Journal of Tourism & Hospitality

Open Access

ISSN: 2167-0269

ISSN: 2167-0269

Research Article - (2017) Volume 6, Issue 3

This study investigates the panel Granger causality relationship approach and variance decomposition to test whether domestic economic growth promote tourists receipts, using international tourism receipts, real GDP per capita growth, exchange rate, financial development, and trade openness for Asian countries over the period of 1995-2014 and whether regional effects should be considered a product of incomes groups in selected Asian countries. Drawing on the selected Asian countries experiments, the empirical investigation of tourism’s contribution to growth indicates that factors, as well as tourism-related factors, are conducive to economic growth. Based on the findings of the Panel Granger tests and variance decomposition analysis, tourism receipts and economic growth should be considered in the analysis, since they provide valuable information for policymakers. The interpretation of the causality test can help providing a tool to allocate limited resources in addition to developing appropriate tourism strategies.

<Keywords: Economic growth; Tourism receipts; Trade openness; Financial development; Asian countries

International tourism receipts in destinations around the world grew by 3.6% in 2015, in line with the 4.4% increase in international arrivals. For the fourth consecutive year, international tourism grew faster than world merchandise trade, raising tourism’s share in world’s exports to 7% in 2016. The total export value from international tourism amounted to US$ 1.4 trillion.

Tourism is today a major group of international trade in services,” said UNWTO Secretary-General Rifai addressing the 60th Regional Commission for the Americas meeting in Havana, Cuba. “Despite a weak and slow economic recovery, spending on international tourism grew faster in 2015, proving the sector’s relevance in stimulating economic growth, boosting exports and creating jobs for an increasing number of economies worldwide,” he added. International tourism represents 7% of total world exports and 30% of services exports. The share of tourism in overall exports of goods and services increased from 6% to 7% in 2015 as for the fourth consecutive year international tourism outgrew world merchandise trade, which grew 2.8% in 2015 according to recent data reported by the World Trade Organization. In 2014, Asia and the Pacific (30% share) saw an increase of US$ 16 billion, reaching US$ 377 billion (euro 284 bn) [1].

Tourism is increasing overall economic activity, and this increase in activity is normally desirable. Often, the positive impacts on economic activity are inaccurately described as the “benefits” of tourism, as explained below [2]. The attention has focused on international tourism as an important potential growth sector for many countries [3]. The speedy growth of tourism causes an increase in household income and government revenues through multiplier effects, improvements in the balance of payments and growth in the tourism promoted government policies. In recent decades, the relationship between tourism and economic growth for both developing and developed countries has been extensively studied. In general, there is the causal relationship from tourism to economic growth.

Tourism attracted relatively little attention in the academic literature on economic development until the twenty first century. There are, however, some early studies which have focused explicitly on tourism’s economic contribution.

First, Sinclair and Stabler [4] argued that the most obvious distinction between developed and developing economies is that, under existing conditional differences, a rapid injection of tourist expenditures into developing economies has a different and significant impact.

Sinclair [5] investigated the tourism’s role in a country’s development, are indirectly relevant to it. Some studies highlight that the potential of tourism on growth is based, to a large part, on its provision of foreign currency earnings and corresponding alleviation of the balance of payments constraint. It is considered that foreign exchange earnings from tourism can be used to import capital goods to produce goods and services, which in turn leads to economic growth. It is also considered that tourism can have other benefits for the economy such as tax revenue, employment creation additional sources of income. In addition, international tourism may contribute to economic growth by enhancing efficiency through competition between local firms and corresponding businesses in other international tourist destinations and by facilitating the scale economies at a local level.

The tourism has become the world’s fourth largest export industry after fuels, chemicals and food [6,7]. Specifically, tourism accounts for 6 percent of the world’s total merchandise and service exports that represent 30 percent of international trade in services in the year 2014. Besides, 9.8 percent of the world’s total gross domestic product (GDP) originates in the tourism sector during the same period. The influence of inbound tourism on national economies is becoming increasingly important because of the growing size of the tourist market. In this context, the tourism-led growth hypothesis (TLGH), proposed by Balaguer and Cantavella-Jordá [8], postulates that expansion of international tourism activities generates economic growth. The TLGH is directly derived from widely known export-led growth hypothesis (ELGH) which suggests that economic growth can promote not just by expanding human resources and technology inside of the economy, additionally by expanding foreign exchange earnings.

Analogously to the trade openness, inbound tourism can stimulate economic growth in many ways. For instance, first, tourism significantly contributes to foreign exchange reserves which help in bringing new technologies for production process [9]. Secondly, tourism stimulates investments in new infrastructure, human capital and increases competition [10,11]. Thirdly, inbound tourism promotes industrial development through spillover effects [12]. Fourthly, tourism creates jobs and hence stimulates earnings (Lee and Chang, 2008) which categorize in third world country’s needs. Finally, tourism generates positive economic externalities [13-16]. Regarding other factors affecting economic growth, that financial development is also emerging as an important driver of economic growth [17]. Besides, Ridderstaat and Croes [18] established a link between money supply and tourism demand cycles. Indeed, the global tourism has been severely affected by the recent financial crisis [19]. From our foregoing discussion, it seems that there is a reasonable relationship between economic growth, tourism and trade openness.

In the case of Asian countries, Oh [20] argues that it is necessary to investigate the hypothesis in many destination countries for thepurpose of generalization.

Tang and Jang [21] studied that the countries could differ in terms of the weight of tourism on their overall economies, the size and openness of the economy, Kim et al. [22] and production capacity constraints Dwyer et al. [23]. The tourism economy relationship could also differ from one country to another.

This paper is organized as follows. Section 2 shows the review of the literature on tourism and economic Growth. Section 3 presents the data and the methods used in this study, Section 3 brings to light why test the panel unit root, the Cointegration approach, estimating the long-run and short-run PMG relationship t, Panel Granger Causality. Section 4 explains the results. Finally, conclusions and policy implications presented in Section 5.

