Journal of Research and Development

Open Access

ISSN: 2311-3278

ISSN: 2311-3278

Research Article - (2024)Volume 12, Issue 1

The UK in the case of a "Brexit," foreign direct investment is expected to be severely impacted in several ways, including restrictions on corporate personnel transfers and the coordination of "service" activities due to customs hurdles. The negative consequences of currency devaluation are also present. In the context of the already present labour market polarization, inward investment flows into advanced manufacturing, food technology, and financial services-all of which can create "good quality" jobs are particularly sensitive to friction in global value chains under Brexit. The paper begins by emphasizing the auto sector case before moving on to illustrate the connections between inward investment, employment restructuring, and the quality jobs calibre produced by foreign enterprises.

Brexit; Foreign direct investment; Global value chains; Employment; Job quality; Regions; Industrial policy

Since 2010, as the UK auto industry has recovered, production has increased, and over £8 billion has been invested in the sector over the past five years [1]. In total, the sector supports about 800,000 jobs in the UK. Regions like the West Midlands, which suffered from deindustrialization, factory closures, and the effects of the global financial crisis, benefited from this recovery [2,3]. The skill base, cooperative labour-management relations, connections to universities, pro-business industrial policies, and other factors all contribute to the success of the auto industry. However, it should be noted that access to the EU single market was also one of the key elements of success. In fact, the industry is seen as having benefited from EU membership, not only in access to the single market but also through trade agreements the EU has with the rest of the world, in the UK affecting EU regulations, and in access to workers' skilled and Europeans. Research Networking and Funding [4]. What, then, might Brexit mean for the UK automotive industry (hereafter referred to as "UK Cars") and, consequently, for UK industrial policy?

Beginning with an assessment of how Brexit will impact foreign investment flows into the UK, this paper offers recommendations for the creation of a post-Brexit UK industrial policy. For the UK economy, the latter is particularly significant. The paper notes that a "hard Brexit" will most definitely have a negative impact on inward investment in a number of ways, including the creation of customs barriers, delays at the border that will make cross-border supply chains more challenging, and the negative consequences of currency depreciation. The paper first discusses the issue of the auto industry before noting the connection between employment restructuring, inward investment, and the standard of the jobs that foreign companies created.

The study points out that, aside from the US, the UK has historically had one of the most adaptable labour markets in the developed world, so increasing labour market flexibility would be of limited use in mitigating the negative effects of Brexit on inbound investment flows. In fact, after Brexit, the UK's labour costs will be more competitive, attracting risky foreign investment and a "race to the bottom." Further increases in labour market flexibility will only help this situation. Investments in food technology, financial services, and advanced manufacturing can create "good quality" jobs in the context of labour market polarization. These jobs are particularly vulnerable to Brexitrelated frictions in global value chains. To try to lessen some of the negative effects of Brexit, we refer to a set of "design principles" in the development of industrial policy.

The effects of the short-run production market

The starting point in understanding the impact of the Brexit vote on the UK car industry is to consider its impact on the wider UK economy, both in terms of economic growth and the value of the pound sterling. For example, a potential slowdown in economic growth is likely to affect car sales in the UK, so at best car sales are likely to grow more slowly than otherwise, and at worst they may decline. For example, PA Consulting forecast a potential decline in UK car sales in the range of 5%-10% after the Brexit referendum, while consultancy LMC revised its baseline forecast for the UK light vehicle market in the United States by 15%. to 2.55 million units for 2018 (versus 3 million units in 2015) -a decrease in projected market size of more than 400,000 units for 2018, in August 2016, General Motors was the first European manufacturer to announce production cuts in Europe in anticipation of slowing car sales in the UK [5,6]. Ford also cut its European production in the third quarter by more than 80,000 units in the wake of the Brexit decision. This negative outlook was offset to some extent by the monetary policy in England immediately after the referendum (including interest rate cuts and more quantitative easing), which helped lower financing rates on new cars. The Bank is now indicating that interest rates may rise. In terms of currency, the value of the British pound fell significantly in the aftermath of the Brexit vote (although the value of the British pound rebounded in September 2017). For UK car collectors, this depreciation should lead to more exports. In response, companies have a choice between increasing production and increasing prices to increase profit margins. However, this should help raise UK car production in the short term to over 1.8 million units. Therefore, the immediate impact on UK motoring is likely to be "production increases while domestic sales decline".

However, at the same time, imported cars and components will become more expensive for consumers and industry alike. On average, only about 40% of the components that make up a UK-assembled car are sourced locally, as opposed to 60% in Germany, due to the fragmented nature of UK automotive supply chains [1,2]. By late 2016, the depreciation of the exchange rate was already feeding into inflation, particularly with regard to imported components and factory input prices (National Statistics stated in August 2016 that input prices rose 4.3% in July 2016). These forces will affect different companies in different ways. Jaguar Land Rover, for example, sources a higher percentage of components in the UK and has higher margins to play with than, say, General Motors with its Vauxhall brand. Both companies have worked hard in recent years to raise supply levels in the UK. This may become necessary if the pound sterling stabilizes at a low exchange rate Page| 4 and imported components become too expensive.

Those car brands that don't assemble in the UK and only import cars have been negatively affected by the drop in sterling over the past year as their cars have become more expensive here (or their margins have shrunk). So in terms of the UK car market, the "bottom line" is that cars (whether imported or UK-made) are likely to get more expensive; This can be seen in the price hikes since late 2016 despite recent discounts and 'junk' schemes due to the UK car market downturn suggest that UK car prices could rise by 2.5% after Brexit) [7]. Moreover, as noted, a slowdown in economic growth is also likely, which will affect car sales.

