permanent availability of funds for users, with the consequence of being able to allocate a portion of these funds to entrepreneurial activities. These findings are consistent with those of Legowo et al., who argue that innovative digital services improve access to government services, support entrepreneurship, promote the growth of existing businesses and strengthen relations between the private sector and public institutions [40].

In comparison with existing businesses, we find that all three digitalization indicators, namely debit or credit cards, mobile microfinance and fund transfers, increase the chances of sustaining businesses established for some time. These tools allow businesses to optimize transaction costs inherent in their activities and increase their operational efficiency.

Regarding the indirect incentives of digitalization on entrepreneurial innovations, it emerges that the use of credit or debit cards, as well as fund transfers, increases the chances of financing innovative entrepreneurial activities. Fund transfers, by mobilizing more financial resources, demonstrate the permanent availability of funds for users, reassuring about the possibility of granting loans. However, the absence of an incentive for mobile microfinance can be explained by the often necessary need for an internet connection, which is not always accessible to the most deprived individuals.

In summary, the use of debit or credit cards, fund transfers and to a lesser extent, mobile microfinance activities facilitate closer connections between users and credit institutions. Comparing this with established businesses, we observe that these three digitalization indicators increase the chances that microfinance institutions are motivated to finance existing businesses. The experience and reputation, whether good or bad, of businesses established for some time can play a role in obtaining financing to support their activities or expand their investments. Entrepreneurs with digital and financial literacy have increased access to financing and demonstrate economic resilience [41].

The obtained results reveal that fund transfers increase the chances of startup development. These findings align with the work of Legowo et al., who argue that innovative digital services enhance accessibility to government services, foster entrepreneurship and stimulate the growth of already established businesses [40]. All three digitalization indicators, namely debit or credit cards, mobile microfinance and fund transfers, increase the probabilities of sustaining existing businesses. These tools help control transaction costs and improve the efficiency of already established businesses [42]. The use of credit or debit cards and fund transfers also increases the chances of financing innovative entrepreneurial activities. Fund transfers, by mobilizing more resources, alleviate concerns of microfinance institutions regarding the financial availability of borrowers. These results align with the emerging trends in specialized literature, emphasizing the major role of digitalization in microfinance in stimulating entrepreneurial innovations and financing existing businesses [43].

As for the control variables, they allow for the consideration of certain elements that may influence the decisions of microfinances regarding loan disbursement, particularly credit risk portfolios (PORTF), decisions guided by governance (GOUV) and opportunities (OPJEUN), mainly those directed towards the youth. Governance and opportunities geared towards the youth are determining factors in incentivizing digitized products and services of microfinances to encourage innovative entrepreneurial solutions. Nevertheless, governance within microfinances, credit risk portfolios and opportunities for the youth also contribute to better growth of existing businesses. Indeed, the work of Morduch et al., highlights the importance of managing credit risk portfolios in the viability of microfinances [35]. PORTF can influence loan disbursement decisions, particularly regarding financing existing businesses, taking into account the financial stability of borrowers. Bateman et al., underline the impact of governance on the performance of microfinances [33]. GOUV can guide decisions on financing existing businesses by influencing the quality of interactions with clients and promoting a healthy and responsible management of financial resources. The writings of Copestake et al., [2] provide perspectives on the impact of specific opportunities for the youth in the context of microfinances. OPJEUN can positively influence the incentive of digitized products and services of microfinances to encourage innovative entrepreneurial solutions among young entrepreneurs (Table 3).

Robustness tests

Tables 4 and 5, allow for a comparison of the effects of the digitalization of micro-financial products and services on the creation and financing of entrepreneurial innovations between urban and rural areas. The results obtained show an almost total similarity with the baseline results mentioned earlier, regarding the positive effects of digitalization on the growth and financing of existing businesses, whether in urban or rural environments. However, concerning startups, digitalization, through fund transfers, demonstrates a positive and significant effect on entrepreneurial incentives as well as their financing. This observation could be explained by a more pronounced adoption of digitization in rural areas compared to urban areas. These results align with those of Kolotouchkina et al., who demonstrate that a more pronounced digital transformation in urban areas leads to increased adoption of digitalization, thus contributing to stimulating innovations in the economic activities of these areas (Tables 4 and 5) [28].

