Journal of Tourism & Hospitality

Open Access

ISSN: 2167-0269

ISSN: 2167-0269

Review Article - (2024)

Tax evasion causes a significant loss of revenue from the state budget not only in the Slovak Republic but also in the European Union. Therefore, European Union countries are looking for ways to detect tax evasion. It is not possible to eliminate tax evasion, but it is possible to effectively detect and combat tax evasion through legislation as well as through effective tax control. This paper aims to outline the theoretical as well as practical approach to quantifying tax evasion and to make recommendations aimed at reducing the tax gap.

Tax evasion; Tax evasion quantification; Tax gap; Tax gap calculation approaches

As a global phenomenon tax evasion is present in all economies. It is a problem to solve it and take effective control over it. The purpose of this work is to determine the assumptions of tax evasion, primarily in the area of indirect taxes, which occur at the micro level in the context of long-term assets and their share in the costs of the organization and in the creation of the economic result, and subsequently its estimated impact on the amount of tax evasion at the level of the organization with a focus on accommodation facilities.

Studies conducted in the past have shown that investments in fixed assets can have a significant impact on a company's profitability. For example, Eriotis, et al., examined the relationship between the debt-to-equity ratio and firm profitability, taking into account the firm's level of investment and the degree of market power achieved [1]. One of the possibilities for evaluating the efficiency of long- term assets in connection with the company's achieved results is the calculation of the turnover of long-term assets in proportion to obtaining a market advantage over the competition. This comparison can give the investor an idea of how efficiently the investment property is being used. Although it is a less accurate measurement of the impact of the value and condition of long- term assets on sales, this indicator is interesting. A higher number of turnovers of long-term assets brings a higher share of sales [2].

At the same time, during the reduction of the amount of funds allocated for the restoration of investment property over the years, their influence on the entire structure of material and technical resources necessary for economic growth and efficient functioning of the company was limited [3].

The focus on the use of long-term assets and their impact on the costs of the organization with an impact on the economic result is justified from various points of view. One point of view is the way it is used in the process of carrying out economic activity, the ways in which this property shares in the company's costs, but also its role in achieving the so-called sales. shadow economic activity at the macroeconomic and microeconomic levels.

According to the Organization for Economic Cooperation and Development (OECD) definition, an economy in which all activities are legal and productive, but are deliberately hidden from public administration, is referred to as unofficial, shadow, informal, hidden, or even dual or parallel. The purpose of this secrecy is to avoid compliance with payments to the state budget (taxes and social security), administrative procedures and/or minimum legal requirements (minimum wages, safety standards, etc.). The shadow economy includes not only illegal activities, but also unreported income from the production of legal goods and services, either from cash or barter transactions, and therefore includes all productive economic activities that would be taxed if reported to the state tax authority [4].

From different points of view, there is a range of classifications of the grey economy. In general, the grey economy manifests itself in the field of business relations from unregistered business transactions (profits from unauthorized business and tax evasion), as well as from labor relations (illegal employment, reduction of legal hours) [5]. Effectively, the grey economy can be divided into: 1) The active grey (shadow) economy, which makes up about 22% Schneider et al., of the total estimated turnover of the grey economy [4]. This category includes business transactions that cannot be seen as completely illegal. From the business relationship, both parties benefit from the transaction, the prerequisite is the full or partial use of cash payment for the sale of the product without transparent records for a consideration significantly lower than the official price. Thus, the seller gets the advantage of not paying value added tax and, consequently, income tax, and the buyer has a lower purchase price by the amount of Value-Added Tax (VAT). Similarly, this method is also used in the area of the labor market, when part of the salary is paid in cash without inclusion in the gross salary as a basis for calculating all social and health insurance contributions and income tax from dependent activity. 2) The passive grey (shadow) economy, which makes up the remaining 78% of the turnover of the grey economy. Its characteristic is the fact that only one party benefits from the illegal trade, namely the seller. When selling goods or services, they will use the option not to issue a document for the provided performance, so they will not include the full sales price in the basis for calculating direct taxes, as well as for calculating indirect taxes. This will avoid paying income tax, as well as value added tax or other excise taxes (depending on whether the sale of goods is also subject to additional excise taxes) [6].

