Journal of Hotel and Business Management

Open Access

ISSN: 2169-0286

ISSN: 2169-0286

Research Article - (2022)Volume 11, Issue 5

Social work studies on entrepreneurship warn that a deliberate, planned and systematic rational choice process that promotes the formation of intellectual capital is predominant determinants. Specify a model for the study of the dimensions of trust: experiences, knowledge, skills, emotions and abilities. Non-experimental, documentary and retrospective study with a non-random selection of sources indexed in repositories, considering the keywords and the publication period 2019-2022. A model with eight hypotheses of three paths of dependency relationships between nine variables raised in the state of knowledge was specified.

Heads of family; Social work; Entrepreneurship; Specification; Model

The objective of this study is to specify a model for the study of social entrepreneurship in household heads [1]. From a review of the literature, the variables that allowed systematizing the determinants of entrepreneurship trajectories [2] are extracted.

The study is part of the humanities and social sciences division, social work discipline, health promotion area and reproductive rights promotion subarea, parental upbringing styles and management of heads of household [3].

However, the project also has interference in economic and administrative sciences, since it will recover in the second phase the effect of cooperative entrepreneurship in human development with an emphasis on reproductive health, family upbringing and the training of entrepreneurs [4].

Intellectual capital theory

The principles that guide the rational choice lie in the tastes and preferences that crystallize the objectives of the actors [5]. Therefore, before making any decision linking preference strategies, it will be possible to collect information that will determine the choice [6]. If individuals prefer to have an indeterminate number of tastes, objectives and goals, then their preference will no longer depend on their ability to choose and act [7]. Therefore, they act non-rationally [8].

Rational choice theory also warns that a decision is the result of an estimation of the costs and benefits of making an effort regardless of its degree of significance [9]. This is a utilitarian dimension in which the control of a situation based on the establishment of a favorable balance of benefits versus costs will determine the choice [10].

More specifically, the benefits and costs translate into a relationship of risk, effort and reward [11]. This means that a choice will be rational when the risks and efforts are minimal as long as the rewards are greater [12].

On the other hand, when the recognition of an effort and risk does not live up to expectations, then the choice has not been entirely rational and rather approaches an irrational dimension if the risks and efforts are increasing and intense with respect to the absence of rewards [13].

This is because the individual attempting it is committed to risks that will be triggered by expectations of gains [14].

The integration of each of the variables represents a series of paths in which the correlations explain each choice [15].

In short, rational choice explains in general terms the process by which preferences are the determining factor for other factors that generate information or intuit an environment of certainty when deciding and acting accordingly [16]. To the extent that such information is available, accessible and actionable, then rational choice will emerge as an option, but rather ambiguity will proliferate, then a non-rational decision with irrational consequences will be generated [17].

However, when information is unavailable or highly abstract, rational choice is replaced by a stricter choice to culture; people's values and norms regarding a contingency for which no precedent is known, but people always react in the same way [18].

Intellectual capital studies

If the rational choice is generated from preferences based on the information available to determine tastes and objectives, the prospective attitude suggests that the absence of information creates uncertainty that determines risk aversion or the renunciation of certain gains and appetite for risk. When losses are imminent [19]. Thus, utility, benefit or happiness crystallizes into losses or gains, eluding the process of rational choice and legitimizing an irrational choice [20].

Therefore, a prospective is more than a decision; it lies in the attitude and expectation of risk or certainty in the face of profits and losses in the immediate future. In that sense, a retrospective is an attitude that is the same relations but compared with the last ones [21].

In short, the prospective attitude is a hinge between rational choice and reasoned action. Each of these theoretical and conceptual frameworks bases its scope and limits on the availability of information, if the individual is capable of assuming an attitude, making a decision or carrying out an action that corresponds to the available information and the representation that it has of it [22].

Modeling of intellectual capital

Unlike rational choice theory, which focuses on the usefulness of available information, and prospective attitude theory, which focuses on the certainty of information, reasoned action theory assumes that information, whatever In other words, it is a general environment that will influence behavior to the extent that information is transformed into rules. This is because the theory of reasoned action considers that all information is cognitively processed [23].

Therefore, a general vision of the environment, its demands and opportunities favors categories of accessible and abundant availability of information that will influence wasteful behavior such as believing that jobs, salaries and financial credits increase significantly [24]. On the contrary, if the context is considered to be one of recession and economic crisis, austere, cooperative and innovative lifestyles will be adopted [25].

However, the theory of reasoned action, like the theory of rational choice and the theory of prospective attitude, pose a general scenario incident on a specific behavior without considering the current and specific situation of the decision maker.