The inward investment value to the economy (UK)

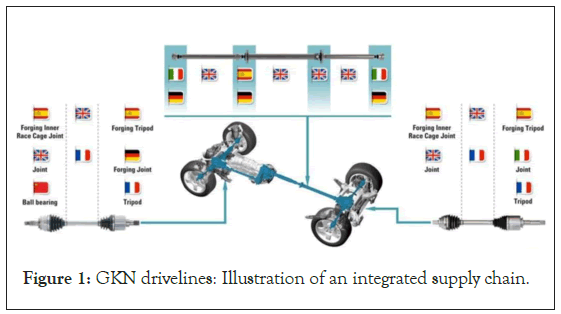

Inward investment is of vital importance to the UK economy. Compared to other G7 countries, the UK has the highest proportion of inward FDI, at 64% of GDP in 2014 [8]. Much of this investment comes from other EU member states, as (Figure 1). In fact, ONS data shows that the largest contributor to gross value added of foreignowned firms has been European Union business with 49.5% of the total since 2008. The second largest contributor has been the Americas with 42%, while Asia, while third, experienced a growth of 94% over the same period. On a macro level, one could speculate that one of the UK's main attractions for non-EU investors is access to the single market, while intra-EU investing is a group of companies seeking access to UK markets directly, as well as harmonizing activities along supply chains across locations. In addition, the proportion of R&D conducted by foreign companies exceeded 50% for the first time in 2011 and has been higher than that achieved by UK-owned companies every year since, except for 2016 when it was equal. Understanding the importance of inward investment in job creation in the UK requires understanding investors' motivations for being in the UK as well as the activities they carry out in the UK. Most investments in the UK from abroad can be categorized as either "market seeking", i.e. coming to the UK to serve clients via the UK single market or in the UK, alternatively as "competence seeking FDI". The latter refers to companies looking for the most efficient locations to supply multiple markets and enable post-export activities. In order to achieve investment-seeking efficiency, cross-border markets must be developed and open; this type of investment usually thrives in integrated regional markets. Both types of inward investment are usually characterized by local multiplier effects and supply chain activity, which brings additional benefits to the host economy. To understand the activities carried out by intrainvestors, one has to consider the nature of global value chains (GVCs the processes/activities by which a company adds value to an article) and the way multinational corporations organize their value chains. Figure 2 illustrates the well-known “smile curve” and the organization of global value chains.

Figure 1: GKN drivelines: Illustration of an integrated supply chain.

Figure 2: Inward investment to the UK by source (stock, £ billion). Note:  Rest of the world [38].

Rest of the world [38].

The UK has seen a concentration of activities at either end of the curve, with R&D and design so much in the UK that more than 50 per cent of the private sector R&D carried out in the UK is done by foreign Multinational Companies (MNCs). As for high-value services and customer-focused ("Service") activity at the other extreme, one could argue that the UK may have been one of the largest beneficiaries globally from this new system of activity.

How possibly brexit impact the inward investment

UK investors will face a number of challenges as a result of Brexit if they are looking to sell into the EU and run the supply chains that cross between the UK and the UK. Firstly, incoming Japanese investors, supported by the Japanese government, have been keen to stress that future investment in the UK depends on free trade with the EU which is as uncomplicated and predictable as possible. The Japanese government's note expressed concerns about the continued viability of Japanese investment in the UK in the event of a "Brexit" without access to the EU single market. Nissan, for example, has commented that it will revise its decision to build the next generation of the model in the UK when the shape of Brexit is clearer [9].

Second, investors will face challenges if they seek to operate supply chains that cross (sometimes multiple times) between the UK and the EU. When the single market was created in 1993, many commentators speculated that foreign direct investment would take place within the European Union and will collapse.

This turned out to be far from the case as companies took advantage of opportunities to coordinate resources across countries. The single market connects innovative companies to the world's richest market and, through EU regional policy and structural funds, allows companies to take full advantage of location economies where labour is available in low-cost locations. Honda, for example, has warned MPs of the consequences of leaving the customs union [10]. Third, the depreciation of the pound sterling will also have an impact on domestic investment decisions.

As Driffield and Karoğlu point out, the current literature has some trouble identifying links between inward investment and currency depreciation. On the one hand, the depreciation of the pound sterling makes British assets cheaper for foreign investors, but on the other hand, the expected returns in local currency also fall. Therefore, determining the dominant influence is problematic. Driffield and Karoglou analyzed 50 years of UK inward investment time series data and found that in (usually short) periods of uncertainty, GBP provides a temporary positive effect on FDI [11].

But when the economy becomes stable again, this positive effect is not only cancelled but becomes reversed and continuous. In other words, a weaker currency will eventually cause concerns about lower future returns to dominate strategic thinking. This, in turn, will inevitably drive investment elsewhere.

The UK automotive industry

Much of UK manufacturing is closely linked to the European Union through complex cross-border value chains. These value chains involve complex value-adding processes by firms in different countries, as component goods and services cross borders often before reaching the final consumer. The automotive sector is a case in point. For example, a typical driveline system produced by GKN, the British supplier of automotive drivetrain technologies and systems, includes specialist forged parts from the UK, Spain, Italy, France and Germany. are assembled at GKN Driveline's UK plant in Birmingham and supplied to UK and EU collectors. This is illustrated in Figure 1 below. The assembled components and drivelines and the then assembled car can cross the English Channel multiple times (Figure 3) [9].

