Journal of Agricultural Science and Food Research

Open Access

ISSN: 2593-9173

ISSN: 2593-9173

Research - (2022)Volume 13, Issue 3

Somali regional state is known for livestock production. Millions of pastoralists are relay on livestock and their byproducts as a major livelihood strategy. Despite the potential relevance of livestock production in improving the living conditions of pastoralists, little was done to understand the structure, conduct and performance of the livestock market. This study aimed to analyze the structure, conduct and performance of live goats marketing by selecting two districts from Korahe zone of Somali regional state. Cross sectional survey research design was applied for this study and data from primary and secondary sources were complemented through direct observations from the field along the market chain. Both traders and pastoralists were providing information through structured interviews, focus group discussions and key informant interviews. The data was analyzed by using market structure conduct-performance framework. Pastoralists, commission men, local collectors, small and large scale traders, hotels and restaurants were found to be major market actors. Four firms Concentration Ratio (CR4) result indicated that live goats marketing was characterized by a very less concentrated traders with traders concentration ratio of 18.99%. In relation to price setting mechanism, the price of live goats was set by both buyers and sellers however in case of sellers the negotiation is done by commission men. The highest total gross marketing margin was 45.69% when producers sold goat to local collectors through commission men and then to small scale traders, medium scale traders, and hotel and restaurants until reaches to consumers. Based on the findings, the study area has tremendous potential and the contributions of commission men in facilitating the marketing activity are incredible. Therefore, attention has to be given to reduce the problems through supporting commission men in order to reduce production and marketing cost.

Marketing margin; Commission men; Pastoralists; Live goats

Ethiopia is endowed with significant livestock resources and holds the largest livestock population in Africa, estimated at around 65 million cattle, 40 million sheep, 51 million goats, 49 million chickens and 4.5 million camels in 2020 [1]. In addition to the official value of livestock’s contribution to agricultural Gross Domestic Product (GDP), livestock supply power for farming and transport. The total economic benefits of livestock goods and services are estimated at more than 113 billion birrs [2].

Ethiopia is one of the top ten goat producing countries in the world. As per the livestock census carried out in 2016, Ethiopia owns approximately 30 million goats; of which 71.57% are females and the rest 28.43% are males. Majority of the national goat population is found in the lowlands. Nearly all (99.99%) of the goats are indigenous types [3]. Although Goats in Ethiopia are kept under traditional extensive system with no or minimal inputs and improved technologies which results characteristically low productivity, they are the livelihoods of small holder farmers, pastoralists and agropastoral alike [4].

Due to marked variability in rainfall, commercialization of livestock and livestock products is the dominant economic activity in the Somali regional state. The economics of livestock production and marketing are well known in Somali areas, where livestock can achieve high herd growth rates and as herds grow, more animals are supplied to markets [5]. The region possessed 17 million goats which represented about 33.8% of the national goat resource [1]. According to central statistical agency report, Korahe zeone has 609943 goats from this 156685 are male and 453258 are female goats [1].

Though the region has tremendous potential in livestock production, preliminary studies in the region and other reviews related in the regions livestock market have perceived the structure and performance of live animal market to be poor in both export and domestic market. The prevailing factors which affects the overall Ethiopian livestock trade is found to be critical to support the regions’ effort against the poor performance of the sector. For this reason this study focuses on the market chain analysis of live goats that can helps to measure the structure, conduct and performance of live goats in selected two woredas of Korahey zone, Somali national regional state, South Eastern Ethiopia.