Long-term assets as a form of productive capital in the production process are perceived as an essential part of it. It is not a permanently turning material like stocks, its turnover time is very low, and in many cases its technical evaluation can be perceived as the turnover time. Sometimes it is very difficult to determine what volume of production for what exact period of time it will be possible to produce in the future with the help of this asset. It is possible to assume its service life and it is also possible to assume expenses for its maintenance or further evaluation. It transfers its value to the value of the property gradually in the form of depreciation, which can have the character of uniform or accelerated depreciation. It is the correct method of calculating depreciation from long-term assets that can play a role in calculating the correct result of the company's management, even for estimating possible tax evasions at the micro level.

Accommodation facilities are part of the small and medium-sized business sector in the Slovak Republic. Most often, these facilities provide mixed services, i.e, accommodation combined with catering and additional services.

Pursuant to the requirements of Act no. 431/2002 Coll. on accounting as amended, the organization accounts for costs, revenues, assets and liabilities in the accounting period with which it is materially and temporally related. Achieving this requirement is often difficult in the field of depreciation of fixed assets. Organizations most often simplify the procedure of including costs due to ownership of long-term assets by lumping them in, even very often by including depreciation in costs under the condition of equal accounting and tax depreciation. Tax depreciation is set by law as a certain social average when using different categories of property without the specifics of a specific company. The method of calculating depreciation of long-term assets into costs based on the principle of costs per unit of performance appears to be the most correct.

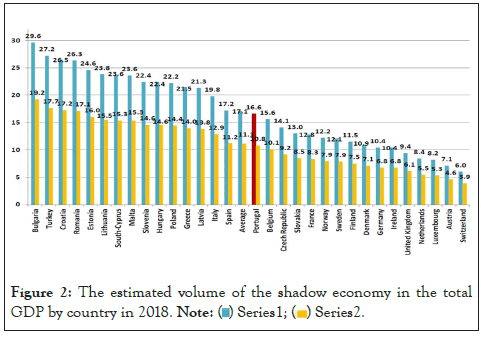

In accommodation facilities, this would be the determination of depreciation for one overnight stay. The basic formula can be used for the calculation:

where:

DE-Cost of Depreciation

OV-Original Value

SV-Salvage Value

EPC-Estimated Production Capability

U-Number of Performances (Products) per year

To calculate the estimated tax evasion in the field of indirect taxes, we adopted the methodology of estimating and calculating the volume of the so-called of the grey economy in Slovakia, which is used within the European Union.

Direct and indirect approaches are used for calculation methods, but most often model approaches. Direct methods are aimed at adding GDP to grey production in a certain place and time, i.e. sample surveys or tax evasion surveys. They are detailed and accurate, but limited in that they can only quantify a sample set.

Indirect methods have a macroeconomic character and are most often monetary methods, which is also their disadvantage. The model approach is based on the assumption of causality between the cause and effect of the shadow economy. The most frequently used is the MIMIC (Multiple-Indicators and Multiple-Causes) method [7].

Focusing on the accommodation facilities sector in Slovakia, specifically only on accommodation excluding additional services provided, means adjusting the input data.

The modification for the accommodation facility will form an identical formula, where the input variables will be: 1) OV- Acquisition price of property that is only related to accommodation, for property that is used also for achieving other outputs, this price is determined by the ratio, 2) SV-Residual price from the property determined similarly to the purchase price for the same property, 3) EPC-Estimated period of use of the property at average utilization of bed capacity accommodation facility, 4) U-Number of overnight stays for the accounting period.

This procedure assumes that a separate depreciation plan is drawn up for each calendar year for accounting depreciation, which at the end of the accounting period is re-evaluated and recalculated according to the actual services provided in the number of overnight stays.

At the same time, it is necessary to determine the average deviation from tax depreciation for the methodology of calculating depreciation per unit of accommodation in accommodation facilities. Of course, the calculation can only be based on actual admitted and declared overnight stays. If we want to estimate the impact of asset depreciation on possible tax evasion from shadow income, it is also necessary to take into account the methodology of estimating this income.