Figure 3: The “smile” of value production [39].

As noted above, these value chains must be “friction-free” in terms of tariff as well as non-tariff barriers (such as regulations and standards). As noted by KPMG “OEMs, such as aircraft and car makers, may prefer the simplicity and flexibility of the EU's supply base rather than dealing with the potential complexities of a company based outside the union [12].

In the long run, more EU-based alternatives will emerge. As buyers annoy their suppliers, British companies may become more marginalized. Integration of supply chains is a double-edged sword our manufacturers are indispensable.” It's a similar story for BMW, which assembles engines at its Hams Hall engine assembly plant near Birmingham. Engine blocks come from France before being processed in the factory.

They may go to Germany for more work before they can be assembled. The engine may go into a MINI assembled in Oxford or the Netherlands, or in a BMW assembled in Germany. The finished car could be sold anywhere in Europe or all over the world. Components, engines, and the final car can cross the channel several times in total. The most integrated global value chains are Just-In-Time (JIT) supply chains.

These originated in the Japanese automotive and electronics sectors, and are now pervasive in many sectors in the UK and EU, including manufacturing, engineering, retail and FMCG markets [13]. JIT enhances the efficiency of the assembly plant in several ways. By delivering components only when they are needed, and only in the exact quantity required, defects are detected (thus improving quality), inventory levels are reduced and the need for storage space and associated costs is reduced. Yoon Kim and McCann noted that before the 1980s, about $600 to $800 of capital was tied up in the inventory of each car in the American auto industry, compared to only $75 to $150 in Japan, which adopted JIT principles [14].

As a result, the average Japanese assembly plant was about 600,000 square feet smaller than its counterpart in the United States. The widespread adoption of JIT in the automotive industries from the mid-1980s onwards led to rapid declines in inventory levels and lower costs without implementation challenges (ibid.), including across the EU automotive industry. So in JIT supply chains, companies have little or no inventories. Supplies are delivered in very small quantities with high frequency from suppliers located in neighbouring regions or countries. But for JIT to work, the entire delivery system must be seamless or friction-free. Frictionless trade enabled by the EU customs union and single market allows JIT supply systems across Europe to operate seamlessly (ibid.). One example of a JIT in operation is Honda UK's Swindon assembly plant. As evidenced before the Business Select Committee late last year, Honda said it kept just four hours of spare parts on its Swindon production line, with the cars manufactured ordered in response to consumer demand and parts delivered in sequence for that particular build. The plant requires the equivalent of 350 truckloads of components to be delivered daily from Europe [10].

Components arrive from EU suppliers within 5 to 24 hours, and Honda like other car assemblers fears border checks in the event of a 'hard Brexit' could cause a serious supply disruption that would require components to be stockpiled at costs [15]. The Japanese company has stated that every 15 minutes of customs delays would cost it up to £850,000 a year and that it would take 18 months to set up new procedures and warehouses if Britain left the customs union. Until then, with two million items moving daily, minor delays in the Dover Channel Tunnel would force hundreds of its lorries to wait the equivalent of 90 hours a day [10]. The company stated that a warehouse capable of holding nine days' worth of Honda stock would need to be approximately 300,000 square metres and be one of the largest buildings on Earth [15].

About 75% of these components come to Honda via the Channel Tunnel rail link, which has the potential to become a major bottleneck, especially in the context of Brexit border checks on a high volume of small shipments. This may force Honda and other auto collectors to switch to marine road use. The latter are less frequent, require larger deliveries and add several days of delay [15]. Patrick Keating, Honda's director of government affairs, stated that “outside of a customs union, there is no such thing as a frictionless border. I wouldn't say the justin- time manufacturing model wouldn't work, but it would certainly be very difficult” (ibid.). As a result, even short stops at customs borders are likely to cause major problems for the delicate supply chains involved in UK manufacturing, especially cars and are likely to make Britain a less competitive place to assemble cars, for example, indeed, if the UK leaves both the EU customs union and the EU single market, it is very difficult to see how cross-border JIT regimes can survive in their current form. However, customs processes, in short, are simply counter to these systems, due to the uncertainty associated with delivery time differences. It is therefore not surprising that the House of Commons Business Select Committee concluded that “non-tariff barriers, in the form of border delays and increased bureaucracy, will affect the competitiveness of the United Kingdom. We recommend that the Government, in its negotiations, attach a high premium to securing trade Friction-free for the automotive sector” (ibid.). It should be noted that a Canadian-style Free Trade Area (FTA) will not solve such problems. Not only do individual truck containers contain components from many different suppliers, but the combinations in each container will vary from day to day and even hour to hour depending on the model mix that goes down the production line at the final assembly plant [13]. In this context, enforcing compliance with EU 'rules of origin' requirements would make cross border JIT systems nearly impossible to operate. And the UK will not be able to easily switch to local suppliers in order to meet EU local content requirements, as local content is well below the 60% required under EU FTA rules.

Job quality, employment restructuring and internal investment

Inward investment is vital to the UK economy, not least because of the jobs created by foreign companies, often in areas with high unemployment, such as the North East. Inside investors dominate several notable manufacturing sectors, such as the automotive sector described above, along with professional services firms, particularly in sectors such as finance. Analysis of firm-level data collected by the National Bureau of Statistics for the period 2012-2015 reveals that firms with some foreign ownership account for about 20% of employment [8].

