Journal of Research and Development

Open Access

ISSN: 2311-3278

ISSN: 2311-3278

Research Article - (2023)Volume 11, Issue 4

The purpose of this research work is to look at the significance of Microfinance Institution (MFIs) funding on the development of SMEs (Small and Medium Enterprises) in Freetown, Sierra Leone. A well-structured 100 questionnaires were administered to SMEs owners in the collection of pertinent data for analysis in this study. However, simple random selection procedures were used to choose the SMEs, which comprised the size of the research sample. In the display and interpretation of data, descriptive statistics incorporating basic graphical charts and tables were strategically used. The data revealed that a substantial number of SMEs profit from MFI loans, despite the fact that few of them have adequate ability to secure the required amount. Surprisingly, the majority of SMEs acknowledge that MFI loans have helped them advance their market share, economic competitive advantage and achieve market excellence.

Microfinance institution; Small and medium scale enterprise; Loans; Freetown

Despite the increased role of Small and Medium Enterprises (SMEs), access to credit by SMEs remains one key limitation for starting or sustaining of the business. Micro Finance Institutions (MFIs) if they serve as a source of finance for SMEs and if they are widely available, microfinance institutions could improve the economic activities. Governments have made a lot of effort to develop the nation through SMEs, in spite of all these attempts, much is needed to enhance this sector which is considered extremely important in the sustainable economic development. Hulme argued that MFIs are not a cure for poverty but a solid foundation for economic growth. However, MFIs could create and provide a broad range of services that would support the less privileged people in their efforts to improve their own prospects. Initially based on traditional forms of community financing, microfinance has globally attained great achievements over the past 30 years.

It has proven that poor people can be viable customers and that microfinance can create strong institutions which focus on them. No doubt microfinance has strongly attracted the interest of private sector investors. The failure of commercial banking to provide financial services to the poor coupled with disadvantages of using informal market are major rationales for interference in the market for financial services at the micro level. Consequently, microinance emerged as an economic approach intended to focus on the financial needs of the deprived group in the society. The services provided by microfinance institutions such as savings, deposits, loans, insurance, payment services, and money transfers to poor and low-income clients help in creating a lesser complex means for SMEs to access finance. Microfinance services are provided by Micro Finance Institutions (MFIs).

Olu posited that the goal of Micro Finance Institutions as financial and development organization is to service the financial needs and underserved market as a means of meeting development objectives [1]. The development of Small and Medium Enterprises (SMEs) is of fundamental significance for the prosperity of countries around the world. SMEs serve as sources of livelihood to the poor, create job opportunities, generate income, and contribute to the growth of an economy. Sierra Leone is a developing country and its economy is dependent on the development of SMEs.

Problem statement

Since her independence in 1961, Sierra Leone has been trying to meet the desires and aspirations of her teeming population, particularly in the area of employment and economic development. Regrettably, not much has been attained in this respect. Given the significance of SMEs in the creation of employment and increase economic activities, this study seeks to review the financing of SMEs in freetown by identifying the problems of financing SMEs. Micro Finance Institutions (MFIs) are established to provide funding for the adventurous poor. Through series of loans and repayments it is anticipated that SMEs are gradually empowered and expanded.

Furthermore, the interest rate is high and it is not the only cost of credit incurred by SMEs. There are also other costs related to the process of obtaining information about the services and the whole process of applying for the credit, cost of getting transportation to make credit payments, time spent obtaining credit and tracking the debt all these are referred as transaction costs.

This study therefore investigated the impact of microfinance service on the development of SMEs in Sierra Leone and to investigate the benefit received from microfinance credit if they outweigh the cost incurred by SMEs when servicing its liability and the contribution of MFIs in Sierra Leone on improvement of access to finance by SMEs.

Objectives of the study

This research work examined the impact of micro finance funding on the development of Small and Medium Enterprises in Freetown. The specific objectives in this study are:

i. To determine the impact of Micro Finance Institution on the development of Small and Medium Enterprises.

ii. To discover Small and Medium Enterprises have reasonable and fair and fair access to micro financing.