Description of the study area

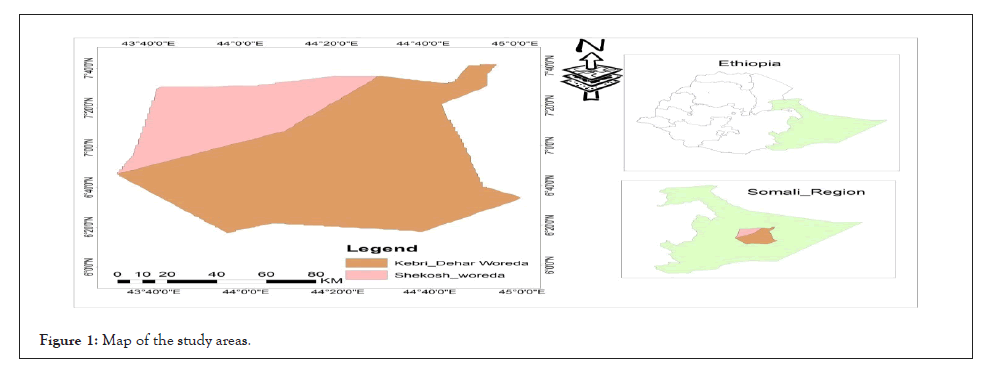

The study was conducted in Korahe zone, one of elven administration zones found in the Somali regional state of Ethiopia which is well-known by its goat production. The zone is bordered on the southwest by the Gode, on the northwest by Fiq, on the north by Degehabur, on the east by Werder, and on the southeast by Somalia's federal state of Galmudug (Figure 1).

Figure 1: Map of the study areas.

Sampling strategy and methods of data collection

A multi-stage sampling strategy was used to select goat producers. At the first stage, two districts namely Kabridahar and Shekosh were purposively selected due their proximity and convenience to data collection. In the second stage, four sample kebeles from the list of all pastoralist kebeles were selected randomly. Finally, a total of 184 goat producer households were randomly sampled taking into account probability proportional to size of producers in each kebele (Table 1).

| Names of producer Kebeles | Total number of households | Sample size of households |

|---|---|---|

| Daraselam | 1817 | 58 |

| Karinbidcile | 1189 | 38 |

| Qorijab | 1455 | 46 |

| Radoye | 1322 | 42 |

| Total | 5783 | 184 |

Table 1: Distribution of sample households.

The sampling activity of the goat traders were complicated by their mobile nature. A very limited number of goat traders were permanently stationed in the study area, so we randomly select eighteen available traders (11 local collectors, 5 small scale traders and 2 medium scale traders). A sample was also taken from service providers like hotels and restaurants. Six hotels and restaurants were sampled. In addition, six commission men were sampled because of their undeniable role in buying and selling of goats.

For the purpose of this study, both primary and secondary data sources were used. Researchers were collecting primary data through questionnaires from producers, traders and service providers, focus group discussions, key informant interviews, field observations and market assessments. Experienced goat producers were selected who had been using pastoral production strategies for a long time to discuss specific issues related to the purpose of the study and the various circumstances of goat production and trading in the area.

Method of data analysis

This study employed descriptive statistics such as ratio, frequency, range, mean and percentages. Structure, Conduct and Performance (SCP) method was used to analyze the data obtained from producers (pastoralist), traders, service providers and commission men.

Market structure: According to Kohls and Uhl [6], concentration ratio (CRx: the percentage of the market sector that is controlled by the biggest X number of firms) is a method widely used to examine the market structure of any market. The most classic concentration ratio widely used for judging market structure is ratio of four firms (CR4). A CR4 of more than 50 percent indicates a tight oligopoly; CR4 between 25 and 50 percent is generally considered a loose oligopoly; and a CR4 of less than 25 per cent is a competitive market.

Market conduct: According to Onyango [7], the conduct is measured in terms of what price is set by individual players for which product and for which consumers? This behavior captures the survival strategies of competitors in the market or adaption strategies to market conditions. Entry barriers are also considered as part of market conduct measurement. As stated by Bain [8], market conduct is analyzed in terms of price setting, purchasing and selling strategies of producers and traders. In this study, to measure the conduct of live goats marketing in Korahe zone the study used market information, entry to barriers, price setting and selling strategy of live goat producers and traders.

Market performance: Marketing margin is the difference between the amount that the consumer pays for the final product and the amount that the producer receives [9]. At each intermediary level, it is the difference between the price received on resale and the purchase price. Marketing margins reflect the costs and profits of middlemen [10].

The profit range accruable to market participants gives an indication of market performance [11]. Marketing margin has remained an important tool for analyzing marketing system performance. Costs and profit margins that make up marketing margins can be indicators of both efficiency and inefficiency in marketing systems. The benefits that accrue to individual participants may be incentives or disincentives to continue in the business. Proper computation, understanding and interpretation of marketing margin value in relation to prevailing circumstances can reveal a lot about performance in different marketing channels.

Total Gross Marketing Margin (TGMM): It is the difference between the final price paid by the end consumer and the producers’ price or it is the summation of individual marketing margins.

Furthermore, we can also calculate the percentage of marketing margin received by each traders and service providers.