This large contribution may be explained by the fact that recipients of UK FDI are typically large Multinational Corporations (MNCs), and this concentration is higher in certain regions, with groups known to be around inward investment, such as Automotive in the West Midlands. Firms with inward FDI were more productive than firms without outward investment, and this is not limited to sectors thought to be high-tech sectors but includes large employers in other sectors. Analysis of company-level data for example indicates that the most productive beverage manufacturer in the UK is Heineken5, but, almost half of this productivity difference is attributed to the fact that multinational companies are more prevalent in sectors with higher value-added, and it should also be noted that the productivity gap between inward investors and the top-performing UK companies is much smaller than this headline figure.

According to the latest analysis by the Office for National Statistics, in 2016, UK companies that received FDI employed 4 million people, 17% of all UK employees [16]. Half of these people (2.1 million) were employees of the companies that received Foreign direct investment from the European Union, with the Netherlands, Luxembourg, France and Germany being the four largest countries. Similar to employment, just over half of the approximate Gross Value Added (aGVA) created by UK firms receiving FDI was generated by firms receiving investment from the EU, and the total gross value added from EU firms was £170 billion. Labour productivity, calculated as gross value added per worker, for UK firms receiving FDI from the EU is on average 70% higher than the productivity of a UK firm not receiving FDI from abroad [16]. The higher productivity of firms receiving FDI can be explained by the benefits of economies of scale, more advanced technology and better access to international best practices, including management practices. Economic theory suggests that more productive firms pay higher wages.

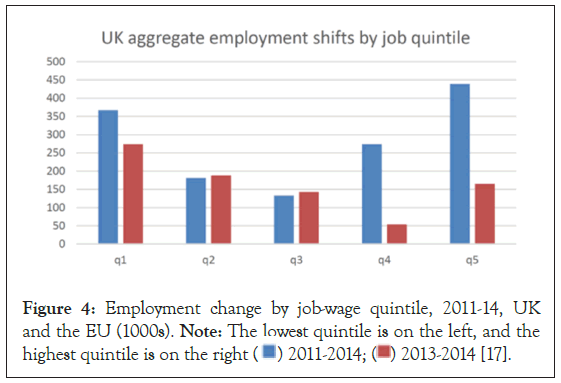

To assess the potential impact of Brexit on job restructuring and employment in more detail, first, we explore recent trends in UK employment patterns. Employment restructuring in EU member states is regularly evaluated by Eurofound, the European Foundation for the Improvement of Living and Working Conditions. Their method is a "job-based approach" that focuses on change in the number of jobs and uses pay as a proxy for job quality. The job salary range is divided into quintiles and the change in the number and proportion of jobs in each bracket is plotted over time [17]. This analysis revealed three trends for the UK: Job polarization, an increase in non-standard forms of employment in general and worse-paid jobs in particular. Eurofound research found that polarization (shown in Figure 4 for a shorter period) has characterized the UK labour market since the 1980s: Employment growth was observed in the bottom and top quintile, while employment contracted in the middle quintile. The global financial and economic crisis led to further polarization UK Employment Structures: During 2011-13, employment contracted in all but the first quintile. When employment levels started to rise in 2013-In 2014, more than 800,000 net new jobs were created in twelve months, and the greatest employment growth was observed in the bottom quintiles. Polarization leads to a “dump” of the labour market: The disappearance of decent jobs in the middle-wage quintile (Figure 4).

Figure 4: Employment change by job-wage quintile, 2011-14, UK

and the EU (1000s). Note: The lowest quintile is on the left, and the

highest quintile is on the right  2013-2014 [17].

2013-2014 [17].

The second trend in the UK labour market is the growing share of non-standard employment, in particular: Fake self-employment and zero-hours contracts. While offering flexibility and lower costs to employers, zero-hour contracts provide no income stability for workers and discourage investment in training either by employers or workers. As a result, these jobs tend to encourage lower productivity. Moreover, these jobs are not necessarily temporary – more than half of those on no-hours contracts have been employed under these terms for more than a year, some for more than 5 years [8]. Self-employment is another form of non-standard flexible work. While in most advanced economies, including the US, rates of self-employment have fallen, the UK has experienced sustained growth and by the end of 2016, 15% of all employed people were self-employed. Employee [18,19]. Self-employment is seen as a consequence of escaping unemployment: much self-employment is imposed and provided through temporary work agencies, with applicants having to be registered as self-employed to be eligible for employment in temporary jobs [20]. The average weekly earnings (excluding bonuses) of the self-employed in the UK fell by 26% between 2007/08 and 2015/16 [21]. Finally, the share of parttime workers who want to work full-time but cannot find full-time jobs is also significantly higher than the long-term average [19]. To summarise these trends, intensive job creation since the end of the global financial crisis has reduced unemployment in the UK, however, many of the new jobs can be characterized as ‘bad jobs’: Low-paid, insecure and with limited progression opportunities. A study by Goodwin and Heath suggests that bad jobs may have contributed to the outcome of the EU referendum, with 71% of those working in routine manual occupations voting leave [22]. Turning to the effects of Brexit and on jobs created by FDI, foreign investment in technology driven highskill sectors in the UK has created higher-paid jobs, and increased the demand for higher-skilled employees, such as technicians, engineers and IT specialists, leading to skills shortages in these occupations. Hard Brexit would jeopardise inward investment and the location here of these jobs by MNEs. In other words, the UK’s leaving the single market will make it more difficult for European businesses to invest in the UK economy, putting almost 20% of current jobs, some of the UK’s relatively ‘good jobs’ at risk.