Research question

In other to achieve the identified objectives the subsequent questions would be appropriate in tendering satisfactory conclusion:

i. What is the impact of Micro Finance Institution on the development of Small and Medium Enterprises?

ii. What are the difficulties in accessingfinance from Micro-finance Institutions by Small and Medium Enterprises?

iii. Microfinance

Microfinance is a development tool that provides a broad range of financial services to low-income earners, usually to assist in establishing or expanding their businesses. Examples of services provided include deposits, small credit, payment services, money transfers, insurance and other services that are provided in small increase in the initial sum that low income individuals can afford. These services assist families to begin and build ‘’micro’’ enterprises, the small businesses that are important sources of employment and income in developing countries. Microfinance does not only cover financial services but also non-financial assistance such as training and business advice. Microfinance is sometimes called banking for the poor and it is mostly used in developing economies where SMEs have limited access to other sources of financial assistance.

Small and Medium Enterprises (SMEs)

There is no single, uniformly acceptable definition of the term SMEs. The SMEs cover non-farm economic activities mainly manufacturing, mining, commerce, and services [2]. According to SMEs can be defined as a productive activity either to produce or distribute goods and or services mostly undertaken in the informal sector [3]. However, the definition of SMEs is based on number of employees, annual turnover, and value of assets, loan size and capital. SMEs definition has been placed on the following criteria: Skill labour, legal status, firm size, turnover level, capital assets and method of production [4].

The government of Sierra Leone defines SMEs according to sector, employment size and capital investment in machinery. For instance

i. A micro-enterprise is one with less than 5 employees

ii. A small enterprise with 5 to 49 employees.

iii. A medium enterprise with 50 to 99 employees and

iv. A large enterprise with more than 100 employees.

Investment in capital range from less than SLL 10,000 to over SLL 900,000. This definition would exclude a number of informal economy enterprises, farmers, and Sierra Leoneans engaged in lower- level income-generating activities.

Most SMEs are not listed in the stock exchange and therefore do not have access to capital markets. Thus, they are not required to make information available to the public. The unlisted SMEs hampered access to equity. Even though some countries have made attempts to create alternate stock exchanges precisely for SMEs but they have been confronted by challenges.

Microfinance and income generating activities

Microfinance has been a key instrument in improving social status of the micro-credit members especially in developing countries. This can be seen in different domains such as running small business, retails shops, grocery and others.

According to borrowers use the loans to start businesses such as buying goods wholesale to sell in markets, making and selling crafts, farming and other similar activities [5]. The profits they earn allow them to repay the loan, make a living and generally improve their living conditions and the conditions of the community. As borrowers build credit, they qualify for larger loans. Most loans are made without collateral. However, to establish creditability with microfinance institutions, borrowers often form groups whose members guarantee one another loan payments. As microfinance focuses on providing poor people with access to finance in the form of credit so they can engage in income generating activities, there is cash flow which is used to increase assets, including permanent houses or savings accounts, offering recourse during hard times and consumption, especially in food, nutrition and education.

The potential for loan uses are virtually endless and different among countries. However, loans provide a source of income for diverse activities chosen specifically by the borrower to create their own life. Microfinance funds are offered by microfinance institutions, these services enhance the capacity of the poor segment of the population for entrepreneurship and enable them to engage in economic activities and be more self-reliant, increase employment activities, enhance household income, and create wealth. Sogorb-Mira observed that the size of a firm develops over period of time [6]. Low income earners wishing to open or continue a micro, small or medium enterprise have to take calculated risk by financing their ideas. Due to the fact that there is a limit in accessing capital for low income earners from commercial banks, microfinance provide funds for entrepreneurs and business people to help in promoting SMEs market share, production efficiencies and competitiveness. Many Small and Medium Scale Enterprises which are profitable are forced to cease their operations due to the inability to meet their short-term debts obligations.