| Independent variables | Startups financing | Growth financing of existing businesses | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Mobile microfinance | 0.2089 | - | - | 0.3982*** | - | - |

| (1.12) | (2.67) | |||||

| Debit or credit cards | - | -0.0354 | - | - | 0.3534** | - |

| (-0.26) | -2.02 | |||||

| Transferts | - | - | 0.7243*** | - | - | 0.3815*** |

| (3.45) | (5.14) | |||||

| Gouv | 0.3105 | 0.1125*** | 0.6376*** | 0.0434 | 0.8002*** | 1.2076*** |

| (1.0573) | (2.7839) | (3.1428) | (0.2716) | (5.95095) | (6.4505) | |

| Portf | -0.0732 | 0.0312 | 0.3241 | 0.1204 | 0.4426 | 0.2363 |

| (-0.388) | (0.2522) | (1.2028) | (0.1164) | (1.3871) | (0.15035) | |

| Opjeun | 0.2738*** | 0.2648*** | 0.3706*** | 0.3709*** | 0.2177 | 0.3506*** |

| (4.0158) | (2.5996) | (3.0458) | (4.0158) | (0.9991) | (4.0158) | |

| Constant 1 | -0.2250*** | 0.2160*** | -0.9008*** | -0.3680*** | 0.9650*** | 1.1950*** |

| (-3.10) | (2.97) | (-10.78) | (-4.97) | (11.135) | (12.65) | |

| Funding through mobile microfinance | (0.1651) | - | - | 0.1483** | - | - |

| (-1.20) | (2.08) | |||||

| Funding through cards | - | -0.0755 | - | - | 0.3227*** | - |

| (-0.40) | (3.43) | |||||

| Funding through transfers | - | - | 0.7251*** | - | - | 0.3232*** |

| (3.44) | (3.43) | |||||

| Constant 2 | 0.3823*** | 0.3830*** | 0.3821*** | 0.3824*** | 0.3802*** | 0.3815*** |

| (5.14) | (5.15) | (5.14) | (5.14) | (5.13) | (5.14) | |

| Wald chi2 | 16.05*** | 16.42*** | 19.35*** | 15.87*** | 18.52*** | 14.93*** |

| (0.0029) | (0.0025) | (0.0007) | (0.0032) | (0.001) | (0.0048) | |

| Athrho | -0.1713** | -0.1608** | -0.0699 | -0.028 | -0.2551** | -0.1537 |

| (-2.12) | (-2.05) | (-0.80) | (-0.36) | (-2.56) | (-1.45) | |

| Rho | -0.1697 | -0.1594 | -0.0699 | -0.0279 | -0.2497 | -0.1525 |

| Wald test of rho | 4.7736 | 4.1269 | 0.6422 | 0.128 | 6.5789 | 2.094 |

| 0.029 | 0.04 | 0.4229 | 0.7204 | 0.0103 | 0.1478 | |

Note: *10%, **5%, ***1% threshold significance of coefficients. ( ) statistics are calculated.

Table 4: Effects of the digitalization of microfinancial products and services on entrepreneurial innovation financing in urban areas.

| Characteristics | Startups financing | Growth financing of existing businesses | ||||

|---|---|---|---|---|---|---|

| Independent variables | (1) | (2) | (3) | (4) | (5) | (6) |

| Mobile microfinance | -0.1989 | - | - | 0.2902** | - | - |

| (-0.89) | (2.09) | |||||

| Debit or credit cards | - | -0.0354 | - | - | 0.3830*** | - |

| (-0.26) | (5.15) | |||||

| Transferts | - | - | 0.2574 | - | - | 0.3821*** |

| (0.155) | (5.14) | |||||

| GOUV | 0.1301 | 0.3105 | 0.1125*** | 0.0434 | 1.2076*** | 0.111 |

| (0.7663) | (1.0573) | (2.7839) | (0.2716) | (6.4505) | (1.4065) | |

| PORTF | 0.3235*** | -0.0732 | 0.0312 | 0.1204 | 0.2363 | 0.4104*** |

| (4.9858) | (-0.388) | (0.2522) | (0.1164) | (0.15035) | (4.7433) | |

| OPJEUN | 0.0859 | 0.2738*** | 0.2648*** | 0.3709*** | 0.3506*** | 0.108 |

| (0.6014) | (4.0158) | (2.5996) | (4.0158) | (4.0158) | (0.5432) | |

| Constant 1 | 0.8071*** | -0.2250*** | 0.2160*** | -0.3680*** | 1.1950*** | 0.5231*** |

| (9.79) | (-3.10) | (2.97) | (-4.97) | (12.65) | (6.89) | |

| Funding through mobile microfinance | -0.2913 | - | - | 0.2483** | - | - |

| (-1.09) | (2.08) | |||||

| Funding through cards | - | -0.2883 | - | - | 0.3232*** | - |

| (-1.07) | (3.43) | |||||

| Funding through transfers | - | - | 0.228 | - | - | 0.3250*** |

| (1.45) | (3.44) | |||||

| Constant 2 | 0.3832*** | 0.3823*** | 0.3830*** | 0.3824*** | 0.3815*** | 0.3821*** |