Generally, these studies, which are noted in Table 1, analyse the economic elements behind the relationship between the two variables from different perspectives and with different methodological approaches. If the results showed the opposite direction of causality, in turn, will result in the expansion of the tourism industry. If there is neutrality causality relationship between tourism growth and economic development, then there is no feedback effect between each other. Finally, if the relationship is bidirectional, and tourism and economic growth have a reciprocal causal relationship, then a push in both areas would benefit both.

| Authors | Country | Period | Variables | Causality |

|---|---|---|---|---|

| Lanza et al. [55] | 13 OECD countries | 1977-1992 | GDP, tourism arrivals, total expenditure, price of manufactured goods, tourism price | Y → T |

| Eugenio-Martín et al. [25] | 21 Latin Americancountries | 1985-1998 | GDP, tourist arrivals, investment, government consumption, public expenditure in education, politicalstability index, corruption index | T → Y in low and medium income countries |

| Algieri[26] | 25 countries | 1990-2003 | GDP, tourism receipts, price index, transport cost | Y → T if elasticity of substitution <1 Y → T |

| Fayissaetal.[29] | 42 sub-Saharan Africancountries | 1995-2004 | GDP, tourism receipts, freedom index, human capital , investment, foreign investment, household consumption |

T → Y |

| Lee and Chang [27] | 23 OECD and32 non-OECDcountries | 1990-2002 | GDP, tourism receipts, exchange rate, tourist arrival | T → Y OECD T↔Y non-OECD |

| ProencaandSoukiazis[59] | 4 SouthernEuropean countries | 1990-2004 | GDP, tourism revenues share of real investment to realGDP, population and technology growth rates | T → Y |

| SequeiraandNunes[28] | 94 countries | 1980-2002 | GDP, tourist arrivals, tourism receipts to export, tourism receipts to GDP, investment, government consumption, market distortion measure, openness, life expectancy, risk, inflation | T → YTourism specialization is an important determinant of economic growth.The effect of tourism decreases when small countries are considered |

| SoukiazisandProenca[59] | Portuguese regions | 1993-2001 | GDP, tourism receipts, accommodation capacity in thetourism sector | T → Y |

| Cortés-Jiménez and Pulina [32] | Italian and Spanishregions | 1990-2004 | GDP, investment, human capital, government consumption, nights spent, national and international tourist arrivals regions for national and international tourism | T → Y in coastal |

| AdamauandClerides (2010) | 162 countries | 1980-2005 | 12 variables (tourism receipts, tourist arrivals) | T → YSpecialization in tourism adds to a country's rate ofeconomic growth but it does so at a diminishing rate |

| Narayan et al. [31] | 4 Pacific islands | 1980-2005 | GDP, tourism receipts,tourist arrivals | T → Y |

| AdamauandClerides (2010) | 162 countries | 1980-2005 | GDP, 12 variables (tourism receipts, tourist arrivals growth, tourism receipts growth, life expectancy, investment, inflation, government consumption....) | T → YSpecialization in tourism adds to a country's rate of economic growth but it does so at a diminishing rate |

| Santana-Gallego et al. [38] | 179 countries | 1995-2006 | GDP, tourist arrivals investment, growth of population, human capital, openness to trade, exchange rate, currency union | T → Y Trade → Y |

| Seetanah [35] | 19 Islands.Extended to 20 developing and 10 developed countries | 1995-2007 | GDP, tourist arrivals, tourism receipts, physical and human capital, openness, freedom index | T↔YTourism development on island economies may have comparatively higher growth effects |

| Holzner[33] | 143 countries | 1970-2007 | GDP, tourism receipts, physical and human capital,exchange rate, openness, taxes | Countries with higher shares of tourism income in GDP grow faster than others. Tourism capital and physical capital are complements |

| Apergisand Payne [36] | 9 Caribbean countries | 1999-2004 | GDP, tourist arrivals and exchange rate | T↔Y |

| Dritsakisv [37] | 7 Mediterraneancountries | 1980-2007 | GDP, tourist arrivals and tourism receipts. exchange rate | T → Y |

| Ekanayakeand Long [34] | 140 developingcountries | 1995-2009 | GDP, tourism receipts, physical capital and labor | - |

| Caglayan, et al. | 135 countries | 1995-2008 | GDP, tourism receipts T↔Y in Europe | T → Y in America, Latin America and Caribbean Y→ T in East and South Asia, Oceania-in the rest regions |

| Mercedes Castro-Nu?o et al. | 187 samples | 2011 | meta-analysis | Y → T |

| Naryan, et al. (2013) | Fiji, Solomon Islands, PNG, Vanuatu, Samoa and Tonga | 1985- 2010 | Tourism and macroeconomic variables | T → Y |

| Kumar [43] | Vietnam | 1980-2010 | tourism and output per worker | A bi-directional causation existed between tourism and output per worker indicating that both tourism and output per worker were mutually reinforcing each other. |

| Ba?arir and Çakir [56] | Turkey and four European Union countries, France, Spain, Italy and Greece | 1995-2010 | tourism, financial development, energy consumptions and carbon emissions | Existence of a feedback type causal relationship between the tourist arrivals and financial development. |

| Bridaet al. (2015) | Argentina and Brazil | 1980-2013 | Nonlinearity Model | M-TAR adjustment mechanism is which best describes this behavior |

| Shahbazet al.[17] | Malaysia | 1975-2013 | the tourism-growth, tourism demand, financial development and trade openness | Mutually re enforcing impact between the variables and providing evidence that tourism was central to enhancing the key sectors and the overall income level. |

Table 1: Literature about the relationship between tourism and economic growth: panel data.

Lanza and Pigliaru [24] investigated the relationship between tourism and growth from an empirical point of view, while Balaguer and Cantavella-Jordà [8] analyzed the tourism-led growth hypothesis.

Eugenio-Martín, Morales, and Scarpa [25] studied the relationship between tourism and economic growth using a data sample between 1985 and 1998 for 21 Latin American countries. In those countries, tourism receipts had a relative weight on the per capita income: high (7), medium (11) and low (3). Using the Arellano-Bond estimator for dynamic panels, the study’s empirical results showed that the development of tourism may have contributed to economic growth in the low or medium-income countries, while the relationship was not clear in developed countries.