The situation is not that they do not have funds to operate but the problem is how they manage their finance especially working capital, human asset and good book keeping [7]. In discussing the rationale for good record keeping practice, the literature pointed to the fact that SMEs had poor quality of financial records, not infrequently they were satisfied with mental records. It was also noted that there was a positive relationship between good record keeping and performance [8].

Accordingly, one relevant reason for undertaking this study is to fill the research gap in the area of challenges facing SMEs in the access, management of finances and people practice of Small and Medium Scale Enterprises. The Small and Medium Enterprise sector has been chosen because they play a very significant role in the economy of Sierra Leone. SMEs contribute about 55 percent to Sierra Leone’s gross domestic product and account for about 90 percent of businesses in Sierra Leone [9].

Research design

The study adopted mixed methods to determine the impact of microfinance on the development of Small and Medium Scale Enterprises by looking at the number of employees and production yield/revenue earned through microfinance loans.

Sample size and sample selection

The sample size constitute of is 100 Small and Medium Enterprises operators and 3 microfinance institutions in Freetown. A nonprobability sampling was used with purposive sampling to select 30 operators from the West End Area of Freetown, 40 operators from the Central Business District of Freetown, and 30 operators from the East End Area of Freetown. The 3 Microfinance Institutions (BRAC, LAPO and OYA Micro Credit Company Limited) were selected from the Central Business District of Freetown.

Instrument and data sources

In this research, instruments were employed by the researcher as much of the data collected were based on questionnaire and personal interview. These instruments were used as primary strategies to obtain the needed information from the study population to determine the present situation of the event.

Both primary and secondary data were employed for the study. Library and internet search were employed to reviewed relevant literature from secondary sources to assemble information about the subject matter.

Techniques of data analysis and interpretation

The responses were grouped under two main categories namely Small and Medium Enterprises and presented in summary tables and figures and later discussed.

The study was interested in knowing the impact microfinance has on the development of SMEs, the challenges faced by SMEs in accessing funds from MFIs. These findings have been presented in summary tables and figures for ease of reference and to compare the cases at a glance. The data collected were further analyzed using the following statistical tools: Tables, pie chart, column charts, bar charts, and narrative notes so that all the details can be seen at glance. The figures (charts) and tables are arranged in rows and columns which exclude any unwanted materials.

Demographic characteristics of SME participants

From the table below, majority of the SMEs participants are registered as sole proprietorship. Out of the 100 participants 86 were sole proprietorship representing 86%. 9 participants representing 9% were partnership while 3 participants representing 3% being private limited company. The remaining 2% of the SMEs participants were registered as corporative company (Table 1).

| Form of business | Frequency | Percentage (%) |

|---|---|---|

| Sole Proprietor | 86 | 86 |

| Partnership | 9 | 9 |

| Private limited company | 3 | 3 |

| Corporative company | 2 | 2 |

| Total | 100 | 100 |

Table 1: Frequency distribution of form of business.

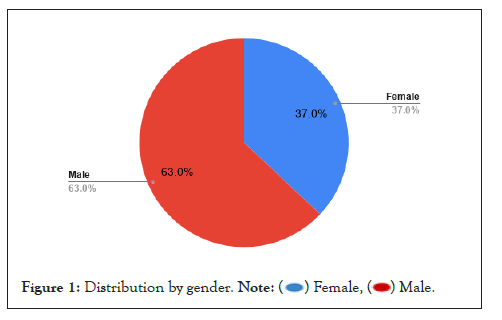

Gender of SME participants

The findings presented in the figure above showed that 63% of the participants were male while 37% were female. Thus, there was no disparity in gender amongst the participants and the indications are that SMEs are managed and operated by both male and female (Figure 1).

Figure 1: Distribution by gender.

Age distribution of SME participants

The table showed that 12% of participants were below the age of 30 years, 13% were 31-35 years, 18% were 36-40 years, 24% were 41-45 years and 33% of the participants were above the age of 45 years (Table 2).

| Participant's age | Number of participants | Percentage (%) |

|---|---|---|

| Below 30 years | 12 | 12 |

| 31-35 years | 13 | 13 |

| 36-40 years | 18 | 18 |

| 41-45 years | 24 | 24 |

| Above 45 years | 33 | 33 |

| Total | 100 | 100 |

Table 2: Frequency distribution of participant’s age.