Sample a documentary work was carried out with a selection of sources indexed to international repositories such as Scopus and WoS, considering the keywords "specification" and "intellectual capital" in the period from 2019 to 2022 (Table 1).

| Code | Author | Sample | Criterion | Relationship |

|---|---|---|---|---|

| a1 | Carreon, et al. 2019 | 100 | Formative | capital attitude ← |

| a2 | Carreon, et al. 2019 | 140 | Formative | capital commitment ← |

| a3 | Baptist, et al. 2019 | 120 | Formative | capital accession ← |

| a4 | Juarez, et al. 2019 | 160 | Formative | Regulatory Capital ← |

| to 5 | Llamas, et al. 2019 | 100 | Formative | capital accession ← |

| a6 | Martinez, et al. 2019 | 160 | Formative | capital welfare ← |

| a7 | Garcia, et al. 2020 | 130 | Formative | capital attitude ← |

| a8 | Bust, et al. 2020 | 130 | reflexive | Liability Capital → |

| a9 | Ferr, et al. 2021 | 150 | Formative | capital commitment ← |

| a10 | Morales, et al. 2021 | 130 | Formative | capital self-care ← |

| a11 | Quintero, et al. 2021 | 140 | Formative | capital prevention ← |

| a12 | Carreon, et al. 2021 | 110 | reflexive | Capital Innovation → |

| a13 | Garcia, et al. 2022 | 140 | reflexive | Capital Commitment → |

Source: Elaboration with data study: a= Summary

Table 1: Descriptive data.

Process: A search of summaries was carried out to subtract the indicators of intellectual capital, considering equation (1). Then, once the indicators of empathy, trust, commitment, entrepreneurship, productivity, competitiveness, innovation, satisfaction, and happiness were selected, experts on the subject rated these indicators in order of importance, with 10 being the most important and 0 being zero or none. Importance . The data was processed in the statistical analysis package for social sciences version 20.0

Analysis: Percentages, contingencies and proportions were estimated to establish risk thresholds in decisionmaking on intellectual capital indicators.

The confidence indicator obtained the highest percentage (25%) followed by commitment (22%), empathy (17%), entrepreneurship (13%), satisfaction (9%), innovation (6%), productivity (4%), competitiveness (3%), happiness (1%). This means that decision making is based on the level of trust, although the instrument does not specify the type of trust that can be organizational, interpersonal, intrapersonal or technological (Table 2).

| 95% credible interval | ||||||

|---|---|---|---|---|---|---|

| To mean | South Dakota | Lower | Higher | BF₁₀ _ | ||

| Fixed effects | m | 0.477 | 0.052 | 0.375 | 0.577 | 4,533e +17 |

| Ordered effects | m | 0.479 | 0.056 | 0.37 | 0.588 | 1,212e +17ᵃ |

| τ | 0.076 | 0.035 | 0.027 | 0.161 | 0.267ᵇ | |

| Random effects | m | 0.478 | 0.056 | 0.369 | 0.588 | 7,447e +16 |

| τ | 0.076 | 0.036 | 0.027 | 0.163 | 0.164ᵇ | |

Note. μ and τ are the effect size at the group level and the standard deviation, respectively.

ᵃ Bayes factor of the fixed effects H ₁ over the ordered effects H₁. The Bayes factor for the unrestricted (random) effects H 1 model versus the ordered effects H₁ model is 1.627.

ᵇ Bayes factor of the (unrestricted/restricted) random effects H₁ over the fixed effects H₁.

Source: Prepared with data study

Table 2: Posterior estimates by model.

It is possible to see that the values of the random effects are within the threshold that explains 95% of the credibility. In other words, the decision to consider established relationships involves a five percent risk given the homogeneity of the metaanalytic review on intellectual capital formation (Table 3).

| Previous | Later | |

|---|---|---|

| Fixed H₀ | 0.250 | 1,54 e-18 |

| Fixed H₁ | 0.250 | 0.699 |

| H ordered ₁ | 0.250 | 0.187 |

| Random H₁ | 0.250 | 0.115 |

Source: Prepared with data study

Table 3: Model probabilities.