Average annual cash income from goat’s sale

Since the household survey was focused on rural pastoralists, it is not surprising to find that almost all surveyed households in both districts earned income from rearing goats, camels, cattle and sheep. In addition, majority of households earned income from remittance from Saudi Arabia, Egypt and other Middle East countries. The annual income from goat’s sale was ranged from 12,000 to 52,480 ETB (Table 2).

| Income range in ETB | Daraselam | Karinbilcile | Radoye | Qorijab | ||||

|---|---|---|---|---|---|---|---|---|

| (N=58) | (N=38) | (N=46) | (N=42) | |||||

| N | % | N | % | N | % | N | % | |

| 12000-21999 | 9 | 15.5 | 3 | 7.9 | 6 | 13.04 | 11 | 26.19 |

| 22 000-31999 | 19 | 32.76 | 15 | 39.47 | 12 | 26.1 | 18 | 42.85 |

| 32000-41999 | 23 | 39.68 | 19 | 50 | 28 | 60.86 | 9 | 21.42 |

| 42000-52480 | 7 | 12.06 | 1 | 2.63 | - | 4 | 9.52 | |

Table 2: Average annual cash income of the study area.

The average cash income earned from goat’s sale among the 184 surveyed households was about 32240 ETB per year during the survey period. The total annual income of surveyed producers was around 5,932,160 ETB (32240 ETB × 184 households). Considering that all households in the districts have similar circumstances, we can use the same calculation to estimate the average annual cash income from goat sale for 5,783 households is shown in Table 2.

Market actors and their functions in live goats market chain pattern

Pastoralists are the primary actors as well as the first stage actors in the chain who perform most of the market chain functions right from providing feed for goats to handling and marketing. In the study areas, pastoralists kept goats range from 30 to 100, with an average of 65 heads. The common breeds of goat are the long eared and short eared goats. The main reasons for keeping goats are to generate income on a regular basis and for household consumption.

In the study area, local collectors usually buy goats from pastoralists home/farm gate and sometimes from bush markets to sell to consumers, small and large traders, butchers, hotels and restaurants. Local collectors use their financial resources and local knowledge to buy goats from the surrounding area. They may or may not have their own capital for marketing process. The contribution of local collectors in adjusting the goats market is undeniable. They play important role by identifying the areas of surplus so that it can be sold in a deficit areas.

Small scale traders are the major actors in the marketing channels located at the middle upper part of the market chain. They sell most of their goats directly to hotels, medium scale traders and other small scale traders. The main reason small scale traders being in the market is that they fetch higher prices from those markets. In the study area, more than 35 small-scale traders buy goats from pastoralists and local collectors from the two official markets (Kabridahar and Shekosh) from monday to sunday and unlike to other markets out of Somali region. The goat market is always from 5:30 AM-7:30 PM in morning.

The other chain actor located in the middle of the market chain is medium scale traders. There are more than 8 medium scale traders, who are relatively financially strong. Medium scale traders purchase goats from producers, small-scale traders and local collectors to sell mainly to butchers, hotels and end consumers. They play a larger role in transferring goats from Kabridahar market to other market place especially to Jigjiga market and informal exporters to Somali land in response to demand.

Hotels and restaurants are the final link in live goat market chain before the end consumer. In the study area, there are around 85 small, medium and large hotels and restaurants to Muslim community and around 36 hotels and restaurants for Christian community those could create jobs for more than 25 temporarily employed slaughters and 510 hotel staff.

Consumers are the final stage actors in market chain of goats those purchases the products from producers, local collectors, small and medium scale traders, and hotels and restaurants for consumption. They are the customers who buy goat meat either as raw or cooked form from different hotels and restaurants.

Unlike other parts of the country, live goats marketing in Somali region is totally different. In this region there is no buying and selling of goats in the absence of commission men at the primary market. The Commission men is a reliable source of information especially price information to the pastoralists. Each clan has their own commission men. According to our focusing group discussion, on average, large clans i.e., Dalal in Kabridahar and Xirsi in Shekosh have more than 12 commission men each and small clans i.e., Feraax booli in kabridahar and Higis in shekosh have around 6 commission men.

Brokers are marketing agents those facilitate the buying and selling activities. Brokers were mainly participating between local collectors and small scale traders, small scale traders and medium scale traders and medium scale traders and consumers. They have good price and other information. The main activity brokers usually did was negotiating and informing buyers and sellers. The average amount of money broker had got was 400-500 ETB per market day.