For 25 countries, Algieri [26] studied high tourism growth with per capita income ratios. The author concluded that the growth ratio of the tourism sector than the manufacturing sector only when the elasticity was less than 1. The author even calculated that an increment above 1% in the world GDP would generate an increase of tourism receipts that would be close to 5.8%. The tourism sector is, therefore, extremely sensitive to world macroeconomic circumstances.

Similarity for OECD and non-OECD countries Lee and Chang [27] analyzed the relationship between growth and tourism using Pedroni (FMOLS). Those authors concluded that tourism development has a strong impact on the GDP of both OECD and non-OECD countries and showed that the relationship is unidirectional in OECD countries and bidirectional in non-OECD countries. It is also highlighted the special influence of tourism on the increase of GDP in sub-Saharan countries.

In the same year, Sequeira and Nunes [28] examined the relationship between tourism and economic growth using two estimators that they considered to be complementary: the GMM estimator. The results of showed that the size of the country does not determine the possibility of economic growth being fostered by the country’s specialization in tourism. On the contrary, the country’s degree of specialization in tourism is itself the decisive factor. The results indicated that a 1% increase tourism receipts on the GDP caused a 0.03 to 0.05% increase in economic growth. Given these results, the authors suggested two interesting research lines. On the one hand, they explored the relationship between tourism and the traditional determinants of economic growth (e.g. human capital) and analysed the determinants of tourism growth, with special attention to the calculation of productivity in tourist companies.

Fayissa et al. [29] analyzed the relationship between growth and tourism in a sample of 42 sub-Saharan African countries with very heterogeneous tourism industries for relevance of heterogeneity between the countries. Those authors also introduced other economic variables that represent traditional factors of economic growth. With the purpose of tackling the problem of heterogeneity in the sample, the authors used estimation methods based on both fixed and variable effects. In addition, they estimated the model using Arellano and Bond [30] with autocorrelation, something that allowed them to consider the endogenous nature of traditional growth variables by using instrumental variables. The results were quite conclusive: a 10% increment in international tourism expenditure means a 0.4% increase in the GDP per capita.

Similarity, Narayan et al. [31] tested whether the TLG hypothesis could be verified in small countries which are strongly specialized in tourism, in particular a group of Pacific islands. Using Pedroni’s panel data cointegration test, a strong, significant and long-term impact of tourism on the GDP of the four islands was verified. Nevertheless, the authors pointed out that there were certain factors limiting the effects of tourism on growth. Those factors were the heavy dependence on food imports, which represent an important break on the multiplying effect of the tourism sector, natural disasters, political instability and a deficit of public infrastructure.

Cortés-Jiménez [32] studied the effects of tourism on the economic growth of Italy and Spain in the period between 1990 and 2004, also from a regional point of view. The author postulated as to whether tourism could be considered a relevant regional-convergence factor. The regions were classified into three different categories: coastal, inland and Mediterranean. The results showed that in coastal and Mediterranean regions, both international and national tourism were important factors for economic regional convergence. In contrast, in inland regions only national tourism was relevant.

For 134 countries, Holzner [33] empirically analyzed the danger of a beach disease Effect in tourism-dependent countries over the long-run over the period 1970-2007 He first worked on the longrun relationship between tourism and economic growth in a crosscountry setting. Empirical results were then checked in a panel data framework on GDP per capita levels that allows control for reverse causality, non-linearity and interactive effects. He found that there is no danger of a Beach Disease Effect. On the contrary, not only do tourism-dependent countries was not face real exchange rate distortion and de-industrialization, they also experience higher than average economic growth. Investment in physical capital, such as transport infrastructure, was complementary to investment in tourism. A similar study, Ekanayake and Long [34] considered a panel of 140 developing countries divided into six regions (East Asia, Europe, Latin America, Middle East and North Africa, South Asia and Sub-Sahara Africa) for the 1995-2009 period. The study found no evidence to support the tourism-led growth hypothesis for any group of countries.

Seetanah [35] examined the TLG hypothesis in a set of nineteen islands and, he obtained at similar conclusions. The author also showed that, the impact of tourism on growth in the islands is certainly greater. With the same perspective as for earlier studies, Apergis and Payne [36] examined the causal relationship between tourism and economic growth for a panel of nine Caribbean countries. The panel error correction model used revealed bidirectional causality between tourism and growth. Dritsakis [37] analyzed whether the TLG hypothesis could be verified in seven Mediterranean countries possessing similar tourist features by also focusing on the relationship between tourism development and economic growth in various countries. He applied a new heterogeneous panel cointegation technique to investigate long-run. The results showed that there is solid evidence of panel cointegration relationships between tourism development and GDP and that tourist receipts have a greater impact on GDP in all seven Mediterranean countries.

Naryan, Sharma and Bannigidadmath [31] examined whether the number of visitors predict macroeconomic variables for panels, namely, Fiji, Solomon Islands, PNG, Vanuatu, Samoa and Tonga over the 1985- 2010 periods. They propose a predictive model for panel regression with two variables where visitor arrivals are the predictor variable and macroeconomic variables are the dependent variables. Motivated by a growing number of studies showing that tourism development has economy-wide effects influencing the macro-economy, and consider abroad range of macroeconomic variables.

Recent empirical research centers on the relationship between international tourism and trade. The results obtained by Santana- Gallego, Ledesma-Rodríguez et al. [38] explored the potential effects on trade, tourism and growth of adopting a common currency for policy purposes. Their research addressed if a common currency (CC) might increase income via international trade and tourism. The investigation analyzed the effects of CC on tourism and trade, followed by the effects of openness to trade and tourism on economic growth, and then the impact of CC on trade, tourism and income. The sample includes data from 179 countries divided into three groups according to income levels. The results showed that the CC has a considerable effect on both trade and tourism and that both variables may have effect on the level of income of the countries, especially on middle- and high-income economies.

With the purpose of studying the relationship between tourism and growth in greater depth, some new studies have been published which contribute to the analysis of hypotheses through new methodological approaches or through the inclusion of new variables.