Brexit impact mitigating

Policymakers at the national level acknowledged the problems of the ‘squeezed middle’ and those in low-paid jobs after the EU Referendum. Following Theresa May’s speech in July 2016 that announced the goal of making “the economy work for everyone” and having a “proper industrial strategy to get the whole economy firing” the Government released the Building Our Industrial Strategy Green Paper which set out proposals for a post-Brexit Industrial Strategy [23,24]. In this document, however, the problem of low wages is discussed primarily as a barrier to productivity rather than a problem in its own right. Based on current UK government policy, it is reasonable to assume, that we will see further increases in labour market flexibility to try to deal with the UK’s competitiveness problem in terms of labour cost. Such policies have proved popular with inward investors, and the greater labour market flexibility in the UK compared with countries such as Germany and France has long been linked with the historically high levels of inward investment in the UK. Critics point out that the UK labour market is already one of the most flexible ones in the developed world apart from the US, so increased flexibility is unlikely to have any benefits. In addition, this type of "race to the bottom" competitiveness is often criticized and rightly so.

There is an emerging consensus among labour market and social policy experts that it is not enough to create jobs; rather better jobs are needed. From an inward investment perspective, the essential problem is that the ‘middle region’ of activities of the value chain, characterized by lower value-added and a higher volume of employment, are typically carried out outside the UK. Developed countries attempt to ‘plug the gap in the middle’ by seeking an inward investment that will generate employment for the ‘squeezed’ middle. This can be achieved by identifying key sectors that hit the ‘sweet spot’ of high productivity but also employment generation.

However, these sectors, such as advanced manufacturing, food technology and financial services, are the ones that are most vulnerable to frictions in value chains which drive away investment, due to the way they are organized in a single market. Moreover, it has been established in the literature that inward investment either generates significant employment opportunities in relatively low value added activities or that it generates few jobs in high value-added activities [25]. An example of the former might be logistics, or perhaps increasingly important sectors such as recycling. An example of the latter might be aspects of the life sciences such as clinical trials, which offer undeniable value but are of limited magnitude. Therefore, the internal investment strategy must create a mixture of these sectors at the local level. The high value-added investment brings new technology, has the potential to diffuse, and advances knowledge transfer and training in supply chains and related sectors.

Drawing on a wide range of research evidence, the policy recommendations made by are not concerned with job creation but rather focus on improving the quality of jobs [26]. Recognizing that some companies deliberately take the low road (offering unsafe jobs), it is recommended that labour standards regulations be adopted and enforced by the government. For example, Australia has introduced national employment standards that list minimum benefits for all employees (Fair Work Australia, quoted in Warhurst) [26]. In the UK context, take a different approach [27].

Their research explored how wages could be increased in those lowerpaying sectors of the UK economy where growth in labour demand was expected (accommodation and food services, wholesale and retail and residential care). They recommended policies that would help raise the level of employees' skills and develop "career ladders" for them to improve productivity, innovation and higher wages. The analysis also highlighted that the most important factor driving wage increases in these three sectors are the total labour demand in a local area. Therefore, sectoral policies alone will not achieve the desired higher wages these policies must be part of a broader overall economic policy that takes into account local and regional economies as a whole and supports job creation.

United Kingdom Trading Relationship with others as noted, the UK has not yet decided what trade relationship it wants with the EU. Brexiteers have not actually made it clear what they want and may not actually agree with, and it is not clear how the EU will respond in turn. At the time of this writing (September 2017), it was not clear how it would pan out. It should be noted that if the United Kingdom reneges on the rules of the World Trade Organization in the absence of a trade deal with the European Union, the tariffs on cars could reach 10%, and on components up to 4%. The Association of Motor Manufacturers and Traders (SMMT) industry body has stated that if trade tariffs were imposed, it would likely mean £2.7 billion in duties on cars being imported into Britain and £1.8 billion on those being exported [1]. A 10% tariff on completed cars is a huge burden to the collective industry and will account for far more than the industry's total wages and profits [28].

In terms of post-Brexit trade arrangements, during the referendum campaign, some suggested that Norway and Switzerland are examples to follow, as they are outside the EU and enjoy forms of free trade with the EU. Switzerland's position is rather complex and is based on a number of bilateral agreements. Some sectors of its economy (services, for example) are not covered. It's kind of an eclectic "Swiss cheese" approach. Like Switzerland, Norway pays the EU budget and has access to the single market (on a blanket basis in its case), but must follow EU rules and has no input in the making of EU regulations. Either way, they are free to negotiate trade deals independently of the EU. So, can the UK "do Norway's work" and stay in the single market at least as part of a transition deal? This would reduce the economic damage from leaving the EU, but it would be difficult given that the campaign to leave immigration was a key issue. Complete freedom of movement for people in the single market is likely to be a sticking point for the UK, as could a payment into the EU budget as part of a transitional arrangement. Of course, some car companies based in mainland Europe will want to continue to trade with the UK (the UK is BMW's second-largest market in Europe for example) and they have already taken a hit in exports to the UK with the depreciation of the pound. There will be some wanting to get some sort of deal beginning a must-have deal.

Though, the position of the German Automobile Industry Association. A company spokesperson stated: (If you want full market access that necessarily comes with free movement of people. This is the bitter pill that Brexiteers have to accept) [29].