Market channels of live goats

The analysis of marketing channels is intended to know the alternative routes in which the product follow from the point of production to final destination (consumption) [12-14].

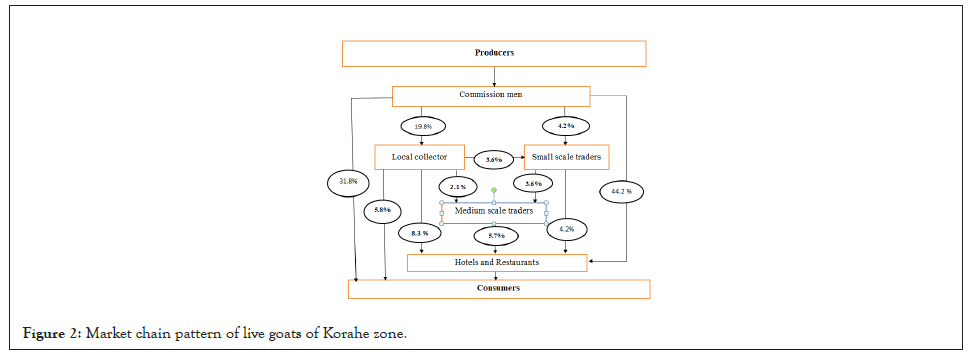

Channel I: Producers → Commission men → Consumers

Channel II: Producers → Commission men → Hotels and restaurants → Consumer

Channel III: Producers → Commission men → Local Collectors → Consumers

Channel IV: Producers → Commission men → Local collectors’ → Hotels and restaurants → Consumers

Channel V: Producer → Commission men → small scale traders’ → Hotels and restaurants → Consumers

Channel VI: Producers → Commission men → Local collectors’ → Small scale traders → Hotels and restaurants → Consumers

Channel VII: Producers → Commission men → Local collectors’ → Small scale traders → Medium scale traders → Hotels and restaurants → Consumers (Figure 2).

Figure 2: Market chain pattern of live goats of Korahe zone.

Market channel I is the channel in which the producers or pastoralists directly sell their goats to consumers through commission men came from the clan of the pastoralists. Around 31.8% of goats are directly provided to consumer with a fixed commission fee of 50 birr from buyers. It is the shortest channel of goat marketing in the study area and the channel stands as the second marketing channels in terms of volume. In market channel II, the pastoralist sells goats to hotels and restaurants through commission men and hotels and restaurants after adding utilities they sell to consumers. It is the first marketing channel in terms of volume of goat marketing (44.2%). In this case, the goats are taken to abattoirs for slaughtering then hotels and restaurants sell either directly by using balance at a price of 400 ETB per a kilogram or in the form of roast (Tibs) at a price of 70 birr, boiled meat (Kikel) at a price of 50 birr and in other forms.

In channel III, the local collectors buy goats from producers through commission men then sell to the consumers at bush market to gain profit. Sometimes local collectors may act as commission men. They act like commission men to gain commission fee and they act like collectors to gain some profit. Around 5.8% of goats were passed through this channel. The fourth channel is the channel in which local collectors purchase goats from producers and resale to hotels and restaurants, and hotels and restaurants to consumers. It is the third marketing channel in terms of volume of transaction. In this channel, additional agent middle men (brokers) are participated to facilitate the transaction between local collectors and hotels and restaurants. In this channel, 8.3% of goats were transacted.

In Channel V, small scale traders sell goats direct to hotels and restaurants by transport them to other cities outside the study area, the main objective of small scale traders being was that to fetch higher prices from those markets. Around 5.2% percentage of live goats passed through this channel. The goats are sold to medium scale traders and hotels and restaurants out of the study areas especially at Jigjiga and Dire Dawa cities. Channel VI is the channel in which local collectors purchase live goats from pastoralists and resale again to small scale traders. Small scale traders again sell to hotels and restaurants mostly found out of the study are like Jigjiga and other big cities. From the total transaction 3.6% of live goats were transacted through this channel. The possible longest channel of live goat marketing in the study area is channel VII. In this case, Local collectors buy goats from producer by paying 50 ETB to commission men then resale to small scale traders and the small scale traders sell to hotels and restaurants. Brokers may participate in this channel. From the total transaction 3.1% of live goats were transacted through this channel.