For 162 countries, Adamou and Chlorides [39] contributed to this research area with new evidence when they allowed the relationship between tourism and economic growth to take a non-linear form. They analyzed the relationship between tourism receipts and economic growth in a sample of in the period from 1980 to 2005, paying special attention to the countries’ specialization in tourism activities. In this way, specialization in tourism was found to be associated with higher but diminishing economic growth rates. Therefore, high specialization reduces the contribution of tourism to economic growth was at least and tourism becomes an obstacle to growth. From that point of specialization onwards, it is better for countries to develop other activities. Thus, tourism may generate economic growth in the first stages of specialization, but little by little its effects reduced.

Mercedes Silva [40] investigated tourism contributes to economic growth. From a sample of 11 studies based on panel data techniques published through to 2011, and for a total of 87 heterogeneous estimations, a meta-analysis was performed by applying models for both fixed and random effects, with the main objective being to calculate a summary measure of the effects of tourism on economic growth. The results showed a positive elasticity between economic growth and tourism, the magnitude of the effect was found to vary according to the methodological procedure employed in the original studies for empirical estimations.

Finally, Berda et al. [41] analyzed the validity of the Tourism-Led Growth Hypothesis (TLGH) for these countries and demonstrated that the relationship between tourism and economic growth is not linear for Argentina and Brazil. However, the authors did not specify the format of the nonlinearity. The present researcher explored about the identity of these nonlinearities. The methodology combined the concepts of cointegration with the asymmetric adjustment thresholds. The results explained the nonlinearity in the case of Brazil that is modeled on the dynamics of the adjustment from transitory situations of disequilibrium between tourism and growth. It showed that an M-TAR adjustment mechanism is which best describes this behavior.

Kumar and Kumar [42] investigated tourism with other contemporary drivers such as financial development and urbanization in economic growth in Fiji over the periods 1981-2009, using the ARDL bounds approach. They found that tourism accounted for 0. 13 percent to per worker output, whereas financial development had the largest contributory power of 0.71% per every 1% increase tourism in the long-run.

Kumar [43] explored the dynamics of the relationship between information commutation technology (ICT), tourism and financial development on economic growth in Vietnam over the period 1980- 2010 using the ARDL bounds testing model. It was found that a bi-directional causation existed between tourism and output per worker indicating that both tourism and output per worker were mutually reinforcing each other.

Song and Lin [44] estimated the impact of the financial crisis of 2007 on tourism in Asia, using autoregressive distributed lag model. It found that the financial crisis had a negative impact on both inbound and outbound tourism in Asia. Ridderstaat and Croes [18] investigated whether money supply cycles affected tourism demand cycles in Canada, United Kingdom, and United States for Aruba and Barbados, using unit root, cointegration and causality testing. They found that money supply cycles could impact the cyclical movements of tourism demand and that the impacts were a symmetric, depending on the stage of development of the cycles.

Ngoasong and Kimbu [45] used a micro-ethnographic approach to analyze the role of informal microfinance in situations in developmentled tourism entrepreneurship in Cameroon. They found that collective action in informal microfinance institutions enabled entrepreneurial members to create small tourism firms (Table 1).

Data

This empirical study used annual data on 35Asian countries (Armenia, Azerbaijan, Bahrain, Bangladesh, Belarus, Bhutan, China, Fiji, Georgia, India, Indonesia, Iran, Islamic Rep, Japan, Jordan, Kazakhstan, Korea, Rep, Kuwait, Lebanon, Macao SAR, Malaysia, Maldives, Mongolia, Nepal, Oman, Pakistan, Philippines, Singapore, Sri Lanka, Thailand, Turkey, United Arab Emirates), (Data is not available for the rest of the Asian countries) over the period 1995-2014.

The variables in this study included Domestic tourism receipts (TOUR) and real GDP per capita (RGDP); Domestic tourist receipts are in terms of billions of U.S. dollars. Real GDP is per capita measured in constant 2005 US$ and trade openness (TR) is (export+ import)/GDP, Financial development (Broad money/GDP) and Official exchange rate (OER). The panel series were obtained from the World Bank, World Development Indicators database (WDI, 2015).

Model and estimation methods

This study analyzed the relationship between economic growth and tourists receipts. This model can be written as follows:

TOUR=f (GDPi,t,RERi,t, FDi,t, TRI,t) (1)

LnTOURi,t=βo+β1LnGDPi,t+β2LnRERi,t+β3LnFD+β4LnTRi,t+εi,t. (2)

Where, i and t indicated countries and time. TOUR is International tourist receipts, RGDP represents the real per capita gross domestic product, TR stands for trade openness and εt is the error term. All the variables were in their natural logarithmic form.

Unit root test: The first step for the causality relationship was to find whether the series had any integration orders. An alternative approach to panel unit root tests used Fisher’s results to derive tests that combine the p-values from unit root tests. This idea has been proposed by Maddala and Wu [46] and by Choi [47]. Instead, the individual tests were Phillips-Perron test of the unit root (PP), and then the combined test performed according toas Fisher-PP test.

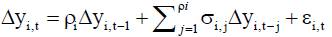

For this purpose, this study used the panel unit root tests developed by Levin et al. [48] and Im et al. [49]. The unit root test considered the following panel ADF specification:

(3)

(3)

The Levin, Lin, and Chu (LLC) assumed that the persistence parameters are ρi are identical across cross-sections (i.e., ρi=ρ for all i), whereas the lag order ρi may freely vary. This procedure tested the null hypothesis ρi=0 for all i against the alternative hypothesis ρi<0 for all i. Rejection of the null hypothesis indicated a possible panel integration process. The Im, Pesaran, and Shin [49] test, which were also based on eqn. (2), differed from the LLC test by assuming ρi to be heterogeneous across cross-sections. The IPS tests the null hypothesis H0: ρi=0 against the alternative hypothesis H1: ρi<0, (i=1,… N); ρi=0, (i=N1,… N) for all i. Acceptance of the alternative hypothesis allowed the individual series to be integrated.

By contrast, the less restrictive IPS test (and other widely used tests such as the augmented Dickey-Fuller tests (ADF) Fisher estimated a separated ADF regression for the three cross-sections to allow for individual unit root processes.