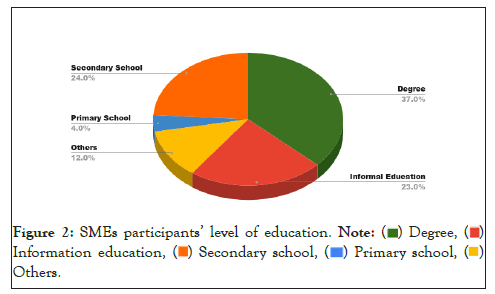

Level of education of SME participants

The figure above showed that majority (37%) of the participants were degree holders, 24% completed secondary school, 23% had informal education, and 12% had other education such as masters while 4% completed primary school. This confirms that 49% of the participants have attained higher education which is encouraging since in theory most of the small business have been associated with the less educated (Figure 2).

Figure 2: SMEs participants’ level of education.

Others.

Others.

Cross tabulation analysis and interpretation

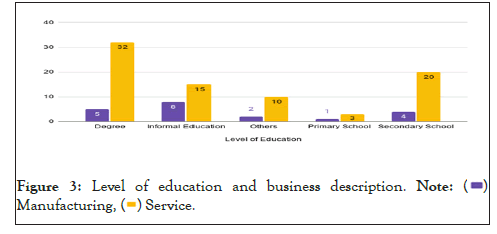

Participants were asked to indicate the type of business they operate and their level of education. This is to determine the expertise of the operators of SMEs.

Out of the 37 participants with degree 5 are operating manufacturing enterprise and 32 operating service enterprise, 8 of the 23 participants with informal education operate manufacturing enterprise while 15 operate service enterprise, 2 of the 12 participants with others such as master’s degree operate manufacturing enterprise while 10 participants with other level of education operate service enterprise, out of the 4 participants with primary school as their level of education 1 is operating manufacturing enterprise and 3 with service enterprise, and 24 participants with secondary school as their level of education has 4 operating manufacturing enterprise and 20 operating service enterprise (Figure 3).

Figure 3: Level of education and business description.

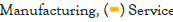

Sources of initial capital of SME participants

From the result shown in the figure above it was realized that 74 participants representing 74% had establish their enterprises with their personal savings, 20 participants representing 20% admitted that their enterprise were established by funds from family and relatives. Only 4 representing 4% confirmed that their business was established through borrowing from non-banks and 2 representing 2% had their business established through grants. This shows that most people set up their enterprises from their own funds through personal savings which were either saved in banks or through some collectors (osusu) (Figure 4).

Figure 4: The source of SME participant's capital.

The number of employees employed

In this research, most businesses have less than 10 employees mainly because owners manage business with the support of their spouse and children.

The family members are not paid any salary since they were considered as the apparent heirs in case of any eventuality. However, with growth of businesses, the owners employ non-family members but they ensure that the control and management remain with the family. As shown below in the table, majority (47%) of the participants SME employed less than 5 employees, 35% have 5-10 employees and 18% of them had above employees respectively. The results are reflection of how SMEs operate, in that most of them are still at their infant stage where they need close management and most belief that outsiders would interfere with the smooth running of businesses (Table 3).

| Employees | Frequency | Percentages (%) | Cumulative (%) |

|---|---|---|---|

| Below 5 | 47 | 47 | 47 |

| 05-Oct | 35 | 35 | 82 |

| Above 10 | 18 | 18 | 100 |

| Total | 100 | 100 |

Table 3: Number of employees employed by SMEs.