It's been finalized, but the compromise will take some time to sort out, and that uncertainty is itself a huge risk in terms of inward foreign investment in the auto industry. So there is uncertainty, and the industry is not sure how long that will take. A temporary or transitional deal on trade and skills is critically regarded by the industry [30]. As Holmes points out, there are practical difficulties to be overcome with sectorial deals for industries such as automobiles [28]. A full free trade agreement (FTA) would make cars exported tarifffree to the EU, but to benefit from this, they need to meet the EU's FTA rules of origin. Currently, these require 60% of the added value of the vehicle to be "domestic" to benefit from the FTA (or with EU parts and components under a so-called "accumulation" agreement). So to eliminate border bureaucracy, a customs union arrangement and a mutual recognition agreement for conformity assessment would be needed. However, to ensure automatic mutual recognition of conformity assessment in the UK, EEA countries are required to accept supranational implementation. Retaining the same offshore tariffs as the EU Common Offshore Tariff, the rules of origin will not be checked. As Holmes points out, such a deal is imaginable in cars because both sides have an interest in preserving the value chains in the sector [28].

Other production effects

Switching the assembly site mid-cycle for models currently made in the UK is not likely to result in higher 'double-play' costs in tooling and logistics. More likely, however, is a shift in assembly at the point of model replacement or when new models are launched [31]. Companies evaluating the collection site will consider a range of issues when making such decisions, including:

• Relative differences in cost between UK and EU locations.

• Dependence of sales of a particular model on the European market versus the UK market.

• The relative importance of 'Made in Britain' to the brand (which is more appropriate for premium and luxury brands).

• The volume of imported components.

• EU location options (linked to how much capacity still exists in the European auto industry).

• Profitability of UK operations, and how lower free trade conditions with the EU will affect this.

Uncertainty in particular about the possibility of imposing tariffs puts a question mark over the future of a number of UK factories and jobs. Furthermore, as supply chain investment moves with aggregator sizes, there could be a broader spillover effect. It should also be noted that automotive technology is changing rapidly with developments in electric cars, connected cars, and autonomous (driverless) cars. As noted by LMC, the lack of foreign direct investment in such new technologies “could have a long-term impact on the competitiveness of UK industry” [6]. A major risk to the UK car industry is that investment decisions to launch new car models are made many years in advance, often with factories entering 'positioning tournaments' to win contracts to build the new models. For many companies, these decisions are made in the middle of Article 50 negotiations. As LMC notes, “New investment initiatives in the UK, such as the expansion of existing manufacturing activity, or new capacity for manufacturers with alternatives to the UK, appear to Unlikely until the current uncertainty diminishes [31]. This uncertainty is likely to persist for several years (Table 1).

| Factory location choices likely to have been made | Decisions yet to be made | |||||||

|---|---|---|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Honda | CIVIC/CR-V | CIVIC | ||||||

| Vauxhall | Astra | MPV | ||||||

| Mini | Country man | Club man | Mini | |||||

| Toyota | Auris/Avensis | Auris | ||||||

| Nissan | Leaf/Juke | Note | Qashqai | Infinity Q30 | ||||

| Jaguar | XJ | F-type | XF/XE | F-Pace | XJ/XJR | |||

| Land rover | EVOQUE | New defender | Range rover sport | Discovery sport | EVOQUE/Discovery | |||

Table 1: Factory location choices [5].

Table 1 shows that it is likely that investment decisions have already been made to produce new car models in 2017-2019, including the Nissan Leaf, Juke and Toyota Auris. However, investment decisions for most of the cars that will be built after 2019 have yet to be made. These include the next generations of the Vauxhall Astra, Honda Civic, Toyota Auris and Range Rover Sport. These investment decisions will be made in what appears to be a window of at least two years of uncertainty. Carmakers will ask: Will the UK gain access to the single market? Is investing in British production worth the risk? This risk is greater for "mass market" producers who operate on low margins, low capacity, depend on exports and have new models in the planning stage. This is why PA Consulting sees the Toyota and Honda plants as most at risk although LMC sees the Vauxhall Ellesmere Port plant as the most vulnerable (eg due to the higher grade of imported components) [5,31]. PSA Group's acquisition of GM Europe (including Vauxhall) adds to this uncertainty given that the latter will be looking for significant cost savings [9].