Cross-section dependence test: Pesaran [50] proposed a simple approach to deal with the problem of cross-sectional dependence. A one-factor model considered with heterogeneous factor loadings for residuals and suggests augmenting the standard ADF regression with the cross-section averages of lagged levels and first-differences of the individual series. For the selected Asian countries in our empirical study, heterogeneity may arise due to differences in the degree of economic and development conditions of each country. To ensure wide applicability of any cointegration panel test, it is important to take into account as much as possible heterogeneity between group members.

Pooled mean group (PMG) model: The main characteristic of PMG was that it allows short-run coefficients, including the intercepts, the speed of adjustment to the long-run equilibrium values, and error variances to be heterogeneous country by country; while the long-run slope coefficients were restricted being homogeneous across countries. This was particularly useful when there are reasons to expect that the long-run equilibrium relationship between the variables was similar across countries or, at least, a subset of them.

The short-run adjustment was allowed to be country-specific, due to the widely different impact of the vulnerability to financial crises and external shocks, stabilization policies, monetary policy and so on. However, there are several requirements for the validity, consistency and efficiency of this method. First, a long-run relationship among the variables of interest requires the coefficient of the error-correction term to be negative and not lower than -2. Second, an important assumption for the consistency of the PMG model was that the resulting residual of the error-correction model is serially uncorrelated and the explanatory variables can be treated as exogenous.

Such conditions fulfilled by including the PMG (p,q) lags for the dependent (p) and independent variables (q) in error-correction form. Third, the relative size of T and N was crucial, since when both of them are large this allowed us to use the dynamic panel technique, which helped to avoid the bias in the average estimators and resolved the issue of heterogeneity. Eberhardt and Teal [51] argued that the treatment of heterogeneity was central to understanding the growth process. Therefore, failing to fulfill these conditions will produce inconsistent estimation in PMG.

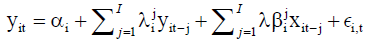

Panel causality analysis: The bootstrap panel causality approach proposed by Kónya [52] is able to account for cross-section dependence. To address the cross-sectional dependence and heterogeneity, the present study used the panel Granger causality test developed by Dumitrescu and Hurlin [53]. They proposed a panel causality test based on the individual Wald statistic of Granger non-causality averaged across the cross-section units. The linear panel regression model is as follows:

(4)

(4)

Where y is real income growth and x is the vector of the tourism variable (i.e., international tourism receipts and other variables).

Dumitrescu and Hurlin [53] stated that “a homogeneous specification relationship between the variables x and y did not allow the interpretation causality relationships if any individual from the sample has an economic behavior different from that of the others”. Thus, they proposed an average Wald statistic that tests the null of no causal relationships for any of the cross-section units, H1:βi=0, (i=1,…,N), against the alternative hypothesis that causal relationships occurred for at least one subgroup of the panel,

H1:βi=0,(i=1,…,N1);Ho:βi≠0,(i=N1+1, N1+2,…,N).

Rejection of the null hypothesis with N1=0 indicated that x Granger causes y for all i, whereas rejection of the null hypothesis with N1> 0 provided evidence that the regression model and the causal relationships varied from one individual or the sample to another. Under these circumstances, the average of the individual Wald statistic assumed the following:

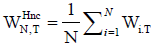

(5)

(5)

Where W(i.T) is the individual Wald statistic for the i-th crosssection unit?

The first two hypotheses postulate a unidirectional causality between two variables. First, the tourism-led economic growth hypothesis and second the economic growth led tourism growth hypothesis. The third and fourth hypotheses relate to a bidirectional relationship between tourism and economy. First the bidirectional causality hypothesis and second the no causality hypothesis.

Table 2 in the Appendix shows descriptive statistics of the variables for selected Asian countries for period 1995-2014. The data set include annual real GDP per capita growth, international tourism receipts growth (in current US $), exchange rate, financial development and Trade openness growth. The panel series obtained from the World Bank [54], World Tourism Organization and Compendium of Tourism Statistics.

| Ln GDP | Ln TOUR | Ln RER | Ln FD | Ln TR | |

|---|---|---|---|---|---|

| Level 0 | |||||

| Levin, Lin andChu T* | 2.53400 | -1.33080 | -3.93972** | -4.13852** | -2.32106** |

| Im, Pesaran And Shin W-Stat | 7.27520 | 4.44747 | -4.00418** | 0.11299 | -0.47679 |

| ADF-Fisher Chi-Square | 11.7697 | 29.0295 | 124.030** | 62.2893 | 74.8182 |

| PP-Fisher Chi-Square | 9.46709 | 36.8420 | 440.951** | 78.4283 | 91.6249 ** |

| Level 1 | |||||

| DLn GDP | DLn TOUR | Ln RER | Ln FD | DLn TR | |

| Levin, Lin and Chu T* | -7.04979** | -10.0244** | -3.11911** | -7.76536** | -8.90970 ** |

| Im, Pesaran And Shin W-Stat | -6.39884** | -9.63692** | -7.41405** | -10.0393** | -9.95763 ** |

| ADF-Fisher Chi-Square | 149.340** | 212.738** | 165.176** | 221.842** | 220.428 ** |

| PP-Fisher Chi-Square | 248.194** | 380.290** | 521.957** | 511.874** | 401.533 ** |

Notes: All unit root tests were performed with individual trends and intercept for each series.

Table 2: Panel unit root tests.

The GDP per capita datasets show that United Arab Emirate is the highest and Nepal has the lowest GDP per capita growth, 11.35% and 7.44%, respectively. The international tourism receipts datasets show that Thailand and China have the highest and lowest of international tourism receipts, 23.48%, and 16.89%, respectively. For high-income countries, Japan is the heights and Kuwait has the lowest tourist receipts because of the Golf war. For middle-income countries, Thailand is the heights and Bhutan has the lowest heights. For low-income countries, Korea is the heights and Nepal has the lowest heights.

Although, the ratio of tourism arrivals to GDP shows Lebanon is the highest and Bangladesh had the lowest GDP per capita growth, 15.24%, and 0.66%, respectively. This study focuses on the Asian countries and investigates whether tourism has any effect on economic growth in these countries. In this regard, the major contribution of this paper, using a panel data approaches to investigate whether tourism contributes to economic growth for the selected Asian countries.