The participation of small scale traders and medium scale traders in live goats marketing is decreased since the outbreak of corona virus became the concern of our globe and our country Ethiopia. As per our discussion with key informants and pastoralists, this study able to understand, before corona virus there was high demand for goats for export purpose but now their participation is decreased.

Market concentration

In this study, the analysis of the degree of market concentration was carried out for all 30 sampled traders and service providers in the study area. It was measured by the percentage share of volume of live goats purchased by the largest four traders annually. This is therefore, as a rule of thumb suggested by Kohls and Uhl, [6]; the four trader’s concentration ratio represents for all live goats traders across the study area.

As Table 3 below shows, the Concentration Ratio (CR4) of the four largest traders for live goats is found to be 18.99 percent. Therefore, according to Kohls and Uhl, [15], live goat marketing is characterized by no oligopoly at all which is relatively very less concentrated traders indicating the market structure has a relatively a competitive nature. This means that no single trader or a group of few traders have no as such a big power on marketing of live goats (Table 3).

| Number of traders (A) | Cumulative frequency (A total) | % of traders (B) | Cumulative % of traders (E) | Quantity purchased in number (F) | Total quantity purchase (G) | % share of purchase (Si) | % Cumulative purchase (C) |

|---|---|---|---|---|---|---|---|

| 1 | 1 | 3.33 | 3.33 | 1245 | 1245 | 3.58 | 3.58 |

| 3 | 4 | 10 | 13.33 | 1650 | 4950 | 14.26 | 17.84 |

| 3 | 7 | 10 | 23.33 | 1620 | 4860 | 14 | 31.84 |

| 1 | 8 | 3.33 | 26.66 | 870 | 870 | 2.5 | 34.34 |

| 1 | 9 | 3.33 | 29.99 | 1012 | 1012 | 2.91 | 37.25 |

| 1 | 10 | 3.33 | 33.32 | 1641 | 1641 | 4.73 | 41.98 |

| 1 | 11 | 3.33 | 36.65 | 765 | 765 | 2.2 | 44.18 |

| 5 | 16 | 16.67 | 53.34 | 680 | 3400 | 9.8 | 53.98 |

| 2 | 18 | 6.66 | 59.98 | 845 | 1690 | 4.87 | 58.85 |

| 4 | 22 | 13.33 | 73.32 | 1340 | 5360 | 15.44 | 74.29 |

| 5 | 27 | 16.67 | 89. 99 | 1080 | 5400 | 15.56 | 89.85 |

| 2 | 29 | 6.66 | 96.67 | 1310 | 2620 | 7.55 | 97.4 |

| 1 | 30 | 3.33 | 100 | 900 | 900 | 2.6 | 100 |

| - | - | 100 | - | - | 34713 | 100 | - |

Table 3: Live goat trader’s concentration ratio in Korahe zone.

Market conduct

Price setting and selling strategy of live goat producers: The survey result showed that more than 95% of pastoralists negotiate on the price to sell their goat but the way of negotiation is totally different from what we know in commonly. In our study areas case the negotiation is done by commission man on behalf of the producers. The commission men received 50 birr as commission fee from buyers. The commission men have market information at what price the goat should be sold and set a price after negotiating with buyers. This shows the price setting manner of goat producers in the study area is dominated as the price determined by commission men that are beneficiary to the producer.

Market information plays a great role for traders because it affects the volume of the product to be purchased, price of purchasing and selling, and time of sales [16]. According to our market observation, the price set by small and medium scale traders is based on the information from other towns and supply of goats in the market, the more numbers of goats in the market the lower price they set and vice versa. In addition, the price of the goat was set by traders also depends on presence and absences of occasions in the study area. At times of special occasions, the demand is very high at the same time the price become high.

During buying all traders make a price difference for quality based on their experience. Majority of traders attract buyers by paying reasonable price and using correct measure. With regard to the time of purchase, 35% of the respondents purchased live goats at the time of special occasions and the remaining ones purchased throughout the year. During buying more than 97% of the sampled traders set price by negotiation.