| (5.15) | (5.14) | (5.15) | (5.14) | (5.14 | (5.14) | |

| Wald Chi2 | 15.72*** | 16.05*** | 16.42*** | 15.87*** | 14.93*** | 15.10*** |

| 0.0034 | 0.0029 | 0.0025 | 0.0032 | 0.0048 | 0.0045 | |

| Athrho | 0.2063** | -0.1713** | -0.1608** | -0.028 | -0.1537 | -0.1196 |

| (2.34) | (-2.12) | (-2.05) | (-0.36) | (-1.45) | (-1.46) | |

| Rho | 0.2035 | -0.1697 | -0.1594 | -0.0279 | -0.1525 | -0.119 |

| Wald test of rho | 5.4884 | 4.7736 | 4.1269 | 0.128 | 2.094 | 2.1217 |

| 0.0191 | 0.029 | 0.04 | 0.7204 | 0.1478 | 0.1432 | |

Note: *10%, **5%, ***1% threshold significance of coefficients. ( ) statistics are calculated.

Table 5: Effects of the digitalization of microfinancial products and services on entrepreneurial innovation financing in rural areas.

The robustness tests conducted using the ivprobit (instrumental variable probit) reveal results generally consistent with those obtained previously. Indeed, fund transfers, including those from migrants, generally increase the likelihood of implementing entrepreneurial innovations, such as the development of startups, as well as their financing. These transfers also favor the growth of existing businesses. Additionally, the Wald exogeneity test indicates the absence of endogeneity between digitalization variables and entrepreneurial innovation.

The assessment of marginal effects in the marginal effects block, obtained by comparing different coefficients pairwise, highlights that debit and credit cards have a stronger propensity to influence entrepreneurial innovations. Across the Sub-Saharan African (SSA) region, this propensity is 27.35% and 25.36%, respectively, for the development of startups and the growth of existing businesses. This more pronounced propensity for the implementation of entrepreneurial innovations through digital tools stems from the fact that digitalization itself is endogenous to innovation. In the digital age, startups are increasingly oriented towards innovative solutions that fully integrate digital tools and services. The supply and demand for Information and Communication Technologies (ICT) are higher in innovative entrepreneurial activities, thereby inducing greater use of digitized financial services, leading to increased fund availability, including the provision of new means of payment (Table 6).

| Independent Variables | Startups Financing | Growth Financing of Existing Businesses | Startups Financing | Growth Financing of Existing Businesses | Startups Financing | Growth Financing of Existing Businesses |

|---|---|---|---|---|---|---|

| Increased Access to Financial Services | 1.270*** | 0.3535** | 0.2880*** | 0.2716** | 0.2717 | 0.2715*** |

| (3.38) | (2.37) | (3.58) | (2.45) | (1.49) | (3.47) | |

| GOUV | 0.08097 | 0.1301 | 0.1125*** | 0.3241 | 1.2076*** | 0.111 |

| (0.6111) | (0.7663) | (2.7839) | (1.2028) | (6.4505) | (1.4065) | |

| PORTF | 0.07214 | 0.3235*** | 0.0312 | 0.6376*** | 0.2363 | 0.4104*** |

| (0.5529) | (4.9858) | (0.2522) | (3.1428) | (0.15035) | (4.7433) | |

| OPJEUN | 0.2196*** | 0.0859 | 0.2648*** | 0.3706*** | 0.3506*** | 0.108 |

| (5.7715) | (0.6014) | (2.5996) | (3.0458) | (4.0158) | (0.5432) | |

| constante | 0.6295* | 0.6576 | -0.1138** | -0.1020* | -0.1034** | -0.1041** |

| (1.64) | (1.05) | (-2.14) | (-1.90) | (-2.00) | (-1.98) | |

| Marginal effects | ||||||

| Funding if digitalization | 0.2735*** | 0.2536*** | 0.134** | 0.1574* | 0.1673 | 0.1995** |

| (3.41) | (3.32) | (2.02) | (0.175) | (1.1) | (2.93) | |

| Wald Chi2 | 12.8913** | 13.0465*** | 15.9274*** | 18.7695*** | 14.482*** | 14.647*** |

| Prob : 0.0199 | 0.00902 | 0.00242 | 0.00067 | 0.00465 | 0.00436 | |

| Wald test of exogeneity | Chi2=2.34 | 2.27 | 2.64 | 2.63 | 2.92 | 2.76 |

| Prob Chi2=0.1260 | 0.855 | 0.7845 | 0.9345 | 0.6983 | 0.8453 | |

Note: *10%, **5%, ***1% threshold significance of coefficients. ( ) statistics are calculated.