The panel unit root tests conduct on levels and first differences of the variables. The tests results show in Table 2 the null hypothesis of a unit root against the alternative of a judgment may refuse in varying levels, but is rejected in their first differences. Therefore, the variables integrated of order one, I (1).

The optimal lag length was selected automatically using the Schwarz information criteria. The null hypothesis is a unit root for all the tests (**) denotes statistical significance at the (5%).

As outlined earlier, testing for cross-sectional dependency in a panel causality study is crucial for the selecting an appropriate estimator. Taking into account cross-sectional dependency in empirical analysis is crucial since countries are highly integrated and have a high degree of globalization in economic relations. Therefore, our empirical study starts by examining the cross-sectional dependency across the countries in concern. To investigate the cross-section dependence, we carried out a CD Test and illustrate the results in Table 3.

| Test | Ln GDP | Ln TOUR | Ln RER | Ln FD | Ln TR |

|---|---|---|---|---|---|

| CD Test | 90.76652**[0.0000] | 84.29008**[0.0000] | 33.51024 [0.0000] | 40.47863**[0.0000] | 11.55820**[0.0000] |

**indicates significance at the 0.5 levels.

Table 3: CD Dependence test.

The approach investigates cross-sectional dependency across countries in the causality test; therefore, they lead to misleading inferences about the nature of causality between international tourism receipts and economic growth. We found strong evidence for crosssection dependence among Asian countries.

The long-run estimates are described in Table 4. All estimated coefficients can be interpreted as long-run elasticities given that variables are in natural logarithms.

| Variables | Coefficient | Std. Error | t-Statistic | Prob |

|---|---|---|---|---|

| Ln GDP | 0.62** | 0.051379 | 3.870419 | [0.0000] |

| Ln RER | 1.47** | 0.117056 | 12.16911 | [0.0000] |

| Ln FD | 0.41** | 0.105993 | 12.57742 | [0.0001] |

| LnTR | 2.27** | 0.218742 | 10.39458 | [0.0000] |

**denotes rejection of the hypothesis at the 0.05 level

Table 4: Long-run PMG estimation model.

The long-run coefficients estimated have the same order of magnitude at the 5% significance. The results showed that tourism receipts contribute significantly to economic growth. From the above estimates, it can be inferred that the effects of multiplier effects on income are extremely important. It is concluded on the basis of our findings that a 1 per cent increase in economic growth increases tourism receipts by 0.62 percent, all else being same in long-run. This results shows that panel estimations of increases in tourism can indeed capture long-run relationships in Asian countries. Just like the influence of exports on economic growth reported in most empirical studies, external competition plays a relevant role when analyzing possible long-run relationships.

1 per cent increase in exchange rates raises tourism receipts by 1.47 percent, other things constant and1 per cent increase in financial development raises tourism receipts by 0.41 percent, other things constant Similarly, trade openness is positively related to economic growth, 1 per cent increase in trade openness raises tourism receipts by 2.27 per cent, other things constant.

In light of the statistical results presented in Table 5, it is possible to construct a final table that clearly demonstrates which of the growth, unidirectional, bidirectional and neutrality hypotheses is supported by the countries in consideration.

| GDP → Tour | Tour → GDP | |

|---|---|---|

| Panel | 0.45126[0.6371] | 0.47237[0.6238] |

| Armenia | 0.32636[0.7273] | 5.18495[0.0221] |

| Azerbaijan | 6.70159[0.0198] | 5.48787[0.0324] |

| Bahrain | 0.97320[0.4038] | 6.20249[0.0128] |

| Bangladesh | 8.64217[0.0041] | 1.08947 [0.3652] |

| Belarus | 1.44153 [0.2720] | 5.83083[0.0156] |

| Bhutan | 2.86208[0.0904] | 0.63706[0.6081] |

| China | 0.22902[0.7985] | 3.46152[0.0623] |

| Fiji | 2.60586 [0.1118] | 5.29491[0.0208] |

| Georgia | 3.74812[0.0519] | 1.66999 [0.2262] |

| India | 3.72063 [0.0528] | 1.59577 [0.2400] |

| Indonesia | 1.27594 [0.3119] | 4.89555[0.0260] |

| Iran, Islamic Rep. | 0.77455[0.4811] | 4.41380[0.0344] |

| Japan | 0.09330[0.9115] | 1.07302 [0.3704] |

| Jordan | 0.25245[0.7806] | 1.39816[0.2819] |

| Kazakhstan | 5.27317[0.0210] | 1.16177 [0.3434] |

| Korea, Rep. | 4.83340[0.0430] | 2.04003 [0.1724] |

| Kuwait | 5.47665[0.0188] | 0.52847 [0.6016] |

| Kyrgyz Republic | 0.22546 [0.8012] | 3.22379[0.0729] |

| Lebanon | 0.13780 [0.8725] | 1.31133 [0.3028] |

| Macao SAR | 3.75986[0.0515] | 8.54476[0.0043] |

| Malaysia | 0.29608 [0.7486] | 3.43411[0.0635] |

| Maldives | 6.25776[0.0125] | 1.19071 [0.3351] |

| Mongolia | 0.88181 [0.4374] | 3.41651[0.0642] |

| Nepal | 5.28851[0.0209] | 0.58516 [0.5710] |

| Oman | 1.37286 [0.2878] | 0.49984 [0.6178] |

| Pakistan | 0.18700[0.8316] | 0.29492[0.7494] |

| Philippines | 3.26542 [0.0896] | 0.11298 [0.7411] |

| Singapore | 6.30032 [0.0122] | 2.57289 [0.1144] |

| Sri Lanka | 2.95950 [0.0873] | 0.66363[0.5316] |

| Thailand | 0.53658 [0.5972] | 2.05427 [0.1678] |

| Turkey | 0.57181 [0.5781] | 10.6465 [0.0018] |

| United Arab Emirates | 0.44743[0.6488] | 1.75832 [0.2109] |

Table 5: The Granger Causality Test.