The contingency parameters suggest significant differences between decisions made based on intrapersonal trust versus interpersonal trust [x2=16.27 (16 df) p < .05]. In other words, as an educational process, intellectual capital focuses on internal capabilities, experiences, skills, knowledge and emotions rather than their externalization by socializing knowledge (Table 4).

| Dear | ||||

|---|---|---|---|---|

| Observed | means | Lower | Superiorᵃ | |

| Carreon, et al. | 0.432 | 0.476 | 0.29 | 0.663 |

| Carreon, et al. | 0.356 | 0.467 | 0.279 | 0.644 |

| Baptist, et al. | 0.431 | 0.467 | 0.306 | 0.617 |

| Juarez, et al. | 0.365 | 0.463 | 0.28 | 0.632 |

| Llamas, et al. | 0.476 | 0.478 | 0.295 | 0.662 |

| Martinez, et al. | 0.423 | 0.471 | 0.293 | 0.642 |

| Garcia, et al. | 0.546 | 0.492 | 0.332 | 0.664 |

| Bust, et al. | 0.324 | 0.456 | 0.269 | 0.621 |

| Ferr, et al. | 0.567 | 0.484 | 0.296 | 0.678 |

| Morales, et al. | 0.657 | 0.495 | 0.320 | 0.688 |

| Quintero, et al. | 0.547 | 0.487 | 0.314 | 0.669 |

| Carreon, et al. | 0.643 | 0.494 | 0.322 | 0.684 |

| Garcia, et al. | 0.543 | 0.485 | 0.309 | 0.670 |

| Hernandez | 0.356 | 0.462 | 0.279 | 0.632 |

| Juarez | 0.436 | 0.474 | 0.288 | 0.655 |

| Spinoza | 0.654 | 0.495 | 0.320 | 0.690 |

| Quintero | 0.672 | 0.497 | 0.323 | 0.694 |

ᵃ Posterior mean and 95% credible interval estimates from the random effects model.

Source: Prepared with data study

Table 4: Effect sizes by study.

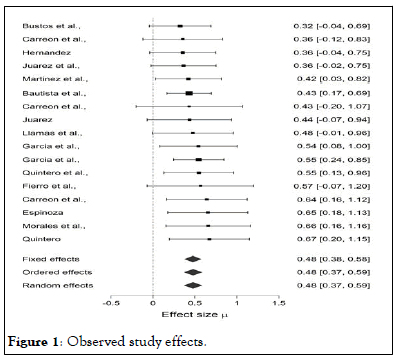

The probability proportions suggest that the training process of intellectual capital, focused on intrapersonal confidence in skills (OR=17.21(13.24 to 19.20)), skills (OR=18.21 (14.35 to 20.21)], knowledge (OR=15.43 (13.24 to 21.23)), experiences (OR=18.20 (14.32 to 23.45)), and emotions (15.46 (10.21 to 22.31)), is at a permissible risk threshold. It then means that the intervention of social work can be based on the formation of intellectual capital and its indicators of intrapersonal trust (Figure 1 and Table 4 ).

Figure 1: Observed study effects.

Source: Prepared with data study

The contribution of the present work to the state of the question lies in the specification of a model for the study of intellectual capital, considering the dimensions of intrapersonal trust in which skills; emotions, experiences, abilities and knowledge are framed, in the expert rating, were located at tolerable risk thresholds.

In relation to the literature where the intellectual captain is approached from non-formative organizational dimensions such as cooperation, tasks, goals, objectives or innovations, this work suggests complementing these dimensions with intrapersonal ones to establish differences between professional training and professional training job training.

Future lines of research around the structural models of intellectual capital, human capital and social capital will make it possible to establish a predictive explanation of academic, professional and work training.

Given that the information is not available or is actionable by the actors that require immediate planning of their actions, the determinants of planned behavior are those in which the information can be delimited and specified based on a particular situation or situation. An event that is subjective decision control make information available and actionable.

Planned behavior theory finds that perceived control is a significant determinant of behavior in both direct and indirect ways. Interacting with subjective norms and attitudes generates an intention that is also assumed to determine behavior.

However, perceived control, as a norm and attitude, depends on a set of beliefs about the availability of information. In this sense, the specification of a model would include variables that anticipate the behavior, but not from the beliefs of availability of information, but from the willingness to cooperate of the actors that form a business project to develop their skills, not only of choice, deliberation or planning, but innovation.

[Crossref]

[Crossref]

[Crossref]

[Crossref]

[Crossref]

Citation: Escobar AB, Lirios CG, Guillen JC, Valdes JH, Morales FE (2022) Meta-Analysis of Intellectual Capital in the Era of COVID-19. J Hotel Bus Manage. 11:023.

Received: 07-Apr-2022, Manuscript No. JHBM-22-16646; Editor assigned: 11-Apr-2022, Pre QC No. JHBM-22-16646(PQ); Reviewed: 25-Apr-2022, QC No. JHBM-22-16646; Revised: 07-Jun-2022, Manuscript No. JHBM-22-16646(R); Published: 14-Jun-2022 , DOI: DOI: 10.35248/2169-0286.22.11.023

Copyright: © 2022 Escobar AB, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.