Nissan and Ford have raised the possibility of divestment in relation to engine assembly, and the Japanese government has raised concerns about the Brexit process and how this could affect Japanese investment in the UK [32]. The Japanese government memorandum emphasized the need for the UK to retain maximum connectivity to the single market and to preserve the free movement of workers between the UK and the EU. The Japanese ambassador to the UK has warned that Japanese companies could invest in the UK if Brexit means they cannot make enough profits. Nissan itself initially stated that it would delay decisions on where to build new generations of models currently assembled at its Sunderland plant, with Renault-Nissan CEO Carlos Ghosn stating that "important investment decisions will not be made in the dark". It was thought the company would make model decisions for the Qashqai and X-Trail in early 2017, but it appears to have pushed forward the decisions to increase leverage over the UK government in the aftermath of the Brexit vote and uncertainty over the future of the UK-EU trading relationship. The British government knew it couldn't afford to lose the Qashqai investment, and Nissan actually held a big gun to its head. A deal has been struck and Nissan has announced that it will build the next generation Qashqai and X-Trail in Sunderland after we received "assurances" from the UK government (return to industrial policy below). Nissan has since said that decision will be reviewed once the terms of Brexit become clearer. The government has remained silent about the support on offer, even refusing to respond to requests from the Office for Budget Responsibility regarding whether there were contingent liabilities arising from the deal [33]. Qashqai's decision was good news for the industry and reflected the underlying competitiveness of the Sunderland plant. However, the bigger battles in securing investment in the UK car industry lie ahead-at Honda, Toyota and Vauxhall all of which are more at risk of shifting production from the UK to Europe if the uncertainty over the UK-Europe trade relationship is not cleared up sooner. While firms like Nissan will certainly face challenges if the UK does not have access to the Single Market, manufacturers may also try to use uncertainty as an excuse to cut capacity in the UK as part of wider efforts to reduce over-capacity in Europe (especially so given how easy it is to lay off workers in the UK compared with other EU countries). Ford has already scaled back investment at its Bridgend engine plant, although it has denied this is linked to Brexit. It should be noted that the UK auto industry’s success rests in large part on its productivity. The UK auto industry boasts plant utilisation running at over 70%, with several plants running 24/7 operations [4]. This compares favourably to European nations such as Italy, where utilisation runs at just over 50%. For example, Nissan’s Sunderland car plant was the UK’s most productive in 2015, building one in three of all new vehicles. The risk is that some firms will try to take advantage of spare capacity on the continent, shifting production from the UK at the time of new model launches, especially if the uncertainty can be used to justify it. While some commentators such as LMC note that while a ‘Hard Brexit’ (here meaning exiting the Single Market) may not represent a severe blow to UK auto, some volume (and by implication jobs in assembly and the supply chain) is likely to be lost over the medium to long term [31]. LMC notes that “new investment initiatives in the UK, such as the expansion of current manufacturing activity, or new capacity for manufacturers that have alternatives to the UK appear unlikely until current uncertainty diminishes [31]. Such uncertainty has the potential to last for several years”. "Dhingra et al., drawing on Head and Mayer suggest that if the UK were not able to maintain tariff-free access to the EU, UK auto output could fall by 12% if the wake of Brexit, with production shifted to elsewhere in the EU and possibly other locations" [7,34].

Desiccations of the future regional industrial strategy and policy

There is a post-Brexit risk that weaker regions of the UK will be disproportionately negatively affected by Brexit [35]. 'Non-core' regions of the UK are more economically dependent on the EU than core regions of the UK through trade and value chain linkages as well as EU cohesion finance: there is a risk that inequality between territories [36]. It may be exacerbated by any post-Brexit trade arrangements that reduce access to the EU single market [35]. Apart from the EU's cohesion policy, the UK has made limited use of place-based policies. After Brexit, the UK must find ways to decentralize and transform in a way that does not further weaken lagging regions. In this context, and after considering the potential impact of Brexit on inward FDI and the complex interrelationships between inward FDI and employment restructuring, we offer some considerations for future industrial strategy. These include a number of policy "design principles" to mitigate the negative impacts of Brexit on inward investment and job creation. It should be noted that the enactment of these influences may require a greater devolution of power and responsibilities to the sub-national level.

This may involve creating development agencies that can intervene more broadly and strategically at the regional level and undertake “smart specialization” through industrial policies at the regional level [35]. Shared powers may be one way to do this (in cities at least). Strengthening local capacity will be critical here, for example by building local growth centres to fill the void left by the cancellation of for example the Manufacturing Advisory Service (MAS). This could be part of the 'Combined Authority Plus' model, as well as moving skills funding to the regional level. Above all, the government needs to avoid a “hard brexit” that sees the return of tariff barriers and, ideally, secure a trade deal that prioritizes access to the single market for as many sectors as possible as quickly as possible.

It is also important to note that the UK should not go back to the days before the single market, when regions effectively competed with each other for foreign investment, for example through subsidies for investors. Instead, we advocate a UK-wide FDI strategy based on an understanding of the benefits of a particular form of investment for the region, linked to key sectors. It should also be noted that there is an underlying tension between the competitiveness achieved by giving inward investors access to a low-cost, flexible workforce and ensuring decent work and wages for employees. Departing from the above analysis, we emphasize the following design principles:

• Reconsider the value proposition for incoming investors. The sites will need to consider the nature of their value proposition to incoming investors, backed by the availability of land, which may involve some difficult decisions in terms of opening up greenbelt land. Part of this proposal also includes building more robust supply chains to support inward investors, addressing skills shortages, and working with companies and universities so that they become pillars of both foreign and domestic investment. This will require a more active industrial policy with regard to, for example, rebuilding UK supply chains and encouraging “resupply” [2]. UK regions may be able to be more active in attracting inward investment, although as mentioned above it is important that this does not herald a return to the excessive subsidies that were paid in the 1990s.

• Develop an inward investment strategy through a greater understanding of why companies are seeking to invest in the region. High-value-added FDI adds significantly to an economy's underlying technology base but creates fewer jobs, while FDI that generates jobs on a large scale is usually (though not always) associated with less sophisticated technology. So any new strategy must articulate which activities will be able to attract inward investment of any kind, and where it is most likely to be sourced from. This does not emphasize “sectors” per se but rather emphasizes activities on value chains, where activity within the region is placed within an international framework, and the weaknesses of value chains in the face of global changes are recognized. The latter can include macroeconomic factors such as changes in exchange rates or changing terms of trade as well as shifts in the nature of the value chain itself [37].