Market performance

Marketing costs: As depicted in the table below, the average marketing costs of live goats producers/pastoralists and local collectors have the lowest marketing costs and the remaining actors. Small scale traders, medium scale traders, and hotels and restaurants have the highest marketing cost. The cost of pastoralists was transportation and rope costs amounted 45 birr on average which is less than the cost incurred by other actors. Costs for local collectors, small scale traders, medium scale traders, and hotels and restaurants had commonly included expenses for taxes, transportation, brokers, ropes, slaughter fee, and personal transport and other costs (Table 4).

| Cost in birr per goat, per day | ||||||

|---|---|---|---|---|---|---|

| Cost | Producers | Local collectors | Small scale traders | Medium scale traders | Hotels and restaurants | Mean |

| Taxes | - | 30 | 30 | 30 | 30 | 24 |

| Transportation | 30 | - | 60 | 60 | 20 | 34 |

| Brokers | - | - | - | 20 | - | 4 |

| Rope | 15 | 15 | - | - | - | 6 |

| Slaughter fee | - | - | - | - | 250 | 50 |

| Personal transport and other costs | - | 40 | 100 | 150 | 50 | 68 |

| Total marketing cost | 45 | 85 | 190 | 260 | 350 | - |

Table 4: Marketing costs for different marketing agents.

When the length of the channel increases, traders (small scale and large scale) incur higher costs to transport goats from the study area to other cities and towns. The costs incurred by small scale traders and medium scale traders include transportation cost including loading and unloading costs, and personal transport and other costs. The highest portion of cost to hotels and restaurant was slaughter fee. When demand is high, hotels and restaurants incur higher costs to slaughters per goat even.

Gross marketing margin: The relative size of various market participants’ gross margins can indicate where in the marketing chain value is added and/or profits are made [13]. Without considering channel I the highest portion of the price paid by the consumer that goes to the producer was recorded in channel III which was around 94.34% and the lowest percent was received in channel VII which was 54.35%. The pastoralists in the remaining channels (II-VI) were also received more than 56% of the price paid by consumer. However, as the chain actors increase the percentage share was decreased. The result of this study was concordant with Onyango, 2013, as the value chain becomes longer and involves more transactions between different actors; the pastoralists’ share of the final price diminishes.

In addition to producers marketing margin, percentage share of traders and service providers from the total gross marketing margin (% MSCM, % MSLC, % MSSST, % MSMST and MSHR) was analyzed. Though the amount of money paid for commission men is fixed (50 birr), the highest percent of margin from the total margin was received in channel III (26.32%) next to channel I (100%) by commission men. Hotels and restaurants received the highest percent of margin in channels II-VII. This result shows that, hotels and restaurants fetch high marketing margin by adding different utilities. The total gross marketing margin was highest in channel VII which was around 2659 Ethiopian birr and lowest in channel I which was 50 Ethiopian birr (Table 5).

| Channels | ||||||||

|---|---|---|---|---|---|---|---|---|

| Actors | Price in Birr | I | II | III | IV | V | VI | VII |

| Producer | Selling price | 3166 | 3166 | 3166 | 3166 | 3166 | 3166 | 3166 |

| Producers’ share % | 98.45 | 66.52 | 94.34 | 66.3 | 60.47 | 56.34 | 54.35 | |

| Commission men | Selling price | 3216 | 3216 | 3216 | 3216 | 3216 | 3216 | 3216 |

| Margin | 50 | 50 | 50 | 50 | 50 | 50 | 50 | |

| % GMMCM | 1.55 | 1.05 | 1.49 | 1.04 | 1.08 | 0.88 | 0.86 | |

| % MSCM | 100 | 3.37 | 26.32 | 3.1 | 2.41 | 2.03 | 1.88 | |

| Local collectors | Selling price | - | - | 3356 | 3316 | - | 3396 | 3396 |

| Margin | - | - | 140 | 100 | - | 180 | 180 | |

| % GMMLC | - | - | 4.17 | 2.1 | - | 3.2 | 3.09 | |

| % MSLC % | - | - | 73.68 | 6.23 | - | 7.35 | 6.76 | |

| Small scale traders | Selling price | - | - | - | 3730 | 3945 | 3650 | |

| Margin | - | - | - | - | 514 | 549 | 254 | |

| % GMMSST | - | - | - | - | 9.8 | 9.78 | 4.36 | |

| % MSSST % | - | - | - | - | 24.84 | 22.37 | 9.55 | |

| Medium scale traders | Selling price | - | -- | - | - | - | - | 4113 |

| Margin | - | - | - | - | - | - | 463 | |

| % GMMMST | - | - | - | - | - | - | 7.99 | |

| % MSMST % | - | - | - | - | - | - | 17.42 | |

| Hotels and restaurants | Selling price | - | 4760 | - | 4775 | 5235 | 5620 | 5825 |