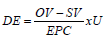

For the calculation of shadow incomes, we used the published research results of the model method of determining the estimate according to analyst Schneider, et al., which until 2016 shows a balanced trend of illegally obtained income in the Slovak Republic [8]. Shown in the following graph in Figure 1.

Figure 1: The estimation of the shadow economy shown in the table shows a relatively balanced trend in the Slovak Republic, it expresses the lowest estimated level of the estimate.

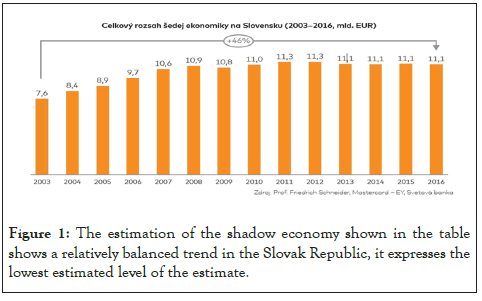

On average, up to 2017, the estimated amount of the shadow economy was maintained at the level of 13%-13.7% of GDP, which compared to neigh-boring countries was still not among the highest estimates. From the overall average, Slovakia is a country with a comparatively lower one (Figure 2).

Figure 2: The estimated volume of the shadow economy in the total

GDP by country in 2018. Note: ( ) Series1; (

) Series1; ( ) Series2.

) Series2.

The final step in the calculation of possible and estimated tax evasion of indirect tax-value added tax, as well as income tax is then the recalculation of performance depreciation for the estimated number of unclaimed overnight stays, which were included in regular costs, and at the same time the calculation of VAT from the difference in estimated shadow income.

Based on the data in the selected 15 hotels with an accommodation capacity of over 100 beds (the area of High Tatras, Low Tatras and the district of Košice), we recalculated performance depreciation for one overnight stay from the data for the years 2018-2022, as well as the share of those cost components that were included in the costs once, but their use can be assumed for longer than one year. These are the costs of other small items, such as smaller room furnishings, bed linen, televisions, etc. We recalculated each item to the period of use it would have if its acquisition price exceeded the threshold at which it would have to be recorded as a long-term asset. To calculate the estimated shadow income, we used the percentage data according to the graphically displayed data above.

Through a very detailed analysis of all items in the selected accommodation facilities, we found the following data of possible shadow income and realistically calculated performance depreciation of all assets that participated in the costs of accommodation for one night, with the following data on average per year and facility in Table 1.

| Text | Amount |

|---|---|

| Accomplished acquisition from accommodation | 14,19,16,200 |

| Number of overnight stays | 31,22,500 |

| Performance depreciation of long-term assets/night | 261 |

| Performance depreciation of other assets/night | 060 |

| Estimated shadow sales | 1,27,724,00 |

| Estimated unacknowledged number of overnight stays | 2,81,000 |

| Estimated undeclared VAT on income from shadow income | 12,77,200 |

| Overestimated costs due to depreciation | 8,14,300 |

| Estimated DPPO tax evasion due to increased depreciation | 1,71,000 |

Table 1: Overview of average indicators in monitored accommodation facilities per year.

We drew data on sales from the register of financial statements of the Slovak Republic for the last three years, i.e, 2018-2022, as well as on the basis of the main books and lists of assets, which for the purposes of implementation research these devices provided. None of the facilities included in the calculation can be linked to the fact that they have shadow income or a shadow economy. It would be just a hypothesis that can neither be proven nor rejected.

Currently, for tax purposes in the Slovak Republic, it is only possible to use tax depreciation provided by law, therefore the calculation of the leakage due to the change in the depreciation method is only theoretical. However, it leaves room for the possibility of re- evaluating the option of using performance depreciation for tax purposes as well.

However, it is clear from the table that at the microeconomic level, there may be a difference in performance depreciation per unit of performance of 11%-12% with the estimated shadow economy in the Slovak Republic in the range of 8.8%-9.1%, in accordance with the conclusions of the decrease in the tax gap at the level of the European Union and the Financial Administration of the Slovak Republic. Unit depreciation would affect the total costs of the accommodation facility. Under the given assumption, the average sales of one accommodation facility would be legally declared lower than in reality by EUR 1,27,724 with an impact on the undeclared and unpaid VAT at its reduced rate of 10% by EUR 12,772 compared to the situation if we would not assume a shadow economy. The impact on the overall economic result in the listed facilities would only be due to incorrectly determined performance depreciation-i.e. only one cost factor higher by the recalculated performance depreciation for the actual nights stayed (which would be 2,810 more) by EUR 8,143 with an impact on tax from income in the amount of EUR 1,710 (we assume a DPPO rate of 21% for the stated turnover). Such a consequence would arise only in one large accommodation facility, i.e., at the microeconomic level. At the same time, it should be noted that the estimate of the shadow economy is even higher in the tourism sector (accommodation facilities mainly of the nature of small guesthouses, restaurants and other facilities for providing food and catering). On the contrary, we do not expect this kind of illegal income from accommodation and catering providers, such as medical and recreational facilities, spas, etc., where the financing is partially connected to the health insurance system, as well as from those entities that provide their services within the so-called congress tourism or through travel agencies with a strict requirement to account for mutual relations. In the past, the problem in smaller establishments and pensions, which indicated the existence of shadow income, manifested itself in the requirement to register reservation and digital platforms on the territory of the Slovak Republic with the obligation to withhold tax on the income of these providers, which they could offset in the country of their own tax domicile [9].

The entire impact of the estimated shadow economy has a much higher dimension when assessing possible leakages at the macroeconomic level. Just to give you an idea of the number of total overnight stays and total sales in Slovakia in recent years (Table 2).

| Period | 2023 | 2022 | 2021 | ||

|---|---|---|---|---|---|

| Text | 2. Q | 1.Q | 1.-4.Q 2022 | 1.-4.Q 2021 | |

| Slovak Republic | Total number of accommodation facilities | 4,612 | 4,450 | 4,829 | 4,667 |

| Total number of rooms available | 68,801 | 67,580 | 76,576 | 75,456 | |

| Total number of beds (incl. camping places) | 1,92,422 | 18,078 | 2,22,019 | 2,26,403 | |

| Revenue for accommodation total | 13,15,76,676 | 11,18,11,078 | 43,37,56,693 | 23,74,21,878 | |

| Average price for accommodation | 378 | 376 | 341 | 291 | |

| Netto use of permanent beds (%) | 267 | 247 | 271 | 223 | |

| Netto use of rooms (%) | 329 | 293 | 317 | 263 | |

| Average number of rooms available per 1 day | 61,808 | 58,135 | 56,228 | 44,039 | |

| Average number of beds available per 1 day | 1,43,052 | 1,34,078 | 1,28,490 | 1,00,359 | |

Table 2: Data on selected data in the tourism industry in Slovakia for the years 2021-2023.

By recalculating the number of beds in our research to the number of beds in the Slovak Republic, the total average tax gap in the Slovak Republic for VAT is approximately 95 million. EUR (converted to a reduced rate of 10%).

Exact control or reliability test of research outputs is not possible as these are estimated tax evasions. It is also no possible to exactly quantify leakages due to the used method of depreciation of long- term assets, since the business entity can choose its own method. However, research has shown that small and medium-sized enterprises do not choose individual depreciation plans. Based on the published annexes to the tax return, almost all companies use the tax and accounting depreciation matching method, which does not take into account performance depreciation. However, their use is the most accurate method that can be used for correct and accurate reporting of the management result. This is, of course, possible under the assumption of fully declared income without the existence of a part of shadow income.