Table 6: IV probit estimation with digitalization instrumentation in microfinance and effects on entrepreneurial innovation financing.

The analysis taking gender into account reveals that the digitalization of microfinance products and services promotes the funding of entrepreneurial innovations for both men and women. However, this effect is more pronounced among men (0.2336) than women (0.1327). This disparity can be explained by the different opportunities available to men and women in terms of resources (physical or financial), which also limits women's access to digital tools, especially since these tools are not always accessible to low-income individuals. Regardless of gender, individuals with limited resources have restricted access to digital tools and services, as well as the benefits they can provide (Table 7).

| Independent variables | Startups financing | Growth financing of existing businesses | Startups financing | Growth financing of existing businesses |

|---|---|---|---|---|

| Increased access to financial services | 0.280*** | 0.3325** | 0.256** | 0.2818*** |

| (3.58) | (2.45) | (2.62) | (3.28) | |

| GOUV | 0.0645 | 0.1101 | 0.2141 | 0.101 |

| (0.6581) | (0.7244) | (1.1248) | (1.3262) | |

| PORTF | 0.0527 | 0.2233*** | 0.5736*** | 0.4004*** |

| (0.4369) | (4.578) | (3.1712) | (4.5933) | |

| OPJEUN | 0.2214*** | 0.0762 | 0.3306*** | 0.098 |

| (5.2604) | (0.5024) | (3.0173) | (0.5705) | |

| Constante | 0.6535* | 0.6476 | -0.0920* | -0.0963** |

| (1.65) | (1.03) | (-1.91) | (-1.99) | |

| Marginal effets | ||||

| Funding if digitalization | 0.2336*** | 0.2108*** | 0.1327* | 0.1795** |

| (3.28) | (3.25) | (0.176) | (2.84) | |

| Wald Chi2 | 11.5643** | 10.0434*** | 10.5643*** | 10.4967*** |

| Prob : 0.0159 | 0.0092 | 0.00057 | 0.00643 | |

| Wald test of exogeneity | Chi2 = 2.54 | 2.24 | 2.36 | 2.44 |

| Prob Chi2 = 0.1140 | 0.565 | 0.6575 | 0.7283 | |

Note: *10%, **5%, ***1% threshold significance of coefficients. ( ) statistics are calculated.

Table 7: IVprobit estimation with instrumentation of microfinance digitalization and effects on the financing of entrepreneurial innovations by gender.

This article aimed to examine the impacts of digitalization of financial products and services in microfinance on the incentive and financing of entrepreneurial innovations. Based on a recursive bivariate probit regression using panel data for 180 microfinances in Sub-Saharan Africa (SSA) over the period 2019-2022, the key findings are as follows. An increase in fund transfers, including those from migrants, coupled with the evolution of debit or credit cards, increases the probability of realizing and financing entrepreneurial innovations. In comparison with already established businesses, the three indicators of digitalization, namely debit or credit cards, mobile microfinance and fund transfers, increase the chances of sustaining established enterprises. These tools help control transaction costs inherent in the business and improve efficiency. However, mobile microfinance does not seem to stimulate the creation of start-ups, likely due to limited internet access for the most underserved. Digitalization of microfinance products and services increases entrepreneurial innovations by 27.35% and 25.36%, respectively, for the development of start-ups and the growth of existing businesses.

When analysing the effects separately between rural and urban areas, it is observed that digitalization more strongly promotes the creation of start-ups in urban areas than in rural areas, explained by a higher level of infrastructure and internet connectivity in cities. The transformation of a city into a digitized city is directly linked to innovation and the digitization of the living environment.

In conclusion, to maximize the contribution of digitalization of microfinance products and services to entrepreneurial innovations, these services should facilitate users' access to new payment methods. This would require an effective policy for the development of digital infrastructure, increased familiarity with the use of digital tools and the internet, as well as the promotion of transparency and information fluidity.

Citation: Fokwa AM, Bita CA, Djoumessi F (2024). Exploring the Impacts of Digitizing Financial Products and Services in Microfinance on Entrepreneurial Innovations in Sub-Saharan Africa. J Stock Forex. 11:265.

Received: 26-Aug-2024, Manuscript No. JSFT-24-33648; Editor assigned: 28-Aug-2024, Pre QC No. JSFT-24-33648 (PQ); Reviewed: 11-Sep-2024, QC No. JSFT-24-33648; Revised: 18-Sep-2024, Manuscript No. JSFT-24-33648 (R); Published: 27-Sep-2024 , DOI: 10.35248/2168-9458.24.11.265

Copyright: © 2024 Fokwa AM, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.