• Consider value acquisition as well as value creation. Current thinking suggests that the co-creation of value, and the capture of this shared value in a sustainable way, can be seen through the co-establishment of sustainable regional ecosystems, and the adoption of the required positioning and specialization in global and local value chain strategies. As a new rationale for place-based regional industrial policies [13]. In this context, the UK regions could aim to position themselves as niche players specializing in difficult-to-replicate “origins of the bottleneck” in advanced manufacturing products and services that are difficult to imitate, based on regional history and heritage (ibid.).

• Focusing inward investment efforts on sectors where free trade with the EU is less important. This could mean, for example: Seeking to maximize the benefits of large-scale 'fixed' investments in infrastructure (in the Midlands context e.g., HS2); Recognizing the need for supporting skills in project management and professional services related jobs associated with infrastructure projects; and building strong supply chains to support infrastructure development.

• Maximize internal investment returns. This again requires understanding the benefits of inward investment, for example, benefits to supply chains or knowledge transfer from inward investors to local firms. In order to understand how policy tools are applied in this area, one must understand the drivers of FDI and its financing. For example, in the years prior to the Global Finance Fund, a high proportion of global foreign direct investment was debt-financed; This has not been available since. Therefore, one response might aim to seek out FDI that is truly outside the UK, i.e., not funded by loan financing raised from UK capital markets, but from the home country. This varies by country. Much Asian FDI for example is now funded by cash flow generated in the home country, compared to US, EU, and Japanese investments that are typically debt-financed. Therefore, the state strategy is required for IPAs as well as the sectoral strategy.

• When selecting the main sectors for internal investment, focus on job creation as well as value added.

• Policymakers have a broader task than just achieving productivity growth, as they need to match the value proposition of a particular location or region to the type of investment they can attract. We must realize that from the point of view of work and productivity, every investment is a good investment. While clearly high-skilled, high-value-added jobs will increase productivity the most, creating jobs for lower-skilled people may increase total value-added by more than that. Likewise, jobs with low added value tend to be filled from the local labour market, rather than attracting people from abroad. Sectoral policies should be part of an overall and comprehensive economic policy that takes into account local and regional economies as a whole and supports job creation.

• Focus on job quality rather than just the number of jobs created. There is no trade-off between job creation and job quality [11]. In other words, more and better compatible functions. Inward investment and its attendant supply chains often have a disproportionate impact on policymakers, as the current Brexit debates illustrate [40-44]. Inside investors can often influence local and regional skills strategies to fill skills gaps in ways that local firms often find challenging. Regions can then use the need to serve inward investors as part of the national government's "request" about (mandating) education and training [45,46].

The UK automotive sector has been successful in recent years in increasing production and to a limited extent in sourcing more components locally. Brexit brings opportunities and challenges to the industry and they must be dealt with effectively in order for the industry to continue to thrive. The Brexit vote, for example, leaves a great deal of uncertainty about the nature of the UK's trade relationship with the EU. This uncertainty is likely to affect foreign investment in the UK car sector, especially as car companies look to replace models. While Nissan decided to build the next-generation Qashqai and X-Trail models in Sunderland, Nissan will review this once the terms of Brexit are clear. Furthermore, other companies may delay making decisions about assembly in the UK until they know whether they will face customs duties when exporting to the EU. Factories and jobs could be at risk if this uncertainty is not quickly "fixed" in the form of clear parameters for an interim or transitional trade deal preferably as close as possible to existing single market arrangements. In this regard, there is a lot the government could do to really try to counter this uncertainty, for example by prioritizing as part of the Brexit negotiations access to the single market under a transition deal and making sure British companies can hire worker’s filly from Europe. The UK also needs to do more than agree to a new trading relationship with Europe, it needs a new industrial strategy to offset the uncertainty caused by Brexit and to “rebalance” the economy, for example by stimulating investment In manufacturing such as by increasing capital allocations, by reviving something like the Advanced Manufacturing Supply Chain Initiative (preferably on a much larger scale), by transferring skills and training to the regional level, and by closing funding gaps for small businesses in the supply chain. There is a chance to "re-subsidize" more of the auto components industry if the pound stabilizes at the exchange rate after the Brexit referendum. Resupply will not happen automatically, though, given the aforementioned barriers to resupply, and an effective industry strategy is needed to drive this. It should also be noted that the industry is undergoing profound changes, with shifts towards electrification and connected and autonomous (driverless) cars. A committed industrial strategy will be needed to support private sector investment in such technologies, a point that Jaguar Land Rover has been keen to stress in its aspiration to build electric vehicles in the UK. In this regard, we await more details from the government's new industrial strategy. More broadly, there is a strong case for giving the UK industrial strategy a similar institutional setting to UK monetary and fiscal policies. At the very least, it should be the subject of regular long-term strategic reviews. By making it this kind of priority, the new government will be sending the kind of powerful message that British industry and foreign investors need to hear. The key point is that given both the opportunities and risks arising from Brexit for UK cars, a more proactive and funded industrial strategy is now needed to support the UK car industry.

Citation: Alali WY, Ellalee H, (2024) UK Employment and Industrial Strategy Influence on Brexit. J Res Dev. 12:250.

Received: 21-Feb-2024, Manuscript No. JRD-24-29715; Editor assigned: 26-Feb-2024, Pre QC No. JRD-24-29715 (PQ); Reviewed: 12-Mar-2024, QC No. JRD-24-29715; Revised: 19-Mar-2024, Manuscript No. JRD-24-29715 (R); Published: 26-Mar-2024 , DOI: 10.35248/2311-3278.24.12.250

Copyright: © 2024 Alali WY, et al. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited