Journal of Stock & Forex Trading

Open Access

ISSN: 2168-9458

ISSN: 2168-9458

Research Article - (2023)Volume 10, Issue 4

This study is conducted to investigate the response of stock market returns to daily growth in COVID-19 confirmed cases and deaths in 14 African countries using both time series and panel approaches. The study employs three estimation methods, Ordinary Least Squares/Robust Ordinary Least Squares (OLS/ORLS), Pooled Ordinary Least Squares (POLS) and Panel Vector Autoregressive (PVAR). While the OLS and POLS are used to examine a conditional mean effect of COVID-19 confirmed cases and deaths on stock market returns PVAR is used to estimate and trace the response of stock market return to shocks from daily growth in COVID-19 confirmed cases and deaths. OLS results show that stock market returns react negatively and significantly to daily growth in COVID-19 confirmed cases in countries like Botswana, Kenya, Tanzania, Tunisia and Uganda while the negative effects of daily growth in COVID-19 confirmed deaths on stock market returns are negligible. Evidence from POLS reveals that the impacts of an increase in COVID-19 confirmed cases and deaths are insignificant. This is corroborated by the results of FEVD. IRF results show that stock market returns react positively to COVID-19 confirmed cases and deaths shocks before declining and returning towards normal returns in the long-run. Our findings underscore the importance of analysing individual country’s socioeconomic reaction to COVID-19 pandemic instead of pooling countries together.

COVID-19 pandemic; Cases; Deaths; Stock market returns; Socioeconomics

The outbreak of COVID-19 has caused a lot of socioeconomic damages across the world. Since its outbreak in the city of Wuhan in the province of Hubei in China on December 31st, 2019, the Coronavirus has spread to about 231 countries. Due to this, the world health of organisation on March 11th, 2020 officially declared it as a global pandemic and since then the organisation has been monitoring the spread of the virus across the world and also offering health-related advice to all its member countries. To curtail the spread of the COVID-19 pandemic, several policy measures were put in place across the world and they include detection and isolation of the affected persons, individual hygienic which entails regular washing of hands and sanitisation, environmental measures which include social and physical distancing, the total lockdown of the economy, restriction of movement and banning of international travelling. However, some of these measures, especially total lockdown, social distancing and international travel ban, have led to the broken down of economic activities, led to a decline global trade and impaired the demand and supply chains of the international transaction. The news about cases and death of COVID-19 pandemic has also generated commodity prices volatility and general loss of revenues across financial sectors.

As COVID-19 pandemic continues to spread across world, African countries are not left behind. There has been an increase in the number of persons infected by the COVID-19 pandemic and a considerable number of people have lost their lives in the process. As of August 6th, 2020, South Africa has recorded a total number of 529,877 COVID-19 confirmed cases and about 9,298 confirmed dead. Also, Egypt recorded the second highest number of cases and deaths with a total number of COVID-19 confirmed cases and deaths stood at 94, 875 and 4,930 respectively. At third distance is Nigeria with a total number of COVID-19 confirmed cases and deaths stood at 44,290 and 927 within the same period respectively. In line with global policy steps to contains the spread of the COVID-19 pandemic among the citizens. African governments have also taken policy steps which entail the total lockdown of the economy in major cities across Africa. This step has had a negative consequence of the economies including stock market performance. At the announcement of COVID-19 as global pandemic on March 11th, 2020, available statistics on stock market performance show that share prices of South Africa’s Top 40, Egypt’s 30 Nigeria’s NSE and declined by 18.99%, 17.16% and 3.75% respectively. Other share prices such as Kenya’s NSE 20, Mali’s Karachi All Share, and Mauritius’s Semdex, Morocco All Share, Tunisia’s Tunindex and Uganda All Share declined by 11.87%, 9.08%, 10.27%, 16.62%, 8.49% and 8.02% respectively [1-3].

Given the stock market performance indicators across African markets, this study examines the impacts of daily growth in COVID-19 confirmed cases and deaths on the stock market returns of 14 African countries. In other words, the study investigates the reactions of stock market returns to daily COVID-19 pandemic confirmed cases and death. A couple of studies have been conducted on how COVID-19 pandemic affects financial market performance in some developed, developing and even emerging economies. For example, the study by Ashraf examines the response of stock market performance to growth in cases and deaths related to COVID-19 pandemic in 64 countries in the world. Using a panel estimation method, he finds that growth in cases of infected persons negatively affects stock market performance. There is no significant evidence, however, to support the negative effect of COVID-19 confirmed deaths on stock market returns. Ali, Alam and Rizvi, while conducting a study on the reaction of stock market returns to COVID-19 pandemic across Asia, Europe and the US, conclude that most of the stock indices consider exhibit negative returns and excess volatility. However, share indices in China become stabilised as the pandemic eases out in the country unlike Europe and the US where there is freefall in share prices and returns. Al-Awadhi, et al. Also examines the impact of daily growth in cases and deaths on stock market returns on stock market returns of Hang Seng index and Shanghai stock exchange composite index in a panel framework. Their results show that both the daily growth in COVID-19 confirmed cases and deaths have negative effects on the stock returns of two share indices. While most of the studies briefly reviewed above focus on the panel analysis, Aravind and Manojkrishnan focus on the computation of returns of stock indices of pharmaceutical companies listed in the Indian National Stock Exchange (NSE). Their findings show that pharmaceutical stock returns are abnormally negative. Raifu, Kumeka and Aminu also investigate the reaction of stock market returns of firms in Nigeria to COVID-19 pandemic and lockdown policy. Their findings reveal that stock market returns reacted negatively to global COVID-19 confirmed cases and deaths than domestic COVID-19 confirmed cases and deaths as well as lockdown policy. The impulse response functions revealed that the effects of COVID-19 confirmed cases and death including lockdown policy oscillate between negative and positive before the stock returns converge to equilibrium in the long-run [4-6].

This study contributes to these existing studies in two ways, especially in terms of specificity and implementation approaches. First, in term of specificity, this study focuses on the investigation of the reaction of stock market returns of 14 African countries to the daily growth of COVID-19 confirmed cases and deaths. most of the studies briefly reviewed above concentrated on developed economies, sometimes on developing economies or combination of both as well as emerging economies. Also, some of the studies are conducted in panel forms without taking into consideration individual country differences. However, it is well known that individual country financial market is different and their ability to withstand the external shocks like COVID-19 pandemic is also quite difference. Hence, it is expedient to take into consideration these individual differences in financial market into consideration when examining the reactions of financial market, particularly stock market returns reaction to COVID-19 pandemic shocks. Second, in terms of implementation, the study looks at how each stock market returns of the 14 African countries reacts to daily growing in the number of persons infected by the coronavirus and deaths of infected persons. In this case, we compare the output of Ordinary Least Squares (OLS) with that of the Robust Ordinary Least Squares (ROLS). In econometric theory, the difference between OLS and ROLS is that ROLS is often used to overcome some basic assumptions of normality, homoscedasticity, no multicollinearity, no outliers and no missing data that often plague the use of OLS. We also pooled the 14 countries together and examine the response of stock market returns to the daily growth in COVID-19 confirmed cases and deaths. Two panel estimation methods are employed. First, we use pooled OLS that accounts for countryspecific effect and daily effect. This, however, estimate a conditional mean effect of COVID-19 confirmed cases and deaths on stock market return. However, since the COVID-19 pandemic has been around for some time, it is expedient to trace its dynamic effects on stock market returns over time. In other words, we examine the dynamic reaction of stock market returns to shocks emanating from daily growth in COVID-19 confirmed cases and deaths. In this regard, we use a panel VAR to achieve this objective, particularly the Impulse Response Function (IRF).

Giving the introduction, section 2 presents methodology and data sources as well as preliminary findings. Section 3 presents the results while section 4 concludes.

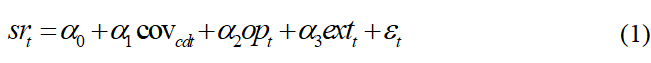

We begin the methodology by specifying a simple OLS regression which consists of dependent variables (stock market returns) and the main dependent variable (COVID-19 confirmed cases and deaths) and a set of other control variables which include spot price of Brent crude oil and exchange rate.

Where;

Sγt: Stock returns (%) for each country.

covcdt: Refers to either COVID-19 confirmed cases or deaths.

opt: Spot price of Brent crude oil (barrel per dollar).

extt: Exchange rate for each country measured in terms of foreign currency (USD) per domestic currency of each of the 14 selected African countries.

α0: Parameter that denotes stock returns without recourse to impact of independent variables.

α1 α2 and α3: Coefficient parameters.

εt: Error term assumed to be normally distributed with zero mean and constant variance.

The inclusion of oil price and exchange rest on their theoretical relationship between them and stock market returns. Based on the existing studies, oil price and the exchange rate could have a positive or negative effect on stock market returns. The COVID-19 confirmed cases and deaths are expected to have negative effects on stock returns [7-10].

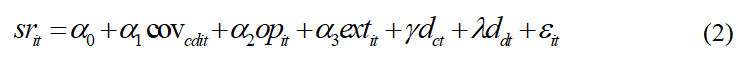

We now turn to panel analysis. Following Ashraf and other studies, we specify a panel model of pooled OLS that accounts for country-specific effect and daily specific effect as follows:

Sγit, covcdt and extit: Remain as defined,

dct: Country specific dummy variable,

ddt: Daily specific dummy variable.

The panel VAR that traces the dynamic effect of daily growing in COVID-19 confirmed cases and deaths on stock market returns following Ouyang and Li, is specified as follows:

In equation 3,

Sγit: Made up of vector of variables which include stock returns and COVID-19 confirmed cases or deaths.

μt: Vector of individual country-specific panel fixed effects.

νit: Error term.

Bi: Matrix of the coefficient parameters to be estimated.

In the panel analysis, all variables are treated as endogenous variables. Instead of using fixed effects method to estimate the panel VAR, we use GMM estimation method following Love and Zicchino and Abrigo and Love. GMM is preferred because it helps in overcoming the problems of serial correlation and heteroscedasticity that often plague the use of fixed effects method. The GMM is estimated using 2 lag lengths selected using a Coefficient of Determination (CD) criterium. The lag lengths are as instruments. The IRF is estimated following Abrigo and Love argument that the shocks on the variables that are ordered first would have a contemporaneous effect on the variables are ordered thereafter. Consequently, we set up a two variables panel framework ordered first COVID-19 confirmed cases or deaths variable and followed by stock market return variable because we are only interested in the response of stock market returns to shock from COVI-19 confirmed cases and deaths.

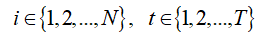

Finally, the stock returns are computed using;

The growth in daily COVID-19 confirmed cases are also computed using:

Changes in oil price and exchange rate are also computed using a similar formula.

Data sources and preliminary findings

This study uses daily data that covers the period from March 11th, 2020 to August 6th, 2020. The daily data of stock prices of 14 African countries are sourced from investing.com. Similarly, the daily exchange rate for the 14 African countries is obtained from investing.com. The daily spot price of Brent crude oil is sourced from the international energy agency. The data on COVID-19 confirmed cases and deaths are obtained from our world database which source is the European Centre for Disease Prevention and Control (ECDC). Table 1 shows the name of the stock market in each of the 14 African countries, the number of COVID-19 confirmed cases and deaths and the date which the first case of the coronavirus is conformed.

Table 2 shows the descriptive statistic of the variables in terms of mean, range (minimum and maximum), standard deviation, Kurtosis and skewness. The average stock market returns during pandemic stood at -0.124% suggesting that investors incurred financial loss during the COVID-19 pandemic. The good news is that stock market returns have turns positive as shown by the maximum value of the stock market returns which stood at 14.583%. The value of the standard deviation of 2.458% which is a bit deviated from its mean value of -0.124% implies that stock market returns are volatile during this period. The average numbers of people that have been infected by a coronavirus and confirmed dead are 13,001 and 301 respectively. The average oil price stood at $31.41 per barrel.

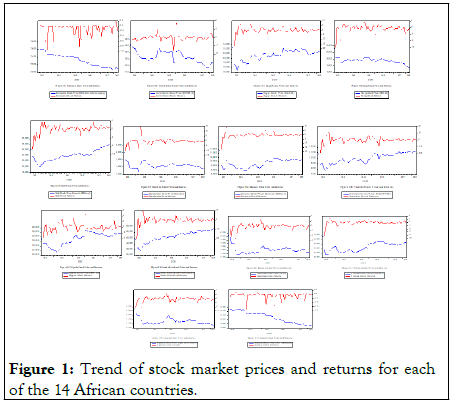

Following the Table of descriptive statistics in Figure 1 shows the trend of movement of stock market prices and their returns. A cursory look at Figures shows that after the declaration of COVID-19 as a global pandemic, the entire stock market price declined drastically. During this period, it can also be observed that stock market returns are volatile. However, the volatility petered out as the economic activities resume in most of the countries. In fact, most of the stock market prices rebounded after the initial lost suffered. It is, however, subject occasional fluctuations as shown in the Figures.

Table 3 reports the results of correlation analysis to show the strength of the relationship among the variables and to detect the problem of multicollinearity among the regressors. As shown in Table, growth in the number of COVID-19 confirmed cases and deaths negatively correlate with stock market returns, albeit the correlation is not statistically significant. While the exchange rate is negatively and significantly correlated with stock market returns, the oil price is positively and significantly correlated with stock market returns. However, the strength of correlation among the variables is very low and as such, there is no danger of multicollinearity (Figure 1).

| S/N | Country | Stock price index | Cases (August 6, 2020) | Deaths (August 6, 2020) | First case confirmed |

|---|---|---|---|---|---|

| 1 | Botswana | BSE domestic company | 804 | 2 | 30-Mar-20 |

| 2 | Cote D'Ivoire | BVRM10 | 16,349 | 103 | 11-Mar-20 |

| 3 | Egypt | EGX 30 | 94,875 | 4930 | 14-Feb-20 |

| 4 | Kenya | NSE 20 | 23,873 | 391 | 13-Mar-20 |

| 5 | Mali | Bank of Africa | 2,546 | 124 | 25-Mar-20 |

| 6 | Mauritius | Semdex | 344 | 10 | 18-Mar-20 |

| 7 | Morocco | Moroccan All Share | 28,500 | 435 | 02-Mar-20 |

| 8 | Namibia | NSX/FTSE | 2,540 | 12 | 14-Mar-20 |

| 9 | Nigeria | NSE all share | 44,890 | 927 | 28-Feb-20 |

| 10 | South Africa | South Africa top 40 | 5,29,877 | 9298 | 05-Mar-20 |

| 11 | Tanzania | Tanzania all share DESI | 509 | 21 | 16-Mar-20 |

| 12 | Tunisia | Tunindex | 1601 | 51 | 04-Mar-20 |

| 13 | Uganda | Uganda all share | 1213 | 5 | 21-Mar-20 |

| 14 | Zambia | LSE all share | 7022 | 176 | 18-Mar-20 |

Table 1: Stock price indices, number of COVID-19 confirmed cases and deaths and date of confirming the first cases.

| Variables | Obs | Mean | Std. dev. | Min | Max | p1 | p99 | Skew. | Kurt. |

|---|---|---|---|---|---|---|---|---|---|

| Spr | 826 | 10015.81 | 12720.19 | 118.38 | 53350.88 | 122.41 | 51558.75 | 1.83 | 5.692 |

| Sprr | 812 | -0.124 | 2.458 | -18.985 | 14.583 | -9.049 | 6.449.000 | -1.862 | 20.578 |

| Cases | 789 | 13003.53 | 52537.04 | 1 | 529877 | 2 | 311049 | 7.204 | 60.592 |

| Deaths | 789 | 300.94 | 1008.942 | 0 | 9298 | 0 | 4930 | 5.288 | 35.027 |

| Brent | 826 | 31.41 | 10.779 | 9.12 | 45.04 | 9.12 | 45.04 | 0-.234 | 1.578 |

| Extrat | 826 | 560.82 | 1067.045 | 2.704 | 3935 | 2.819 | 3800 | 2.162 | 6.344 |

Note: spr, Sprr, Cases, Deaths, Brent and Extrat indicate stock market price, stock market returns, COVID-19 confirmed cases, COVID-19 confirmed deaths, the spot price of Brent crude oil and nominal exchange rate respectively. |

|||||||||

Table 2: Descriptive statistics results.

| Variables | Sprr | Casesg | Deathsg | Brentg | Extratg |

|---|---|---|---|---|---|

| Sprr | 1 | ||||

| Casesg | -0.057 | 1 | |||

| (0.111) | |||||

| Deathsg | -0.026 | 0.560* | 1 | ||

| (0.515) | 0 | ||||

| Brentg | 0.146* | -0.121* | -0.076 | 1 | |

| (0.000) | (0.001) | (0.055) | |||

| Extratg | -0.267* | 0.109* | -0.008 | -0.083* | 1 |

| 0 | (0.002) | (0.842) | (0.018) | ||

| *shows significance at the 0.05 level | |||||

Note: sprr, casesg, deathg, brentg and extratg are stock market returns, daily growth in number of COVID19 confirmed cases, daily growth in number of COVID-19 confirmed deaths, percentage change in spot price of Brent crude oil and percentage change in exchange rate respectively. |

|||||

Table 3: Pairwise correlations.

Figure 1: Trend of stock market prices and returns for each of the 14 African countries.

Empirical findings

OLS and ROLS Results: Table 4 presents the results of the effects of growth in COVID-19 confirmed cases and deaths on stock market returns in each of the selected 14 African countries. The results are obtained from OLS and ROLS. A cursory look at the results in the Table reveals that there is no significant difference in the results from the two estimation methods. Consequently, we interpret and explain the results of OLS. As revealed in the table, growth in COVID-19 confirmed cases has negative effect stock market returns of Botswana, Cote d’Ivoire, Egypt, Kenya, Mali, Morocco, Nigeria, Tanzania, Tunisia, Uganda and Zambia. However, the negative effect is only statistically significant in countries such as Botswana, Kenya, Tanzania, Tunisia and Uganda. Specifically, as the number of infected persons by coronavirus increases by 1%, the financial loss in stock markets of Botswana, Kenya, Tanzania, Tunisia and Uganda by 0.030%, 0.020%, 0.016% 0.020% and 0.030% respectively. However, the daily growth in the number of infected persons has a positive effect on stock returns as South Africa Top 40 index and Mauritius Semdex. The investors investing in the South Africa Top 40 index are the one making positive significant returns among the countries. Our findings are similar to the finding of Ashraf who submitted that as the number of COVID-19 confirmed cases soars, stock market returns decline for 64 countries he considered in a panel framework analysis. Ali, Alam and Rivzi concluded that financial market suffers deterioration as a result of the spread of COVID-19 pandemic [11-16].

Concerning the effect of daily growth in COVID-19 confirmed deaths on stock market returns, we find that stock market returns react negatively to rise in COVID-19 confirmed deaths except in Nigeria and South Africa. The negative and positive impacts of COVID-19 confirmed deaths are not statistically significant. This shows that the effect of the rise in COVID-19 confirmed deaths is not strong, a situation Ashraf alluded to the fact that death takes some days after a person is infected. Hence, stock market prices or returns will respond aggressively to COVID-19 confirmed cases than COVID-19 confirmed deaths.

POLS results: We now explain the results of the panel estimation. As shown in Table 5, stock market returns react negatively but insignificantly to the daily growth in COVID-19 confirmed cases. This suggests that when pool all the 14 countries together, the effect of COVID-19 confirmed cases is not strong on the stock market returns in Africa. We further test the consistency of our results using fixed effects estimation method, the result remains ditto as the negative effect of daily growth in COVID-19 confirmed cases remain insignificant. In the case of daily growth in COVID-19 confirmed death, our results show that stock market returns react positively but insignificantly to confirmed deaths. However, the resulting change to negative insignificant effect when we use fixed effects estimation method. Our finding is contrary to that of Ashraf and Erdem who documented a negative effect of COVID-19 confirmed cases on stock market returns in a panel of country analyses. However, the countries they selected comprise of developed, emerging and developing countries. Their negative and significant results might be alluded to the fact that most of the stock market indices selected are from the developed countries which reacted strongly to the news of growth in COVID-19 confirmed cases and thus, their impacts are likely to outweigh those of developing countries where the cases of coronavirus are gradually growing.

From the Table 4 also, evidence show that oil price has a positive effect on stock market returns while the exchange rate has negative effect on it.

| (Botsw) | (Cot) | (Egp) | (Keny) | (Mal) | (Maur) | (Mor) | (Namb) | (Nig) | (Sa) | (Tanz) | (Tun) | (Uga) | (Zamb) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| sprr | sprr | sprr | sprr | sprr | sprr | Sprr | sprr | sprr | sprr | sprr | sprr | sprr | sprr | |

| Reaction of stock market returns to COVID-19 confirmed cases (OLS) | ||||||||||||||

| Cases | -0.003* (0.002) | -0.004 (0.008) | -0.035 (0.029) | -0.020* (0.011) | -0.001 (0.005) | 0.005 (0.027) | -0.001 (0.01) | 0.004 (0.018) | -0.005 (0.009) | 0.040** (0.016) | -0.016*** (0.005) | -0.020*** (0.006) | -0.030* (0.017) | -0.002 (0.002) |

| Extratg | 0.045 (0.029) | -0.417 (0.318) | -0.46 (1.445) | -0.873 (0.574) | -0.432 (0.298) | -1.526** (0.632) | -0.246 (0.419) | -1.189*** (0.233) | -0.075 (0.107) | -0.269 (0.185) | 0.054 (1.716) | -1.165*** (0.202) | 0.259 (0.549) | 0.084* (0.047) |

| brentg | -0.001 (0.002) | -0.003 (0.015) | 0.064** (0.029) | -0.016 (0.014) | -0.017 (0.012) | 0.008 (0.025) | 0.03 (0.019) | 0.018 (0.029) | 0.005 (0.013) | 0.040* (0.023) | -0.013 (0.01) | -0.003 (0.01) | -0.003 (0.015) | -0.004 (0.004) |

| _cons | -0.071** (0.034) | -0.154 (0.25) | 0.365 (0.544) | 0.127 (0.273) | 0.620*** (0.188) | -0.012 (0.371) | 0.08 (0.313) | 0.427 (0.467) | 0.269 (0.225) | 0.008 (0.41) | 0.061 (0.152) | 0.064 (0.161) | 0.155 (0.259) | -0.145** (0.063) |

| Obs. | 49 | 57 | 58 | 57 | 52 | 53 | 57 | 57 | 57 | 57 | 56 | 58 | 53 | 54 |

| R-squared | 0.121 | 0.037 | 0.131 | 0.124 | 0.079 | 0.117 | 0.051 | 0.352 | 0.043 | 0.211 | 0.168 | 0.456 | 0.119 | 0.084 |

| Reaction of stock market returns to COVID-19 confirmed cases (ROLS) | ||||||||||||||

| cases | -0.003* (0.002) | -0.004 (0.006) | -0.035 (0.06) | -0.02 (0.021) | -0.001 (0.005) | 0.005 (0.036) | -0.001 (0.021) | 0.004 (0.014) | -0.005 (0.016) | 0.04 (0.027) | -0.016 (0.011) | -0.02 (0.018) | -0.030* (0.017) | -0.002 (0.002) |

| extratg | 0.045 (0.03) | -0.417 (0.579) | -0.46 (1.439) | -0.873 (0.799) | -0.432 (0.311) | -1.526 (1.058) | -0.246 (0.404) | -1.189*** (0.259) | -0.075 (0.136) | -0.269 (0.243) | 0.054 (2.299) | -1.165*** (0.374) | 0.259 (0.597) | 0.084 (0.052) |

| brentg | -0.001 (0.001) | -0.003 (0.013) | 0.064** (0.031) | -0.016 (0.013) | -0.017 (0.014) | 0.008 (0.025) | 0.030* (0.016) | 0.018 (0.02) | 0.005 (0.012) | 0.040* (0.02) | -0.013 (0.009) | -0.003 (0.009) | -0.003 (0.009) | -0.004 (0.003) |

| _cons | -0.071** (0.032) | -0.154 (0.21) | 0.365 (0.537) | 0.127 (0.306) | 0.620*** (0.174) | -0.012 (0.284) | 0.08 (0.259) | 0.427 (0.436) | 0.269 (0.193) | 0.008 (0.381) | 0.061 (0.137) | 0.064 (0.146) | 0.155 (0.198) | -0.145** (0.054) |

| Obs. | 49 | 57 | 58 | 57 | 52 | 53 | 57 | 57 | 57 | 57 | 56 | 58 | 53 | 54 |

| R-squared | 0.121 | 0.037 | 0.131 | 0.124 | 0.079 | 0.117 | 0.051 | 0.352 | 0.043 | 0.211 | 0.168 | 0.456 | 0.119 | 0.084 |

| Reaction of stock market returns to COVID-19 confirmed deaths (OLS) | ||||||||||||||

| deaths | -0.003 (0.003) | 0.005 (0.012) | -0.017 (0.023) | 0.01 (0.009) | -0.003 (0.007) | -0.029 (0.036) | 0.004 (0.013) | -0.015 (0.012) | 0.012 (0.009) | 0.016 (0.014) | 0.001 (0.007) | -0.006 (0.007) | -0.003 (0.003) | 0 (0.003) |

| extratg | 0.05 () | -0.636 (0.407) | -0.897 (1.38) | 0.43 (0.725) | -0.461 (0.304) | -1.348** (0.661) | -0.314 (0.438) | -0.517* (0.252) | -0.02 (0.24) | -0.085 (0.148) | -0.155 (1.946) | -0.503*** (0.151) | -3.541 (0.749) | 0.068 (0.063) |

| brentg | -0.001 (0.002) | -0.004 (0.016) | 0.065** (0.029) | -0.008 (0.013) | -0.009 (0.012) | 0.012 (0.025) | 0.033 (0.02) | 0.177 (0.422) | 0.012 (0.012) | 0.029 (0.017) | -0.011 (0.008) | -0.011* (0.006) | -0.492 (0.091) | -0.004 (0.004) |

| _cons | -0.101*** (0.029) | -0.183 (0.267) | 0.178 (0.527) | -0.308 (0.22) | 0.552*** (0.193) | 0.089 (0.363) | 0.021 (0.307) | 0.504 (0.55) | 0.088 (0.218) | 0.266 (0.338) | 0.049 (0.121) | 0.081 (0.098) | -0.528 (0.103) | -0.177** (0.07) |

| R-squared | 0.079 | 0.051 | 0.117 | 0.046 | 0.068 | 0.128 | 0.053 | 0.453 | 0.047 | 0.09 | 0.045 | 0.263 | 0.99 | 0.049 |

| Reaction of stock market returns to COVID-19 confirmed deaths (ROLS) | ||||||||||||||

| deaths | -0.003*** (0.003) | 0.005 (0.007) | -0.017 (0.046) | 0.01 (0.009) | -0.003 (0.006) | -0.029 (0.039) | 0.004 (0.023) | -0.015 (0.009) | 0.012 (0.018) | 0.016 (0.016) | 0.001 (0.004) | -0.006 (0.01) | -0.003 (0.002) | 0 (0.004) |

| extratg | 0.05 (0.037) | -0.636 (0.808) | -0.897 (1.408) | 0.43 (1.091) | -0.461 (0.342) | -1.348 (1.02) | -0.314 (0.508) | -0.517* (0.214) | -0.02 (0.04) | -0.085 (0.141) | -0.155 (1.299) | -0.503*** (0.182) | -3.541* (0.427) | 0.068 (0.073) |

| brentg | -0.001 (0.002) | -0.004 (0.011) | 0.065** (0.03) | -0.008 (0.009) | -0.009 (0.014) | 0.012 (0.022) | 0.033* (0.018) | 0.177 (0.288) | 0.012 (0.013) | 0.029** (0.014) | -0.011** (0.005) | -0.011* (0.006) | -0.492* (0.053) | -0.004 (0.003) |

| _cons | -0.101*** (0.028) | -0.183 (0.224) | 0.178 (0.484) | -0.308 (0.19) | 0.552*** (0.201) | 0.089 (0.326) | 0.021 (0.243) | 0.504 (0.679) | 0.088 (0.216) | 0.266 (0.306) | 0.049 (0.108) | 0.081 (0.086) | -0.528 (0.13) | -0.177** (0.066) |

| Obs. | 48 | 51 | 58 | 51 | 49 | 53 | 57 | 10 | 53 | 51 | 51 | 53 | 5 | 47 |

| R-squared | 0.079 | 0.051 | 0.117 | 0.046 | 0.068 | 0.128 | 0.053 | 0.453 | 0.047 | 0.09 | 0.045 | 0.263 | 0.99 | 0.049 |

| Standard errors are in parenthesis | ||||||||||||||

| ***p<0.01, **p<0.05, *p<0.1 | ||||||||||||||

Notes: sprr, cases, deaths, brentg, extratg are stock market returns, growth in COVID-19 confirmed cases, growth in COVID-19 confirmed deaths, the spot price of Brent crude oil price (growth rate and exchange rate (growth rate) respectively. |

||||||||||||||

Table 4: Effects of COVID-19 confirmed cases and deaths on stock market returns in some selected countries in Africa.

| Pooled OLS | Fixed Effect | |||

|---|---|---|---|---|

| sprr | sprr | sprr | sprr | |

| casesg | -0.004 | -0.003 | ||

| (0.004) | (0.004) | |||

| deathsg | 0.001 | -0.003 | ||

| (0.004) | (0.003) | |||

| brentg | 0 | 0.057*** | 0.01 | 0.009 |

| (0.006) | (0.014) | (0.007) | (0.007) | |

| extratg | -0.411*** | -0.114 | -0.437* | -0.234** |

| (0.069) | (0.081) | (0.206) | (0.087) | |

| _cons | -0.254 | 4.006*** | 0.097 | 0.089*** |

| (0.444) | (1.081) | (0.059) | (0.027) | |

| Obs. | 775 | 637 | 775 | 637 |

| R-squared | 0.272 | 0.377 | 0.064 | 0.02 |

| Country1 dummies | Yes | Yes | ||

| Date1 dummies | Yes | Yes | ||

| Standard errors are in parenthesis ***p<0.01, **p<0.05, *p<0.1 |

||||

Note: sprr, cases, deaths, brent, extratg are stock market returns, growth in COVID-19 confirmed cases, growth in COVID-19 confirmed deaths, the spot price of Brent crude oil price (growth rate and exchange rate (growth rate) respectively |

||||

Table 5: Panel regression results.

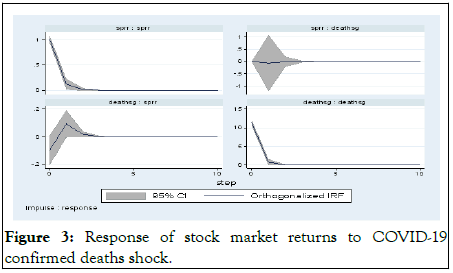

Panel VAR results: This section explains the results of panel VAR. The full results of PVAR are put in Table 1 in the Appendix. Our focus is particularly on impulse response function results because we want to trace the dynamic effect of daily growth in COVID-19 confirmed cases and deaths on stock market returns of the 14 African countries. The IRF results are presented. Figures 2 and 3 show the dynamic effects of daily growth in COVID-19 confirmed cases and deaths on stock market returns. In other words, they show the response of stock market returns to innovative shock from the daily growth in COVID-19 confirmed cases and deaths respectively. We limit the panel VAR estimation to two variables-stock market returns and COVID-19-confirmed cases and deaths since we are only interested in the response of stock market returns to the shock from COVID-19 confirmed cases or deaths. However, before the interpretation, it is important to know whether the models are stable, hence we conduct the stability test. The stability test results are displayed in Figures 1 and 2. The results show that the panel models are stable because all the eigenvalues (dotted points) lay within the unit circle. From Figure 2, it is evident that the stock market returns increase in response to innovative shock from the growth in COVID-19 confirmed cases after the March 11th, 2020 declaration of COVID-19 as a global pandemic. It can be observed that the stock market returns that are initial in the negative territory of IRF before it increases spontaneously in the short-run and later decline and return to normal in the long-run. In Figure 3, the response of stock market returns to innovative shock to the daily growth in the number of dead persons due to infection from coronavirus is akin to its response to innovative shock from daily growth in the number of infected persons. We see clearly that before the declaration of COVID-19 as a global pandemic, the stock market returns were already down, showing a financial loss to the investors. When the declaration was made by the WHO, the stock market returns reacted positively. However, as the number of deaths increases, the stock market returns decline drastically. This shows that as more people died due to infection from coronavirus, the stock market reacted negatively and then returns to normal towards the long-run equilibrium.

The next to explain is the Forecast Error Variance Decomposition (FEVD), The FEVD is computed using 500 Monte Carlo simulations. Basically, FEVD helps in determining the percentage of variation in stock market returns explained by daily growth in the number of persons infected with coronavirus and the number of infected persons that died. We forecast up to ten horizons which represent 10 months. The results of FEVD are reported in Table 5. As shown in the Table, it is evident that an increase in the number of persons affected by COVID-19 pandemic explains negligible, insignificant or little variations in the stock market returns during the global pandemic. Specifically, daily growth in COVID-19 confirmed cases explains about 0.005% in the variation in stock market returns in the first three horizons while even in the long run (10th month), daily growth in COVID-19 confirmed cases only explains about 0.023%. This suggests that most of the deviation from stock market returns can only be explained by stock market returns itself (Figures 2 and 3). Similar results are observed in the case of daily growth in the number of infected persons that died. As revealed in the Table, we find that at the first horizon (1st Month), about 1.705% variation in stock market returns can be explained by the number of persons that died of coronavirus. Even at 10th horizon (10th month), the number only increased marginally to 1.735% implying that only 1.735% variation in stock market returns is explained by the growth in the number of persons who died of coronavirus in the long-run (Table 6).

Figure 2: Response of stock market returns to COVID-19 confirmed cases shock.

Note: The first variable in Figure 2 is the impulse variable while the second variable is the response variable.

Figure 3: Response of stock market returns to COVID-19 confirmed deaths shock.