| Margin | - | 1544 | - | 1459 | 1505 | 1675 | 1712 | |

| % GMMHR | - | 32.42 | - | 30.56 | 28.74 | 29.8 | 29.39 | |

| % MSHR | - | 96.53 | - | 90.67 | 72.75 | 68.25 | 64.39 | |

| % TGMM | 100 | 100 | 100 | 100 | 100 | 100 | 100 | |

| Consumers price | 3216 | 4760 | 3356 | 4775 | 5235 | 5620 | 5825 | |

| TGMM | 50 | 1594 | 190 | 1609 | 2069 | 2454 | 2659 | |

Table 5: Gross marketing margin and its distribution along the channel.

Net marketing margin and percentage share: As shown in the table below, hotels and restaurants received the highest share from the total margin in channels II-VIII. This indicated that hotels and restaurants add more value than other chain actors next to producers. Small scale traders took the highest share in channel V and VI which was 6.19% and 6.38%, respectively. Medium scale traders were only participating in channel VII and they took the second highest share next to hotels and restaurants. In addition, the net share of the producer from the final consumer price was calculated and the producer received more than 50% of consumer price in all channels (Table 6). The performance of live goat marketing was evaluated by considering gross marketing margins, associated costs and net marketing margins with channels comparison. Therefore, as we go from channel I to channel VII the percentage share of producer from the final consumer price was decreased. On the contrary, marketing cost was increased. This was due to market chain actors add value to the live goats as they pass from one actor to another. In a way, the actors add value like form, place, and time utilities on the goats.

| Marketing margin % | Ch-I | Ch -II | Ch-III | Ch-IV | Ch-V | Ch-VI | Ch-VII |

|---|---|---|---|---|---|---|---|

| Net sharep | 97.04 | 65.56 | 92.99 | 65.36 | 59.61 | 55.53 | 53.57 |

| NMMCM | 1.55 | 1.05 | 1.49 | 1.04 | 0.95 | 0.88 | 0.85 |

| NMMLC | - | - | 1.63 | 0.31 | - | 1.69 | 1.63 |

| NMMSST | - | - | - | - | 6.19 | 6.38 | 0.94 |

| NMMMST | - | - | - | - | - | - | 3.48 |

| NMMHR | - | 25.08 | - | 23.22 | 22.06 | 23.57 | 23.38 |

Table 6: Gross marketing margin and its distribution along the channel.

Pastoralist survey was conducted in 2020/21 by interviewing 184 pastoralists and 30 traders and service providers through structured questionnaire. Structure, Conduct and Performance (SCP) method was used to analyze the data obtained from producers (pastoralist), traders, service providers and commission men. The study result revealed that four firms concentration ratio of live goats marketing was about 18.99%. This means from the total number of goats came in the market, 18.99% were purchased by four firms and the market was near to monopolistically competitive.

Moreover, this study also tried to investigate the conduct and performance of the market. More than 95% of pastoralists were represented by commission men who have good market information to negotiate the price. Likewise, traders and service providers set a price based on information from other towns, supply of goats in the market and presence and absences of occasions in the study area. Further analysis was also done to measure the performance of the market. The marketing costs of producers and local collectors was relatively lower than small scale traders, large scale traders and hotels and restaurants and the marketing margin of producer is high in the shortest marketing channel.

Therefore, since the study area has tremendous potential in livestock production especially in goat production, the government should create market linkage with rest of the world to improve the income and living standard of pastoralists. In addition, unlike to other areas the contribution of commission men as source of market information to pastoralists and security to buyers is huge. So, the government should legalize commission men to exploit their potential in live goat marketing.

Citation: Tadesse M, Tsega W, Kidanie D, Mohamed A (2022) Market Chain Analysis of Live Goats: The Case of Korahe Zone, Somali Regional State, Ethiopia. J Agri Sci Food Res. 13:497.

Received: 02-May-2022, Manuscript No. JBFBP-22-16564 ; Editor assigned: 04-May-2022, Pre QC No. JBFBP-22-16564 (PQ); Reviewed: 18-May-2022, QC No. JBFBP-22-16564 ; Revised: 25-May-2022, Manuscript No. JBFBP-22-16564 (R); Published: 06-Jun-2022 , DOI: 10.35248/2593-9173.22.13.497

Copyright: © 2022 Tadesse M, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.