Table 5 shows that in selected Asian countries, there is unidirectional causality relationship from international tourists receipt to economic growth for Bangladesh, Bhutan, Georgia, India, Kazakhstan, Korea, Rep., Kuwait, Maldives, Nepal and Philippines and unidirectional causality relationship is from economic growth to international tourists receipt for Turkey, Mongolia, Malaysia, Kyrgyz Republic, Iran, Islamic Rep., Indonesia, China, Belarus, Bahrain, and Armenia. There are bidirectional causality relationships between tourists receipt and economic growth for Azerbaijan and Macao SAR. The neutrality hypothesis is not valid for Japan, Jordan, Lebanon, Oman, Pakistan, Sri Lanka and United Arab Emirates.

There is a unidirectional causality running from tourists receipts to economic growth in some Asian countries. The results which clearly back up those of Lanza et al. [55], who observed that tourism activity has a positive influence on economic growth in OECD countries.

From Table 5, in terms of policy recommendation emerges: if policymakers want to encourage growth, they should expand their tourism industry as much as possible and focus their attention on long-run policies. For example, it is essential to increase investment in tourism infrastructure, such as water, electricity and telephone, in transportation facilities, like roads or public transport systems, in transportation and management skills, political stability, crime control, natural resource management, Environmental conservation and in the preservation of local culture i n some Asian countries [16].

Additionally, the government should try to upgrade, develop and enhance the domestic tourism economy by implementing strategies to reduce initial risks and provide capital needs for private firms operating in tourism, to stimulate private investment in the tourism industry by lowering costs to acquire capital and land, including loan guarantees, tax exemptions and lower tax rates. Should outcomes show reverse causality, then economic growth may be necessary for the expansion of the tourism industry, as in Asian countries. In those cases, the government should first concentrate on economic growth, and this will naturally yield the feedback effects for the development of tourism. Aside from determining the regional effects, from the global standpoint, all Asian countries can concurrently enjoy the benefits of tourism development and economic growth [56-59].

The validity of the hypotheses may also be sensitive to the indicators employed. In the present study, while the growth hypothesis holds for the Asian panel with respect to the receipts, it reverts to feedback when the indicator is tourism expenditures. If one assumes the receipts as a part of the national production process, it is natural to expect that the growth hypothesis exists. However, the international tourism receipts represent the income of the visitors that was generated by a foreign production process, thus indicating another channel for explaining the impact of tourism on economic growth.

The results of Variance Decomposition for Asian countries are shown in Table 6.

| Variance Decomposition Of TOUR | |||||

|---|---|---|---|---|---|

| Period | LTOUR | LGDP | LRER | LFD | LTR |

| 1 | 0.229095 | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.231202 | 0.007109 | 0.017677 | 0.018989 | 0.008307 |