Note: The first variable in Figure 3 is the impulse variable while the second variable is the response variable.

| Response variable/Forecast horizon | Impulse variable | Response variable/Forecast horizon | Impulse variable | ||

|---|---|---|---|---|---|

| Stock market returns | Stock market returns | Cases | Stock market returns | Stock market returns | Deaths |

| 0 | 0 | 0 | 0 | 0 | 0 |

| 1 | 1 | 0 | 1 | 0.990935 | 0.0090651 |

| 2 | 0.999977 | 2.31E-05 | 2 | 0.982953 | 0.0170467 |

| 3 | 0.99995 | 0.00005 | 3 | 0.982658 | 0.0173417 |

| 4 | 0.999923 | 0.000077 | 4 | 0.982652 | 0.0173476 |

| 5 | 0.999896 | 0.000104 | 5 | 0.982652 | 0.0173477 |

| 6 | 0.99987 | 0.00013 | 6 | 0.982652 | 0.0173477 |

| 7 | 0.999844 | 0.000156 | 7 | 0.982652 | 0.0173477 |

| 8 | 0.999818 | 0.000182 | 8 | 0.982652 | 0.0173477 |

| 9 | 0.999792 | 0.000208 | 9 | 0.982652 | 0.0173477 |

| 10 | 0.999767 | 0.000233 | 10 | 0.982652 | -0.017348 |

| 0 | 0 | 0 | 0 | 0 | 0 |

| 1 | 0.030037 | 0.969963 | 1 | 0 | 1 |

| 2 | 0.031579 | 0.968421 | 2 | 3.07E-05 | 0.9999693 |

| 3 | 0.032179 | 0.967821 | 3 | 3.17E-05 | 0.9999682 |

| 4 | 0.032484 | 0.967516 | 4 | 3.17E-05 | 0.9999682 |

| 5 | 0.032667 | 0.967333 | 5 | 3.17E-05 | 0.9999682 |

| 6 | 0.03279 | 0.967211 | 6 | 3.17E-05 | 0.9999682 |

| 7 | 0.032877 | 0.967123 | 7 | 3.17E-05 | 0.9999682 |

| 8 | 0.032942 | 0.967058 | 8 | 3.17E-05 | 0.9999682 |

| 9 | 0.032993 | 0.967007 | 9 | 3.17E-05 | 0.9999682 |

| 10 | 0.033034 | 0.966966 | 10 | 3.17E-05 | 0.9999682 |

Table 6: Forecast error variance decomposition results.

As the coronavirus spreads across the world, economists have begun to examine how this spread, especially growth in the number of persons contacted the virus and died as a result of the infection, would affect the economic indicators, including the financial sector. Although several studies on how daily growth in COVID-19 confirmed cases and deaths affect the financial market, especially stock market returns in most affected countries in the world and some emerging and developing countries, little studies have been done how the daily growth in COVID-19 confirmed cases and deaths affect the individual country or African countries. In light of this, this study is conducted to investigate how the stock market returns in 14 African countries are affected by daily growth in COVID-19 confirmed cases and deaths. Two approaches were adopted to implement the objective of this study. First, we examine the response of stock market returns to the daily increase in COVID-19 confirmed cases and deaths using time series estimation approaches, particularly OLS and ROLS. Second, we pooled 14 countries together in panel form and then examined how stock market returns to daily growth in COVID-19 confirmed cases and deaths. Two estimation methods were adopted, namely POLS (Fixed Effects estimation method) and PVAR. POLS is used to estimate the one-point effect of daily in growth in COVID-19 confirmed cases and deaths on stock market returns while PVAR estimation method traces the dynamic response of stock market returns to the daily increase in the number of infected persons and died as a result of being infected.

Our findings reveal that daily growth in COVID-19 confirmed cases have negative and significant effects on the stock market returns in some countries such as Botswana, Kenya, Tanzania, Tunisia and Uganda. The daily growth in COVID-19 confirmed deaths have negligible negative effects on stock market returns in each of the countries. Evidence from the panel OLS results shows that daily growth in COVID-19 confirmed cases and deaths do not have meaningful significant effects on stock market returns. This is corroborated by the results of PVAR especially FEVD results which reveal that only a small fraction of deviation in stock market returns can be explained by the daily increase in COVID-19 confirmed cases and deaths. IRF results show that stock market returns initially rise as a result of shocks from daily growth in COVID-19 confirmed cases and deaths. However, with further increase in the number of infected persons and deaths, stock market returns declined and tapper out towards normal returns in the long-run.

This study has shown that pooling countries together and analyse the effect of COVID-19 pandemic on the economic fundamentals, including financial market indicators could be misleading and leads to policy bias. Analysing individual countries socioeconomic reactions to the COVID-19 pandemic could is indispensable in helping the policymakers to formulate policies that would enable them to address the affected sectors or industries in a particular country.

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

[Crossref] [Google Scholar] [PubMed]

Citation: Raifu IA, Kumeka TT (2023) The Effects of COVID-19 Pandemic on Stock Market Performance in Africa. J Stock Forex. 10:248.

Received: 19-Jan-2023, Manuscript No. JSFT-23-21449; Editor assigned: 23-Jan-2023, Pre QC No. JSFT-23-21449 (PQ); Reviewed: 06-Feb-2023, QC No. JSFT-23-21449; Revised: 25-Apr-2023, Manuscript No. JSFT-23-21449 (R); Published: 28-Dec-2023 , DOI: 10.35248/2168-9458.23.10.248

Copyright: © 2023 Raifu IA, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.