There is no doubt about the existence of shadow incomes that are not transparently recognized and taxed with direct and indirect taxes. This fact is recognized by all the countries of the world, including the countries of the European Union. The Parliamentary Letters of the European Parliament, in a post-dated 27/04/2021, sets out the procedures of member countries in the fight against tax fraud and tax evasion [10,11]. Since September 2020, it has established the Subcommittee for Tax Issues and adopted measures in this area. Babcak, et al., cites the disproportionate amount of taxes, which does not allow entrepreneurs to make sufficient investments in business development, as the reason for shadow income, especially of small and medium-sized enterprises [12]. With reference to the Deloitte study from 2018, up to 74% of entrepreneurs in Slovakia consider the tax burden to be disproportionately high and the business environment to be unfavourable, which is the reason for the risk associated with tax cuts. Based on the statistics of the Financial Administration of the Slovak Republic, in 2019 for example, VAT tax evasions amounted to 410 million EUR with an assumed tax gap exceeding 26%. That year, according to the same source, the tax gap in the tourism sector was 491 million EUR in absolute terms. EUR. The accommodation itself from this amount is not specified, but when examining the selected set of facilities, it can be assumed that the tax gap from the accommodation alone amounted to about 196.4 million. EUR (40% of total income in tourism). Starting from 2020, the tax gap was reduced, and according to the report of the Ministry of Finance of the Slovak Republic (2022), the current estimated tax gap represents a decrease to 9.1% in EU countries, while the Slovak Republic is below the average and its level can be assumed to be 8.8% [13,14].

Durinova I [15], states that depreciation can have a significant impact on the amount of the reported income tax base and become a tool of the so-called tax optimization [15]. If these also serve to achieve shadow income, they directly affect the amount of the legal economic result.

Even if the results of other authors and institutions are not quantified at the micro level in the accommodation facilities sector exactly (with the exception of evasion in the field of indirect taxes quantified in the statistics of the Financial Administration of the Slovak Republic), the result presented in our study corresponds to the assumed tax gap of approximately 11% from 2018-2023, in the amount of 95 million EUR per year on average, while the Financial Administration for 2019, with a reduced VAT rate, only accommodation showed a tax gap of 98.2 million EUR [16].

The problem of the shadow economy is global and the need for its investigation is also declared at the level of world communities. In addition to active tax control and control of the labor market and the legality of employment, the research indicates that the dimension of the shadow economy is wider than the tax loophole and is also related to the examination of the real rate of use of the company's assets in reported sales, resources for repaying bank loans for new assets in the context of its real use. The results indicate that in practice there is no aid for determining the optimal rate of asset utilization in individual departments in a causal connection with the officially reported results of enterprises. The expansion of tax depreciation by properly justified and calculated performance depreciation for a wide range of used long-term assets would make real tax costs and the reported economic result as a basis for calculating income tax.

However, tax evasion is striking especially in the area of indirect taxes, in accommodation facilities it is Value-Added Tax (VAT). A lower level can be assumed in large establishments, where the registration of sales by electronic cash registers is much more transparent than in small establishments and boarding houses. The situation was improved by the obligation of large employers to contribute to the regeneration of the workforce by reimbursing accommodation for at least two nights in a facility in the Slovak Republic, for which a valid tax document is required. The situation is worse in catering establishments and establishments serving drinks, where the tax gap is higher than the average in the tourism sector. Tax audits are limited to the collection method, however, focusing on operations with a long-term reported loss can certainly be considered expedient. Demonstration of sales in this case would be related to the assessment of the rate of purchase of raw materials in relation to the sales achieved. However, there is at least an indicative standard for what should be the share of the raw material base in the calculated price. Supplementing the guidelines on the threshold value of the share of raw materials in the price would be highly desirable.

Equally, the uniform procedure of the individual member countries of the European Union in the fight against tax evasion and the expansion of opportunities for the exchange of experience is a way to prevent this negative phenomenon.

Citation: Petruscakova M (2024) Tax Evasion and the Estimated Tax Gap at the Micro Level in Accommodation Facilities in Slovakia. J Tourism Hospit. S1:001.

Received: 17-Jun-2024, Manuscript No. JTH-24-32024; Editor assigned: 20-Jun-2024, Pre QC No. JTH-24-32024(PQ); Reviewed: 04-Jul-2024, QC No. JTH-24-32024; Revised: 11-Jul-2024, Manuscript No. JTH-24-32024(R); Published: 18-Jul-2024 , DOI: 10.35248/2167-0269.24.S1.001

Copyright: © 2024 Petruscakova M. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.