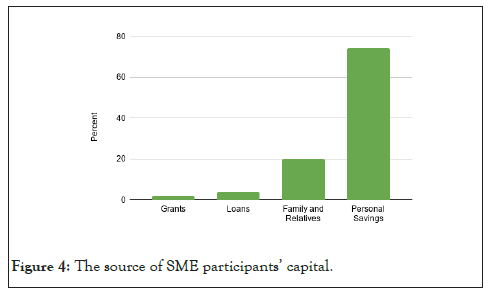

Loan options available to SMEs

The participants were questioned about the loan options available to them. Loans from financial institutions such as commercial banks and microfinance institutions were options available to participants. From the study which is shown in the figure above, it was realized that 51 of the participants representing 51% have taken loan from microfinance institutions, 13 of the participants representing 13% have taken loan from commercial banks and 36 of the participants representing 36% have taken loan from both microfinance institutions and commercial banks (Figure 5).

Figure 5: The loan options available to SMEs. Note:

Repayment of loans by SMEs

The study reveals that not all SMEs that acquire loans pay. The findings show that out of the 100 participants that took loans from financial institutions, 83 participants representing 83% have repaid or on the process of completing the loan while 17 participants which represent 17% have not repaid their loans (Table 4).

| Loans repayment | Participants |

|---|---|

| No | 17 |

| Yes | 83 |

Table 4: SME participants that are repaying loans.

The reasons for not paying loans

Further study was conducted to identify the reasons why SMEs fail to repay their loans and the sources of finance for the repayment of loan by the other SMEs. The result in the table below showed that out of the 17 participants representing 23.53% fail to repay the loans provided to them because they were discouraged by the other SMEs, 3 out of the 17 participant representing 17.65% fail to repay their loans because they diverted from the original purpose used to apply for loans from financial institutions and invested in none profitable venture and the majority failed to repay their loan because of reason other than the two stated above such as business running at loss, increase in the prices of commodities due to coronavirus and increase in the price of goods and services (Table 5).

| Reasons for not paying loan | Participants | Percentage (%) |

|---|---|---|

| Discouraged by others | 4 | 23.53 |

| Diversion of loan | 3 | 17.65 |

| Others | 10 | 58.82 |

| Total | 17 | 100 |

Table 5: The reasons for not paying loans.

SMEs sources of finance for loan repayment

For the 83 participants that have paid their loan or still repaying their loans, findings in the table below showed that 58 participants representing 69.9% paid off the loan from income generated from operation(s) of the business, 15 participants representing 18.1% secured finance from other financial institutions to settle their loan. However, 7 participants which represent 8.4% sell or pledge assets to repay loans and 3 participants representing 3.6% use personal finance to settle loans (Table 6).

| Sources of loan repayment finance | Participants | Percentage (%) |

|---|---|---|

| Personal finance | 3 | 3.6 |

| Selling/pledging of assets | 7 | 8.4 |

| Loan from other financial institutions | 15 | 18.1 |

| Business income generated | 58 | 69.9 |

| Total | 83 | 100 |

Table 6: SME source of finance for loan repayment.

The impact of microfinance loan on the number of employees

The results from the findings in the table below indicated growth of SMEs in the number of employees after microfinance loans. Out of the participants, 29 representing 33.4% operate a small enterprise before microfinance loans, after the loans 42 participants representing 48.3% operate a small enterprise which indicates a 14.9% increase in the number of participants with small enterprise. 17 participants representing 19.5% operate a medium enterprise before microfinance loans, after the loans 37 participants representing 42.5% operate a medium enterprise which indicates a 23% increase in the number of participants with medium enterprise (Table 7).

| Number of employees | Participants before microfinance loan | Percentage % | Participants after microfinance loan | Percentage % | Percentage change after microfinance loan (%) | Growth rate after microfinance loan (%) |

|---|---|---|---|---|---|---|

| 05-Oct | 29 | 33.4 | 42 | 48.3 | 14.9 | 44.6 |

| Above 10 | 17 | 19.5 | 37 | 42.5 | 23 | 117.9 |

| Total | 87 | 100 | 87 | 100 |

Table 7: Growth of SMEs in the number of employees after microfinance loans.