| 3 | 0.228267 | 0.010272 | 0.017807 | 0.018909 | 0.010735 |

| 4 | 0.224596 | 0.010737 | 0.018348 | 0.017827 | 0.012178 |

| 5 | 0.220873 | 0.010564 | 0.018897 | 0.016369 | 0.012973 |

| 6 | 0.217155 | 0.010236 | 0.019419 | 0.014883 | 0.013394 |

| 7 | 0.213456 | 0.009882 | 0.019899 | 0.013432 | 0.013596 |

| 8 | 0.209788 | 0.009530 | 0.020342 | 0.012038 | 0.013667 |

| 9 | 0.206157 | 0.009184 | 0.020750 | 0.010706 | 0.013658 |

| 10 | 0.202567 | 0.008846 | 0.021127 | 0.009436 | 0.013598 |

| Variance Decomposition Of GDP | |||||

| Period | LTOUR | LGDP | LRER | LFD | LTR |

| 1 | 0.029288 | 0.119168 | 0.000000 | 0.000000 | 0.000000 |

| 2 | 0.034463 | 0.140983 | -0.001279 | 0.021244 | 0.006586 |

| 3 | 0.035111 | 0.147949 | 4.41E-06 | 0.021696 | 0.009844 |

| 4 | 0.036020 | 0.149055 | 0.001953 | 0.021078 | 0.012102 |

| 5 | 0.036735 | 0.148982 | 0.004115 | 0.019631 | 0.013587 |

| 6 | 0.037374 | 0.148587 | 0.006251 | 0.018085 | 0.014626 |

| 7 | 0.037944 | 0.148129 | 0.008332 | 0.016530 | 0.015397 |

| 8 | 0.038459 | 0.147664 | 0.010355 | 0.015007 | 0.016008 |

| 9 | 0.038929 | 0.147204 | 0.012323 | 0.013525 | 0.016520 |

| 10 | 0.039358 | 0.146748 | 0.014240 | 0.012089 | 0.016968 |

| Variance Decomposition Of RER | |||||

| Period | LTOUR | LGDP | LRER | LFD | LTR |

| 1 | -0.015333 | -0.082254 | 0.021738 | -0.032295 | 0.099454 |

| 2 | -0.009889 | -0.106189 | 0.028961 | -0.043267 | 0.154334 |

| 3 | -0.006687 | -0.113574 | 0.032444 | -0.046868 | 0.185867 |

| 4 | -0.005074 | -0.115907 | 0.033694 | -0.049560 | 0.204192 |

| 5 | -0.004375 | -0.116648 | 0.033965 | -0.052201 | 0.215143 |

| 6 | -0.004197 | -0.116810 | 0.033763 | -0.054925 | 0.221947 |

| 7 | -0.004322 | -0.116737 | 0.033321 | -0.057693 | 0.226409 |

| 8 | -0.004626 | -0.116560 | 0.032758 | -0.060460 | 0.229544 |

| 9 | -0.005039 | -0.116337 | 0.032136 | -0.063192 | 0.231920 |

| 10 | -0.005523 | -0.116099 | 0.031488 | -0.065872 | 0.233858 |

| Variance Decomposition Of FD | |||||

| Period | LTOUR | LGDP | LRER | LFD | LTR |

| 1 | -0.004045 | -0.028303 | 0.004700 | 0.098355 | 0.000000 |

| 2 | -0.008407 | -0.017898 | 0.002548 | 0.081520 | -0.010576 |

| 3 | -0.007269 | -0.017337 | 0.001355 | 0.080549 | -0.014592 |

| 4 | -0.006619 | -0.016292 | 0.000927 | 0.077423 | -0.016589 |

| 5 | -0.005736 | -0.015648 | 0.000605 | 0.074765 | -0.017271 |

| 6 | -0.004835 | -0.015084 | 0.000387 | 0.072175 | -0.017259 |

| 7 | -0.003929 | -0.014582 | 0.000223 | 0.069695 | -0.016864 |

| 8 | -0.003043 | -0.014118 | 9.31E-05 | 0.067304 | -0.016269 |

| 9 | -0.002186 | -0.013682 | -1.42E-05 | 0.064994 | -0.015572 |

| 10 | -0.001363 | -0.013269 | -0.000105 | 0.062759 | -0.014830 |

| Variance Decomposition Of TR | |||||

| Period | LTOUR | LGDP | LRER | LFD | LTR |

| 1 | 0.005897 | -0.016308 | 0.098434 | 0.000000 | 0.000000 |

| 2 | 0.010923 | -0.023019 | 0.095039 | 0.005587 | -0.006385 |

| 3 | 0.009586 | -0.022402 | 0.093043 | 0.004153 | -0.010655 |

| 4 | 0.008883 | -0.021908 | 0.090555 | 0.004227 | -0.013048 |

| 5 | 0.008229 | -0.021253 | 0.088237 | 0.004239 | -0.014452 |

| 6 | 0.007673 | -0.020635 | 0.086014 | 0.004337 | -0.015278 |

| 7 | 0.007172 | -0.020044 | 0.083873 | 0.004456 | -0.015781 |

| 8 | 0.006711 | -0.019477 | 0.081800 | 0.004588 | -0.016101 |

| 9 | 0.006279 | -0.018930 | 0.079784 | 0.004725 | -0.016317 |

| 10 | 0.005871 | -0.018399 | 0.077822 | 0.004864 | -0.016474 |

Table 6: Results of variance decomposition.

The results of variance decomposition are consistent with the Panel Granger test results. According to these results, economic growth is mostly affected by tourism expansion and tourism volatility and tourism expansion is an important determinant of economic volatility in the long-run.

On the other hand, tourism expansion and tourism volatility are substantially determined by them and their effect on economic grow this nothing. Variance decomposition shows that the effects of economic growth on the tourism are greater than the effects of economic variables on tourism. Specifically; economic growth totally explains itself within the first period, however, the contribution of tourism receipts 0.008%, financial development 0.09%, trade openness 0.13% and exchange rate 21% is highly remarkable at the end of the10th period. Again, this shows that economic variables have slight effects on tourism.

This study investigates the panel Granger causality relationship approach and variance decomposition to test whether domestic economic growth promote tourists receipts, using, international tourism receipts, real GDP per capita growth, exchange rate, financial development, and trade openness for Asian countries over the period of 1995-2014 and whether regional effects should be considered a product of incomes groups in selected Asian countries. Drawing on the selected Asian countries experiments, the empirical investigation of tourism’s contribution to growth indicates that factors, as well as tourism-related factors, are conducive to economic growth.

The long-run relationships between tourism development and real GDP per capita signifies that both variables are causally related. This paper investigated not only whether tourism benefits have a different and more significant impact on the destination country in terms of economic development.

The approaches investigate cross-sectional dependency across selected Asian countries in the causality test; therefore, they may result in misleading inferences about the nature of causality between international tourism receipts and economic growth.

The results show there is panel cointegation relation between these two concepts, while PMG approach consisted long-run relations. Since the tourism sector plays a major role in economies, it is crucial to empirically verify the positive relation hypothesis as is commonly accepted in Asian countries. Our empirical results showed that the feedback hypothesis is unidirectional causality between tourism receipts and economic growth. And the neutrality hypothesis is in the nature of a causal direction between tourism receipts and trade openness in some Asian countries.

Based on the findings of the Panel Granger tests and variance decomposition analysis, tourism receipts and economic growth should be considered in the analysis, since they provide valuable information for policymakers. The interpretation of the causality test can help providing a tool to allocate limited resources in addition to developing appropriate tourism strategies.

These results may help a government to establish priorities about the resources for national strategies to economic Growth and development of tourism in Asian countries. Policy makers should careful in designing policies, especially in weighing up the share of investment in tourism and other productive sectors.

However, even though inputs of the tourism sector are importoriented in some Asian countries, it can be noted that the causality is from tourism to economic growth. This may arise simply due to the growth effect is driven by the initial conditions such as lower national income and/or population of the economy in consideration. Because the growth affect originated from tourism can be relatively bigger in the economies that have worse initial conditions than the economies with better ones. In other words, the marginal physical product of the inputs allocated in tourism in those countries may be relatively higher. The second explanation of why causality goes from tourism to economic growth in some Asian countries and it is in the opposite direction for some others can be attributed to the interconnections among the sectors. Assuming the tourism is linked to many other sectors, it is expected that the more tourism develops, the more the others produce and the faster an economy grows and vice versa.

International trade in general and capital goods imports in particular, appear as the catalysts of economic growth fostered by tourism. Therefore most contributions have focused on international tourism flows as they represent another source of external revenue for the nation. Another channel considered is the stimulation of interindustry linkages. In summary, studies show a causal link between tourism and economic growth, and that the weight of tourism on a country’s economy is a determinant of the degree to which tourism affects economic growth. However, little is known about how this occurs and what its effects may be.

Asian Countries with an established tourist attraction are likely to benefit from the inflow of tourists in the long-run which, in turn, fosters economic growth. However, places that do not have such a long history of tourism rely on their material to maintain tourist inflow, and economic growth is the only way to invest in tourism and sustain the inflows.

Finally, the economic growth itself may play a vital role in determining the causality between tourism and economic growth in Asian countries. Since growth also means the redistribution of income, it may result in the inefficiency of resource allocation. If the resources are allocated unequally among the sectors, some of the sectors will not receive sufficient resources for development. Thus, if the share of resources allocated for tourism is less on its contribution to economic growth.

The authors acknowledge financial support by Islamic Azad University, South Tehran Branch, and Iran for The Evaluation Impacts of Tourism Development on Iranian Economy project.