SMEs participants change in revenue generated

The results from the findings in the table below indicated growth of SMEs in revenue generated after microfinance loans. 59 participants representing 67.8% had small revenue earned before microfinance loans, after the loans only 10 participants representing 11.5% have small revenue earned which indicate a 56.3% reduction in the number of the small earning SME participants got from microfinance. 18 participants representing 20.7% had medium revenue earned before microfinance loans. However, after the loan 52 participants representing 59.8% have medium revenue earned. This indicates a 39.1% increment in the number of medium earning SME participants got from microfinance. 10 participants representing 11.5% had revenue earned before microfinance loans. However, after the loans 25 participants representing 28.7 have large revenue earned. This indicates a 17.1% increment in the number of large earning SME participants got from microfinance (Table 8).

| Size of production yield/revenue earned | Participants before microfinance loan | Percentage % | Participants after microfinance loan | Percentage % | Percentage change after microfinance loan (%) | Growth rate after microfinance loan (%) |

|---|---|---|---|---|---|---|

| Small | 59 | 67.8 | 10 | 11.5 | -56.3 | -83.1 |

| Medium | 18 | 20.7 | 52 | 59.8 | 39.1 | 188.9 |

| Large | 10 | 11.5 | 25 | 28.7 | 17.2 | 150 |

| Total | 87 | 100 | 87 | 100 |

Table 8: The impact of microfinance loan on the production yield/revenue earned by SMEs.

The financial accessibility technique is used in this study to investigate the influence of microfinance institutions on the growth of SMEs in Freetown. It makes use of data gathered from a field survey of MFIs and SMEs in Freetown. Tables, pie charts, column charts, bar charts, and narrative notes were employed as statistical tools. A cross tabulation of analysis was also utilized to analyze the influence of microfinance on the chance that participants would improve the volume of sales and income creation. The study findings show that an increase in MFIs financing will lead to the development of SMEs. During the research period, these MFIs issued varying amounts of loans to SMEs, with the lowest amount been Le200/Le200,000 and the maximum amount being Le100,000/Le100,000,000. It also sought to ascertain the influence of microfinance services on the expansion of SMEs in Freetown. However, it is important to note that one of the many challenges SMEs face in accessing loans from MFIs is the high interest rate. The study findings revealed that MFIs had a favourable influence on the growth of SMEs. The contribution of SMEs to economic growth and creation of employment is very evident worldwide.

The study main policy significance is that the government of Sierra Leone should address the credit demands of SMEs in order to achieve quick economic growth. In reality, there can be no sustainable growth in a country without a thriving SMEs development. However, the government may succeed in the following ways:

1. Credit should be made easily accessible through specialized or development-oriented banks or other financial institutions such as micro credit. This money should be made available at a reduced interest rate to SMEs.

2. There should be moratorium or grace period of loan and tax haven especially for startups.

3. Government should set up a vibrant entrepreneurial ecosystem for SMEs with the necessary facilities.

4. Through the central bank of Sierra Leone, a specialize stock market can be created for SME owners to interact with potential investors.

5. Establishment of a well-funded National Credit Guarantee Fund (NCGF) to support banks and other financial institutions with micro-loan facilities. This will assist to minimize the oversupply of collateral security.

6. Furthermore, micro finance institutions should be structured to not only provide loans to SMEs but help in providing financial management and business analytic for a successful enterprise.

[Crossref]

Citation: Kamara A (2023) The Impact of Micro Finance Funding on the Development of Small and Medium Enterprises (SMEs). J Res Dev. 11: 242

Received: 06-Nov-2023, Manuscript No. JRD-23-27917; Editor assigned: 09-Nov-2023, Pre QC No. JRD-23-27917(PQ); Reviewed: 24-Nov-2023, QC No. JRD-23-27917; Revised: 01-Dec-2023, Manuscript No. JRD-23-27917(R); Published: 08-Dec-2023 , DOI: 10.35248/2311-3278.23.11.242

Copyright: © 2023 Kamara A. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.